Finding the right accounting software for a non-profit or faith-based organization can be a daunting task.

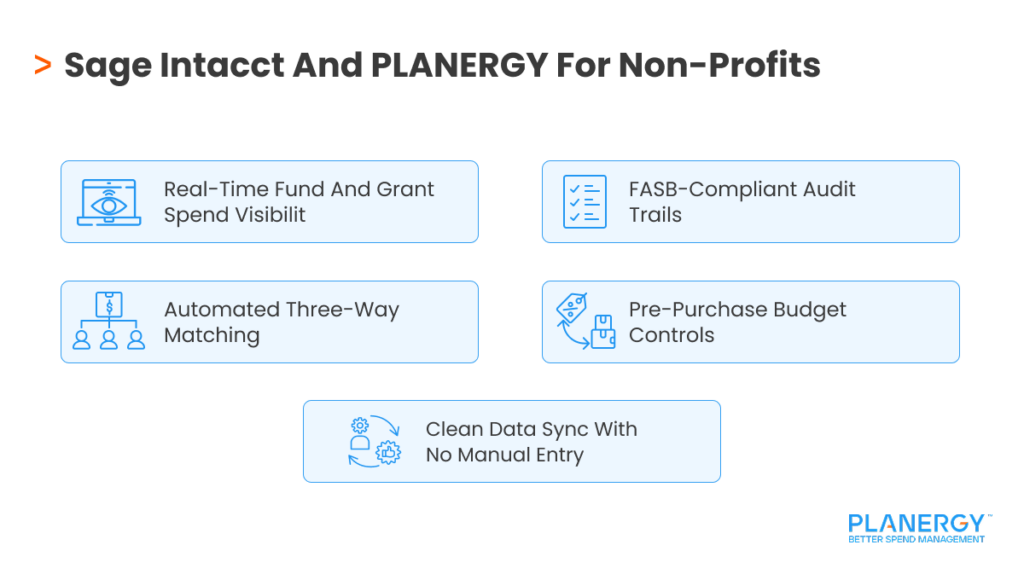

While many software applications claim to offer the right support, non-profit and fund accounting require specialized capabilities. These include tracking multi-year grants, managing restricted funds, and reporting for both internal and external stakeholders.

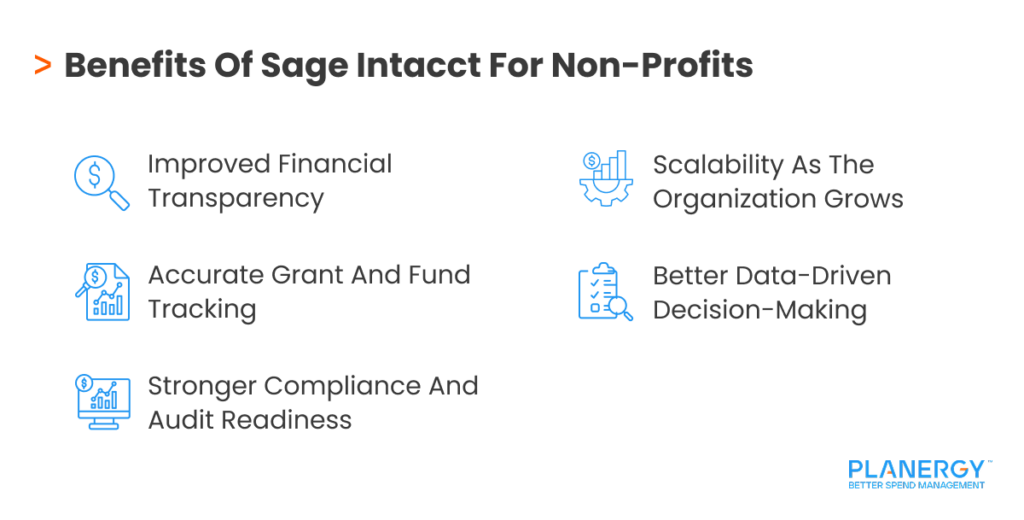

If you’re searching for the right non-profit accounting software for your organization, a good place to start is with Sage Intacct for Non-profits, which offers robust financial management along with the specialized features that a non-profit requires.

What are the Features of Sage Intacct Non-Profit Accounting Software?

Sage Intacct for Non-profits is a cloud-based accounting software application that offers the features that a non-profit organization needs.

