Spend analysis is the art of extracting useful information from your spending data. It can help your company make better business decisions and avoid unnecessary waste.

However, it is also very time-consuming. A proper plan should be implemented to make the process as efficient as possible.

Spend analytics involves classifying your spending data, identifying relevant trends, and implementing solutions that improve your purchasing power.

Spend analytics can be performed by hand or with the help of software. Using data visualization tools, you can explore spend data and discover hidden insights.

Tools often have an intuitive interface that allows non-technical users to build customized dashboards and explore data in real time.

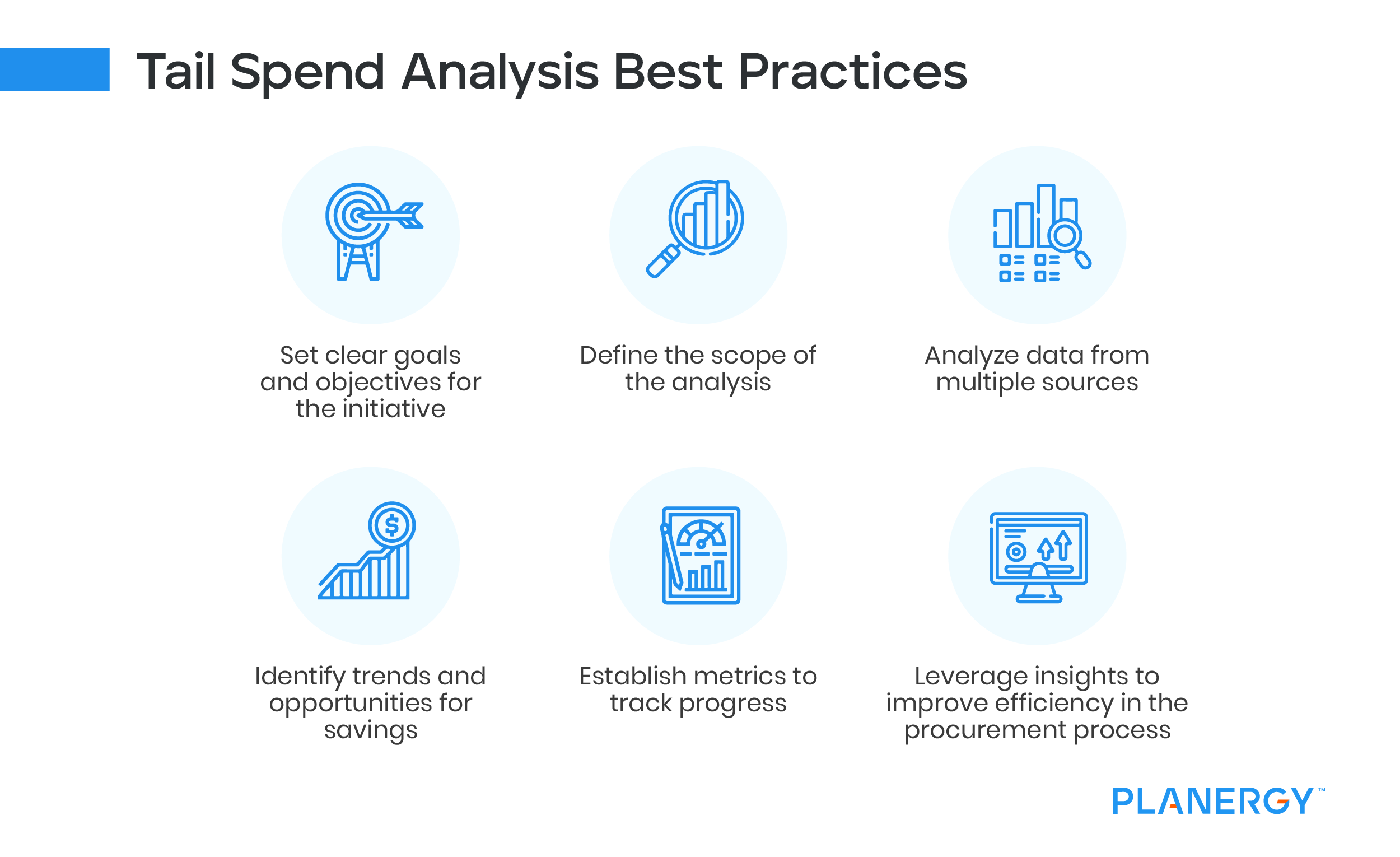

Getting your spend data in order is a key first step in any spend analysis project. Clean spend data will enable you to analyze and improve your spending quickly.

Once a plan is in place, companies should begin analyzing their data. This involves looking at spending patterns and identifying areas of potential savings.

Companies should look for trends in spending, such as overspending on certain items or underutilizing certain suppliers.

