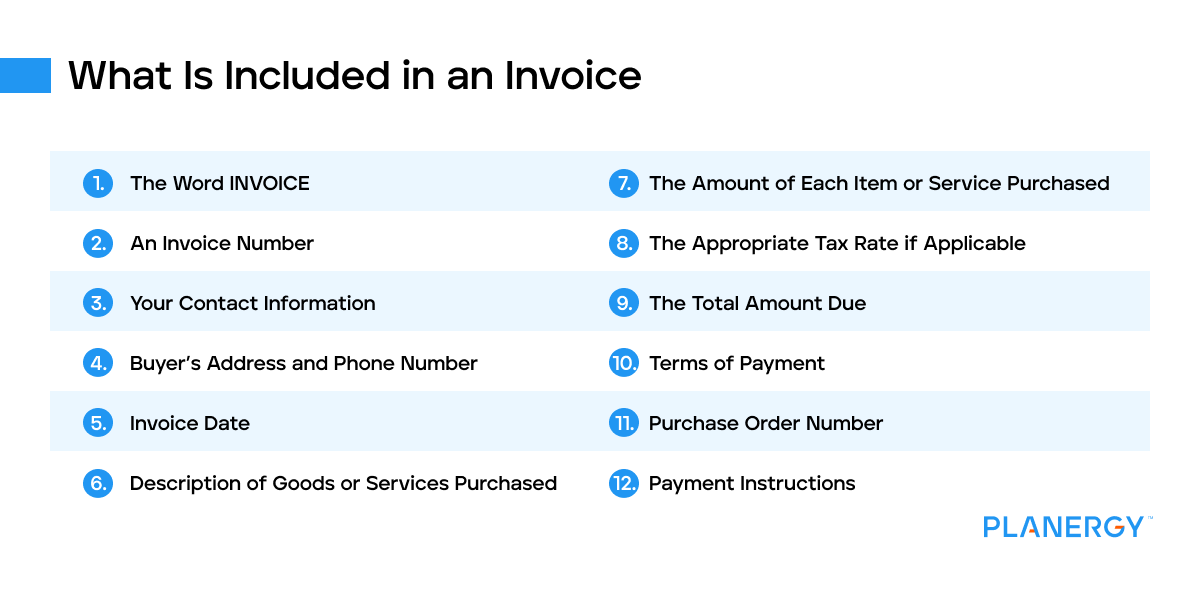

The Word INVOICE

The word ‘invoice’ should always be front and center on any invoice that you create.

This helps differentiate the document from a purchase order, shipping receipt, or other similar documents.

An Invoice Number

A unique invoice number is important to both buyers and sellers, with both keeping track of this unique number for payment purposes and to ensure that duplicate invoice numbers are not processed.

Your Contact Information

Your company information including company name, complete address, phone number, and email address should be included in any invoice that your business sends.

Buyer’s Address and Phone Number

Buyer information including the company name if your customer is with a company, and their complete address including phone number and email address should be included on all invoices.

Invoice Date

The invoice date is important, particularly for buyers, since the invoice date is technically the first date of their payment term.

For example, if your payment terms with a company are Net 30 and the invoice date is September 21, your payment due date would be October 20.

Description of Goods or Services Purchased

An invoice should always include a complete description of any items or services purchased including the purchase date, the number of items purchased, or the type of service purchased.

Each item or service purchased should be listed as a separate line item.

The Amount of Each Item or Service Purchased

Along with the description (see # 6), each product or service will need to have an individual cost as well as the total cost.

If you purchase 10 bookcases, you will need to include the cost of each bookcase, along with the total cost.

The Appropriate Tax Rate if Applicable

If you’re selling products, for tax filing purposes, you’ll need to include sales tax on your invoice.

Determining the correct sales tax rate can be confusing, particularly if you frequently sell out of state.

Following these steps can help:

Find the Appropriate Sales Tax Rate: If you’re selling in your home state, use your state’s current tax rate. If you’re selling to another state, you’ll need to determine the tax rate for that state.

Determine What Items Are Taxable: Products sold to an end-user are typically taxable, while those that have been purchased for resale may not be. It’s best to consult the tax regulations for the appropriate state or jurisdiction.

Calculate the Sales Tax: If your taxable items total $200 and the state tax rate is 10%, the total tax due would be $20.

Add the tax to your product or service total to determine the total amount due from your customer.

The Total Amount Due

The total amount due should include the individual total of all products and services purchased as well as additional charges such as shipping or sales tax.

Terms of Payment

Before you sell to a customer, specific payment terms should be agreed upon.

Those agreed-upon terms will need to be included on any invoice including both early payment options and late payment fees.

Purchase Order Number

If your customer used a purchase order during the sales process, the purchase order number should be included on the invoice.

Payment Instructions

Payment instructions can include a remittance address where a check can be sent as well as a website or other link where customers can pay an invoice electronically.

Remember, the more payment options you provide your customers, the quicker the customer usually pays.

For companies required to create a VAT invoice will also have to include the VAT number, the total amount of the invoice excluding VAT, and the VAT rate for each item.