Whether you’re a new business trying to use invoice processing best practices, or your company needs to reassess their current processes, it’s always a good time to start using best practices when processing invoices.

-

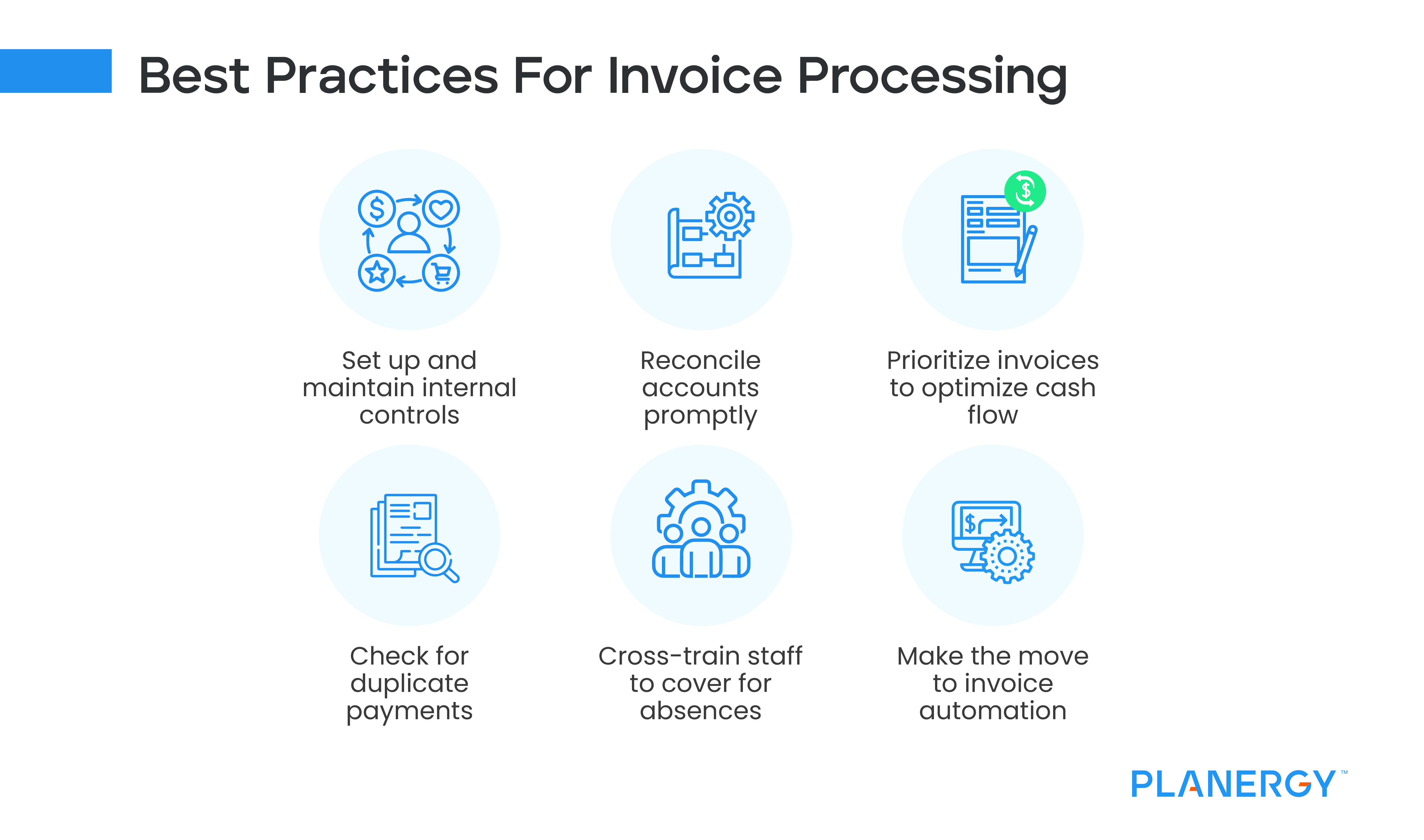

Set up and maintain internal controls

Whether you’ve been paying bills for years, or you’re just starting out, the most important thing you can do is to set up and maintain internal controls. It’s well known that accounts payable is a department ripe for potential fraud.

But much of that fraud can be eliminated when you set up an internal control process that assigns different accounts payable tasks to different employees.

For example, if you have a single person handling accounts payable, that person is responsible for the following:

- Approves new vendors

- Enters new vendors into the system

- Verifies invoices that are received

- Sets up payment

- Runs checks or pays vendor electronically

With the ability to do all of the above, how difficult would it be for an employee to create a fictitious vendor and pay them.

One of the most important components of your internal controls is using segregation of duties. Segregation of duties ensures that one person approves the order, one person verifies the invoice, one person authorizes payment, and one person signs the check or approves the electronic payment.

By having more than one person process invoices from beginning to end, you can reduce or even eliminate the possibility of fraud.

-

Reconcile accounts promptly

Keeping your accounts reconciled daily helps you identify any checks that have not been cashed.

There may be a legitimate reason why the supplier or vendor has not cashed your check, but keeping an eye out for outstanding checks and following up with the vendor or supplier can help you maintain cash flow, eliminate possible late fees (if the check was lost), and help you maintain a good relationship with your vendors and suppliers.

-

Prioritize Invoices to Optimize Cash Flow

Positive cash flow is important for any business, no matter the size. That’s why prioritizing invoices for payment is essential. Invoices should always be slated for payment based on their due date, not on when they’re received.

Let’s say you receive an invoice with 2/10 Net 30 terms on a Monday, a second invoice with Net 30 terms on a Tuesday, and a third invoice with Net 15 terms on Wednesday of the same week. In what order should you pay those invoices?

To take advantage of the two percent discount, you’ll want to pay the 2/10 Net 30 invoice first. Then, you’ll want to pay the Net 15 invoice, even though it came in last. Finally, you’ll pay the Net 30 invoice. This allows you to maintain a good level of cash flow for your business while also taking advantage of the discount offered.

-

Check for Duplicate Payments

Even with the proper processes in place, you may still end up with duplicate payments, particularly if you’re still using manual processes. Hopefully, you’ll spot a duplicate payment before it goes out to your vendor or supplier, but if it doesn’t, you’ll need to contact your vendor immediately to see if you can get the check returned.

In many cases, a vendor or supplier is reluctant to return the check and may be open to issuing a credit on your account. However, if you don’t regularly use the vendor, it means having your money tied up for months.

The best way to handle the issue of duplicate payments is to make the move towards AP automation, which will automatically flag duplicate payments before they’re sent out.

-

Cross-train staff to cover for absences

If you have a single employee processing AP, what happens when that employee is sick or takes vacation? Do your vendors and suppliers have to wait until they return to be paid?

While it’s never a good idea to have one person handling all AP tasks, not having a backup trained is even worse. By cross-training a few of your employees to process AP when necessary you’re able to maintain a consistent flow of payments while also providing another set of eyes to review the AP process, especially important when only one person is handling AP.

-

Make the move to invoice automation

Making the move to invoice automation is one of the best things you can do for your business. Automating the invoice process can do the following:

- Eliminate manual data entry

- Expedite invoice approvals

- Eliminate duplicate payments

- Reduce the possibility of fraud

- Reduce invoice processing costs

- Allow you to store documents electronically

- Perform three-way matching

One of the best things you can do for your business is to move towards complete AP automation, starting with invoicing. Once you see how much time, money, and labor costs you’ll save, making the switch to complete AP automation will soon follow.