Accounts payable teams use 3-way matching to manage financial risk and ensure company funds are spent properly. So, what is a 3-way match and why is it a critical step in the accounts payable process?

What Is 3-Way Matching in Accounts Payable?

3-way matching is a procedure for processing a vendor invoice to ensure that a payment is complete and accurate. The goal of 3-way matching is to highlight any discrepancies in three important documents in the purchasing process.

The three documents that must have matched totals include purchase orders, order receipts/packing slips, and invoices. Ensuring that these documents are matched before paying an invoice saves businesses from overpaying or paying for an item that they did not receive.

How Does 3-Way Matching Work?

3-way matching works by having accounts payable review the quantities, prices, and terms to ensure that what is ordered (via the purchase order) matches the goods received (via the order receipt/packing slip) which matches what they are being charged (via the invoice).

This process is important for large purchases or purchases with newer vendors, but businesses may choose not to use three-way matches for small or recurring purchases.

Let’s explore the three critical documents that accounts payable teams use to enforce 3-way matching before paying a supplier invoice.

Purchase Orders

A purchase order (PO) is an official confirmation sent from the buyer’s purchasing department to a vendor that authorizes a purchase. POs generally include the buyer’s company name, date, description and quantity of the goods or services, price, mailing address, payment information, invoice address, and PO number.

Order Receipts/Packing Slips

Along with the goods delivered, vendors provide an order receipt as proof of payment and delivery. It details exactly what is in the shipment or order. Order receipts typically include the same information as in the invoice, as well as the method of payment.

Invoices

An invoice is sent from the purchaser to the vendor to request payment for a purchase. Invoices include the same information as the purchase order, as well as an invoice number, vendor contact information, any credits or discounts for early payments, payment schedule, and total amount due.

If any issues are found—inaccurate quantities, wrong prices, damaged goods, or more—payment is not sent until the issue is rectified. Once the invoice has been validated by the 3-way matching process, payment is sent according to the terms.

