Expense reimbursement is when an organization provides money to its employees or contractors to cover expenses they have incurred while conducting business on behalf of the organization.

This payment type is typically used when employees purchase items or services necessary for their job, such as travel expenses. Let’s take a closer look at expense reimbursement and why it matters.

Why Is Expense Reimbursement Important?

Expense reimbursement allows businesses to accurately track their spending and ensure that employees are not out of pocket for any legitimate business-related costs.

It also prevents employees from paying upfront for items they may need to complete their job tasks; instead, they can wait until they have been reimbursed before purchasing them.

For companies with multiple employees or contractors who travel frequently, expense reimbursement is especially important to ensure accurate tracking of all expenses.

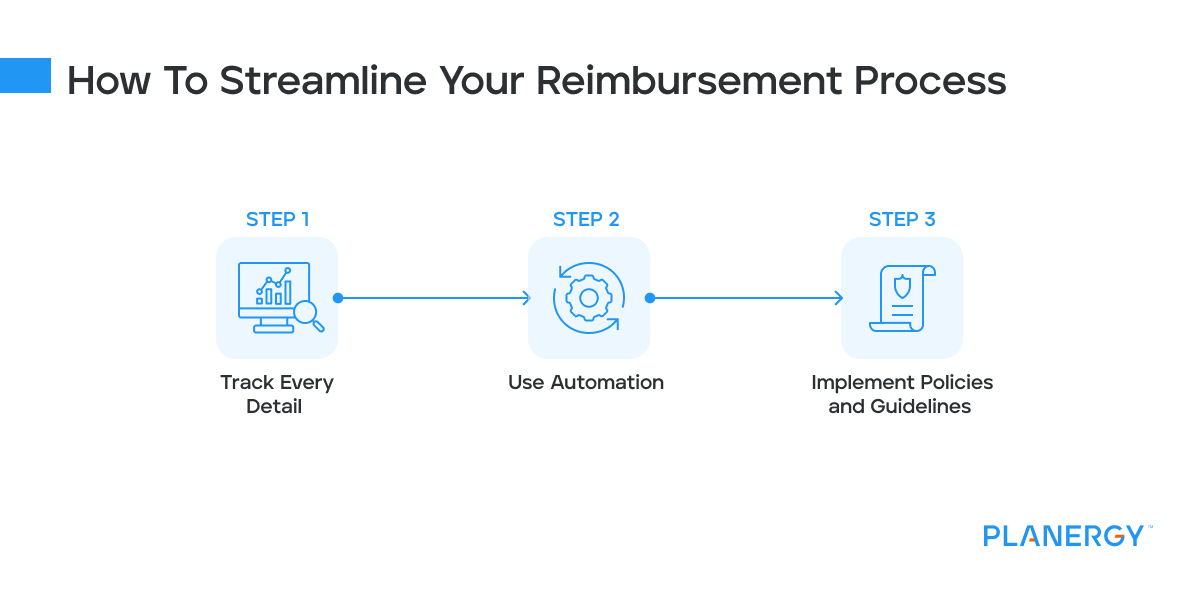

How to Streamline Your Reimbursement Process

Reimbursing business expenses can become quite complex, especially if many employees make work-related purchases with their own money.

Regardless of how many reimbursement requests you expect to process within a calendar year, keeping records is crucial for accounting and taxes. Any reimbursement to employees is a business tax deduction.

-

-

Track Every Detail

The first step in streamlining your business’s expense reimbursement process is to track every detail. This means having a system to track all expenditures, including travel expenses, meals, and other miscellaneous costs.

Having detailed records of where the money is going makes it easy to reconcile the expenses with their respective accounts when it comes time to reimburse them.

Tracking each expenditure will help you identify potential issues or discrepancies that could cause problems later.

You’ll need to know the five Ws to track, monitor, and effectively handle expense management properly. These are:

-

What

What are you spending your money on? This is important to understand what kind of expenses you should be aware of and manage.

-

Who

Who is making the purchases? Knowing who is responsible for each transaction will help you build accountability into your system.

-

Where

Where are expenses being made from? Tracking where the money was spent is essential for accurately tracking your finances.

-

When

When were these purchases made? It’s important to know when items were purchased, or services were rendered so that you can properly manage payments.

