Discretionary expenses are costs that are not essential for the maintenance of a home or business.

These expenses can be adjusted or eliminated depending on an individual’s or a company’s financial situation and priorities.

When finances are tight these will be the costs that you can cut when tightening your belt.

In this article, we will explore discretionary expenses in both personal and business contexts, including their definition, examples, and best practices for managing them.

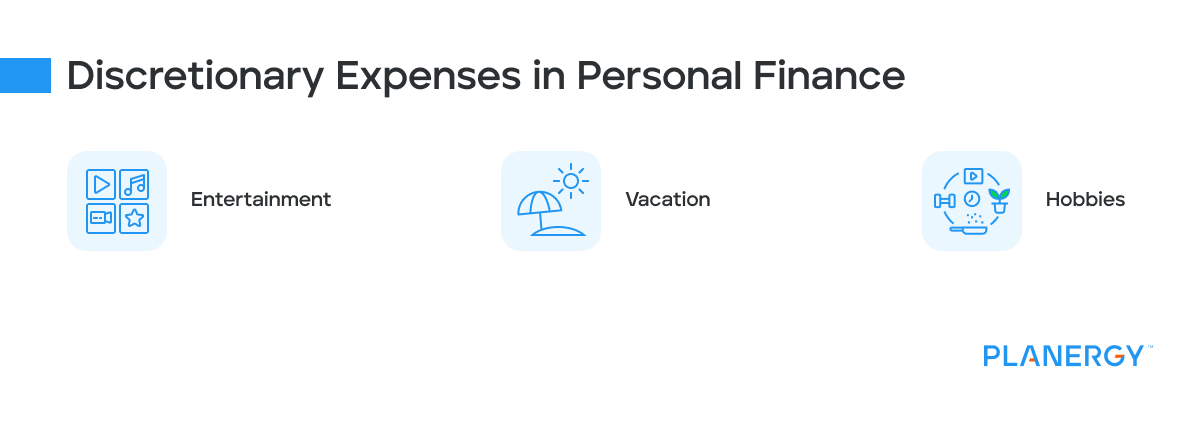

Discretionary Expenses in Personal Finance

In a household setting, discretionary expenses are incurred for non-essential items such as entertainment, vacations, and hobbies.

These expenses are considered discretionary because they are unnecessary for maintaining a basic standard of living, unlike non-discretionary expenses such as housing, utilities, groceries, and transportation.

Some examples of discretionary spending, or non-essential expenses in households include:

Entertainment

Entertainment expenses can include many activities that provide enjoyment and relaxation.

These may consist of movie tickets, streaming service subscriptions, concert tickets, and other forms of amusement.

While entertainment is essential for personal well-being, it is not necessary for maintaining a basic standard of living, making it a discretionary expense.

Vacation

Vacation expenses encompass all costs related to travel and leisure, such as hotel stays, airfare, car rentals, and sightseeing.

These expenses are considered discretionary because they are not required for day-to-day living and can be adjusted or postponed based on an individual’s financial situation.

Hobbies

Hobby-related expenses include the costs of pursuing personal interests and passions, such as art supplies, sports equipment, club memberships, and classes.

These expenses are discretionary because they are not essential for maintaining one’s basic needs and can be reduced or eliminated.

