Effective procurement budgeting is crucial for any organization’s financial health and success.

We’ll examine the process, its importance, how to do it, and more.

What is Procurement Budgeting?

Procurement budgeting involves the strategic allocation of financial resources to acquire the goods and services necessary for a project.

It’s a vital part of procurement planning, encompassing everything from requirement identification to supplier management.

Why is Procurement Budgeting Important?

Cost Control: Ensures Spending Stays Within Limits

Cost control is one of the primary benefits of an effective procurement budget.

By carefully planning and monitoring expenditures, organizations can ensure they do not overspend on procurement.

For instance, a manufacturing company that tracks raw material costs can adjust orders based on market price fluctuations, avoiding unnecessary expenses.

Resource Allocation: Provides Funds Where They’re Needed Most

A well-structured procurement budget ensures that funds are allocated to the most critical areas of a project.

This means prioritizing spending on essential goods and services.

For example, in the construction industry, a detailed budget might allocate more resources to high-quality building materials and skilled labor, ensuring the project’s structural integrity and overall success.

Financial Planning: Supports Accurate Forecasting and Future Planning

A robust procurement budget enhances financial planning, allowing for accurate forecasting and better preparation for future initiatives.

For example, a tech company might use historical data from previous projects to predict the costs of new software development.

This foresight helps set realistic budgets and timelines, ultimately leading to more successful projects.

Risk Management: Helps Identify and Mitigate Financial Risks

Effective procurement budgeting also plays a critical role in risk management.

By identifying potential financial risks early on, organizations can develop strategies to mitigate them.

For instance, a retail company might factor in possible supply chain disruptions due to geopolitical events and allocate contingency funds accordingly.

This proactive approach ensures that the business remains resilient against unforeseen challenges.

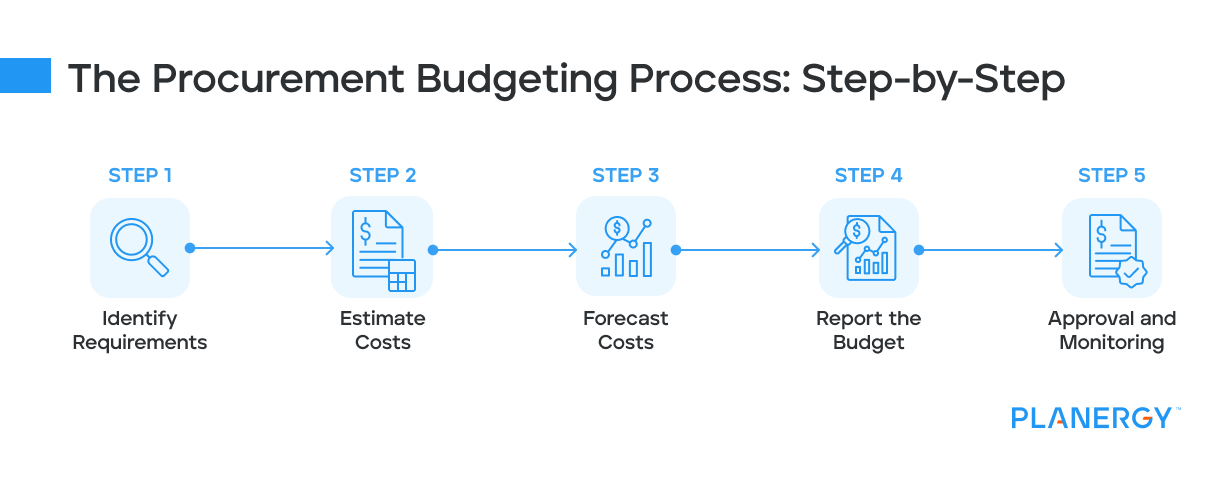

The Procurement Budgeting Process: Step-by-Step

Creating a procurement budget is a systematic process that involves several key steps.

Each step ensures the budget is comprehensive, accurate, and aligned with the organization’s financial goals.

Identify Requirements

To start budget planning, collaborate with various departments to determine what goods and services the project needs, including specifications.

The marketing department might require promotional materials, while the IT department might need new software licenses.

By understanding these needs, you can create a detailed list of all necessary items, ensuring nothing is overlooked.

Example: In a construction project, you would collaborate with the engineering team to identify the types and quantities of building materials, tools, and labor required.