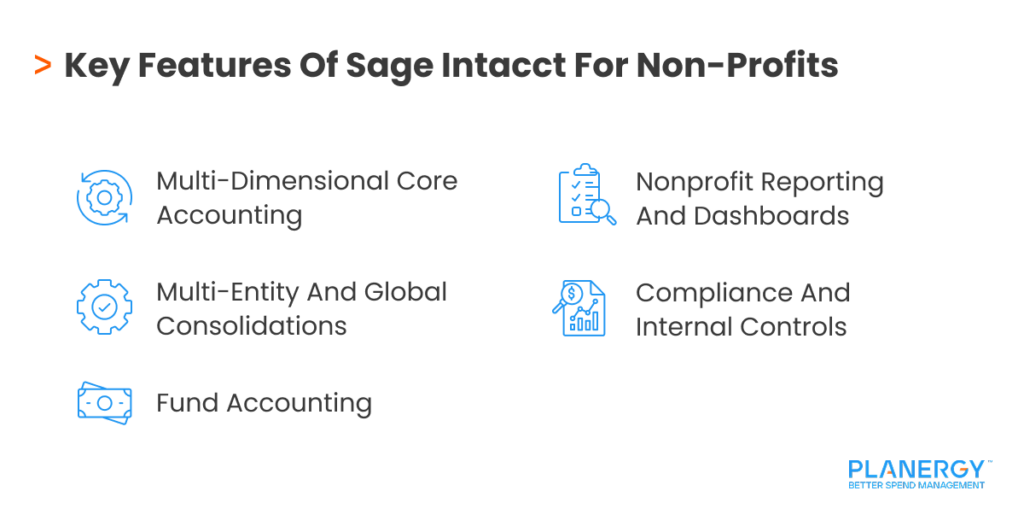

These features include:

Strong Core Accounting Capability

Sage Intacct for Non-profits includes a multi-dimensional chart of accounts with a general ledger that helps you track program and grant funds, while managing accounts payable, accounts receivable, cash management, order management, and purchasing.

The application also includes Sage Intacct Collaborate, which allows you to communicate with team members in real-time and streamlines workflows for the finance team and the CFO.

Multi-Entity Management

Many non-profits need to manage multiple grants and multiple programs simultaneously.

The multi-entity and global consolidations feature allows you to track income and expenses separately, yet still consolidate transactions for a complete view of your organization’s finances.

Fund Accounting

A robust fund accounting feature lets you create a separate close for each revenue source, perfect for organizations that receive funding from multiple sources.

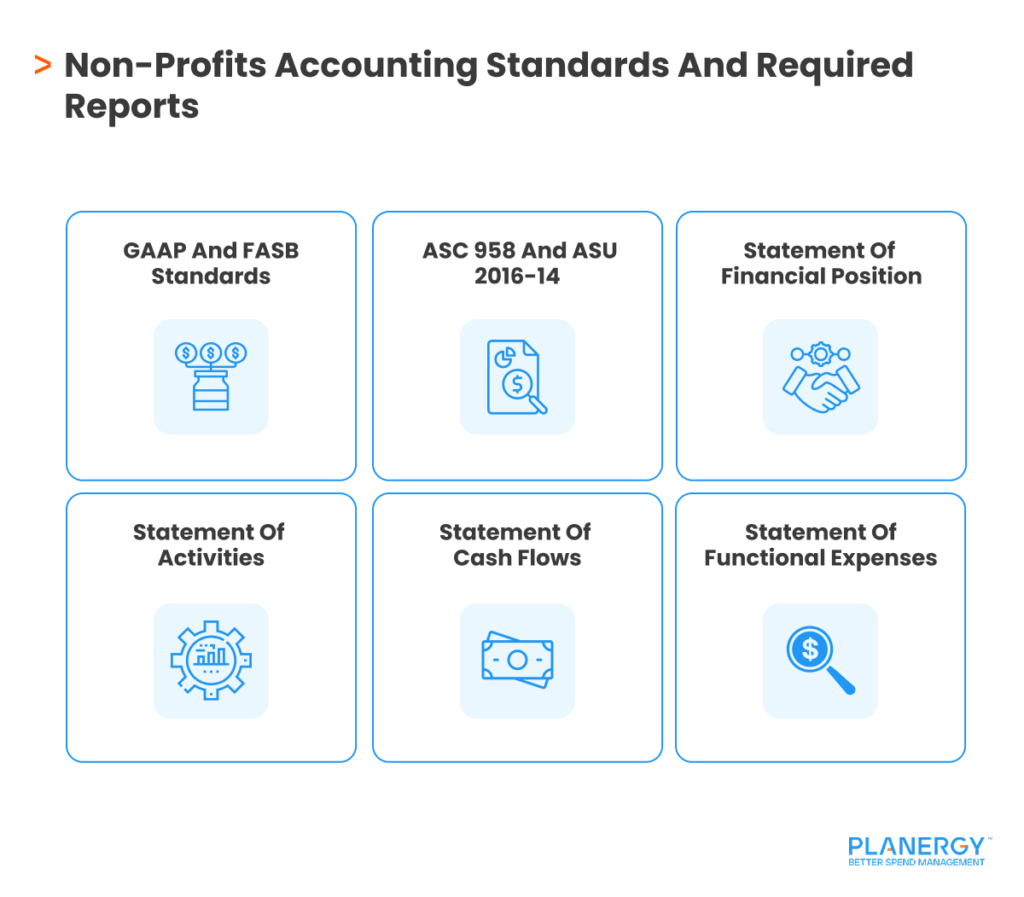

In addition, the fund accounting feature allows you to create required non-profit reports like the statement of activities, statement of financial position, statement of cash flow, and Form 990 for the IRS.