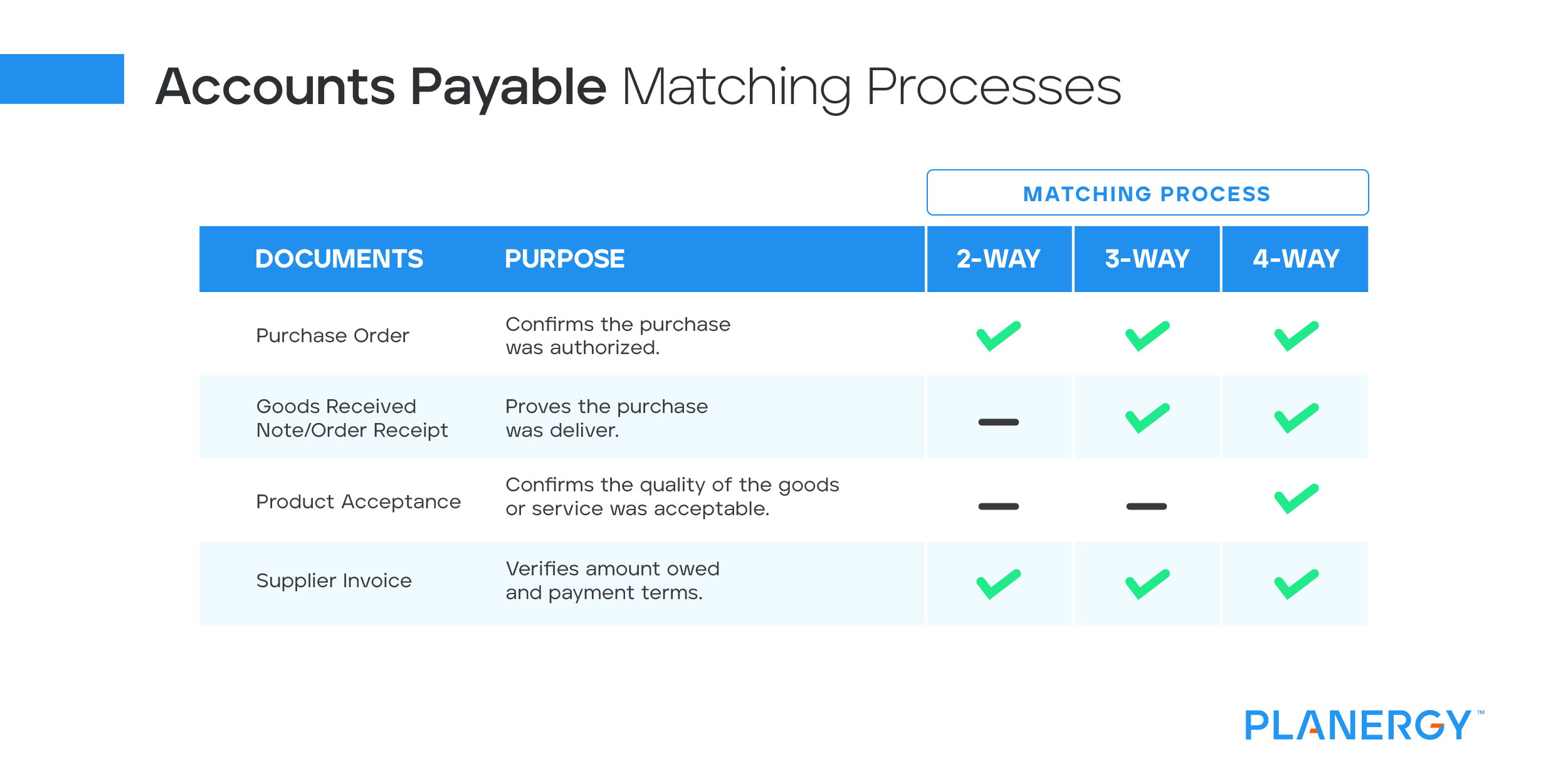

What Is the Difference Between 3-Way, 2-Way, and 4-Way Matching?

Some accounts payable teams may rely on two-way or four-way matching—rather than 3-way matching—to ensure that invoices are accurate. The difference between these methods involves the documents used and confirmation needed before payment is released.

2-Way Matching

Only the invoice and the purchase order are matched before payment is released. This more basic method is used when only two documents are available, or for regularly recurring payments such as software subscriptions.

3-Way Matching

Considered the industry standard, this process involves matching the invoice, purchase order, and packing slip/order receipt.

4-Way Matching

This involves the same documents as 3-way matching but adds the more rigorous element of human confirmation. This confirmation could be a visual inspection (such as checking if repairs are sufficient) or a verbal confirmation (such as stating that a training session was successfully delivered).

Accounts payable can use these different methods of invoice matching for different situations. At their discretion, they can decide if two-way matching or three-way matching is enough, or if the added confirmation of four-way matching is required.