Companies should also look for opportunities for consolidation and standardization. This can help them streamline their processes and reduce costs.

It’s important to remember that tail spend analysis is an ongoing process. Companies should regularly review their data and update their plan as needed.

Identify Your Supplier Base

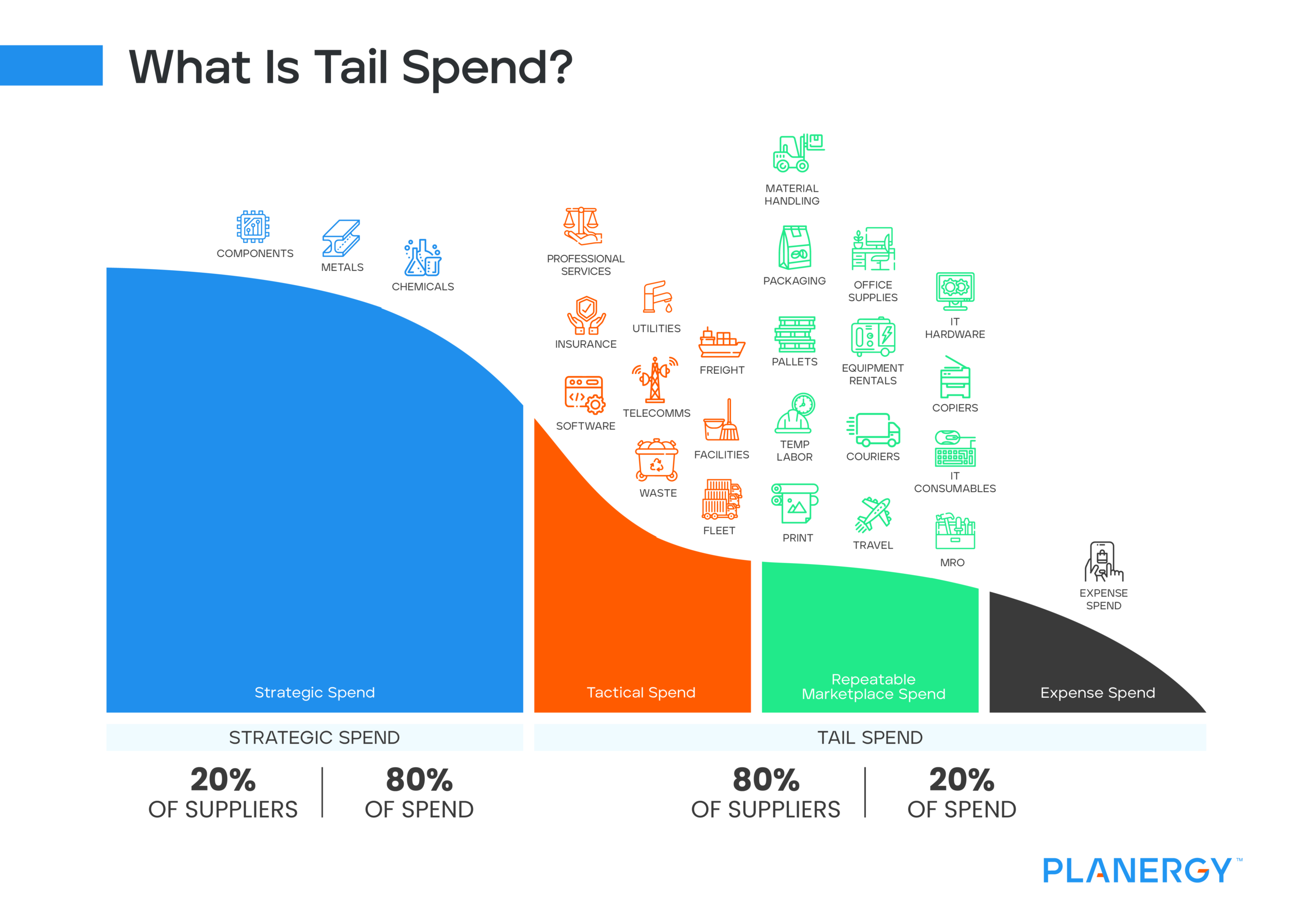

When conducting a tail spend analysis, it’s important to understand your supplier base. Tail spend is often overlooked as a source of significant savings.

But when properly managed, it can save an organization up to 15 percent of its total procurement spending.

It can also help improve the employee experience. If your employees aren’t happy with the quality of products they receive from your suppliers, they’re likely to be less productive.

You’ll also be able to eliminate obstacles like delivery delays.

As many B2B businesses have learned, it pays to consolidate your supply base. Many suppliers are now working as aggregators. This means they’re expanding their business offerings to fulfill customer demands.

