Developing and applying internal controls is a crucial part of building and maintaining a successful business. This is especially true for vital functions like purchasing, where waste, needless expense, and unnecessary risks can occur without proper controls in place.

By following a few best practices, you can implement effective purchasing internal controls that also leave room for flexibility and handling uncertainty.

You’ll be sure that your organization is following the required rules and regulations, and is ready for an external audit at any time.

What Are Internal Controls in Procurement?

Internal controls in procurement are policies and procedures that control how purchasing is done and what can be purchased. They define who can approve purchases, what suppliers can be used, what payment terms are acceptable, and more.

Ensuring the rules are followed for compliance with regulations and audits such as the AICPA’s SOC 1 audits audits for service organizations is also a key factor in internal controls.

Purchasing software can help organizations automatically enforce compliance and internal controls through built-in approvals and rules that must be adhered to in order for a purchase to go through.

When looking at internal controls in procurement from a compliance-first perspective, there are 5 components and 3 objectives that most organizations consider.

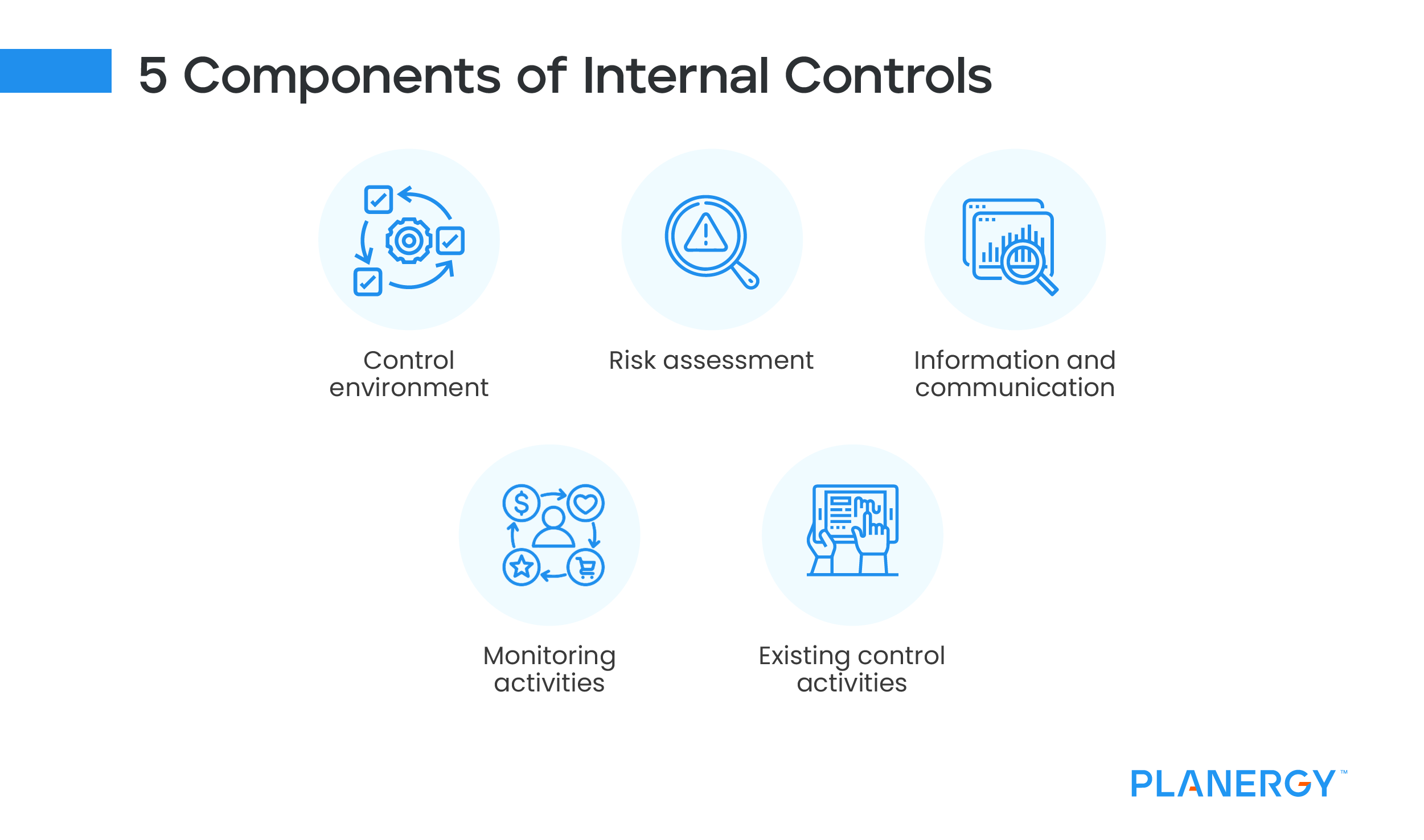

What Are the 5 Components of Internal Controls?

When preparing for an audit, it’s important to understand the 5 components of internal controls for purchasing. These components act as guideposts for SOC 1 compliance and are commonly used in financial audits for many industries.

Organizations should know what these are and be able to show them to auditors if asked. They include:

Control Environment

How an organization enforces policies and procedures an organization uses to control purchasing. This component also considers how well the company follows these policies.

Risk Assessment

How an organization identifies financial threats and assesses the risk they pose toward company objectives.

Information and Communication

How management communicates to purchasers and other stakeholders what’s expected of them in following internal controls. This also includes ensuring that they receive acknowledgment and understanding of what’s being asked of them.

Monitoring Activities

The way management oversees company spend, how they identify when things aren’t working properly, and what they do to fix these issues.

Existing Control Activities

The current controls (policies and procedures) an organization has in place and how long they’ve operated for.

What Are the 3 Objectives of Internal Controls?

Along with 5 components, there are 3 objectives that audits such as the SOC 1 place high importance on. These objectives address how a company is executing and reporting on its internal purchasing control policies and procedures. They include:

Operations

Ensuring that internal controls are operating effectively and achieving what they’re expected to.

Reporting

Providing financial reporting both internally and to clients that verify the organization is operating the way it’s expected to operate.

Compliance

Defining the laws and regulations that must be adhered to and showing proof of compliance. Companies should be able to show that both they and the companies that rely on them as a supplier are in compliance.

