From the earliest days of commerce, identifying and mitigating risk has been an integral part of supply chain management. Such risk can originate outside your business or within its walls; it can strike upstream or down.

Companies who invest in supply chain risk management understand the new role procurement occupies in their organizations, and take action to ensure this powerful source of strategic value generates maximum returns with minimal exposure.

Mitigating the financial risk in your supply chain requires careful consideration and a proactive approach, but doesn’t have to be difficult.

With help from best-in-class software solutions and by following a few basic best practices, you can gain the visibility into, and control over, your supply chain required to manage financial risk, guard against supply chain disruption, and preserve business continuity while you pursue your goals for growth and profitability.

Taming Financial Risk in the Supply Chain is Critical to Business Continuity

Doing business in the 2020s has been a rocky journey for many businesses. Even before the COVID-19 novel coronavirus pandemic sent shockwaves through global supply chains, companies of all types and sizes were facing unprecedented business and supply chain disruption from natural disasters and climate change, international conflict, and sourcing difficulties related to ethical procurement and sustainability.

Other high-risk threats included time-tested frustrations such as:

- Theft and stock loss;

- Regulatory challenges;

- Maverick spend and invoice fraud;

- Suppliers closing their doors due to unforeseen business disruptions;

- Customers closing their doors due to unforeseen business disruptions; and

- A lack of staff expertise in assessing and mitigating risk.

Essentially, the arrival of a global pandemic simply exacerbated a problem that, while more serious than ever before, was as old as business itself.

So, yes, supply chain risk mitigation (SCRM) has always been a priority for savvy business owners. But in a world and marketplace increasingly defined by digital transformation and data management, managing risk in supply chain finance has taken on new levels of importance.

In fact, in a 2018 survey of financial risk professionals conducted by Dun & Bradstreet, respondents said supply chain disruptions were the number-one risk on their list.

Why? Because procurement and accounts payable are no longer simply back-room centers of opportunistic cost-cutting. Instead, companies have come to realize that their spend activities—along with the data they generate—represent a tremendously rich source of potential process improvements and strategic insights that can guide them to hitherto-unimaginable levels of profitability, performance, and competitive strength.

Furthermore, because procurement touches every area of an organization, a powerful supply chain disruption can lead not just to lower profits, but insolvency and closure.

It only makes sense, then, to strive for maximum transparency, accuracy, and accountability in every step of the supply chain.

The trouble is, volatility is inherent to international commerce, and a company’s financial health, long-term viability, and business continuity are tied directly to its skill at risk assessment and mitigation.

In a world and marketplace increasingly defined by digital transformation and data management, managing risk in supply chain finance has taken on new levels of importance.

Obstacles to Effective Supply Chain Risk Management

Tossing one more spanner in the works is the difficulty many companies experience in achieving a level of supply chain transparency required to perform an accurate and complete risk assessment—let alone take corrective action.

Without the proper tools, risk managers and their procurement teams don’t have all the information they need. If vendors don’t have the ability or willingness to share their supply chain data, the window for effective risk assessment narrows even further.

The work required to develop and implement risk mitigation strategies can be daunting as well. Global supply chains are often multi-tiered and intricately complex. A single finished product may lie at the end of a supply chain involving dozens or even hundreds of suppliers.

Tracing every possible source of risk (or at least most of them) from the sourcing of raw materials through delivery of finished goods requires time, talent, and tools to make it tenable at all.

Fortunately, these difficulties are not insurmountable. High-quality data, paired with the automation, analytics, and artificial intelligence required to leverage its value, can shatter the silos that hamper supplier risk assessment and help supply chain managers assess and reduce risks at all stages of the value chain to protect their company’s competitive footing and business continuity.

Best Practices for Reducing Financial Risk in Supply Chains

Companies who combine digital tools with proactive problem solving can tackle risk more effectively.

1. Start with the Tools

All of the tasks involved in effective SCRM—from the initial risk assessment through development of detailed risk mitigation strategies—are more accurately and swiftly performed with help from digital tools.

The huge amount of information involved, paired with the need to organize, manage, and analyze it in an efficient way, makes relying on manual workflows, paper-based processes, and the speed and accuracy of an average human being simply untenable.

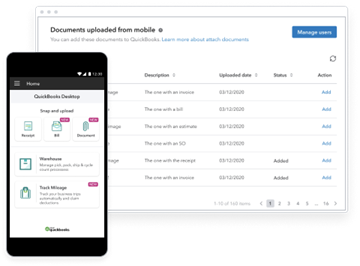

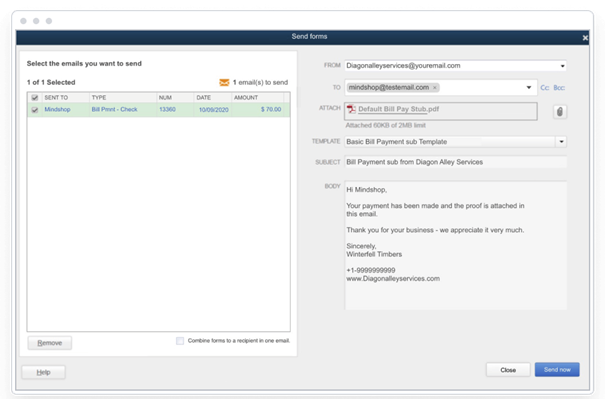

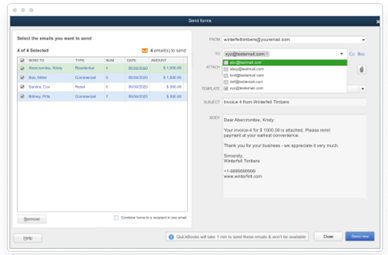

Investing in a comprehensive procure-to-pay (P2P) solution like PLANERGY sets the stage for effective risk mitigation by:

