In today’s rapidly evolving business landscape, companies must continually adapt and innovate to stay ahead of the competition.

One way businesses can achieve this is through strategic expansion, which often involves either horizontal or vertical integration.

In this blog post, we will explore these two critical concepts, their benefits, challenges, and differences, and how they apply to modern-day businesses.

What is Horizontal Integration?

Horizontal integration refers to a company expanding its operations by acquiring or merging with other companies operating at the same supply chain level.

This approach allows businesses to grow their market power, diversify their product offerings, and achieve economies of scale.

Examples of Horizontal Integration

A classic example of horizontal integration is when Facebook acquired Instagram and WhatsApp.

These acquisitions allowed Facebook to consolidate its dominance in the social media space, eliminate potential competitors, and expand its user base.

Amazon’s acquisition of Whole Foods in 2017 exemplifies a horizontal integration strategy, as it allowed the e-commerce giant to enter the grocery market and enhance its physical retail presence.

Disney’s acquisition of Pixar in 2006 marked a significant milestone in the entertainment industry, as it brought together two giants of animation.

The acquisition proved to be mutually beneficial for both companies. For Disney, it rejuvenated its animation division by gaining access to Pixar’s cutting-edge technology, creative talent, and innovative storytelling techniques.

This led to a series of successful animated films under the joint banner, such as “Up,” “WALL-E,” and “Inside Out.”

On the other hand, Pixar benefited from Disney’s vast distribution network, marketing expertise, and resources, which helped expand the reach and impact of Pixar’s films worldwide.

Ultimately, the strategic collaboration between Disney and Pixar resulted in a powerful synergy that strengthened both companies’ positions in the animation market and created memorable content for audiences globally.

Pixar isn’t the only noteworthy acquisition from Disney. The business expansion allowed Walt Disney Company to expand its content portfolio and increased its market share by acquiring 21st Century Fox in 2019.

In the technology sector, Microsoft’s acquisition of LinkedIn in 2016 enabled the company to expand its suite of business services, while Google’s purchase of YouTube in 2006 helped it solidify its presence in the online video market.

These examples demonstrate how acquiring companies at the same level of the value chain can lead to growth and competitive advantages.

What is Vertical Integration?

There are two main types of vertical integration: forward (downstream) integration and backward (upstream) integration.

Each type involves taking control of different levels of the production or distribution process to achieve various strategic objectives.

-

Forward (Downstream) Integration

This type of vertical integration occurs when a company expands its control toward the end of the supply chain, moving closer to the final customer. This can involve activities such as acquiring or establishing distribution channels, retail outlets, or service centers.

Forward integration allows a company to gain more control over sales, distribution, and customer relationships and can lead to increased market share, improved profit margins, and enhanced customer experiences.

Example: A car manufacturer acquiring a chain of dealerships to sell its vehicles directly to consumers.

-

Backward (Upstream) Integration

In contrast, backward integration refers to a company’s expansion toward the beginning of the supply chain, taking control of the production of raw materials or components used in its products.

This can involve activities such as purchasing suppliers, acquiring mines or farms, or establishing manufacturing facilities. Backward integration enables a company to secure its supply chain, reduce production costs, enhance quality control, and potentially create barriers to entry for competitors.

Example: A smartphone manufacturer acquiring a company that produces microchips or other essential components for its devices.

Examples of Vertical Integration

A well-known example of vertical integration is Apple’s decision to design and manufacture its chips in-house.

By doing so, Apple gained greater control over its supply chain, reduced reliance on external suppliers, and enhanced its ability to innovate and differentiate its products.

Tesla’s decision to build its own battery factory, the Gigafactory, demonstrates a forward vertical integration strategy, as it allowed the electric vehicle manufacturer to secure its supply chain and reduce production costs.

In the fashion industry, Zara’s parent company, Inditex, manages its entire production process, from design to distribution, enabling it to quickly adapt to market trends and maintain tight control over quality and cost.

Netflix’s move into producing original content, such as “House of Cards” and “Stranger Things,” showcases a successful backward vertical integration as the streaming giant expanded its role from content distributor to content creator.