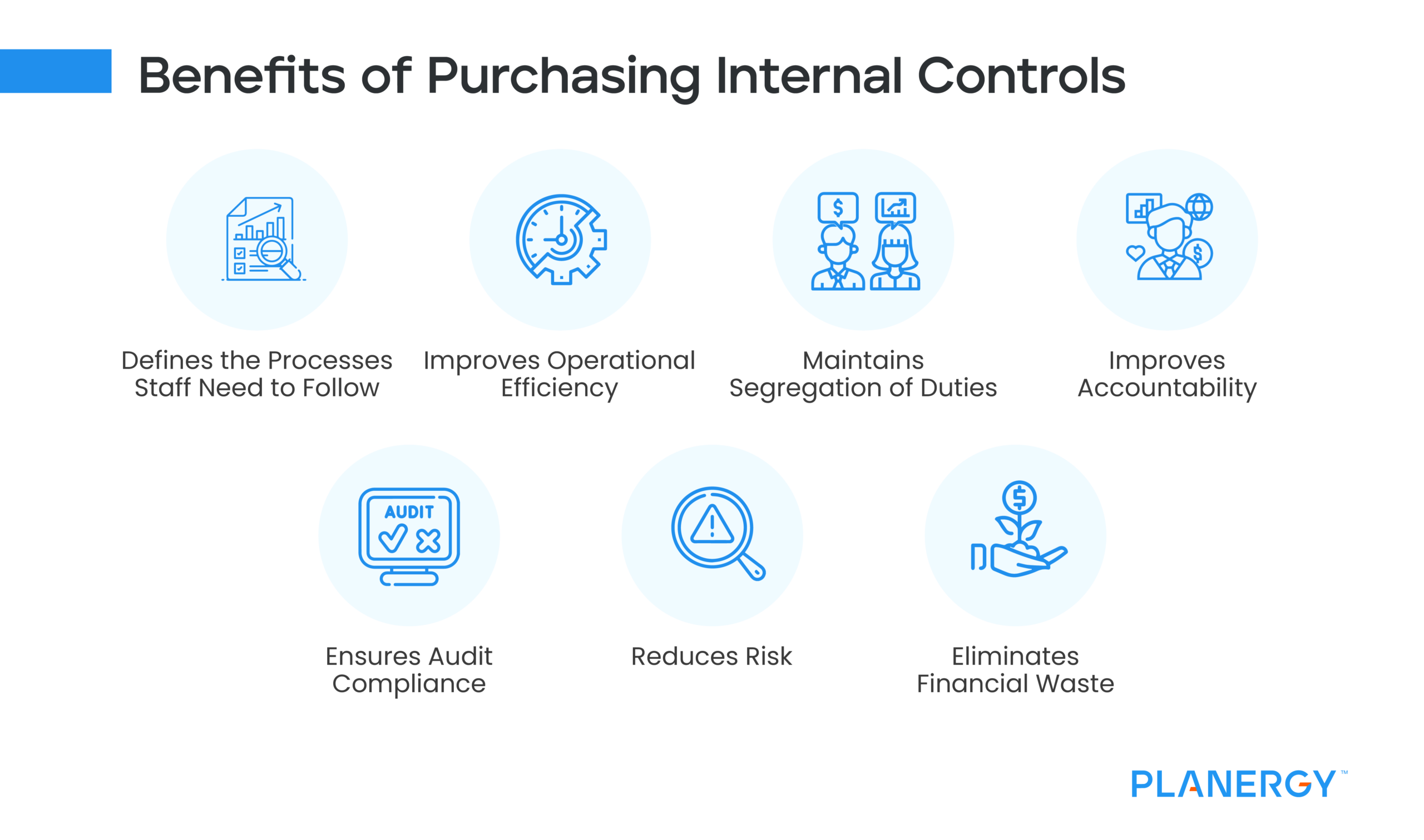

Why Are Purchasing Controls Important?

Without internal controls for purchasing, you’ll be at a greater risk of failing financial audits.

Internal controls ensure you’re properly tracking expenditures and staying up to date with supporting documentation and financial statements—all of which are important during audits.

From reducing fraud risk to stopping wasteful spend, purchasing controls are important for a multitude of reasons.

Ensuring Audit Compliance

Without internal controls for purchasing, you’ll be at a greater risk of failing financial audits. Internal controls ensure you’re properly tracking expenditures and staying up to date with supporting documentation and financial statements—all of which are important during audits.