The best way to identify your supplier base is to conduct a comprehensive spending analysis. To do this, you’ll need to gather information on all spend data sources. Spend analysis includes grouping spending into standardized categories and cleaning data for errors.

After gathering all your data, you can categorize your expenditures and identify specific small purchases.

Categorizing your spending data by department or type of spend (direct vs. indirect spend) will help you achieve sustainable cost reduction with more strategic purchasing.

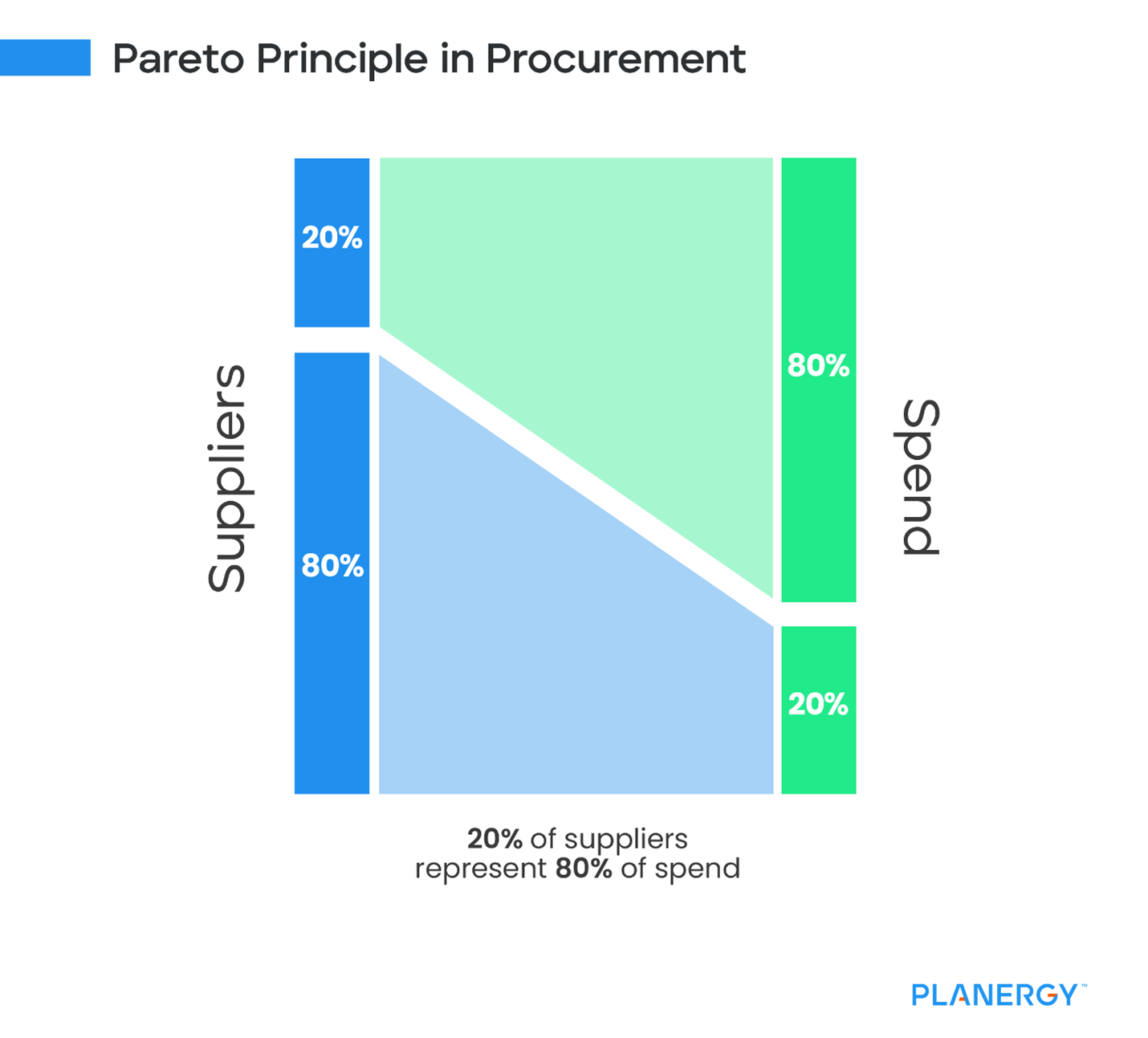

Segmenting “Major” Spend from “Tail Spend”

For most procurement teams, this can be a daunting task. However, it’s also an opportunity to create a competitive advantage. Companies often make a multitude of purchases, some of which may not be worth the time or cost.

While not a magic pill, many steps can be taken to improve the process and reduce costs.

Some key points to remember include the importance of data collection and establishing a process to follow. This can include a combination of technology and training.

A good way to start is by examining the various spend categories within your organization. This will give you an idea of where to focus your efforts.