-

Why

Why were the purchases made? Understanding why an expense was made will help inform future budgeting decisions.

-

-

![]()

-

Use Automation

Expense management automation tools can save time and eliminate tedious tasks such as manually entering data into spreadsheets or sending emails requesting receipts.

Automation can also be used to set up reminders for employees who are late submitting their expense reports or need additional information from their managers before they can be reimbursed.

-

Implement Policies and Guidelines

The policy should include definitions of what constitutes an eligible expense, including travel costs, meals, supplies, and training materials.

It should also include details on what type of documentation is required for the claim—such as receipts and itemized statements—as well as a timeline for submitting the claims.

Additionally, it’s important to note if there will be limits on certain types of expenses, such as entertainment costs or mileage reimbursement rates.

Explain the process after the claim has been submitted is important—including when and how employees will receive their reimbursements.

If there is an internal audit process for all claims, then this should also be noted in the policy so that employees can expect delays if their claims are flagged for review before approval.

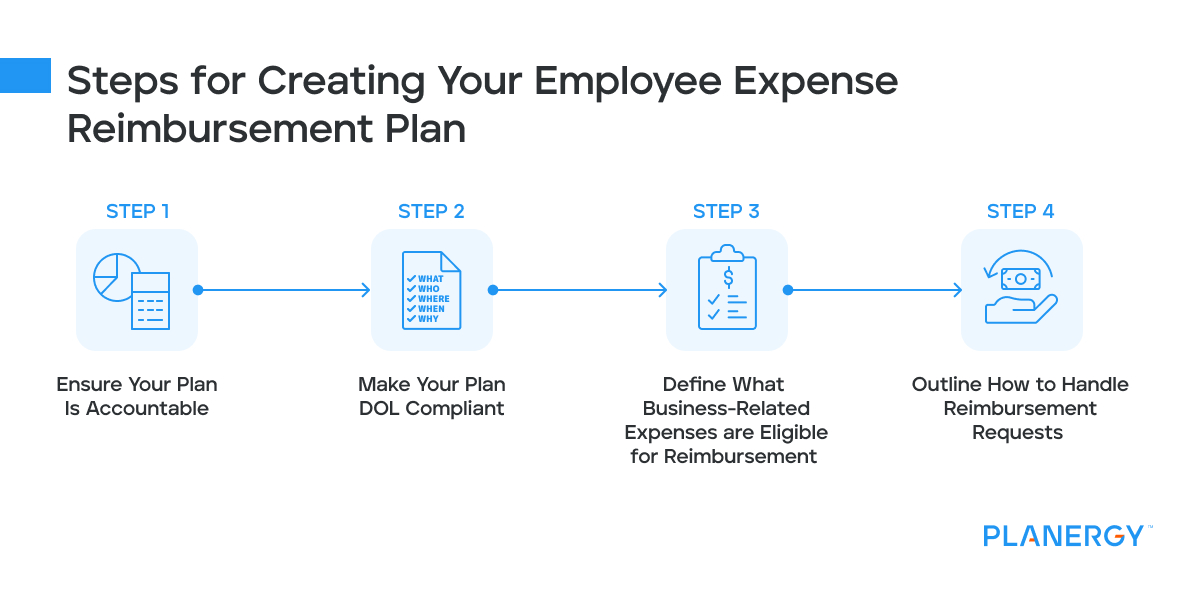

Creating Your Employee Expense Reimbursement Plan Step-by-Step

-

Ensure Your Plan Is Accountable

If your plan is “accountable,” it generally allows for tax-free reimbursement.

To be considered accountable, the plan must have these elements:

- Business Purpose: A legitimate business reason for the expense.

- Validation: Proof of the total expense via receipt.

- No Extras: Only the exact amount of the business expense is reimbursed. If there are any extra funds available from an employer-provided stipend, such as per diem rates, it must be returned to the employer. Only the actual cost of expenses will be reimbursed.

-

Make Your Plan Department of Labor Compliant (for USA-Based Companies)

The U.S. Department of Labor has set regulations regarding the proper documentation of employee expenses, requiring all items to be meticulously recorded with receipts provided and all five “Ws” attended to.

Itemized receipts are required for meal reimbursements. For organization-owned or leased vehicles, accurate data must be supplied, including date of travel, number of miles driven for personal/business purposes, and odometer readings.

