It’s well known that the budgeting process is part of running a business. Unfortunately, while traditional annual budgeting is useful, it provides little flexibility for adjustments.

For instance, if you prepare your budget in November for the upcoming year, you’re preparing it based on information that is available in November.

But what happens when circumstances change? What if your business needs to change suppliers, and your costs suddenly rise?

Or your products go viral and you need to add additional staff? Suddenly, the numbers on your annual budget become obsolete.

One way to avoid the issue is to use financial forecasting.

There are numerous forecasting methods that can be used in a business environment, but for accurate measurement of metrics and KPIs, a rolling forecast approach may be the best choice.

What Are Rolling Forecasts?

A rolling forecast is a report that uses the most current historical data to predict future performance.

It continuously updates to use the most current data to adjust future financial forecasts.

To use a rolling forecast, a business establishes a set period to review and update its current forecast based on real-time results.

A rolling forecast does not replace a budget, but instead, provides additional flexibility, allowing CFOs and other finance leaders to have the most accurate forecasting information at their fingertips for resource allocation and decision-making, allowing them to better leverage opportunities and mitigate potential issues.

What is the Difference Between an Annual Forecast and a Rolling Forecast?

The biggest difference between an annual forecast and a rolling forecast is the lack of flexibility that an annual forecast offers.

An annual forecast is completed using the best information available at the time that the forecast or budget is prepared and is seldom updated throughout the year.

However, circumstances beyond our control, such as changing market conditions, can significantly render a forecast prepared the previous year essentially useless.

A rolling forecast provides you with the most current financial data available, updating results in real time.

When used together, an annual forecast serves as a good starting point for a rolling forecast, which will be updated at specified intervals as needed.

ABC Plumbing spent three weeks in November creating a budget for the upcoming year.

The CFO and controller obtained feedback and detailed information from all the department heads to ensure that the budget numbers accurately reflected the business.

January numbers were fairly close to budget, but February brought multiple changes to the business.

Their closest competitor closed their doors in the middle of February and the sudden influx in business required ABC to hire additional workers to take care of the additional work that came in.

In addition, they needed to increase their purchasing, since they were now serving 25% more customers than they did in January.

If ABC Plumbing continued to use the budget they prepared in December with no changes, both income and expenses would be drastically understated.

If ABC Plumbing had used a rolling forecast, they could have updated their budgeted numbers to reflect both current income and expenses, providing a more complete financial picture.

| Annual Forecast | Rolling Forecast |

|---|---|

| Inflexible | Flexible |

| Completed using best available data at the time the forecast is prepared | Regularly updated to factor in changing circumstances |

| Provides a picture of the financial data from when it was created | Provides the most current financial data |

| Rarely updated | Updated at regular intervals or in real-time |

What Kind of Organizations Can Benefit From a Rolling Forecast Process?

Is a rolling forecast a good choice for your business?

Businesses of any type and size can use this performance management tool, but this financial model may provide more benefits for the following businesses.

Seasonal Businesses – Seasonal businesses can benefit from using a rolling forecast since income and expenses are more likely to vary in a seasonal business than one that has steady income and expenses year-round.

Retailers – Retailers often have specific months when business swings upwards, along with slower months.

Preparing a rolling forecast can help businesses prepare for these upswings and slower months.

Project-Based Businesses – Industries like construction can benefit from using a rolling forecast, which allows managers to tie income and expenses directly to a specific project.

Hospitality – The hospitality industry, much like the retail industry experiences market upswings and downturns regularly, based on the time of year.

Preparing a rolling budget can help CFOs better manage both.

If your business provides a service, you may not see as many of the benefits of using a rolling forecast, but it can still be a useful tool for getting a better understanding of your income and expenses.