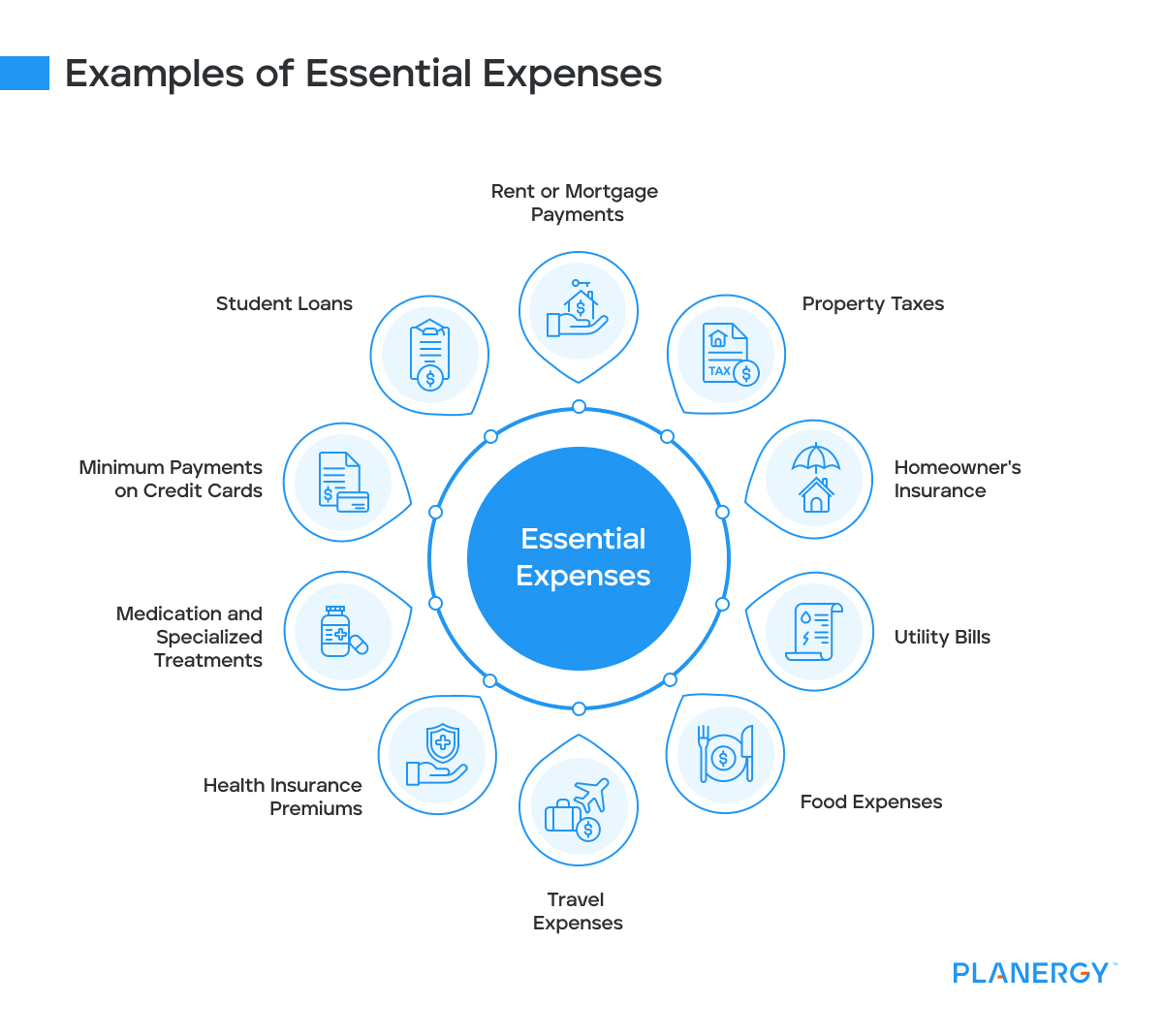

Essential Expenses

Essential expenses are the costs necessary for maintaining a basic standard of living.

These expenses are fundamental to your well-being and cannot be eliminated without significantly impacting on your quality of life.

Examples of Essential Expenses

Rent or Mortgage Payments

Rent or mortgage payments are essential expenses for maintaining a place to live. They represent the monthly cost of occupying a residence, whether a rental property or a home purchased through a mortgage loan.

Property Taxes

Property taxes are levied on homeowners by local governments and are based on the property’s assessed value. These taxes contribute to funding public services such as education, public safety, and infrastructure.

Homeowner’s Insurance

Homeowner’s insurance is a policy that provides financial protection against damage to your home and personal belongings due to events like fires, storms, or theft. It may also cover liability for accidents that occur on your property.

Utility Bills

This includes things like your electricity, water, gas, etc. Other essential utilities may include basic telephone service, trash removal, and sewer services.

Food Expenses

Groceries are an essential expense, as they provide the food necessary for daily sustenance and nutrition.

Basic dining expenses include occasional meals at affordable restaurants or takeout options. Luxury or non-essential dining experiences are considered discretionary expenses.

Travel Expenses

Costs associated with commuting to work may include public transit fares, carpooling fees, or parking expenses.

Car payments are a necessary expense if you have financed the purchase of a vehicle through a loan.

Fuel costs are essential for vehicle operation and depend on fuel efficiency and driving habits.

Auto insurance premiums provide financial protection in case of accidents or other incidents involving your vehicle.

Health Insurance Premiums

Health insurance premiums are paid to maintain coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

Medication and Specialized Treatments

Medication costs include prescription drugs and over-the-counter medicines required to maintain good health. You may also need to pay for medical devices, therapy, or other specialized treatments.

Minimum Payments on Credit Cards

Credit card debt payments are essential to avoid late fees, maintain a good credit score, and eventually eliminate debt.

Student Loans

Student loan payments are necessary to repay educational loans and avoid defaulting on the debt.

