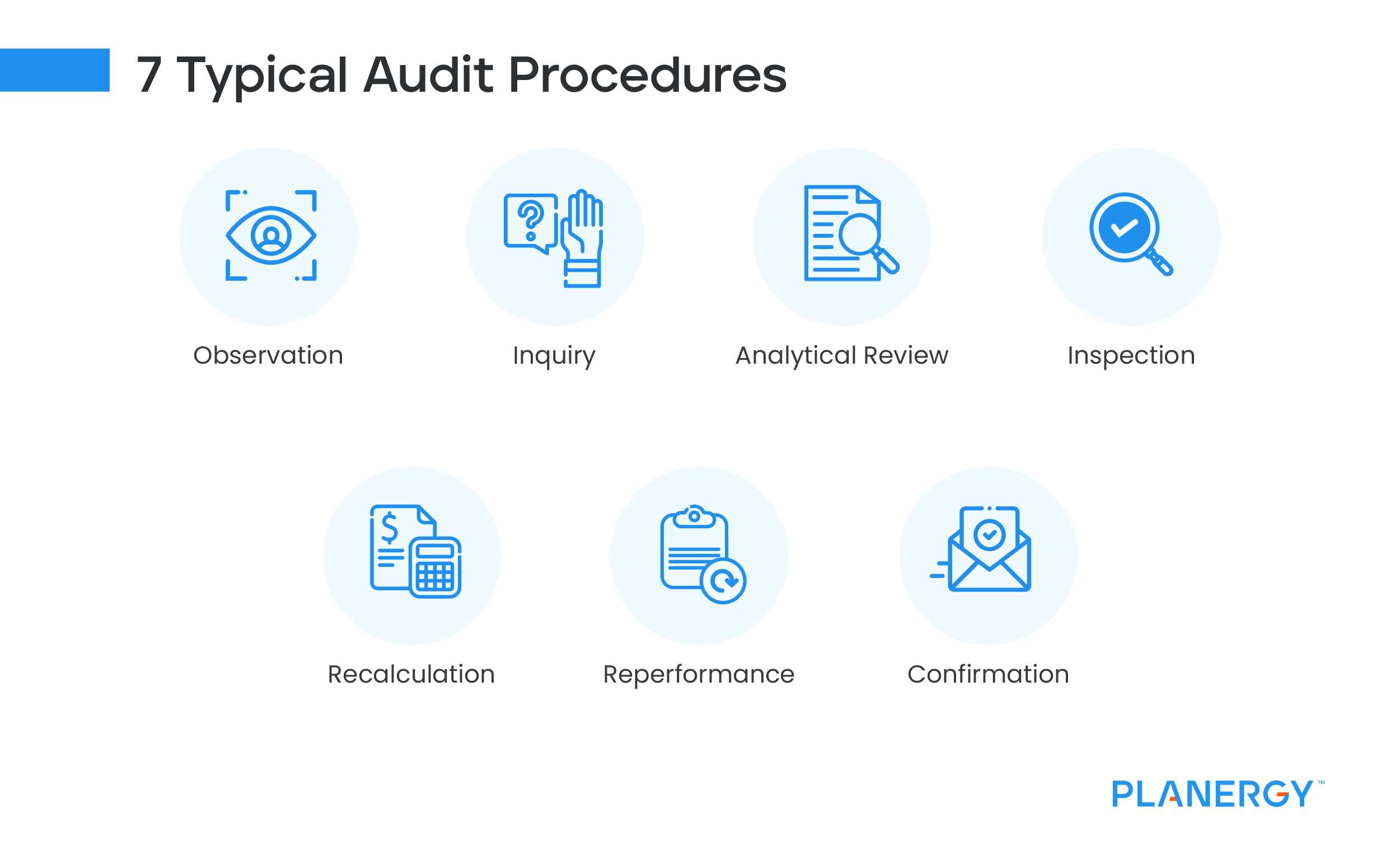

When auditing accounts payable, most auditors will use five or possibly seven audit procedures. The five most common audit procedures include the following.

Observation

Observation is when auditors spend time observing typical business processes. This can include anything from entering a new vendor into the accounting software to whether inventory is counted properly. Depending on the type of business that is being audited, keen observation can point out operational deficiencies.

Inquiry

The inquiry portion of an audit stems from the auditor reviewing reports, financial statements, transactions, and balances. During this review process, any unusual or suspicious transactions will be inquired about, with the business required to supply the appropriate explanation or supporting documentation.

Analytical Review

Analytical review includes a review of account balances, trends, and market information to help ensure that financial statements reflect accurate balances. Analytical review can include sales comparisons to the previous year, expense analysis, and comparing marketing expenses with revenue.

Inspection

The inspection of records and transactions is the heart of the audit process. The inspection process typically involves an onsite review of both internal and external documents including sales invoices, payment details, and purchase orders to ensure that both accounts payable expenses and payments are recorded properly and that open balances match those in the general ledger.

Recalculation

The recalculation process is used when auditors perform a calculation to check their accuracy. The auditor then compares the calculation result with the number currently recorded in the general ledger. Recalculations are often done for areas such as depreciation and deferred expenses.

While these are the five audit processes, some auditors will add the following processes when conducting an audit.

Reperformance

Similar to the recalculation process, this process is used to reperform key internal controls to check for any deficiencies. These internal controls include the establishment of responsibility, segregation of duties, physical control, documentation process, internal verification, and human resource control.

Confirmation

Confirmations are performed when auditors need to verify transactions with third-party businesses such as vendors, banks, and other financial institutions.