Procurement organizations tend to devote most attention to direct costs. However, indirect costs hold an impressive potential for organizations looking to find ways to improve their spend management.

With the right tools, companies who want to control their indirect spend can find savings and build value.

In this article, we’ll go over what indirect costs are, how to calculate them, and how to reduce your indirect spend.

How Do You Determine Direct and Indirect Costs?

Determining direct and indirect costs is a matter of knowing the difference and categorizing costs accordingly.

Direct costs are the costs of producing actual goods and services. They’re the raw materials, components, capital expenditures, direct labor costs, direct salaries, finished goods, and professional services connected to the production of your company’s products.

Indirect costs are the costs of doing business that don’t actually produce goods or services. Things like office supplies, rental costs for office space, or money spent on marketing materials can be considered indirect costs.

They support the business and are often necessary, but they don’t produce anything tangible.

While this might seem straightforward, the shift to a largely service-based economy has blurred the lines between indirect and direct costs. In the modern era, many companies don’t produce anything tangible at all, but instead produce a social media app, online educational content, or video streaming services.

Consider data storage costs. For a video-streaming service, data storage could be considered a direct cost because the product is literally storing videos to be shared online. However, for a manufacturing company, data storage could be an indirect cost because it doesn’t directly produce physical products.

What Are Examples of Indirect Costs?

To determine what costs fall under indirect procurement, companies will need to consider their unique business situation. If they’re manufacturing products or selling items out of a physical store, it will be more straightforward.

If they’re an online service-based company, it could be a bit more difficult but certainly not impossible.