Many of these essential personal expenses also translate to the business world. You must pay for your building/offices/product facilities (whether through rental or mortgage), utilities, credit cards, loans, etc.

While you don’t necessarily have to pay for employee healthcare expenses but if you choose to offer benefits, that benefits package becomes an essential expense.

Discretionary Expenses in Business

In a business context, discretionary expenses are costs that can be adjusted or eliminated without directly impacting the company’s core operations.

These expenses often vary across departments, such as marketing, human resources, and operations.

Examples of discretionary expenses in various business areas include:

Employee Perks and Benefits

Employee perks and benefits are incentives offered to employees beyond their regular salary.

These include gym memberships, team-building events, workplace wellness programs, tuition reimbursement, retirement planning, and flexible work arrangements.

While these perks can improve job satisfaction, employee engagement, and staff retention, they are considered discretionary because they are not essential for the day-to-day functioning of the business.

Office Decor and Aesthetics

Office decor and aesthetics involve the design and layout of your workspace, including furniture, artwork, and other decorative elements.

The basic elements of desks, chairs, and computers will be a required part of the office management setup to cover core business operations. Above and beyond that it will depend where the leadership team want to draw the line.

These expenses can create a comfortable and visually appealing work environment, positively impacting employee morale and productivity.

However, they are considered discretionary expenses because they do not directly affect the business’s core operations.Professional Development and Training Programs

Investing in professional development and training programs for your employees can enhance their skills, knowledge, and overall performance.

These programs may include workshops, seminars, conferences, or online courses.

While professional development can benefit your business in the long run, it is considered a discretionary expense because it is not essential for daily operations.

Non-Essential Software Subscriptions

Non-essential software subscriptions refer to tools and applications that are not crucial for the daily functioning of your business but may offer convenience or additional features.

Examples include project management tools, graphic design software, and social media scheduling platforms.

These might be paid for on behalf of the member of staff or handled by an expense reimbursement fulfilled based on a properly returned expense report.

While these subscriptions can provide value, they are considered discretionary expenses because they are not vital to your business’s core functions.

Business Travel and Entertainment Expenses

Business travel and entertainment expenses include attending conferences, networking events, trade shows, client meetings, employee outings, and recreational activities.

If travel and expense management practices are poor, or worse if there is no travel and expense policy in place, these expenses can get out of hand when financial circumstances are strong.

This makes them an ideal candidate for cutting back on when times are hard.

These expenses can help build relationships, foster collaboration, and expand your business network. There is a lot of value to the business created when this expenditure is managed correctly.

However, they are discretionary because they are not required for the business’s day-to-day operations.

Donations and Sponsorships

Donations and sponsorships are voluntary contributions a business makes to support charitable causes, community events, or industry initiatives.

These expenses can improve your company’s reputation and public image, but they are considered discretionary because they do not directly impact the core functions of your business.

Monitoring and controlling discretionary expenditures is crucial for businesses, as it can significantly impact overall expenses and help avoid potential financial setbacks.

Distinguishing Between Essential and Discretionary Expenses

The primary difference between essential and discretionary expenses lies in their necessity for maintaining a basic standard of living.

Necessary expenses are fundamental and cannot be eliminated without negatively impacting one’s quality of life.

Discretionary costs, however, are non-essential and can be adjusted or eliminated based on an individual’s financial priorities.

To effectively manage your finances, it’s crucial to distinguish between these two types of expenses.

By categorizing your expenses as either essential or discretionary, you can better identify areas where spending can be reduced and allocate resources more effectively.

In most cases a split of direct and indirect expenditure is a good starting point. Indirect spend categories are where you likely find the majority of your discretionary expenses.

Improving how you manage indirect procurement will have a lot of benefits for your indirect procurement process now but can also help if you need to review what expenses you can cut out without impacting core operations.

In times of financial hardship, it’s crucial to prioritize essential expenses and cut back on discretionary spending.

Focus on maintaining the core functions of your business, including paying employees, keeping the lights on, and ensuring that your products or services are still available to customers.

Reducing non-essential spending can help your business weather the storm and emerge stronger when conditions improve.

Closely monitoring spending and comparing it to your budget can help control expenses.

