What Is Expense Reporting?

Expense reporting is the process of documenting and submitting expenses incurred by an individual or an organization during business operations.

It involves keeping track of all expenses, such as travel expenses, office supplies, meals, and other expenses related to business operations, and then submitting a report to the appropriate party for reimbursement or accounting purposes.

Expense reporting is an important process for businesses as it helps to ensure that expenses are properly accounted for and that employees are reimbursed for legitimate business expenses promptly.

Additionally, expense reports can provide valuable insights into how much money is being spent on different categories of expenses, which can help organizations identify areas where they may be able to cut costs or optimize their spending.

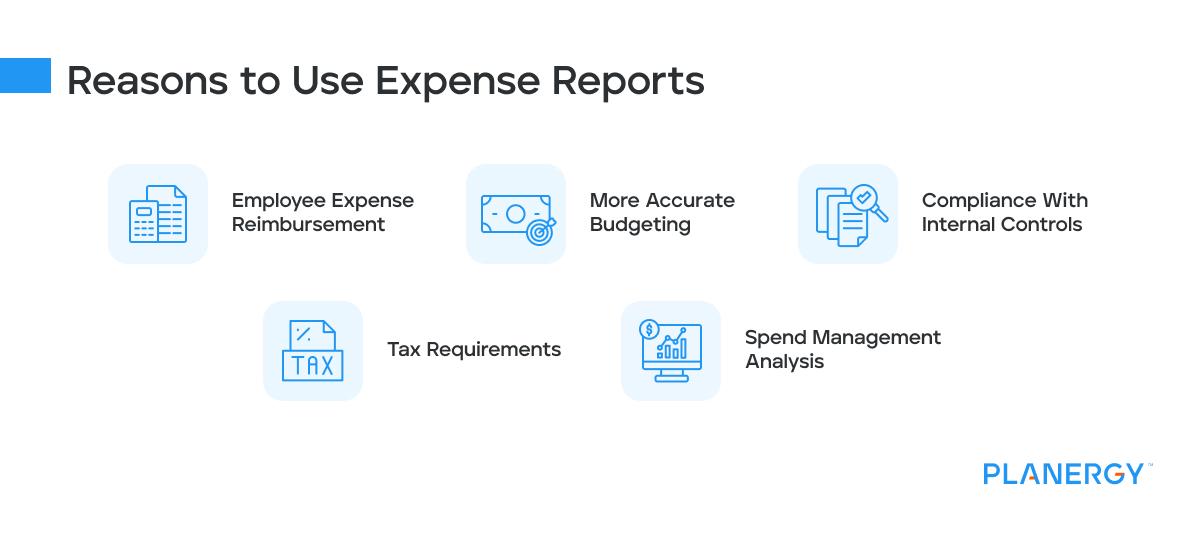

Reasons to Use Expense Reports

Businesses may not think expense reports are necessary, but the truth is businesses of all sizes can benefit from them.

Employee Expense Reimbursement

One of the primary reasons for expense reports is to reimburse employees for business-related expenses they have incurred on behalf of the company. This could include travel expenses, meals, accommodations, and other costs.

More Accurate Budgeting

Expense reports can provide valuable data for budgeting purposes. By tracking expenses over time, companies can gain insights into where they are spending money and identify areas where they may need to cut costs or adjust their budget.

Compliance With Internal Controls

Expense reports can help you ensure compliance with internal policies and external regulations. Companies can reduce the risk of fraud, errors, and noncompliance by requiring employees to document their expenses and obtain proper approvals.

Tax Requirements

Expense reports are also used for tax purposes. By tracking business expenses, companies can deduct them from their taxable income and reduce their tax liability.