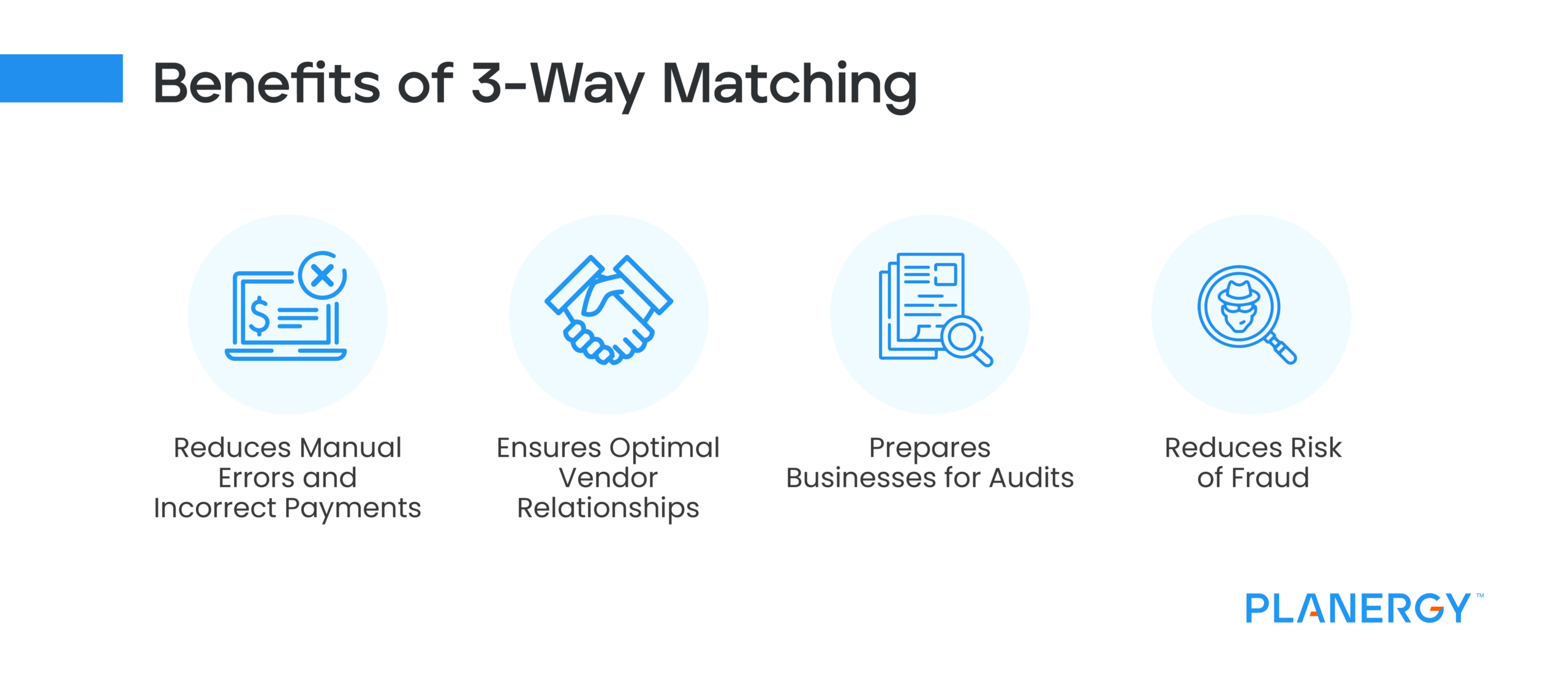

What Are the Benefits of 3-Way Matching?

There are multiple benefits of 3-way matching that inspire accounts payable teams to take the time to do it. Four of the most important benefits of 3-way matching are the following:

Reduces Manual Errors and Incorrect Payments

Verifying that data is consistent across purchase orders, receipts, and invoices helps businesses avoid overpaying, paying for duplicate items, and paying for things they haven’t received.

Ensures Optimal Vendor Relationships

High-quality vendors respect the importance of purchase orders, invoices, and receipts in the accounts payable process. Frequent mistakes on receipts and invoices can be a sign of a broader business issue, and may indicate that it’s time to begin shopping around.

Prepares Businesses for Audits

Auditors are specifically on the lookout for financial discrepancies. Compiling these documents in advance of an audit and checking that the numbers line up using the 3-way matching process shows auditors that your business is well-organized and financially responsible.

Reduces Risk of Fraud

According to a 2022 survey, 58% of AP departments report being targeted by email scams that include fake invoices or wire transfer information. 3-way matching helps ensures that fraudulent invoices aren’t paid because they should not match existing POs and receipts.

3-way matching helps accounts payable teams save money, improve vendor relationships, prepare for audits, and reduce fraud risk

What Are the Disadvantages of 3-Way Matching? Why Is Manual 3-Way Matching Bad?