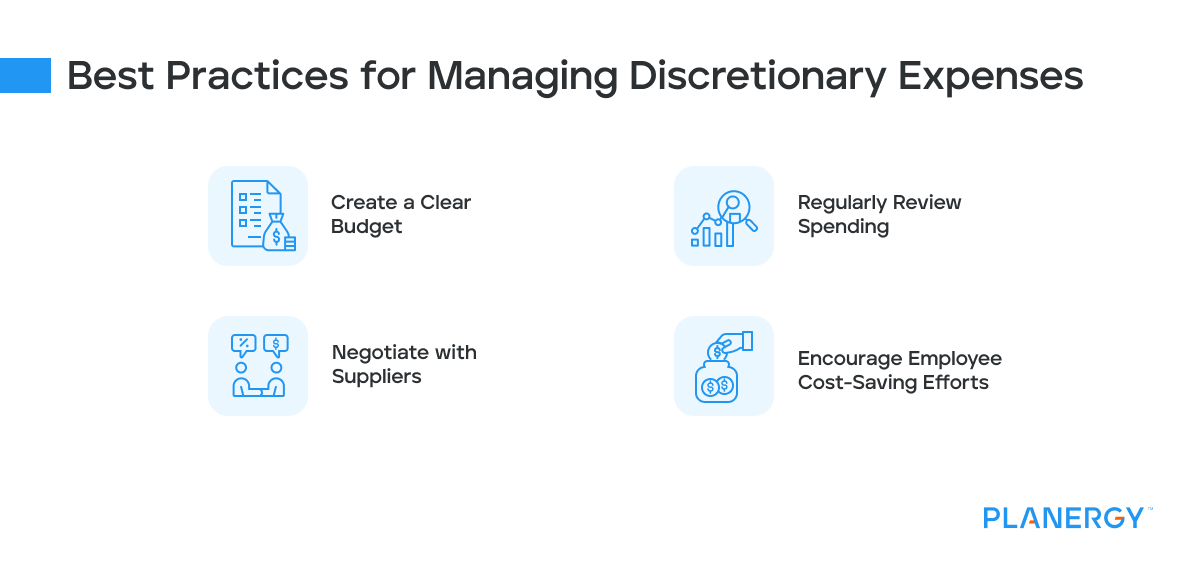

Best Practices for Managing Discretionary Expenses

Create a Clear Budget

Establishing a comprehensive and strategic budget is crucial for effectively managing discretionary expenses.

A detailed budget should outline all discretionary and non-discretionary expenses, making it easier to identify areas where spending can be reduced.

Both individuals and businesses can benefit from tracking their income and expenses, setting spending limits, and prioritizing financial goals.

Regularly Review Spending

Periodically assessing spending habits is essential for identifying and eliminating unnecessary expenses or areas of overspending.

By regularly reviewing bank statements, credit card transactions, and expense reports, individuals and businesses can gain better control over their finances and adjust as needed to stay within their budget.

For businesses, a dedicated spend management software, like PLANERGY, with automated spend analytics and drill down reporting makes this much easier.

Negotiate with Suppliers

Seeking better deals or alternative options for products and services can lead to significant cost savings for both individuals and businesses.

Negotiating with suppliers, comparing prices, and exploring different vendors can potentially secure more favorable terms and reduce discretionary expenses.

Encourage Employee Cost-Saving Efforts

Implementing company-wide initiatives that promote cost-saving behaviors among employees can help businesses manage their discretionary expenses more effectively.

These initiatives may include offering incentives for cost-saving ideas, providing training on expense management, and encouraging employees to be mindful of their spending habits.

By fostering a cost-conscious culture within the organization, businesses can reduce expenses and improve their financial health.

Using Software to Manage Discretionary Expenses

Software solutions, such as PLANERGY’s spend management software, can be instrumental in better management of discretionary costs.

By tracking spending, identifying areas of overspending, monitoring employee spending habits, and providing detailed reports for more accurate budgeting you can improve the management of discretionary spend.

Tools like this ensure you have enough money to cover mandatory spending and can appropriately plan for discretionary items.

Some common questions about using software to manage discretionary expenses include:

Can the software integrate with existing financial systems?

PLANERGY, and many other expense management software, can integrate seamlessly with popular accounting systems and ERPs, making tracking and analyzing expenses easier.

How customizable are the reports?

PLANERGY offers customizable reporting options and dashboards, allowing businesses to focus on specific areas of concern or interest. Create standard reports, schedule them, and use spend analytics software to gain better insights.

This is not standard for all spend management software. Often they include basic reporting options without significant flexibility.

Is the software user-friendly?

Look for a solution that is easy to use and offers accessible customer support. If you fail to achieve user adoption across the company, you will be missing out on valuable data.

Understanding and managing discretionary expenses is vital for both individuals and businesses to maintain healthy finances.

By implementing best practices and utilizing tools such as expense management software, it is possible to gain control over discretionary spending and make informed decisions that benefit overall financial health.

Whether business or personal, financial planning and saving money when and wherever possible is important.