- Capturing and storing all spend data in the cloud and providing full integration of all data relevant to the value chain in a single location, maximizing transparency while providing leveled, role-appropriate access to all stakeholders.

- Eliminating internal and external data silos that can hamper collaboration and reduce the utility and accuracy of analytics in making informed decisions.

- Manage cash flow more effectively to increase liquidity in the face of disruptions.

- Providing automation tools to eliminate human error (and the need for most human oversight) from high-volume tasks while increasing accuracy, speed, and data quality.

- Providing advanced analysis, forecasting, and reporting tools that can transform data from diverse sources into actionable insights that directly inform risk mitigation strategies.

- Make it easier to identify, sort, and address external (e.g., credit risks for suppliers and clients) and internal (maverick spend, process inefficiencies) risk factors using customizable metrics for performance, compliance, and more.

2. Risk Assessment: Identify Your Known and Unknown Risks

Before you can mitigate risk, you need to understand the types of risk you’re dealing with, the likelihood of reducing or eliminating them, and the limits of your own ability to predict the unpredictable.

Known risks are readily identifiable and can be measured and mitigated. Market risks (e.g., changing consumer behaviors or exhaustion of limited resources), legal risks (e.g., regulatory compliance issues) , and internal risk factors (e.g. inefficiencies in operations management) are all examples of known risks.

Analyzing these risks can help you quantify your exposure. For example, a supplier’s financial history or a customer’s payment history, along with other data such as credit rating, can help you establish the potential risk for bankruptcy or default.

Other risk factors that affect financial stability, such as a supplier’s record for ethical hiring and labor practices or their policy on cybersecurity and data management, can also be used to evaluate and reduce risk to your company’s financial health and business continuity.

Cross-functional collaboration is key in managing known risks, as a diverse set of skill sets, perspectives, and expertise will be required to build a risk management program using well-calibrated metrics, clear benchmarks, and context-aware solutions to each risk factor.

In addition, a cross-functional risk management team can apply their skills to establish the potential scope, if not the exact nature, of unknown risks in order to expedite your response to them.

Unknown risks are, in essence, impossible to predict. A hacker finding a concealed backdoor in a piece of software and stealing customer payment data, or an earthquake in a zone where none have occurred for thousands of years, burying the main facility of your primary supplier, are just two examples of unknown risks.

With this type of risk, your risk management team should focus on maintaining the agility and flexibility to create and deploy an effective response as quickly as possible.

The cross-functional collaboration that provides innovative and creative solutions to known risks can also serve to ensure everyone has the necessary skills and training to engage effectively in a crisis, regardless of their specific expertise or primary role.

The other side of the coin lies in supply chain resilience; you can’t predict unknown risks, but you can analyze all available data to identify patterns and trends.

Everything from international relations to market trends to climate change data can provide your team with business intelligence they can use to create risk profiles and test scenarios of varying likelihood and severity.

You can also create strong supply chain contingencies that allow you to keep things moving while you formulate a response. This one-two punch of preparation and agility can help you build risk awareness into your corporate culture and keep even potentially devastating supply chain disruptions from crippling your business.

3. Measure, Monitor, Manage

With digital tools at your disposal, you can create a supply chain risk management framework you can use to measure, monitor, and manage risk using metrics.

For every risk on your list, make sure you know:

- The potential impact on your company’s financial health should the risk occur;

- The overall probability that the risk will occur; and

- Your company’s overall preparedness to respond to this outcome.

Based on the risk thresholds you set, you can classify threats as high-risk, medium-risk, and low-risk in order to prioritize solutions development and deployment.

Of course, risk assessment isn’t a “one and done” affair.

Regularly revisit your threats in order of severity, and continue to expand your available data in order to help your team create new scenarios that incorporate emerging threats as well as changes to existing ones.

By setting benchmarks and employing real-time monitoring of key risk factors, you can reduce your risk exposure and further reduce the potential financial impact of a given threat by having multiple mitigation contingencies at the ready.

Tame the Financial Risk in Your Supply Chain

When it comes to risk exposure, supply chain finance can be a golden opportunity to insulate your company against volatility, or a serious vulnerability that could cripple your business when disaster strikes.

Invest in the data management tools and training your procurement and accounts payable teams need to identify, measure, and reduce risk exposure in your supply chain.

Establish the criteria and controls you need to achieve end-to-end supply chain transparency, and collaborate with your suppliers to ensure their compliance in support of shared success.

With a proactive approach, you’ll gain the transparency and control you need to minimize financial risk in your supply chain.