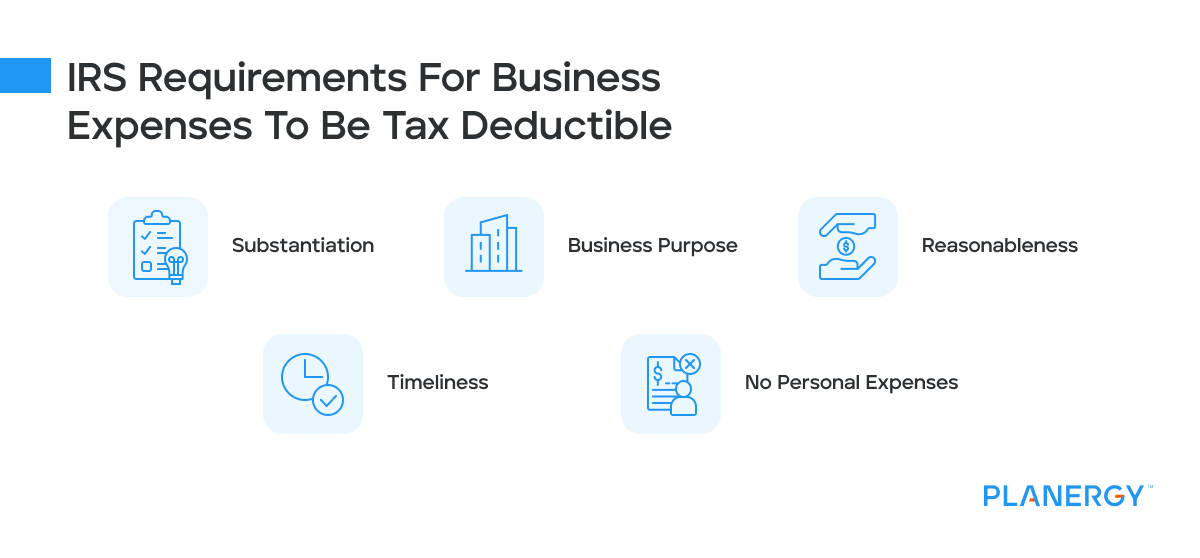

IRS Requirements for Expense Tracking and Reporting

The Internal Revenue Service (IRS) has specific rules and requirements for business expenses that can be deducted from taxable income.

To be deductible, expenses must be ordinary and necessary expenses incurred during business operations. Here are some of the key requirements that the IRS has for expense reports:

Substantiation

The IRS requires that adequate records, such as receipts, bills, and invoices substantiate expenses. These records must show the expense’s amount, date, place, and business purpose.

Business Purpose

Expenses must have a business purpose. This means that they must be directly related to business operations, such as travel expenses for a business trip or office supplies for use in the office.

Reasonableness

Expenses must be reasonable in amount. This means that they should not be excessive or unnecessary for the business purpose. For example, a coach flight instead of a first-class seat, or a basic hotel room instead of a suite.

Timeliness

Expenses must be reported in a timely manner. The IRS requires that expenses be reported on a regular basis, typically within 60 days of the expense being incurred.

No Personal Expenses

Personal expenses cannot be deducted as business expenses. The IRS requires that expenses be exclusively for business purposes and not for personal benefit.

Spend Management Analysis

Expense reports can provide valuable insights into how employees are using company resources.

By analyzing the spend data, companies can identify trends and patterns in employee spending, which can help them make informed decisions about budgeting, procurement, and other business processes.