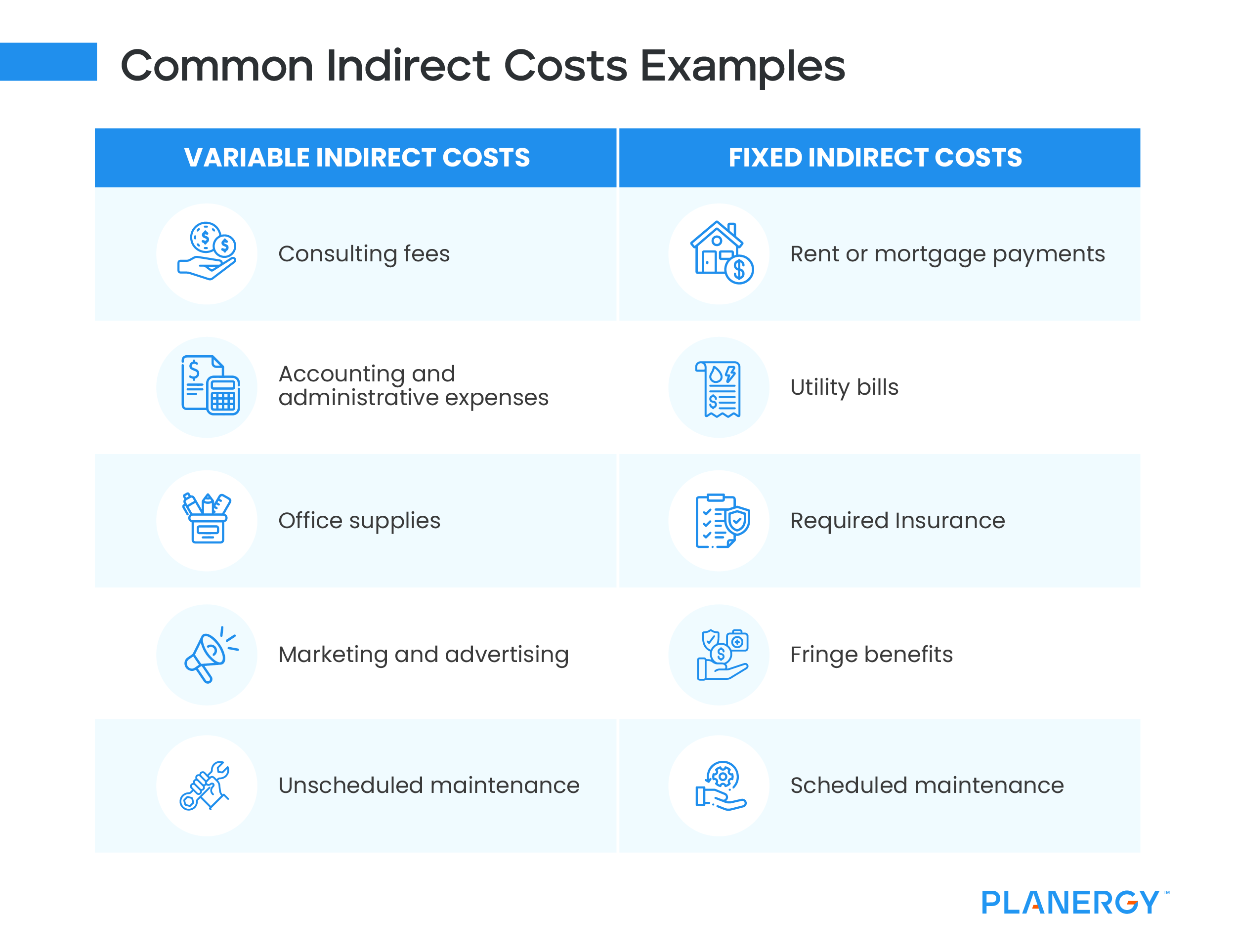

Additionally, indirect costs can either be fixed costs or variable costs. Fixed costs are recurring costs that stay the same (or change very little) over time. Fixed costs include mortgage payments, insurance premiums, utility bills, and other recurring costs.

Variable indirect costs go up and down depending on need and may even only be a temporary cost that goes away after its useful life. Examples include consulting fees, advertising campaign budgets, and office supplies.

Common examples of indirect costs include:

| Variable Indirect Costs | Fixed Indirect Costs |

|---|---|

| ● Consulting fees | ● Rent or mortgage payments |

| ● Accounting and administrative expenses | ● Utility bills |

| ● Office supplies | ● Required Insurance |

| ● Marketing and advertising | ● Fringe benefits |

| ● Unscheduled maintenance | ● Scheduled maintenance |

What Are the Two Main Types of Indirect Costs?

Most, but not all, indirect costs will fall under two main cost categories: Administrative and Overhead.

Administrative Costs

Any costs a company incurs that are not directly tied to a core function, such as production or sales, can be considered administrative expenses.

Typically, these expenses are related to the whole organization, and not an individual department.

Examples include management salaries, legal services, and IT support. While completely necessary to run a business, these costs are often the first to go during budget cuts because they don’t directly contribute to production, service delivery, or sales.

Overhead Costs

Often referred to as “the business of doing business,” overhead costs must be paid regardless of how a company is performing. Examples include rent, utilities, insurance, and taxes.

These costs aren’t directly tied to producing items or delivering services, but they are necessary for those things to take place.

Many companies have considerable indirect expenses (often 25-40%) and lack transparency and control over these indirect costs.

How to Calculate Indirect Costs

When calculating indirect costs, finance teams likely won’t be able to directly correlate costs to specific functions. This makes indirect costs more difficult to allocate correctly than direct costs.

Some expenses, like utilities, insurance, and wages simply can’t be assigned percentages for each project or department.

The secret of effective indirect cost allocation lies in calculating indirect expenses as a single shared cost, and then finding ways to divide it up across projects, business units, production lines, etc. in a fair and proportionate way.