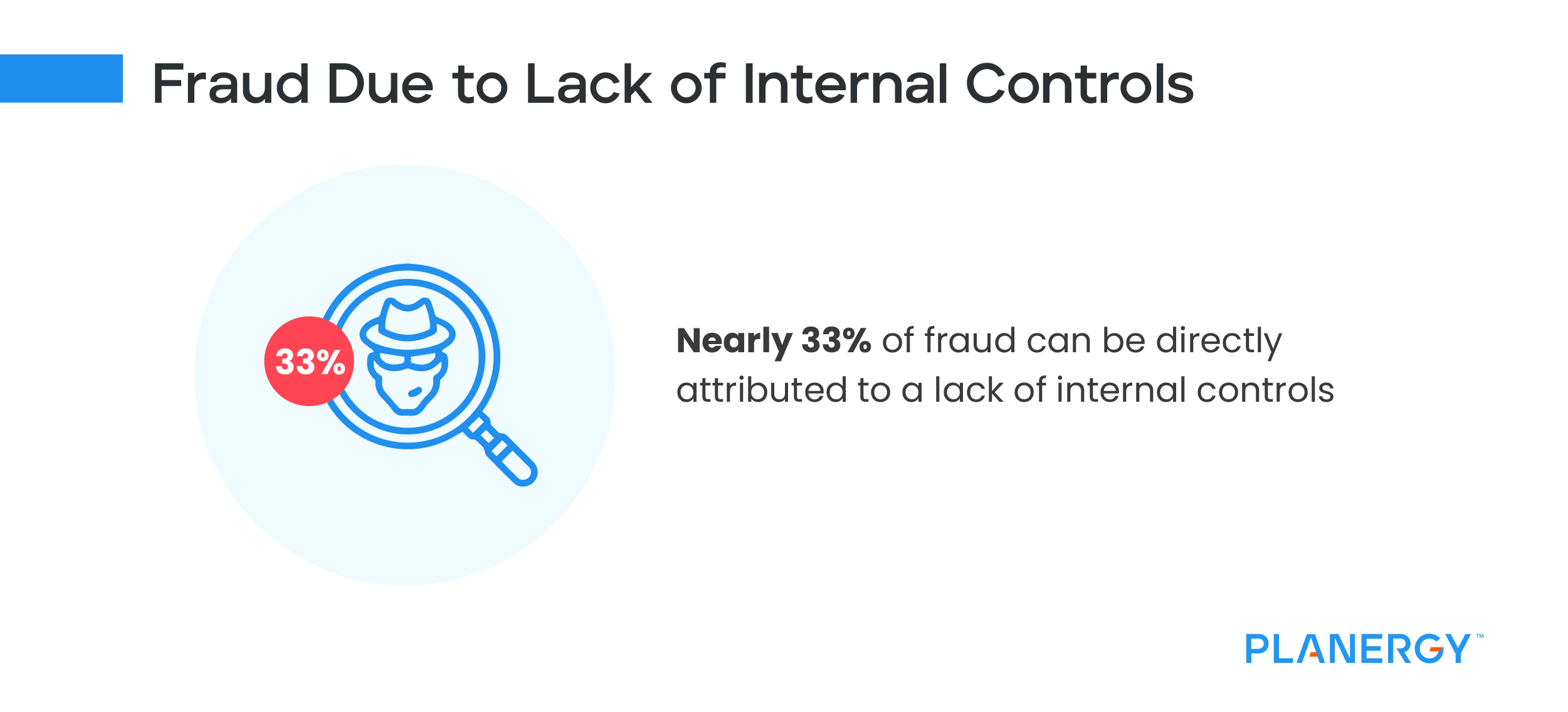

Reducing Risk

Along with ensuring compliance, reducing fraud risk and financial waste are the primary drivers for developing purchasing internal controls. In fact, the Association of Certified Fraud Examiners (ACFE) 2020 Report to the Nations found nearly 33% of fraud can be directly contributed to a lack of internal controls.

Eliminating Financial Waste

Ensuring that purchases are reviewed properly makes it much more difficult for wasteful purchases to slip through.

Defines the Processes Staff Need to Follow

Having well-defined controls stops staff from being confused about what they can and can’t purchase, and what they need to do when making a purchase.

Improves Operational Efficiency

Adhering to purchasing controls helps teams ensure that they are spending within their budgets and operating with efficiency.

Maintains Segregation of Duties

Purchasing controls define roles within the review and approval process so that no one person has too much control over a company’s spend.

Improves Accountability

In formalizing your purchasing procedures and creating these controls, you also improve accountability and generate more effective, audit-friendly data trails.

Like accounts payable internal controls, purchasing internal controls are a risk management system (complete with contingencies) and not a series of unbreakable rules. Having flexibility with your controls ensures you’re not sacrificing competitive advantage when opportunities or struggles arise.

From vendor selection and management to contract negotiation and actual purchasing authority, having clear and consistent policies helps streamline your workflows.