Estimate Costs

Now, take the requirements and estimate the costs associated with each item. Break the total costs down into three main categories:

Direct Costs: These are costs directly attributable to the procurement, such as raw materials, equipment, and labor.

Example: Direct costs for a manufacturing company could include the price of raw materials and machinery used in production.

Indirect Costs: These are overheads that support the procurement process, including administrative expenses, utilities, and transportation.

Example: Indirect costs for an office renovation project might include administrative salaries and utility bills.

Contingency Costs: These are funds for unexpected expenses or cost overruns. It’s prudent to allocate a percentage of the total budget for contingencies to cover unforeseen issues.

Example: A contingency fund might be reserved for unexpected material price hikes or last-minute changes in project scope.

Forecast Costs

Cost forecasting involves using historical data and market analysis to predict future expenditures.

Consider factors like inflation, currency fluctuations, and changes in supplier pricing.

Analyzing past spending patterns and current market trends can help you make more accurate predictions about future costs.

Example: If historical data indicates that the price of steel tends to increase by 5% annually, you can factor this into your construction project budget.

Report the Budget

After estimating and forecasting costs, compile all the information into a detailed budget report. This report should include:

Expected Costs: A breakdown of all anticipated expenses and GL accounts.

Justifications for Each Cost: Reasons for each expenditure, providing transparency and accountability.

Comparisons with Previous Budgets: Highlight any significant differences or changes from past budget allocations to understand trends and anomalies.

Variance Analysis: An assessment of potential deviations between estimated and actual costs, helping identify risk areas.

Example: A budget report for a software development project might show expected costs for developer salaries, software licenses, and hardware, with justifications based on project requirements and industry standards.

Approval and Monitoring

Present the budget for senior management approval.

Explain the rationale behind each cost and demonstrate how the budget aligns with your organization’s financial goals.

Once approved, regularly monitor spending to ensure it aligns with the budget.

Regular reviews ensure the project stays on track financially and allow for adjustments as needed.

Example: In a large-scale marketing campaign, you would present the budget to executives for approval and then track spending on advertising, promotional events, and collateral production to ensure adherence.

Procurement software budgeting tools can help with spend analysis, real-time visibility, and workflow automation to help you optimize the entire process.