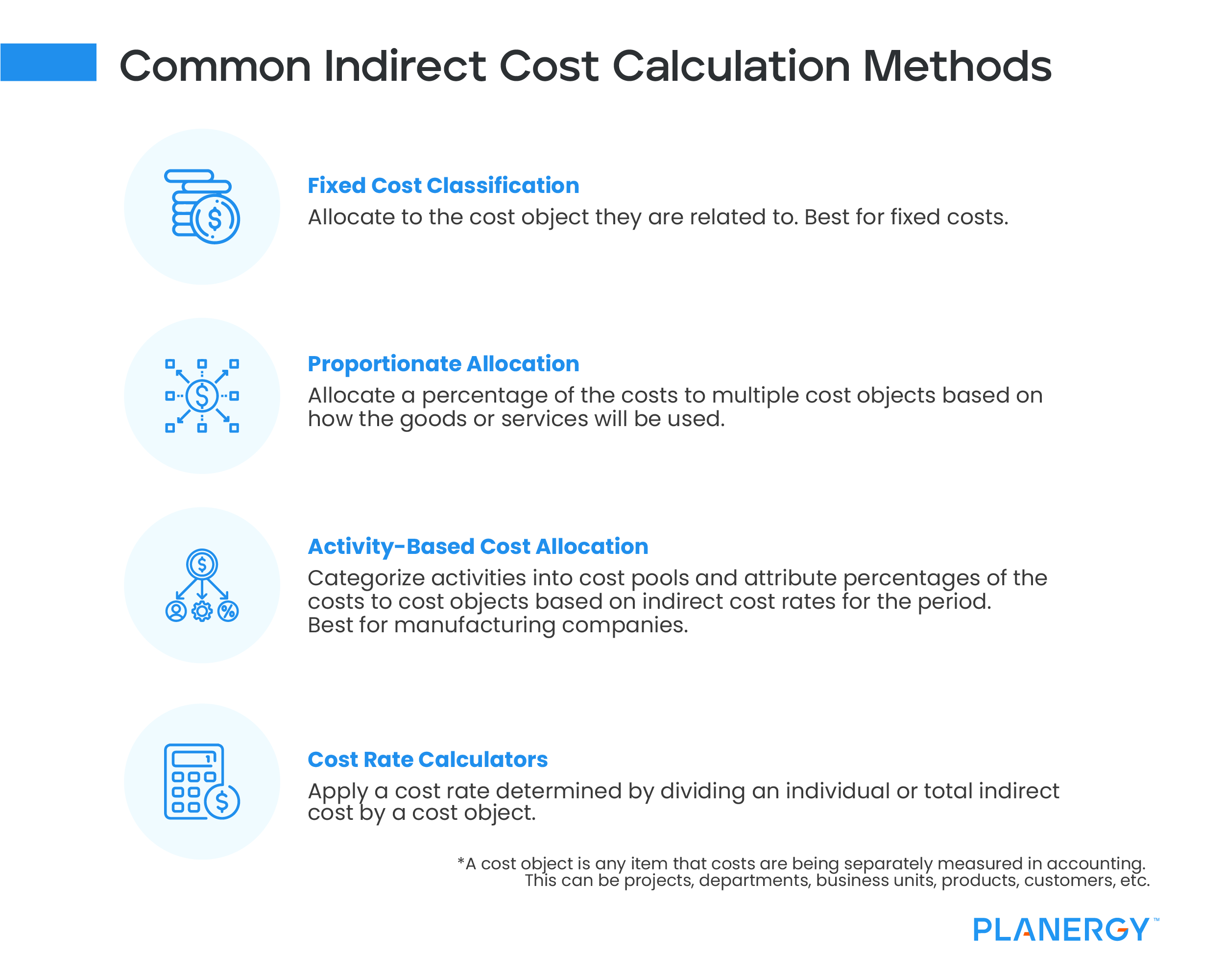

Some of the most common indirect cost calculation (IDC) methods include:

Fixed Cost Classification

The most basic of indirect cost allocation methods, fixed cost classification works best with fixed expenses such as indirect labor costs, depreciation, and rent. These costs are recorded as charges to specific assets, projects, departments, subcontracts, business units, etc.

For example, wages for the marketing team are allocated to the marketing manager’s budget, office supplies are allocated to the department that ordered them (or to the business unit under whom multiple departments will share the supplies), and depreciation on a company copier is allocated to the copier itself.

Proportionate Allocation

“To each their own” underpins proportionate allocation. In this method, indirect costs are shared out among projects, departments, and business units based on the type of cost and how the goods or services will be used.

Percentages can be assigned monthly but are generally calculated, allocated, and reviewed every fiscal year.

So, the company’s Internet services might be split evenly among the budgets of every department, whereas cleaning services might be allocated based on the square footage of a given department.

Activity-Based Cost Allocation

This approach to allocating indirect costs takes more time and effort, but is also much more accurate than proportionate or fixed cost allocation. To collect the data needed for indirect cost calculation, managers will:

- Identify and record all business activities within their department for a given accounting period.

