QuickBooks Desktop for Non-Profits

It’s no secret that millions of small business owners across the globe use Intuit applications such as QuickBooks Desktop or QuickBooks Online to manage their finances. With its minimal learning curve, good reporting options, and the choice of either a desktop or online application, QuickBooks can be a real asset for just about any type of business.

But what about nonprofit organizations? Are QuickBooks applications a good choice for them as well?

That’s a difficult question to answer. For smaller nonprofits, both QuickBooks Desktop and QuickBooks Online can provide good financial management options. However, for larger nonprofits that manage multiple funds, programs, or projects, or receive grant funding, there are nonprofit accounting software options available that offer true fund accounting, which may be a better fit.

Why nonprofit software is different

Like any business, a nonprofit needs to perform standard bookkeeping tasks such as handling multiple bank accounts and bank reconciliations, tracking organizational expenses, and paying vendors on a timely basis. But nonprofits also need to deposit donations and grant funds, track both monetary and in-kind donations, provide donors with tax receipts and thank you letters, and in many cases manage volunteers.

Here are just a few of the ways that for-profit and nonprofit organizations differ.

- Taxes – While for-profit businesses are required to pay taxes on their income, a nonprofit organization is exempt from paying taxes on donations or grants. However, like a for-profit business, a nonprofit is still responsible for all federal, state, and local taxes, as well as Social Security and Medicare taxes.

- Profit management – A for-profit business can put profits earned into retained earnings for future use, distribute earnings to shareholders, or a combination of the two. Any profit earned by a non-profit must be reinvested back into the organization’s work.

- Accountability – While a for-profit business is typically accountable to the owners or shareholders, a nonprofit is accountable to its board members as well as anyone that provides funding to the organization, whether it’s a $5 million grant or a $50 donation.

In addition, nonprofits often hold fundraisers or run campaigns in order to fund their programs. All of the funds raised from that fundraiser or campaign, as well as any related expenses, need to be handled separately, using separate funds.

Like for-profit businesses, nonprofits vary in both size and scope. For example, an organization that typically is funded exclusively through grants will have much different accounting needs than that of an organization that is funded through public donations.

The following are just a few of the areas that nonprofit organizations need to manage.

- Chart of accounts: One of the most important components in nonprofit software is the ability to create a custom chart of accounts. If you only manage a few programs or projects, this is a simple thing to do in any accounting software application. However, if you’re not using an application with a flexible chart of accounts, you’ll need to create numerous sub-accounts, making the entire process even more confusing.

- Donations: If your nonprofit is funded primarily through individual donations, you will need a way to manage both the donation as well as each donor. You’ll also need to provide donors with thank you letters and receipts.

- Grants: Many nonprofit organizations are funded by grants from various state and local government entities, or through private foundations. If you receive grants from more than two entities, it’s wise to have a way to manage each grant separately.

- Funds: Fund management is a catchall category for foundations that receive funding from multiple sources. If you receive funding from multiple sources, you’ll need to have a way to individually track activity for each of those sources.

- Campaigns: If you typically have numerous campaigns throughout the year, you’ll need a way to track both income and expenses for each campaign.

Choose nonprofit software that suits your organization

For smaller nonprofits, using QuickBooks Desktop or QuickBooks Online is adequate. For larger nonprofits that would like to continue using QuickBooks applications, your best bet is to use the nonprofit edition of QuickBooks, which is available in both QuickBooks Premier and QuickBooks Enterprise editions.

These are a few of the nonprofit features found in the QuickBooks Nonprofit edition.

Nonprofits need accounting software to deposit donations and grant funds, track both monetary and in-kind donations, provide donors with tax receipts and thank you letters, and in many cases manage volunteers.

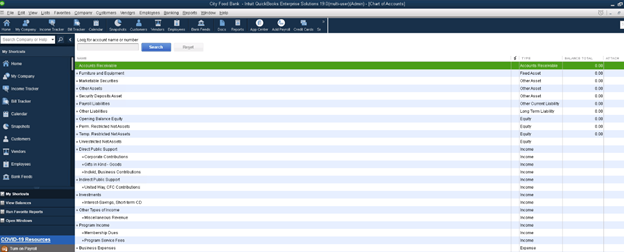

Create a nonprofit chart of accounts

To properly manage multiple funds, you’ll need to have access to a nonprofit chart of accounts. Unlike the standard version of QuickBooks, QuickBooks Enterprise for Nonprofit Organizations includes a default nonprofit-specific chart of accounts that can be easily customized to suit your needs.