While it’s always an important internal control, the disadvantages of 3-way matching come into play when it’s done manually, rather than automated. When done manually, it can be labor-intensive, time-consuming, and a considerable cost to your organization.

The manual three-way matching process generally looks like this:

- Thumbing through stacks of paperwork to find the three documents you need

- Visually scanning each document to ensure the numbers are aligned

- Logging a confirmation of the match in a spreadsheet

- Manually approving the payment for release

Not only is this inefficient, but it’s also highly susceptible to human error.

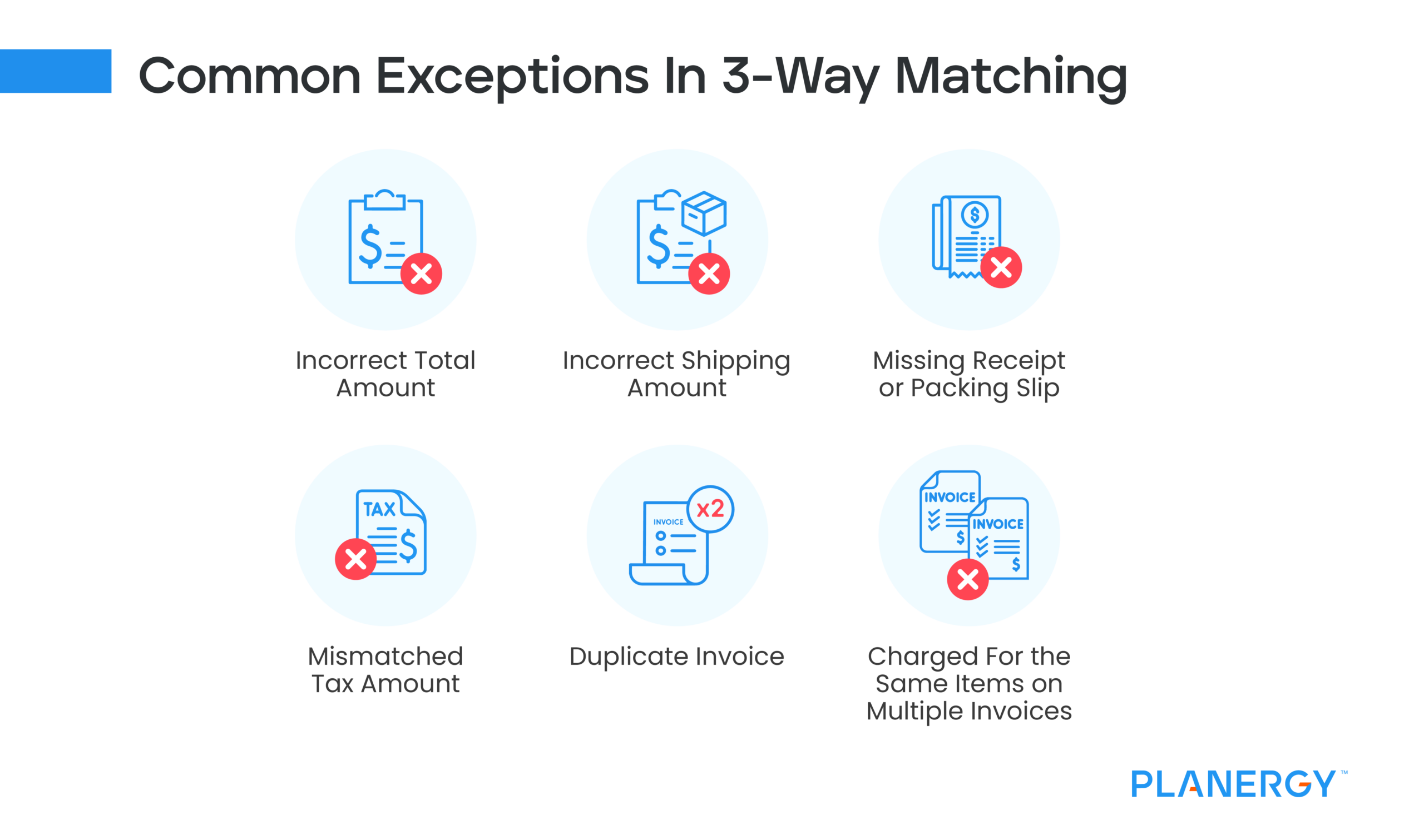

What Are Common Exceptions in 3-Way Matching?

Sometimes, an exception is found between the three documents in 3-way matching (which means the process worked). When this happens, the buyer will typically reach out to the vendor for clarification to make sure they’re paying the right amount and received the goods or services they ordered.

Common exceptions in 3-way matching include:

Incorrect Total Amount

When the total amount on the invoice is higher than on the purchase order or packing slip. This could indicate that the vendor used an incorrect unit price or just be a data entry error.

Incorrect Shipping Amount

When a vendor delivers more or less than the amount ordered. Finding a mismatch here may also indicate that you were charged for more or less because you did not receive the exact amount that you ordered.

Missing Receipt or Packing Slip

When a vendor delivers an order without a goods receipt, packing slip, or a receiving report, it can’t be paid under the 3-way match system because that crucial document is missing. When this happens, the buyer’s receiving department can reach out to the vendor for a replacement packing slip or receipt.