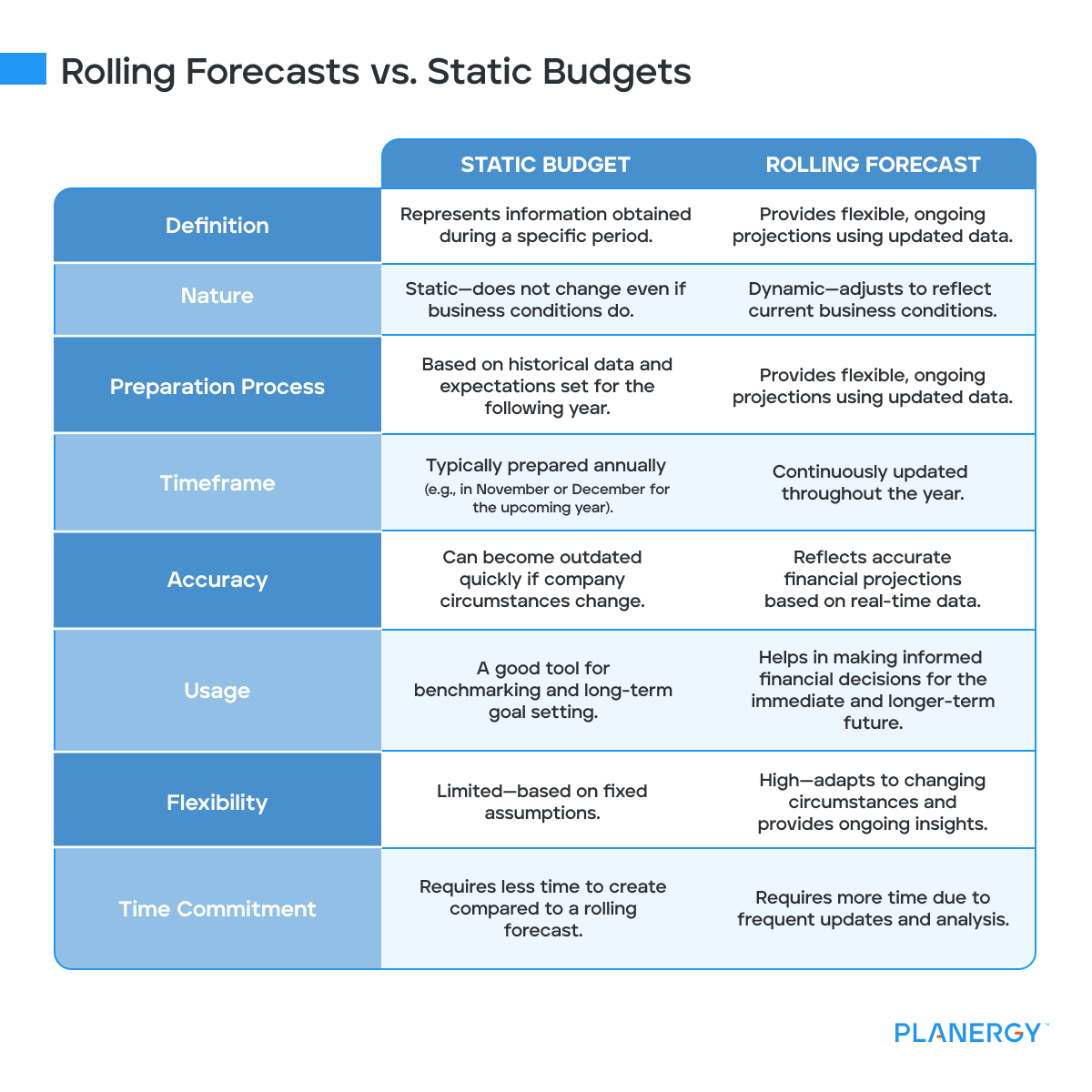

What’s the Difference Between Rolling Forecasts and Static Budgets?

Both budgets and forecasts remain some of the most important tools in a CFOs arsenal.

Budgets and rolling forecasts both use historical data during the preparation process, and both help management plan for the future, set strategic goals and provide a blueprint for establishing and meeting goals.

The biggest difference between a rolling forecast and a budget is that the budget represents information obtained during a specific period.

A static budget doesn’t change, even if the business does, which can cause a multitude of problems.

If you typically create a budget in November or December for the upcoming year, you’re creating it based on historical data obtained from the current year along with expectations that have been set for the following year.

While a static budget is a good tool for creating a benchmark to build off of, should company circumstances change, a static budget quickly becomes outdated.

On the other hand, a rolling forecast is designed to offer the flexibility needed to make more informed financial decisions about your business throughout the year.

Though it requires more time than creating a static budget, creating a rolling forecast allows you to use the latest data to create accurate financial projections that factor in actual totals rather than the ‘what if’ approach often used when preparing a budget.

By having this information readily available, businesses can better plan for the immediate future and beyond.