QuickBooks Enterprise chart of accounts offers flexibility for nonprofit organizations.

The default chart of accounts also incorporates the unified chart of accounts, making it easy to transfer financial data directly into IRS forms for easy processing and filing.

Entering transactions

Once your chart of accounts has been set up properly, you can begin to enter accounting transactions.

QuickBooks Enterprise for Nonprofits allows you to take advantage of handy features such as electronic invoicing, which allows your donors or customers to pay online using a link that is included in the invoice. Automatic reminders can be set up to remind donors and customers about upcoming payment due dates.

You can also create email receipts for donors and customers immediately upon receiving their payment, which can also be emailed to them for added convenience.

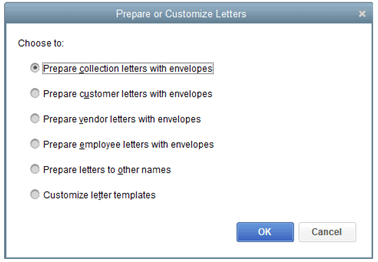

Along with processing payments and invoicing, you can track mileage and schedule tasks and appointments. In addition, QuickBooks Enterprise easily integrates with Microsoft Office and includes several documents built using Word templates, making it easy to provide donors and supporters with everything from a receipt for a donation, to an annual appeal letter.

QuickBooks Enterprise offers letter templates to simplify the letter preparation process.

In addition, Enterprise also offers integration with Salesforce CRM, enabling you to manage your donor database without the need for duplicate data entry.

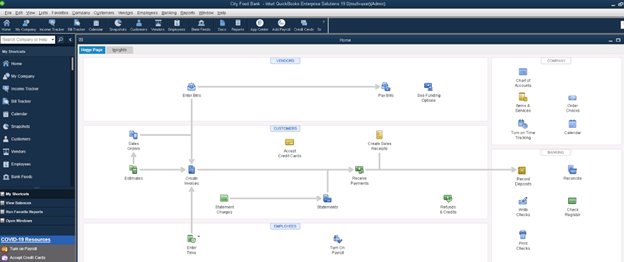

An easy-to-use interface

If you’re already familiar with QuickBooks Desktop applications, the nonprofit edition offers the same user interface, that offers easy access to all tasks from the workflow area.

QuickBooks Desktop includes an easily navigated user interface.

If you prefer, you can access all system tasks from the vertical menu on the left side of the screen. Also included are a series of task icons on the menu bar at the top of the screen.

In addition, you can create a ‘Favorites’ list on the vertical menu bar that allows you to quickly access frequently used tasks.

Reporting

Both for-profit and nonprofit businesses need access to financial statements along with other business and financial reports. However, a nonprofit organization also has to present board members with a variety of nonprofit-specific reports which include the following:

- Statement of financial position: Similar to a standard balance sheet, the statement of financial position displays assets, liabilities, and net assets while providing detailed information on restricted, temporarily restricted, and unrestricted assets. On the statement of financial position, net assets take the place of owner’s equity, since a nonprofit does not have owners or investors.

- Statement of activities: The statement of activities is a valuable report for any nonprofit, showing any changes in net assets over a specific period of time. The statement of activities is similar to an income statement, but also includes both current and prior-year totals, budgeted totals, and budget variances for a particular period of time. In addition, when preparing a statement of activities, a detailed explanation of any changes that have occurred during that period of time should always accompany the statement.

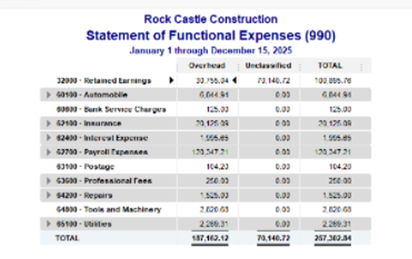

- Statement of functional expenses: The statement of functional expenses provides details on administrative and overhead expenses, as well as fundraising expenses for each program administered by the nonprofit. This report is also used when preparing Form 990 for the IRS.

- Cash flow statement: The cash flow statement is the only report that is used in both for-profit businesses and nonprofit organizations. The cash flow statement identifies and reports on cash received from operating and investment activities as well as cash from financing activities.

All of these reports are offered in QuickBooks Enterprise for Nonprofits, along with other nonprofit reports which include:

- Donor Report

- Grant Report

- Donor Contribution Summary

- Budget vs. Actual by Donor

- Budget vs. Actual by Grants

- Biggest Donors

- Biggest Grants

Like all QuickBooks Desktop reports, the nonprofit reports can be viewed on-screen, printed, or emailed directly to recipients. This option can come in handy when preparing board reports for upcoming meetings or to just keep members in the loop.