Mismatched Tax Amount

This usually happens alongside incorrect total amounts since taxes are calculated based on the wrong amount. Other errors can happen here as well, especially in interstate or international transactions where taxes aren’t straightforward.

Duplicate Invoice

Ever so often, suppliers will send the same invoice twice. This is most likely a clerical error on their part and not an attempt to get double paid but should be checked against nonetheless. This is easily caught when the AP team goes to sign off on a 3-way matched invoice and sees that the invoice has already been paid.

Charged For the Same Items on Multiple Invoices

Some vendors might make the mistake of throwing the same items on multiple invoices. Luckily, procurement teams will have sent a PO for the specific items they ordered, so this should be caught in the 3-way match process when those items don’t line up exactly as they were on the PO.

Tracking the exception rate (exceptions / total orders) can help you evaluate which vendors you prefer to order from. Choosing vendors with low exception rates will save you time and money in your accounts payable processing because you can expect that they will require fewer corrections before payment.

Why Automate 3-Way Matching?

Automating 3-way matching makes your accounts payable team significantly more efficient while ensuring you don’t overpay your suppliers. According to a 2021 report, best-in-call AP teams are twice as likely to automate invoices, which results in higher efficiency workflows and fewer exceptions.

Automating 3-way matching is simple when you upgrade to PLANERGY’s e-procurement system. Without any human intervention, issues are brought to light early so you don’t slow down the payment process. You’ll significantly reduce processing costs and be able to spend more time on valuable work.