These examples highlight how companies can benefit from taking control of different stages of the production or distribution process through vertical integration strategies.

Understanding the differences between these growth strategies is crucial for any company considering making any move. Self-sufficiency has its benefits, but may also lead to a company’s downfall.

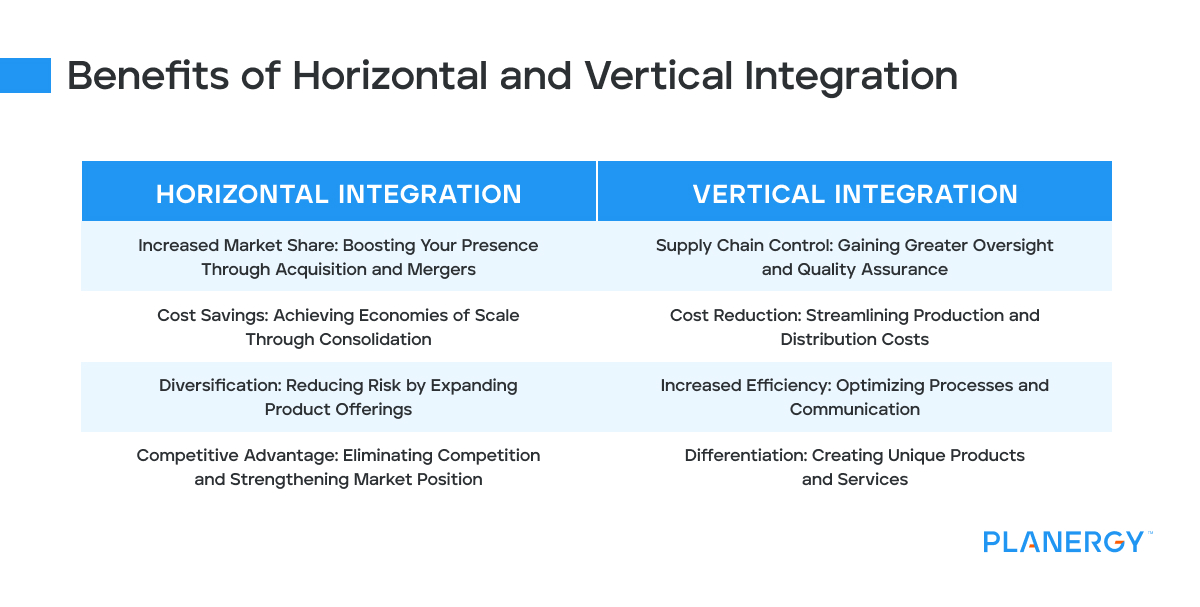

Benefits of Horizontal and Vertical Integration

Both horizontal and vertical integration offer unique advantages for businesses looking to expand:

-

Benefits of Horizontal Integration

-

Increased Market Share: Boosting Your Presence Through Acquisition and Mergers

Horizontal integration allows companies to quickly gain a larger market share by acquiring or merging with competitors.

This strategy can significantly increase a company’s presence, customer base, and overall market influence. A larger market share often leads to increased brand recognition, customer loyalty, and the ability to set prices favorably.

-

Cost Savings: Achieving Economies of Scale Through Consolidation

One of the key benefits of horizontal integration is the potential for cost savings. By consolidating operations and leveraging shared resources, companies can achieve economies of scale, which result in lower costs per unit.

This can lead to increased profit margins, greater financial stability, and the ability to invest in innovation and growth. Additionally, cost savings can be passed on to customers, making products and services more competitive in the marketplace.

-

Diversification: Reducing Risk by Expanding Product Offerings

Horizontal integration can also help companies diversify their product offerings and reduce reliance on a single market segment.

By expanding into new markets or adding complementary products and services, businesses can mitigate risks associated with changes in consumer demand, economic fluctuations, and industry disruptions.

Diversification can also open up new revenue streams, making the company less vulnerable to downturns in any one area of the business.

-

Competitive Advantage: Eliminating Competition and Strengthening Market Position

Finally, horizontal integration can provide a significant competitive advantage by eliminating competition and strengthening a company’s position in the market.