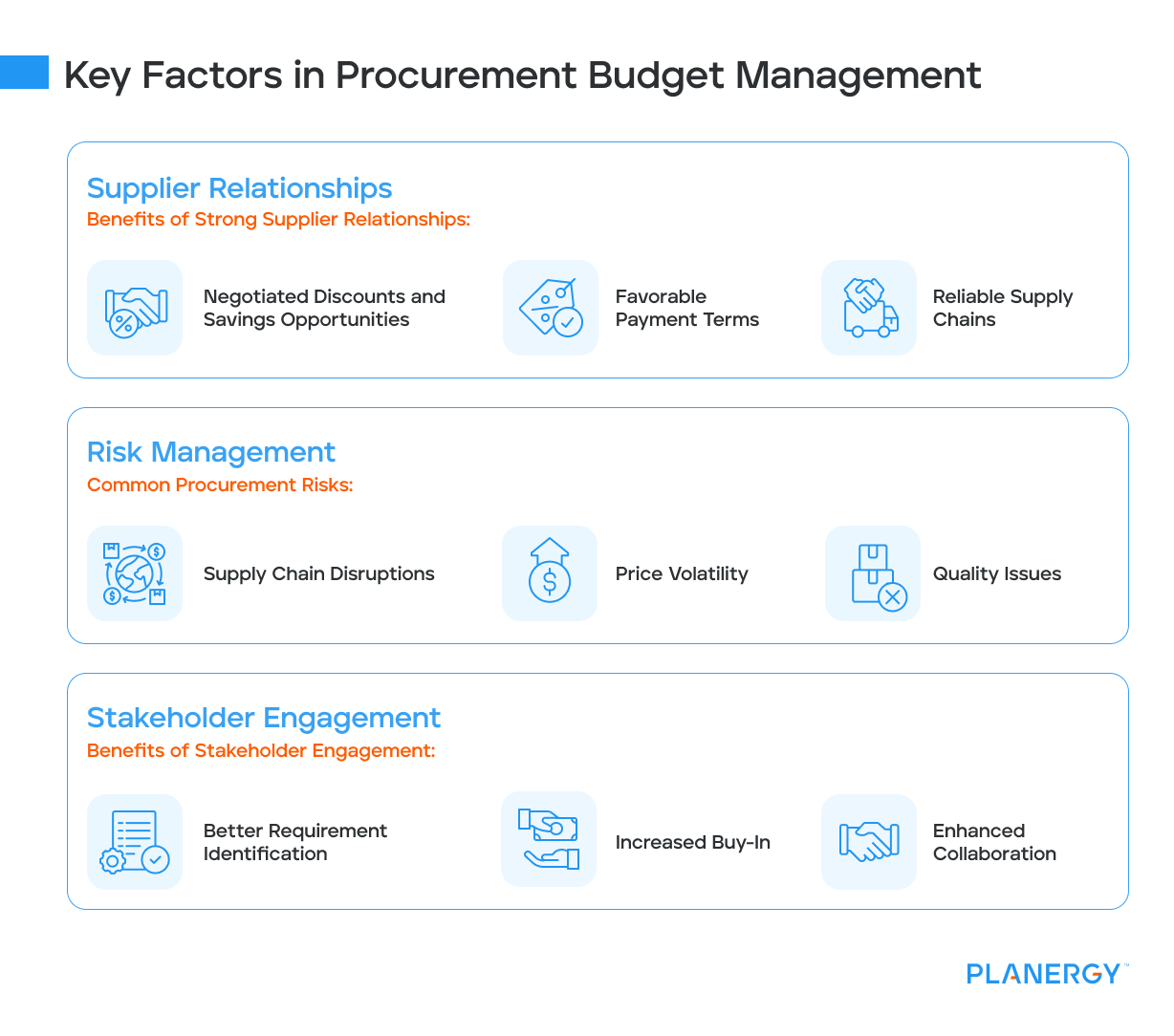

Key Factors in Procurement Budget Management

Supplier Relationships

Strong supplier relationships are foundational to effective procurement budget management.

Building and maintaining good partnerships can yield several benefits, including better pricing, favorable terms, and reliable supply chains.

Benefits of Strong Supplier Relationships:

Negotiated Discounts and Savings Opportunities: Suppliers are more likely to offer discounts to loyal customers or those who place large, regular orders.

For example, a manufacturing company that consistently purchases raw materials from the same supplier might negotiate a bulk discount, significantly reducing overall costs.

Favorable Payment Terms: Establishing trust with suppliers can also result in more flexible payment terms.

This flexibility can ease cash flow management and allow for delayed payments during tight financial periods.

Reliable Supply Chains: Strong relationships enhance communication and collaboration, ensuring timely deliveries and reducing the risk of supply chain disruptions.

For instance, a retailer with strong supplier ties can quickly restock high-demand items, avoiding stockouts and lost sales.

Investing time and effort into nurturing these relationships can yield substantial long-term savings and operational stability.

Risk Management

Effective risk management is crucial for keeping the procurement budget on track.

Identifying potential risks and preparing mitigation strategies helps protect the organization from unforeseen financial impacts.

Common Procurement Risks and Mitigation Strategies:

Supply Chain Disruptions: Natural disasters, geopolitical events, or logistical issues can disrupt supply chains.

To mitigate this risk, diversify your supplier base.

For example, an electronics manufacturer might source components from multiple suppliers in different regions to avoid dependency on a single source.

Price Volatility: Prices for raw materials and goods can fluctuate due to market conditions.

Implementing hedging strategies or locking prices through long-term contracts can help manage this uncertainty.

For instance, a food processing company might use futures contracts to stabilize prices for essential ingredients like wheat or sugar.

Quality Issues: Poor-quality materials can lead to project delays and increased costs.

Conduct thorough supplier evaluations and establish quality assurance protocols.

Regular audits and inspections can ensure that suppliers meet the required standards.

By proactively managing these risks, organizations can maintain budget integrity and avoid costly disruptions.

Stakeholder Engagement

Engaging stakeholders throughout the procurement process is vital to meeting their needs and securing their support for budget adherence.

Involvement and clear stakeholder communication can lead to more accurate budgeting and smoother implementation.

Benefits of Stakeholder Engagement:

Better Requirement Identification: Involving stakeholders early helps accurately identify project requirements, reducing the likelihood of scope changes that can inflate the budget.