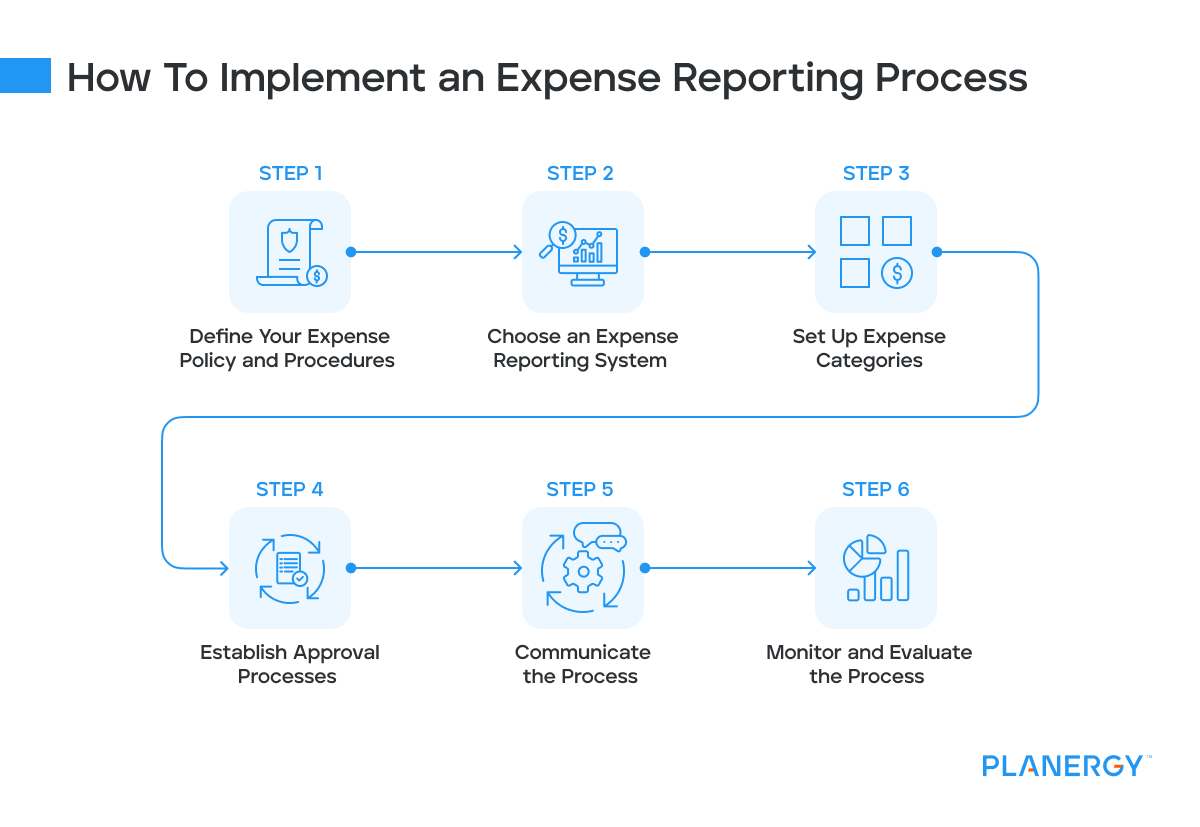

How To Implement an Expense Reporting Process

It’s up to your organization to define the expense reporting process in a way that makes sense for you and your industry.

Typically, employees will be given specific guidelines on what expenses are eligible for reimbursement, what documentation is required, and how to submit their expense reports.

This might be covered by a corporate travel policy and employee expense reimbursement policy.

This can vary depending on the organization, but the process generally involves keeping receipts, filling out a form, or using an online tool to document expenses and then submitting the report to the appropriate person or department for review and approval.

Developing an expense reporting process for a company typically involves several steps.

Define Your Expense Policy and Procedures

Start by establishing clear policies and procedures that define what expenses are eligible for reimbursement, what documentation is required, and how expense reports should be submitted and processed.

This should be communicated clearly to all employees and stakeholders involved.

As you define your company policies, consider the following:

- What type of expenses will you cover?

- What expenses are not eligible for employee reimbursement?

- Will you allow employees to use a corporate card or purchasing card?

- Will you allow employees to book their own business travel or have someone book it for them? What pricing limits will you enforce?

- What should employees do during a business travel emergency? For example, the flight is overbooked, only first-class is available on another airline, etc.

- Will you require paper receipts for all expenditures or allow employees to submit photos of receipts through a mobile app?

Choose an Expense Reporting System

Next, determine the expense reporting system you’ll use. This could be a paper-based system, a Microsoft Excel spreadsheet, or a cloud-based expense management software.

As you evaluate options, consider ease of use, functionality, security, cost, and integration with other systems, such as your ERP or accounting software.

The ideal expense management solution will work with your accounting software and allow you to establish automated workflows for data entry and accounts payable.

Set Up Expense Categories

Define and set up expense categories, such as travel, meals, entertainment, and office supplies. This will help ensure expenses are properly tracked and allocated in your general ledger.

Establish Approval Processes

Next, establish an approval process for expense reports, which may involve multiple levels of approval depending on the expense amount or the employee’s position. This helps ensure that expenses are properly reviewed and authorized.

A simple process looks like this:

Employee Submits Expense Report

The employee submits an expense report to the appropriate person or department, typically the employee’s supervisor or the finance department.

Review of Expense Report

The approver reviews the expense report to ensure all expenses are legitimate, necessary, and comply with company policies and procedures.

Approval or Rejection of Expense Report

The approver either approves the expense report, indicating that the expenses are acceptable and can be reimbursed, or rejects the report, indicating that some or all expenses are unacceptable.

Corrections and Resubmission

If the expense report is rejected, the employee may need to make corrections and resubmit the report for approval.

Processing of Approved Expense Report

Once the expense report is approved, the finance department will process the report and arrange for reimbursement of the approved expenses.

Communicate the Process

After establishing the approval process for employee expenses, you must communicate the expense reporting process to all employees, including how to submit expenses and what to expect in terms of reimbursement.

This should be done through employee handbooks, training sessions, and other communication channels.

Monitor and Evaluate the Process

You should regularly monitor and evaluate the expense reporting process to ensure it works effectively and efficiently.

This could involve tracking metrics such as expense report turnaround time, the accuracy of submissions, and the amount of reimbursement. Based on this feedback, the process can be refined and improved over time.

For example, tracking everything in a spreadsheet may be the quickest and easiest way to handle things when you’re a small company. But as you scale, it will lose efficiency because it relies on manual data entry.

Investing in expense reporting software makes more sense to streamline and automate the expense management process.