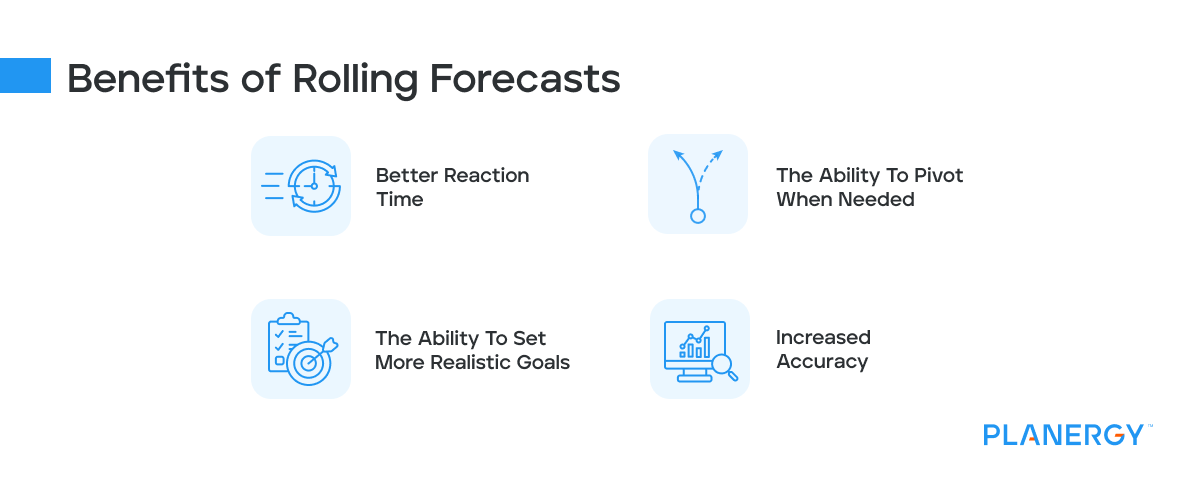

What are the Benefits of Rolling Forecasts?

There are a lot of reasons why preparing a rolling budget can be useful for your business.

First, it allows your business to be more flexible and responsive to change.

But there are plenty of other benefits to preparing a rolling budget including the following.

Better Reaction Time

If you’re following a static budget, months could go by before you make any internal adjustments based on current data.

On the other hand, using a rolling budget allows you to account for variances as they happen and factor those variances into your planning for the upcoming months.

The Ability To Pivot When Needed

When a budget is prepared, no one can guarantee that all the circumstances that apply at that moment will still apply three months later.

Using a rolling forecast allows you to adjust spending levels as needed while creating a more accurate budget for the future.

The Ability To Set More Realistic Goals

Setting goals is an important part of managing a business.

But if the goals you’re setting are based on a budget created six months ago, those goals have little chance to be realized.

Stop setting your business up for failure by creating static goals that don’t change with circumstances.

Instead, using a rolling forecast allows you to create and achieve realistic goals that better reflect the financial health of your business.

Increased Accuracy

A static budget is created based on historical financial data, coupled with estimates of future sales revenue increases and upcoming expenses.

If completed properly, a budget provides a good blueprint for the upcoming year’s activity.

But a budget prepared six months ago may bear little resemblance to your current financial position.

An unexpected drop in sales, an uptick in revenue, or an unforeseen expense can all wreak havoc on budget accuracy.

Using a rolling forecast allows you to better predict outcomes for your business by using the latest data available to make those predictions.

How Do You Implement a Rolling Forecast Model in Financial Planning and Analysis?

The last quarter of your fiscal year is often when you begin the process of planning for the new year.

When creating a financial plan for your business, it can be helpful to incorporate a rolling forecast model that factors in change.

Products and services may be unexpectedly added or discontinued, revenue may decline, or your building may be destroyed by an earthquake.

But none of those changes will be included in your financial planning model unless you use a rolling forecast.

The first step in viable financial planning is to create a strategic plan that outlines the goals of the business and what it wants to accomplish.

These are usually highlighted by creating financial projections based on current and historical data.

By implementing a rolling forecast into the financial planning process, you’ll be better prepared to manage revenue fluctuations, mitigate potential issues, and create a more accurate picture of your business for the long term.