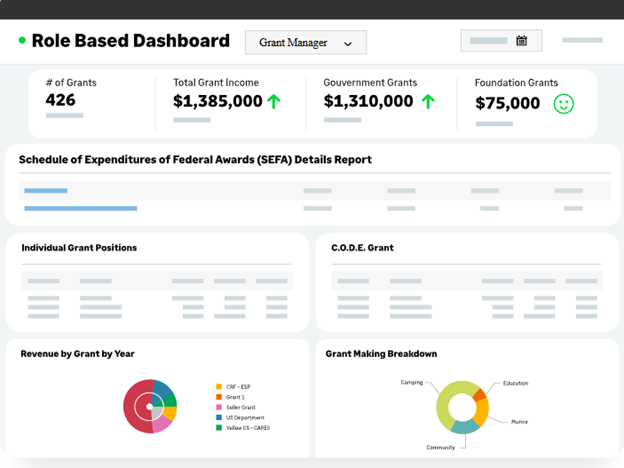

Non-Profit-Specific Reporting and Dashboards

Sage Intacct offers real-time reporting with non-profit-specific options. Its dashboard tracks funds and expenses by project, along with organization-wide performance levels that you can drill down to view for each program or fund, with real-time visibility.

Sage Intacct offers a role-based dashboard that summarizes grant details

Sage Intacct offers a role-based dashboard that summarizes grant details

Compliance

Non-profit organizations have specific compliance requirements that need to be managed.

These include non-profit specific reports (discussed above) as well as FASB and IRS statements that non-profit organizations are required to supply, with internal controls available to streamline the entire compliance process.

Revenue Recognition

A non-profit accounting system should have strict revenue recognition protocols in place.

These include ASU 2018-08, which is used to determine whether grant monies received are considered a contract or an exchange.

If a grant is determined to be an exchange, ASC 606 applies and requires use of the five-step revenue recognition model: identify the contract, identify performance obligations, determine the transaction price, allocate the price, and recognize revenue.

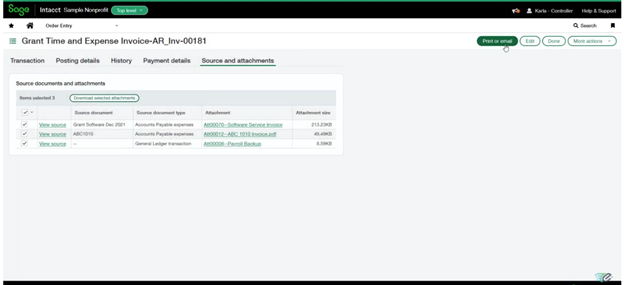

Complete Grant Tracking and Billing

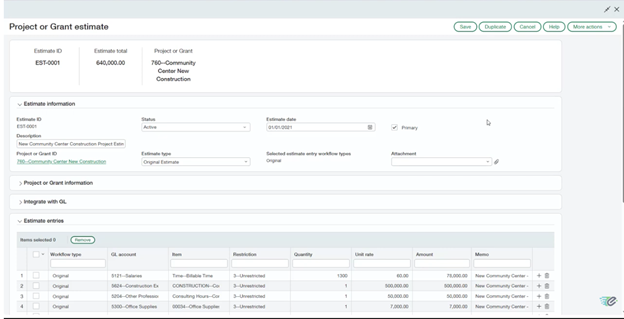

For organizations that regularly receive grants, proper grant management is a necessity. Sage Intacct for nonprofits allows you to track each grant individually, with automated grant tracking and billing functionality.

Sage Intacct for Non-profits lets you enter project or grant-specific information easily.

Sage Intacct for Non-profits lets you enter project or grant-specific information easily.

The Latest Cloud Technology

Sage Intacct is cloud accounting software that includes an open API that facilitates integration with third-party applications, including CRM, payroll, donor management, and budgeting.

Sage Intacct allows you to track grant time and create invoices for work completed

Sage Intacct allows you to track grant time and create invoices for work completed Sage Intacct lets you view balance sheet detail by location, fund, program, or grant

Sage Intacct lets you view balance sheet detail by location, fund, program, or grant