By acquiring or merging with competitors, businesses can consolidate their market presence, making it more difficult for new entrants to gain a foothold. This strategy can also lead to increased bargaining power with suppliers and customers and the ability to dictate industry standards and trends.

In short, horizontal integration can create a formidable market force that is difficult for competitors to challenge.

-

-

Benefits of Vertical Integration

-

Supply Chain Control: Gaining Greater Oversight and Quality Assurance

Vertical integration allows companies to gain greater control over their supply chain, ensuring quality and timely delivery of products.

By taking ownership of various stages in the production process, businesses can closely monitor quality standards, optimize inventory management, and reduce the risk of disruptions caused by external suppliers.

This level of control can lead to increased customer satisfaction, brand reputation, and a competitive edge in the market.

-

Cost Reduction: Streamlining Production and Distribution Costs

Eliminating intermediaries through vertical integration can often result in cost reductions associated with production and distribution.

By owning multiple stages of the production process, businesses can minimize the markups and fees charged by third-party suppliers and distributors. This streamlined approach can lead to lower operating costs, increased profit margins, and more competitive customer pricing.

-

Increased Efficiency: Optimizing Processes and Communication

Vertical integration enables companies to streamline processes and improve communication between different stages of production.

By consolidating operations under one organizational umbrella, businesses can eliminate redundancies, enhance coordination, and foster a more collaborative environment.

This increased efficiency can result in faster production times, reduced waste, and the ability to respond more quickly to changes in market demand.

-

Differentiation: Creating Unique Products and Services

Owning various stages of the production process can enable businesses to create unique products and services that set them apart from competitors.

Vertical integration allows companies to innovate and customize their offerings more effectively, as they have direct control over the entire production and distribution process.

This can lead to the development of proprietary technologies, exclusive features, and tailored solutions that meet specific customer needs. Differentiation can help businesses establish a strong brand identity and build customer loyalty.

-

Challenges and Key Differences Between Horizontal and Vertical Integration

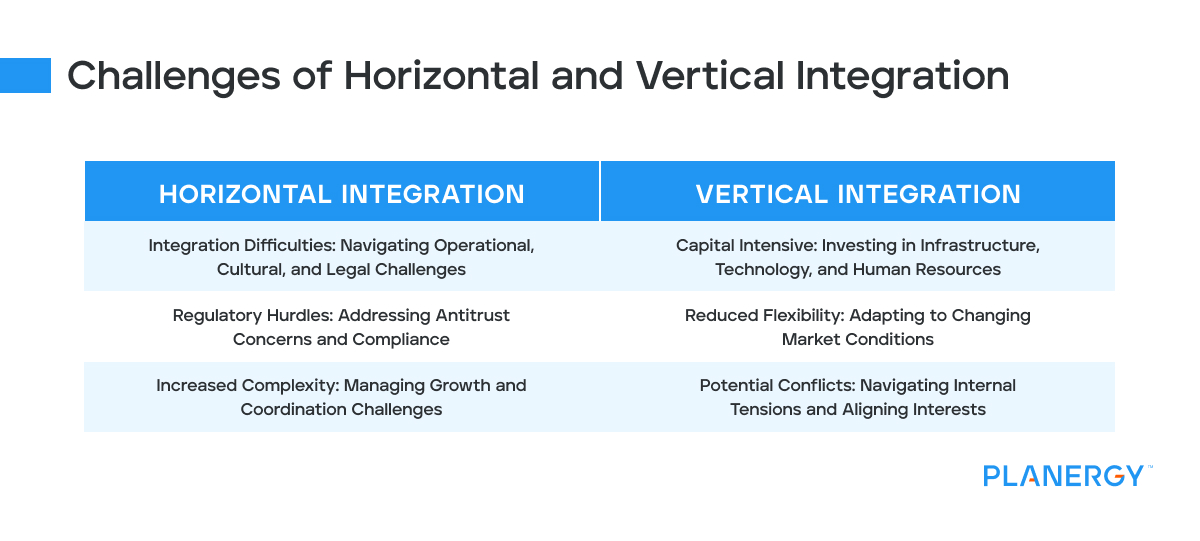

While both approaches offer significant benefits, they also present unique challenges and risks:

-

Horizontal Integration Challenges

-

Integration Difficulties: Navigating Operational, Cultural, and Legal Challenges

Merging with or acquiring other companies can lead to several integration difficulties that must be carefully managed. Operational challenges may include consolidating systems, processes, and resources and aligning company goals and strategies.