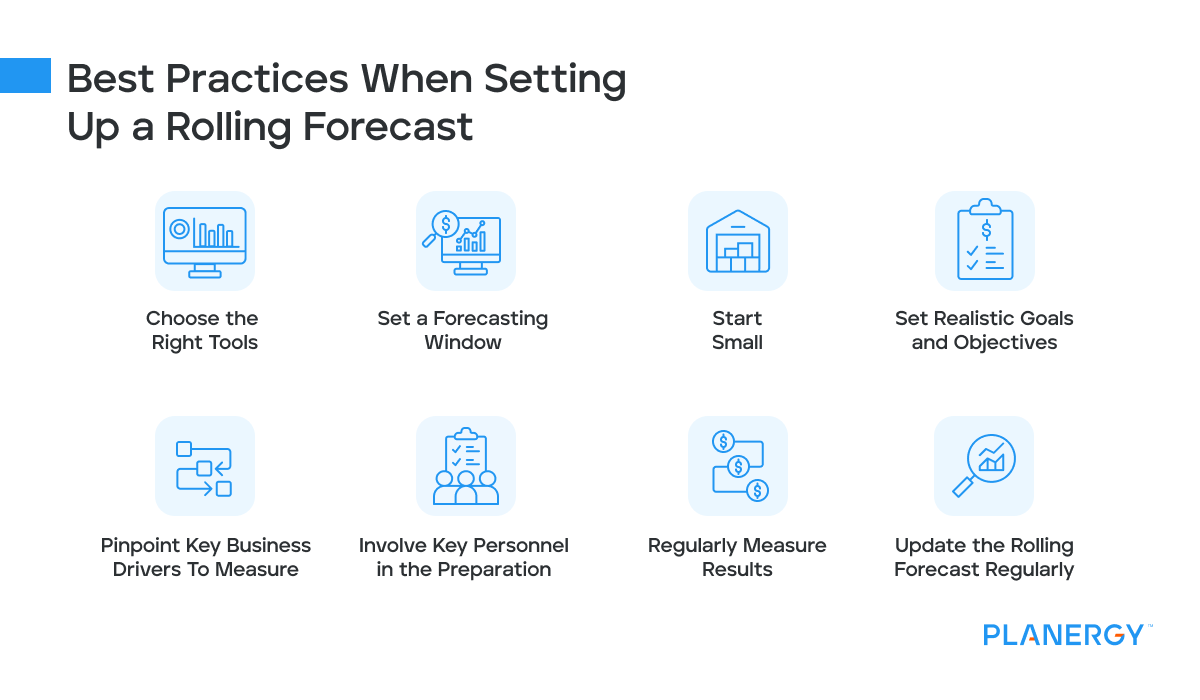

What Are Best Practices When Setting Up a Rolling Forecast?

The easiest way to incorporate rolling forecasts into your business is by following these best practices.

Choose the Right Tools

While using Microsoft Excel is common when creating budgets and rolling forecasts, you’ll find it much more effective to use a single application like PLANERGY that combines data management tools with your accounting software application to provide more accurate data that can be used when making critical decisions for your business.

Set a Forecasting Window

How often will you update your rolling forecast?

Deciding the proper time frame for making updates is an important part of the forecasting process and depends on the type of business you have, how much income and expenses fluctuate, and what your plans are for the future.

One way to determine what time frame would work best is to determine if you have the time or staff available to update your rolling forecast monthly.

While it certainly takes additional time, updating a forecast monthly can provide you with the most accurate data available for making key decisions.

For businesses that experience fewer variances each month, updating a rolling forecast quarterly would likely be sufficient.

Start Small

Jumping in with one foot instead of two will help you get accustomed to the nuances of creating and using a rolling forecast.

For example, if your budgets have always been on point for revenue but you’ve struggled to accurately estimate expenses, you may want to start there.

Once you’re comfortable with the process and have ironed out any potential bottlenecks, you can expand the process to all areas of the business.

Set Realistic Goals and Objectives

Standard reports such as Budget vs. Actual provide insight into actual revenue and spending totals.

However, preparing a rolling forecast provides you with a vital extra step by allowing you to adjust your forecast going forward based on those actuals.

This can be particularly helpful when using a rolling forecast to track spending or assess the success of a new product or service.

Pinpoint Key Business Drivers To Measure

By identifying and measuring key drivers, you’ll be able to zero in on the results that matter.

Using driver-based measurements ties into the suggestion above, which allows you to concentrate on what’s important and add the rest at a later date.

Involve Key Personnel in the Preparation

By including key stakeholders such as department heads in the rolling forecast preparation process, you’ll have the most accurate data to measure results against.

Regularly Measure Results

Simply adjusting your forecast to reflect the prior month’s activity will do little to help you identify issues.

Be sure to spend some using variance analysis to review business performance results for a specific period of time, which can help identify pain points while allowing you to better estimate future performance.

Update the Rolling Forecast Regularly

Once you’ve analyzed the results, be sure to regularly update your rolling forecast to include the most recent financial data available.

You’ll also want to share results with key personnel who may have additional input into the process.

How Do You Create a Rolling Forecast Model in Excel?

The best solution to creating a rolling forecast model is to use financial software that integrates with your core accounting system.

However, if that is not an option, you can an Excel spreadsheet, which is an excellent vehicle for setting up a rolling forecast.

To do so, you’ll need to use both a data table and formulas to start.

Unless you have access to an experienced Excel user, the best option would be to download one of the free forecast templates that are available from a variety of sources.

This eliminates the time-consuming process of creating a model from scratch, so all you’ll have to do is enter the appropriate drivers that you wish to track and the beginning and end dates for your forecast period.

Here are the quick steps to setting up a rolling forecast in Excel.

- Define your timeframe for the rolling forecastv

- Choose the drivers you wish to include in the forecast

- Add both actual results and projected values for each period in the forecast

- Remember to update the rolling forecast with current information

- Adjust any formulas after adding new data

A Rolling Forecast Can Help You Better Plan for the Future

Even the most careful considerations are no guarantee that your budget or forecast will be accurate.

But by using rolling forecasts instead of a static budget, you can proactively make adjustments as needed, allowing you to make more informed business decisions.