The term ‘audit’ is usually associated with the IRS or another tax authority. However, the words ‘audit’ and ‘audit trail’ are essential parts of your accounting processes.

But what exactly is an audit trail, and why is it so important to have one in place?

What Is an Audit Trail?

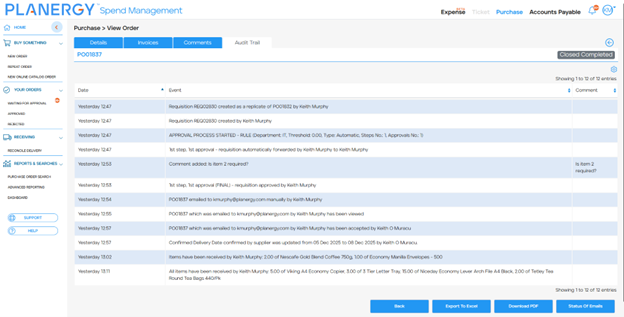

Audit trail records provide documentation of any changes made in a software application, recording the following information:

- Date and time of transaction

- Identification of who completed the transaction

- What was done (sequence of events)

- The area involved (AP, AR, etc.)

- Transaction result

- Transaction source (device or IP address)

- Transaction details

This information is essential for verifying the accuracy and integrity of system data and helping to pinpoint unauthorized transactions.