For example, involving the IT department in software procurement decisions ensures that the purchased solution meets technical needs, avoiding costly modifications later.

Increased Buy-In: When stakeholders feel included in the decision-making process, they are more likely to support and adhere to the budget.

This buy-in can be crucial during budget reviews and approvals.

Enhanced Collaboration: Engaging stakeholders fosters a collaborative environment where feedback is sought and considered.

This collaboration can lead to innovative solutions and cost-saving ideas.

For instance, cross-departmental workshops can uncover opportunities for bulk purchasing or shared resources.

Regular meetings, transparent communication, and clearly defined roles and responsibilities are key to effective stakeholder engagement.

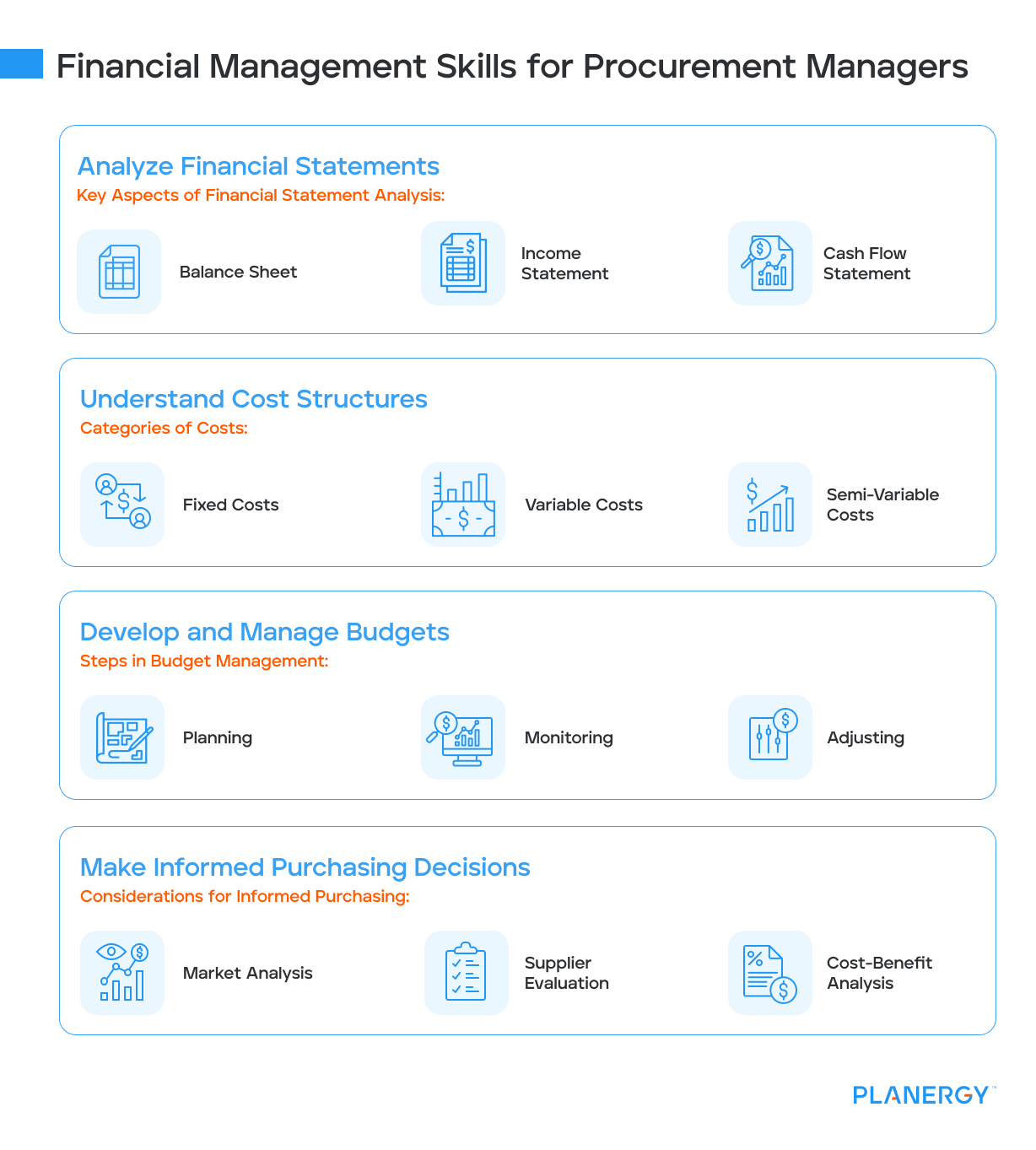

Financial Management Skills for Procurement Managers

Procurement managers play a critical role in an organization, responsible not only for sourcing and purchasing but also for ensuring that the procurement process aligns with financial goals.