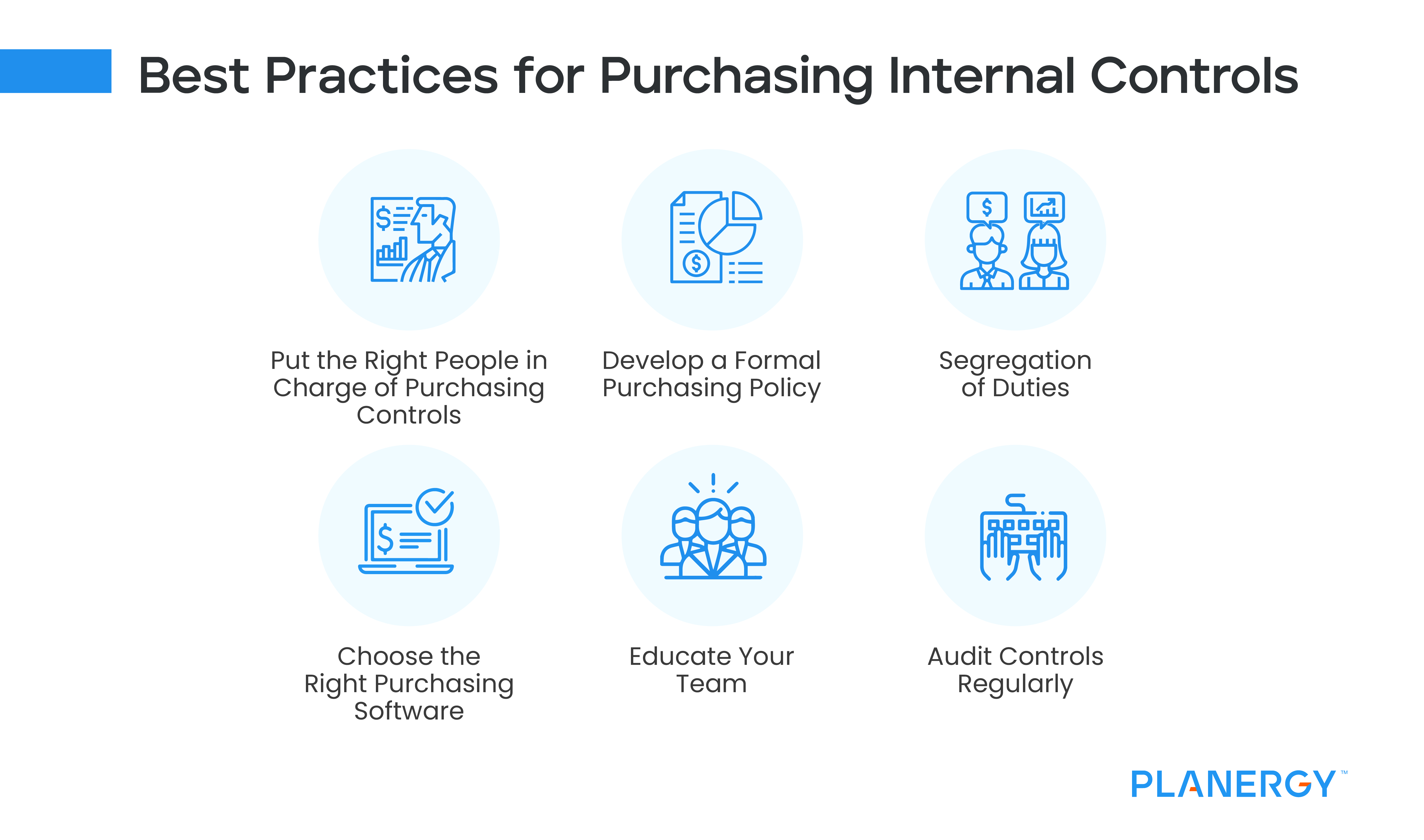

What Are the Best Practices for Purchasing Internal Controls?

When it comes to internal controls, no two organizations have the same needs. Small businesses are more likely to focus on things like separating personal finances from business finances. Meanwhile, a large corporation is more likely to be on the watch for invoice fraud.

However, businesses of all sizes can benefit from following best practices when setting up purchasing internal controls. These best practices include:

Put the Right People in Charge of Purchasing Controls

Small business owners may find themselves wearing this hat along with their main duties. In larger organizations, choosing an individual or team to handle purchasing controls makes sense.

You can choose a responsible purchasing team member or have them share the responsibility collectively.

It’s important to choose wisely because this person or team will handle controls for:

- Managing inventory.

- Vendor selection, management, and relationship development.

- Contract negotiation and management.

- Purchasing best practices, including payment methods, approved buyers, and formalized approval workflows.

- Collaboration with accounts payable and integrating purchasing data with the accounting system.