- Categorize these activities as direct or indirect costs.

- Analyze all costs and calculate indirect cost rates at the end of the accounting period (e.g. a month or a quarter), then allocate indirect costs accordingly.

Using Cost Rate Calculators

Indirect cost rate calculations rely on cost pools, a value representing total indirect costs broken out and allocated based on percentages calculated in various ways. This is done by dividing the cost pool by a cost object (i.e., a variable such as usage, physical dimensions, project category, department, etc.).

For example, if you’re using the proportionate allocation method, you could allocate your overhead costs by dividing your total overhead costs by the direct costs incurred by each specific department. The resulting indirect rate is called an overhead rate.

Let’s say your company’s total indirect costs are $6,000. 3D Printing (Production) has direct costs of $6,000, while engineering has $4,000 and design has $2,000, meaning your total direct costs are $12,000. Divide indirect costs to get an overhead rate of 50%:

6,000 ÷ 12,000 = .5

Now, calculate each department’s share of the total indirect costs by multiplying each department’s total direct costs by the overhead rate.

- 3D Printing: $6,000 x .5 = $3,000

- Engineering: $4,0000 x .5 = $2,000

- Design: $2,000 x .5 = $1,000

- Total indirect costs: $6,000

Breaking out expenses this way is similar to a method used to allocate direct and indirect expenses by project rather than department, using what’s known as a Total Project Cost (TPC) calculation.

This cost allocation method multiplies the overhead rate for a specific department, source of funding, or project by a total direct cost base.

This value is either your total direct costs (TDC) for the department, project, etc. or another value called Modified Total Direct Costs (MTDC), which is all direct costs minus budget items that don’t carry overhead.

The MTDC base method is commonly used by schools and nonprofits who receive funds from a federal agency or the federal government itself (and also by those who receive funding from non-federal sources, albeit less commonly).

Nonprofits and schools generally have specific indirect rate agreements in place with sponsors and funding sources.

However, applying indirect rates to a MTDC base is also useful for businesses who want to budget by project, subcontractor, or other cost objectives for a more granular breakdown of indirect cost allocation.

How Can You Reduce Indirect Costs?

In order to reduce indirect costs, companies need reliable ways to identify, quantify, and then optimize their indirect costs. Cost allocation is often focused primarily on direct costs.

The indirect procurement process can often be unmanaged and ad-hoc causing a lot of waste. But many companies have considerable indirect expenses (often 25-40%) and lack transparency and control over these indirect costs.

Modernizing and digitizing the process can have significant impact.

Effective indirect cost allocation and management can also help companies and organizations center procurement as a value creation center rather than a budget trimmer through:

- Greater spend transparency.

- More accurate financial reporting, budgeting and forecasting.

- Improved cash flow and strategic spend.

- Eliminating waste and inefficiency.

Additionally, companies looking to reduce indirect costs can practice effective indirect spend management.

There is significant opportunity to increase savings and build value through process optimization, monitoring, and streamlining total spend—rather than prioritizing direct spend management alone.

One of the most effective ways to simplify and streamline tracking, calculating, and allocating indirect costs correctly is with the use of eProcurement software like PLANERGY.

With cloud-based, centralized data management, process automation, and advanced analytic tools, you can:

- Categorize and capture all spend data—including indirect spend—and access it for review and analysis in real time.

- Create and modify cost pools as needed to generate accurate reports, budgets, and forecasts, and actionable insights.

- Foster guided buying environments using category management, contract management, and supplier relationship management tools.

- Eliminate both maverick spend and invoice fraud, which can wreak havoc on financial reporting and forecasting while hindering cash flow management.

- Leverage spend analysis insights to refine your supply chain and ensure cost-effective indirect spend across all projects, departments, business units, etc.

Calculate and Streamline Indirect Costs

Knowing what you’ve spent and how it’s supporting your business makes it much easier to plan and make smarter decisions.

By calculating and allocating your indirect spend correctly, you can improve spend visibility, reduce waste, and ensure every part of your organization is supporting productivity and profitability.