Though the DOL does not make any exceptions for costs under $75, a signed statement from the employee can be provided as proof of expense if a receipt is lost.

These guidelines ensure proper recordation and compliance with government regulations while legitimately safeguarding all employee expenses incurred while on duty.

-

Define What Business-Related Expenses are Eligible for Reimbursement

Your plan should clearly state what expenses you’ll reimburse and what expenses you won’t. It should also state at what rate they’ll be reimbursed.

For instance, the General Services Administration publishes per diem and standard mileage rates. Your business can pay employees those standard rates or for the actual expenses.

Per diem rates provide allowance for food, lodging, mileage/transportation, and other expenses.

They’re based on location, so travel to Los Angeles, New York City, or other high-cost locations will have higher limits than lower-cost locations.

Several business-related expenses can be eligible for reimbursement when proper documentation is provided. These include:

- Travel costs such as airfare, hotel accommodations, rental cars, ground transportation, and other related expenses

- Meals while traveling including breakfast, lunch, and dinner

- Supplies purchased for business use, such as stationery, pens, and other necessary items

- Training materials such as books or online subscriptions

- Mileage for business travel taken in a personal vehicle

- Any additional costs required to fulfill the job duties of an employee

Your policy should clearly state the types of expenses that are not eligible for reimbursement, such as entertainment expenses, gifts, or alcohol purchases.

It should also outline the types of expense claims that may require additional documentation beyond a standard receipt—such as itemized statements or proof of payment.

For example, will you require employees to use public transportation while on a business trip? If they’re traveling to an area where public transportation isn’t widely available, will you provide a stipend for ride-share services? Will they be allowed to rent a vehicle? If they rent a vehicle, will they be required to share it with other employees who may also be on the trip?

If your small business policy requires that they use public transportation where available and choose not to, employees should be aware that they will use their own money to pay for commuting during the trip.

-

Outline How to Handle Reimbursement Requests

Your expense reimbursement policy must tell employees what the organization will cover, how they should submit reimbursement requests, and how quickly they can expect payment.

It should include the required documentation to submit with the request, the timeframe for submitting the request, where to submit the request, and who to submit it to.

Any time an employee pays a business expense out of their pocket, they should be aware of what is covered by the expense reimbursement policy.

Reimbursements and Income Taxes

What Is the Difference Between a Reimbursement and a Deduction?

A reimbursement is a compensation your company pays to an employee for out-of-pocket expenses they pay.

Typically, they aren’t considered taxable income.

A deduction is an expense that can be subtracted (deducted) from a taxpayer’s gross income to reduce the amount subject to taxes.

If the reimbursement is considered taxable income, then the employee can deduct it from their taxes. If it is not taxable, it cannot be deducted.

Do Expense Reimbursements Count as Income?

Under IRS regulations, job-related expenses shouldn’t be counted as taxable income.

You aren’t to include them on the W2 form as part of the employee’s income because job-related expenses are deductible business expenses for your organization.

Per diem rates, as long as they remain below the top rate, are not subject to taxes.

However, if your company uses a nonaccountable plan, reimbursements received outside the rules of that plan are considered taxable income and required to be reported as income on a W2.

This allows employees to deduct the expenses on their personal tax returns.

How Are Expense Reimbursements Taxed?

If the expenses are made, reported, and paid under the terms of an accountable plan outlined above, they are not taxed.

If the expenses are made, reported, and paid under the terms of a nonaccountable plan, then it is taxed as part of the employee’s income. Unless it is deducted, it would be taxed as income.

Expense Reimbursement and Independent Contractors

The same rules apply here to employees with accountable vs. nonaccountable plans.

The reimbursable expenses should not be included as income on the 1099 NEC or 1099 MISC form, as they are not part of the contractor’s income under accountable plans.

If your expense reimbursement plan is not accountable, those reimbursements are added as income and can be deducted from the contractor’s tax return as business expenses.

Expense reimbursement is an important part of any organization’s accounting system.

It helps businesses accurately track their spending and ensures that employees aren’t left paying out-of-pocket for any legitimate business-related costs.

By understanding what expense reimbursement covers and why it matters, businesses can better manage their organization’s finances effectively and efficiently.