No matter which method you choose, having an expense reporting process in place helps keep operations running smoothly.

Basic Expense Report Template

[Company Logo]

Expense Report

Employee Information

- Name:

- Department:

- Employee ID:

- Date of Expense Report:

Expense Details

| Date | Description | Category | Amount | Receipt Attached |

|---|---|---|---|---|

Sub-Total: [Total amount of expenses]

Receipts Attached: [Yes/No]

Approvals

| Employee Signature | Date | Manager Signature | Date |

|---|---|---|---|

Notes/Comments:

[Add any notes or comments regarding the expenses or the report]

This is just a basic template that is customizable to fit your company’s specific needs.

The expense report should include all relevant information, such as the date, expense description, category, amount, and whether or not a receipt is attached.

It should also have spaces for the employee and manager’s signatures to certify the information as accurate and additional notes or comments to aid approval.

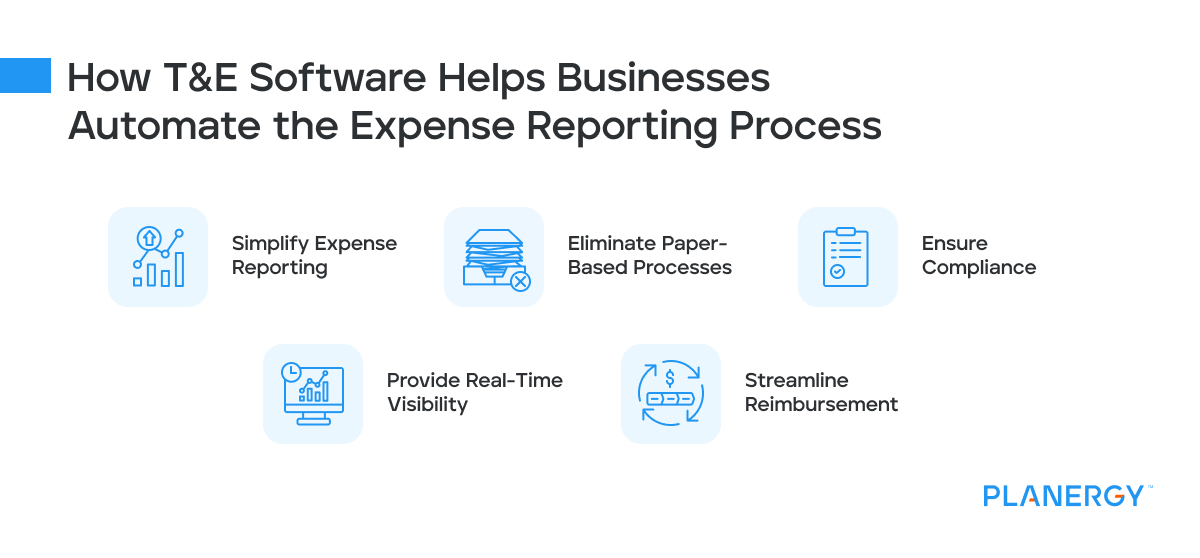

How Travel and Expense (T&E) Software Solutions Can Help

Travel and expense management can be difficult if you are using manual processes.

Travel and expense (T&E) software can help businesses automate and streamline their expense reporting process.

Simplify Expense Reporting

T&E software can make it easy for employees to submit expenses by providing a user-friendly interface for capturing and categorizing expenses.

This can reduce the time and effort required to complete expense reports and ensure that all required information is included.

You can also automate expense reporting, streamlining reimbursement approval and cutting down on the manual tasks in the process.

Eliminate Paper-based Processes

T&E software can eliminate the need for paper-based expense reports and receipts, which can be time-consuming and error-prone. It is very easy to lose a receipt.

Instead, employees can use mobile devices or web-based portals to submit expenses and attach electronic receipts. This can be done as soon as receipt is received, reducing the possibility of missing documents.

Ensure Compliance

T&E software can help businesses ensure compliance with internal policies and external regulations by providing automated approval workflows, audit trails, and built-in compliance checks.

Provide Real-time Visibility

T&E software can provide real-time visibility into expenses, allowing businesses to track spending and identify areas where costs can be reduced or optimized. This can help businesses make informed decisions about budgeting and procurement.

Streamline Reimbursement

By automating the expense reimbursement process, T&E software can make it easy for businesses to reimburse employees for expenses. This can reduce the time and effort required to process reimbursements and ensure that employees are paid accurately and on time.

Overall, T&E software can help businesses reduce the administrative burden of expense reporting and ensure that expenses are properly documented and compliant with internal policies and external regulations.