Cultural challenges may arise due to differences in organizational values, communication styles, and employee expectations. Creating a positive company culture will need to be managed over a more complex business structure.

It might introduce new management challenges, like the need to manage a distributed workforce or the need to face the challenges of managing remote teams.

Legal challenges can involve navigating regulatory requirements to avoid oligopolies and monopolies, contract negotiations, and potential disputes.

Successful integration requires careful planning, open communication, and a willingness to adapt and compromise.

-

Regulatory Hurdles: Addressing Antitrust Concerns and Compliance

Horizontal integration can sometimes attract antitrust scrutiny from regulatory authorities due to potential anti-competitive effects. Acquiring or merging with competitors can lead to market concentration, reduced competition, and the potential for monopolistic practices.

To avoid regulatory hurdles, companies must carefully assess the competitive landscape, consider the impact of their actions on market dynamics, and ensure compliance with all relevant laws and regulations.

-

Increased Complexity: Managing Growth and Coordination Challenges

Expanding horizontally can complicate a company’s operations, making managing and coordinating activities harder. As they grow, businesses may face communication, decision-making, and resource allocation challenges.

Maintaining a unified vision and culture while integrating diverse teams, products, and markets can become increasingly difficult.

To overcome these challenges, companies must invest in strong leadership, efficient systems and processes, and a culture of collaboration and continuous improvement.

-

-

Vertical Integration Challenges

-

Capital Intensive: Investing in Infrastructure, Technology, and Human Resources

Vertical integration often requires significant infrastructure, technology, and human resources investments. Companies must be prepared to invest in facilities, equipment, and systems necessary to manage various stages of the production process.

Additionally, they may need to hire and train new employees to handle the increased scope of operations. While these investments can lead to long-term benefits, they can also strain a company’s financial resources and require careful planning and risk management.

-

Reduced Flexibility: Adapting to Changing Market Conditions

Owning multiple stages of the production process can make it more challenging for companies to adapt to changing market conditions.

When a business is vertically integrated, it may be less able to quickly pivot its operations or outsource specific tasks in response to fluctuations in demand or shifts in industry trends.

This reduced flexibility can make it harder for companies to stay agile and responsive to customer needs, which is crucial for maintaining a competitive edge in today’s fast-paced business environment.

-

Potential Conflicts: Navigating Internal Tensions and Aligning Interests

Vertical integration can sometimes lead to conflicts of interest between different divisions within a company. For example, a division responsible for producing raw materials might prioritize its own profitability over the needs of the division responsible for manufacturing finished products, leading to internal competition and tension.

To avoid these potential conflicts, companies must establish clear communication channels, align incentives and objectives across divisions, and foster a culture of collaboration and mutual support.

This may involve implementing cross-functional teams, setting shared performance metrics, and promoting organizational transparency.

Organizations that understand these differences and select the appropriate integration strategy can significantly impact your business’s growth and success.

By carefully considering the benefits, challenges, and risks associated with horizontal and vertical integration, you can make informed decisions that align with your company’s goals and objectives.

-

How Companies Can Benefit from the Right Integration Strategy

Organizations must adapt to the changing business landscape by leveraging the right integration strategy.

Horizontal integration can help these companies expand their customer base, diversify their product offerings, and enhance their market position.

Vertical integration can enable purchasing software providers to offer end-to-end solutions, improve supply chain efficiency, and differentiate themselves from competitors.

The choice between horizontal and vertical integration depends on your company’s specific goals, resources, and market dynamics.

Using market opportunity analysis can help identify the right route to take.

By thoroughly understanding these concepts and considering their benefits, challenges, and risks, purchasing companies can make strategic decisions that drive growth, innovation, and long-term success.