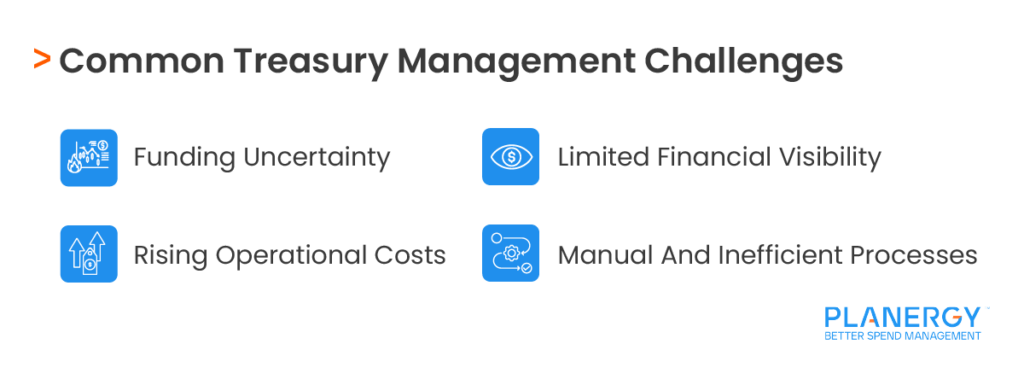

Educational institutions today face unprecedented financial pressures. While enrollment fluctuates and operational costs climb steadily, funding streams remain unpredictable.

For school administrators and university business officers navigating these challenges, treasury management has evolved from a back-office function into a strategic imperative that directly impacts educational quality and institutional survival.

Understanding financial sustainability in MATs has never been more critical.

Understanding Treasury Management in Educational Settings

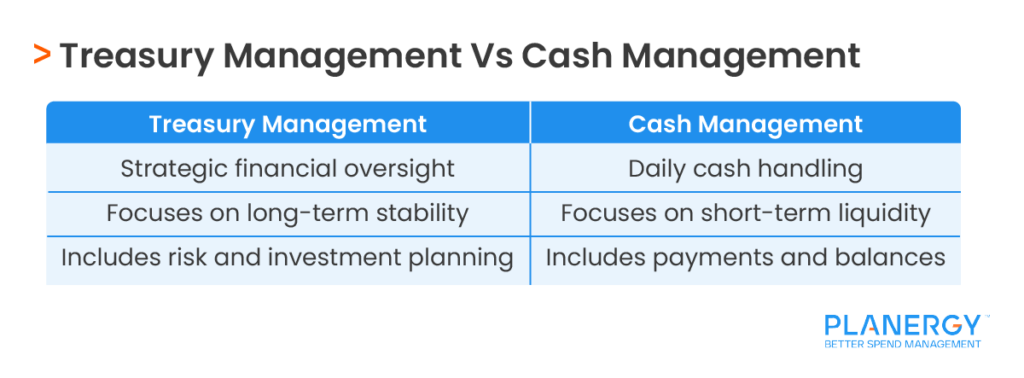

Treasury management encompasses the strategic oversight of an institution’s financial assets, cash flow, and liquidity.

Unlike basic bookkeeping, it involves sophisticated financial planning that ensures schools and universities can meet immediate obligations while positioning themselves for long-term financial stability.

At its core, treasury operations focus on two main areas: managing liquidity and controlling financial risks.

The first ensures sufficient cash is available when needed for everything from payroll to facility maintenance.

The second protects institutions from interest rate fluctuations, currency risks (for institutions with international programs), and other financial uncertainties that could derail budgets.

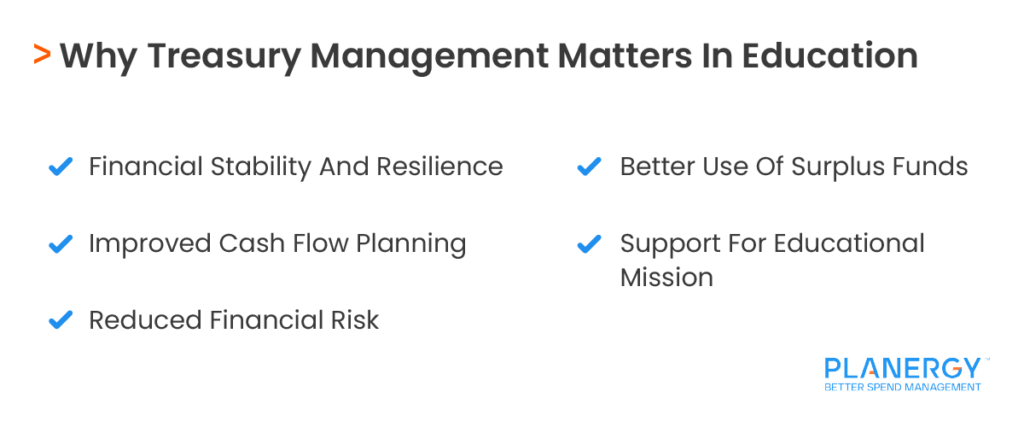

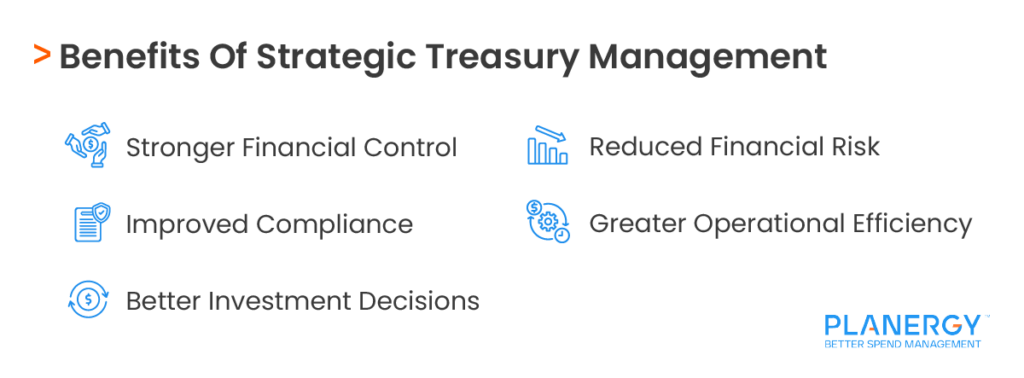

For education institutions, effective treasury management means more than keeping the lights on.

It creates the financial foundation that allows schools to invest in education programs, attract talented educators, and weather economic downturns without compromising student services.