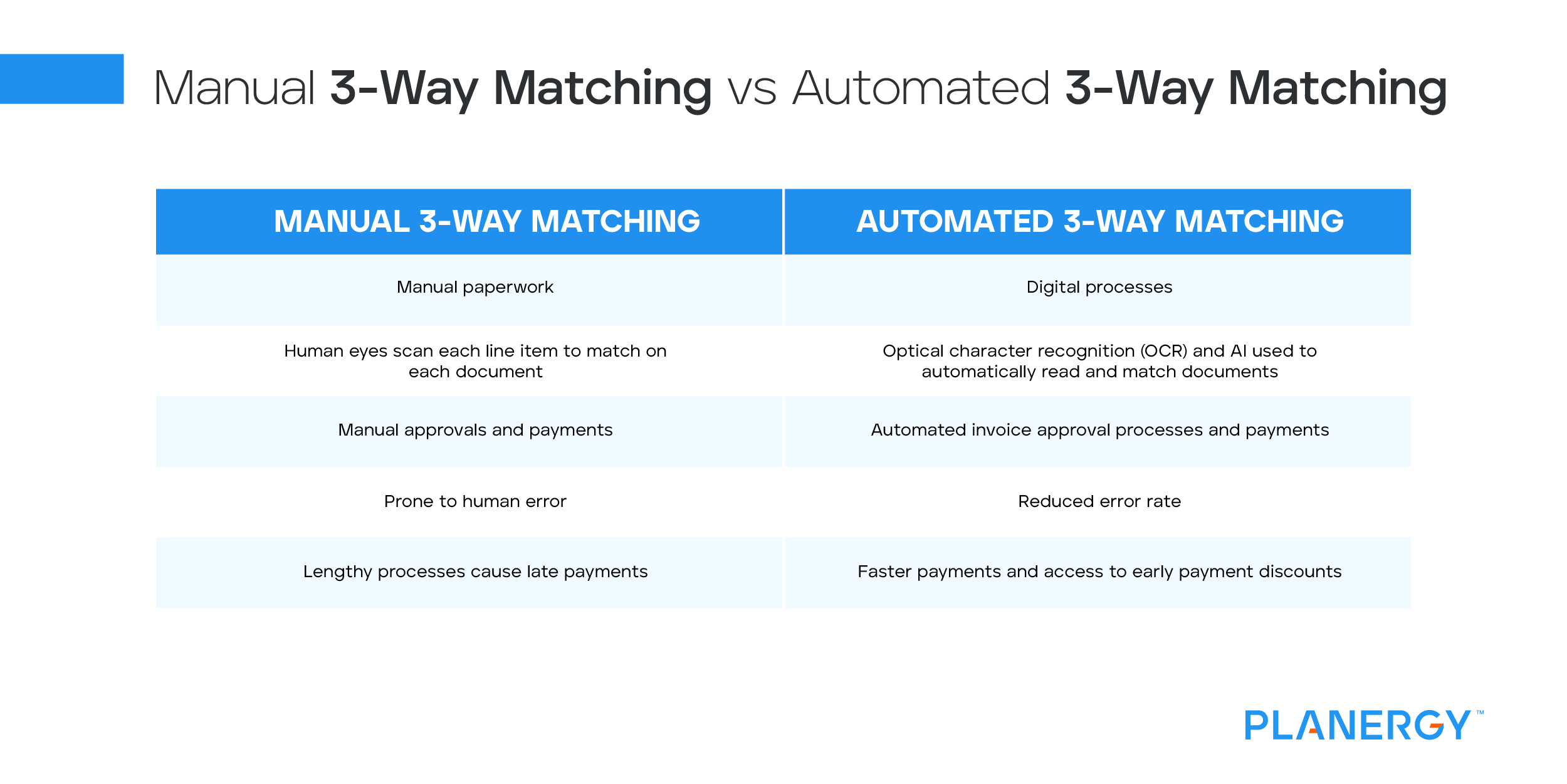

Manual Matching vs Automated Matching

| Manual | Automated |

|---|---|

| Manual paperwork | Digital processes |

| Human eyes scan each line item to match on each document | Optical character recognition (OCR) and AI used to automatically read and match documents |

| Manual approvals and payments | Automated invoice approval processes and payments |

| Prone to human error | Reduced error rate |

| Lengthy processes cause late payments | Faster payments and access to early payment discounts |

Leading procurement teams know that automation and digital solutions are the future. According to Deloitte’s 2021 Global CPO survey, the top three priorities for CPOs are:

- Driving operational efficiency (78%)

- Reducing costs (76.4%)

- Digital transformation (76.1%)

Investing in automated 3-way matching is an excellent way for organizations to make an impact in all three of those priorities. Teams that are able to achieve automation will make the entire procurement process more efficient while positively impacting their organization’s bottom line.