Spend in areas such as direct purchasing and indirect purchasing can be especially beneficial.

Reducing the Number of Suppliers in the Tail-End

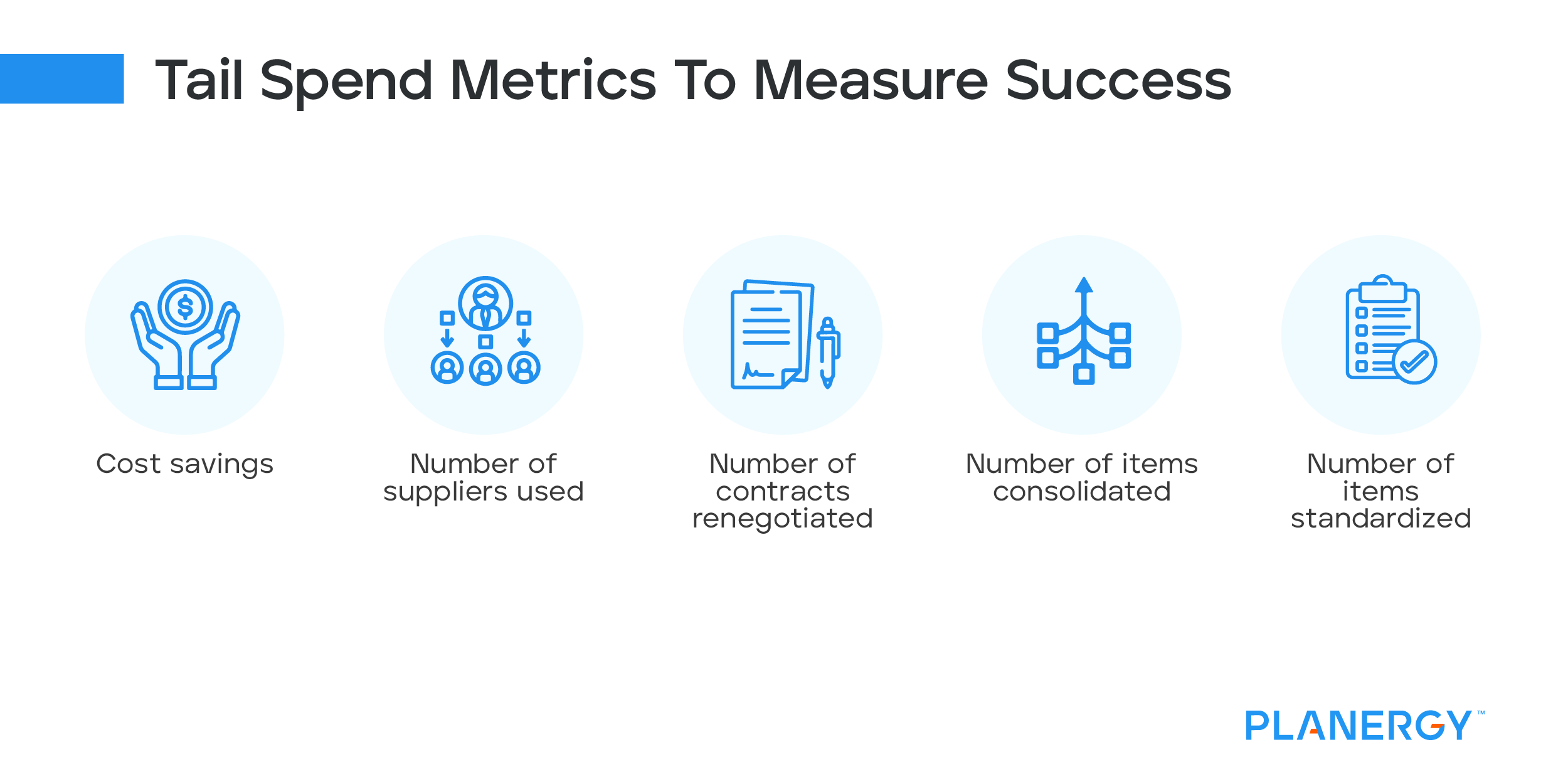

Companies can reduce the number of suppliers in the tail-end of their supply chain through digital tools and a well-established procurement framework.

This can help them save time and money while maintaining quality and compliance with business policies.

For instance, one manufacturing company found hundreds of duplicates in its supplier list. The team used an algorithm to identify these duplicates and eliminated them from their RFQ.

They found that their costs could be reduced by about 30%. Another example involves a global chemicals company. By bundling materials with strategic suppliers, they can get better prices, less lead times, and reduced quality issues, making stakeholders happy.

However, switching suppliers can be difficult. Suppliers often need approval from production, R&D, or quality control. When a new supplier is brought in, they must understand the product or service’s value to the company.