Mastering financial management skills is essential for procurement managers to create realistic budgets, make informed decisions, and ultimately contribute to the organization’s success.

Analyze Financial Statements

Procurement managers must have a deep understanding of financial statements.

These documents provide insights into the organization’s financial health, highlighting areas where costs can be reduced or efficiencies gained.

Key Aspects of Financial Statement Analysis:

Balance Sheet: Understanding assets, liabilities, and equity helps procurement managers assess the organization’s financial stability and available resources.

Income Statement: Analyzing revenues, expenses, and profits enables managers to identify cost-saving opportunities and forecast future financial performance.

Cash Flow Statement: Monitoring cash inflows and outflows ensures that the organization has sufficient liquidity to meet its procurement needs.

Example: A procurement manager at a manufacturing firm might analyze the income statement to identify high operational costs and negotiate better terms with suppliers to reduce these expenses.

Understand Cost Structures

Knowing the cost structures involved in procurement allows managers to break down expenses into various categories and understand their impact on the overall budget.

This knowledge is crucial for identifying areas where costs can be optimized.

Categories of Costs:

Fixed Costs: Expenses that remain constant regardless of production levels, such as rent and salaries.

Variable Costs: Costs that fluctuate with production volumes, such as raw materials and utilities.

Semi-Variable Costs: Costs with fixed and variable components, like certain utility bills.

Example: In a construction project, understanding that labor costs (variable) will increase with project scope changes allows the procurement manager to plan and allocate resources more effectively.

Develop and Manage Budgets

Procurement managers are core responsible for creating and managing budgets.

This involves detailed planning, continuous monitoring, and adjustments as necessary to ensure financial objectives are met.

Steps in Budget Management:

Planning: Establishing budget goals and estimating costs based on project requirements and historical data.

Monitoring: Regularly tracking actual spending against the budget to identify variances and take corrective actions.

Adjusting: Making necessary changes to the budget in response to unforeseen events or changes in project scope.

Example: A procurement manager working on a large-scale marketing campaign might develop a budget that includes costs for advertising, promotional materials, and events and then monitor these expenses throughout the campaign to stay within budget.

Make Informed Purchasing Decisions

Informed purchasing decisions are critical to ensuring procurement activities align with the organization’s financial goals.

This requires thoroughly analyzing market conditions, supplier proposals, and cost-benefit assessments.

Considerations for Informed Purchasing:

Market Analysis: Understanding market trends and pricing helps managers negotiate better deals and avoid overpaying for goods and services.

Supplier Evaluation: Assessing supplier reliability, quality, and financial stability ensures that the organization partners with the best vendors.

Cost-Benefit Analysis: Comparing the costs and benefits of different procurement options helps select the most cost-effective solution.

Example: When procuring IT equipment, a procurement manager might compare multiple suppliers’ offers, evaluate the total cost of ownership, and choose the one that provides the best value while meeting the organization’s technical requirements.

The Importance of Financial Management Skills

Financial management skills enable procurement managers to create realistic budgets, control costs, and make strategic purchasing decisions.

These skills ensure efficient financial management, contributing to the organization’s overall success and sustainability.

Master Procurement Budgeting with Ease

Creating and managing an effective procurement budget ensures better resource allocation, cost control, and overall project success.

Follow these steps to streamline your procurement processes and achieve financial efficiency.

The lack of flexibility, visibility, and control is a major issue for procurement teams trying to align with the finance department.

Research indicates that nearly half of finance leaders believe that only 20% or less of procurement savings are shown in the bottom line.

Most procurement and finance leaders rate the sourcing process as less than “very effective.”

The main reasons savings are not reflected in the bottom line are that budgets are not enforced and that company savings end up being spent in other areas, which demonstrates an inability to adjust for various changes in specifications or needs.

Without building in proper flexibility, controls, and visibility, you cannot adjust the budget which increases the risk of your savings being depleted.