Form 990

Even though nonprofit organizations are exempt from taxes, they are still required to file a tax return at year-end.

That tax return, Form 990 is also made available for public inspection and will need to be filed annually to retain nonprofit status. Though many nonprofits have their accountant or CPA prepare Form 990, having good accounting software in place that can adequately manage nonprofit finances is a must.

The Statement of Functional Expenses is used when preparing Form 990 for the IRS.

Budgets

Accurate budgeting is important for any business, but perhaps even more important for nonprofits. In QuickBooks Enterprise for Nonprofits, you can create an annual budget from scratch, or use prior year numbers as a good reference point. You can also import a budget from another source if desired.

Once a budget has been created you can easily use included reports such as the Budget vs. Actual to track actual expenses against those budgeted.

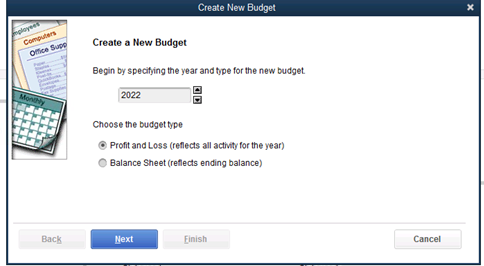

To create a new budget, just click on the Set Up Budgets option which is located under Nonprofit on the main menu. You can create a budget for your entire organization or individual accounts or classes.

The Create a New Budget feature lets you choose your preferred budget type.

You can choose from either a Profit and Loss Budget format or a Balance Sheet format for your nonprofit. Once you choose a format, you’ll also be able to choose any additional criteria you wish to include in the budget, including Customer Job or Class.

Donations

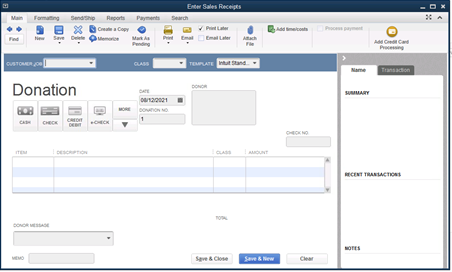

If your nonprofit is funded primarily by donations, you’ll need to be able to manage those donations properly. The Enter Donations feature does just that. This feature is basically the same as the Enter Sales Receipts feature in regular QuickBooks editions but has been revised to include nonprofit-specific language.

The Donation screen allows you to enter all the information you need for any donation.

The donation screen is where you can enter the donation amount, description, and how the donation was paid. If you’re signed up for QuickBooks Payments, you can also process donor payments made by credit card directly from this screen as well.

For tracking purposes, you’re also able to attach any related files to the donation. You’ll also be able to email a receipt directly to your donor, with an option to add a personal message directly from the donation screen as well.

Enter Pledges

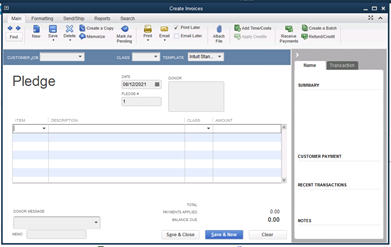

If your nonprofit normally accepts pledges from donors or constituents, you can easily invoice the pledge amount from the Pledges/Invoice screen. This is the same screen used to create invoices in the desktop version of QuickBooks, with wording updated to better suit the needs of a nonprofit organization.

The Pledge screen is where you can process pledges (invoices) for any pledges made.

To enter a pledge, just enter the item number assigned to the pledge along with a description. Again, you can add a custom message to the pledge invoice if desired.

QuickBooks Desktop Enterprise for Nonprofits vs. QuickBooks Online

If you’re in the process of choosing between QuickBooks Nonprofit or QuickBooks Online, there are some advantages to going with the desktop version. While QuickBooks Online offers the benefit of any time/anywhere access as long as you have an internet connection, it will require more customization to be of benefit to nonprofits. If you do opt for the online version of QuickBooks, using add-ons can give you a more complete accounting solution. Though some additional customization is available in QuickBooks Online Advanced, the online version is still better suited for for-profit businesses.

On the other hand, QuickBooks Desktop’s non-profit version offers numerous nonprofit-specific features. If pricing is not a concern, forego QuickBooks Pro and opt for the more expensive QuickBooks Premier or QuickBooks Enterprise.