Develop a Formal Purchasing Policy

From vendor selection to purchasing approvals, having clear and consistent purchasing policies helps streamline your workflows. It also improves accountability, ensures your team is following the same guidelines and protects against rogue spending and fraud.

Don’t overlook the importance of contingencies for critical processes, especially approval workflows and areas of the supply chain that maintain production and day-to-day operations. Planning ahead can ensure you’re ready to react quickly and efficiently when things take a turn for the worse.

Documenting these policies in your procedures manual helps support ongoing compliance, accountability, and process auditing.

Additionally, you can enforce these policies through purchase order software that enables you to set and streamline approval flows and allow purchases only through preferred suppliers.

Segregation of Duties

Keep purchasing tasks separated by capability and responsibility to ensure no single person has total control over purchasing activities. This avoids conflicts of interest, preserves accountability, and supports transparency.

Make sure different people are in charge of:

- Purchase approvals.

- Receiving goods.

- Invoice payment approvals/disbursements.

- Bookkeeping/financial records management.

- Inventory management.

Failing to split these duties can lead to unauthorized purchases, fraud, unauthorized charges, and avoidable expenses from duplicate payments and chasing exceptions.

Choose the Right Purchasing System

Globalization has created a competitive global marketplace for businesses large and small. Due to this, every procurement process—from purchase requisitions to vendor management—needs to be optimized for accuracy and speed.

PLANERGY’s purchasing software makes it easy for your purchasing departments to create, implement, and enforce internal controls. Teams can create controls for the approval process, suppliers, permissions, and more in order to meet standards while still allowing for contingencies and manual intervention if necessary.

Good procurement systems have features like cloud computing, deep data analytics, robotic process automation, machine learning, and more. They make it possible for your purchasing department to:

- Create data transparency for all transactions.

- Eliminate human error and costly delays by automating time-consuming tasks such as data entry from approval workflows.

- Create a closed buying environment where purchasing agents are automatically presented with approved vendors and pre-negotiated pricing terms and conditions.

- Gain full control and visibility over all purchasing methods—from POs to credit cards.

- Develop contingencies for all workflows, including approvals, so purchasing processes never get stuck.

- Streamline processes such as requisitions and invoice approvals to be faster, more accurate, and complete. When supplier invoices are paid in a timely manner, purchasing teams are able to capture early payment discounts and avoid late payment penalties.

- Create a connected software environment that integrates systems like accounting, ERP, marketing, and sales into the procure-to-pay system.

- Make more strategic sourcing decisions based on complete purchasing information that’s automatically captured.

- Create more robust and accurate financial reports that enable teams to make better financial decisions faster.

Educate Your Team

Purchasing policies, and the software that helps implement them, aren’t effective when people don’t know how to use them. Without proper training, team members are more likely to find workarounds that violate policies and controls.

Ensure that everyone who’s involved with purchasing—from the CFO to the administrative assistant—knows the policies and controls and how to follow them by using the purchasing system. When everyone is trained properly, they’re much more likely to stick to these controls; which means your goals are more likely to be met.

Always introduce new policies before they’re implemented and invest in training before, during, and after implementation to make sure everyone’s comfortable with the controls you’ve developed.

Audit Controls Regularly

As a company evolves, so should its purchasing controls, which is why it’s important to regularly do a thorough review of purchasing internal controls. The goal of this audit should be to make sure that the controls are still the right fit for the company.

If controls aren’t working in a changing business environment, employees may try to circumvent them to purchase what they need. This leads to rogue spending and makes it more difficult to stay on track with budgets and preferred suppliers.

Auditing purchasing internal controls can be part of a larger procurement internal audit program . An audit program helps procurement teams identify areas for improvement, ensure they’re meeting industry standards, reduce fraud risk, and of course ensure that internal purchasing controls are meeting company needs and being complied with.

Control Over Purchasing is an Investment Worth Making

Setting clear and effective internal controls over purchasing processes helps your business is a surefire way to minimize waste and maximize performance.

Investing time and resources to develop and implement these controls is always worthwhile. With help from the right software solution, any organization can create an optimized purchasing function that has automatic controls and policies built-in—generating value, rather than waste, for your organization.