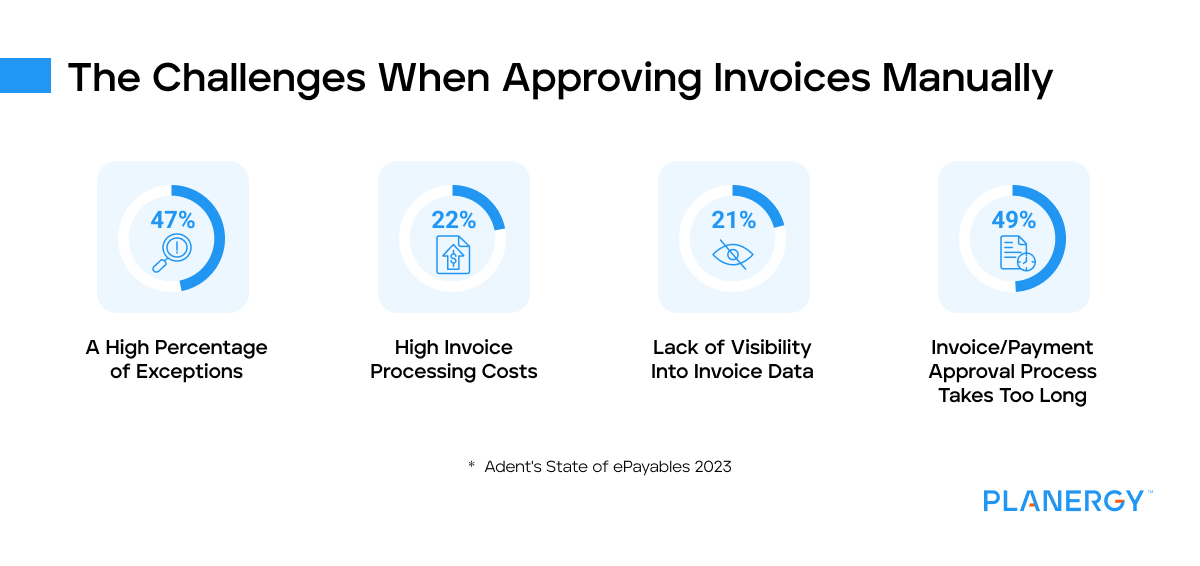

Invoice processing and invoice approval are time-consuming processes for those using a manual accounting system.

As a result, staff time is often tied up with common AP workflow tasks such as receiving, distributing, processing, and approving invoices.

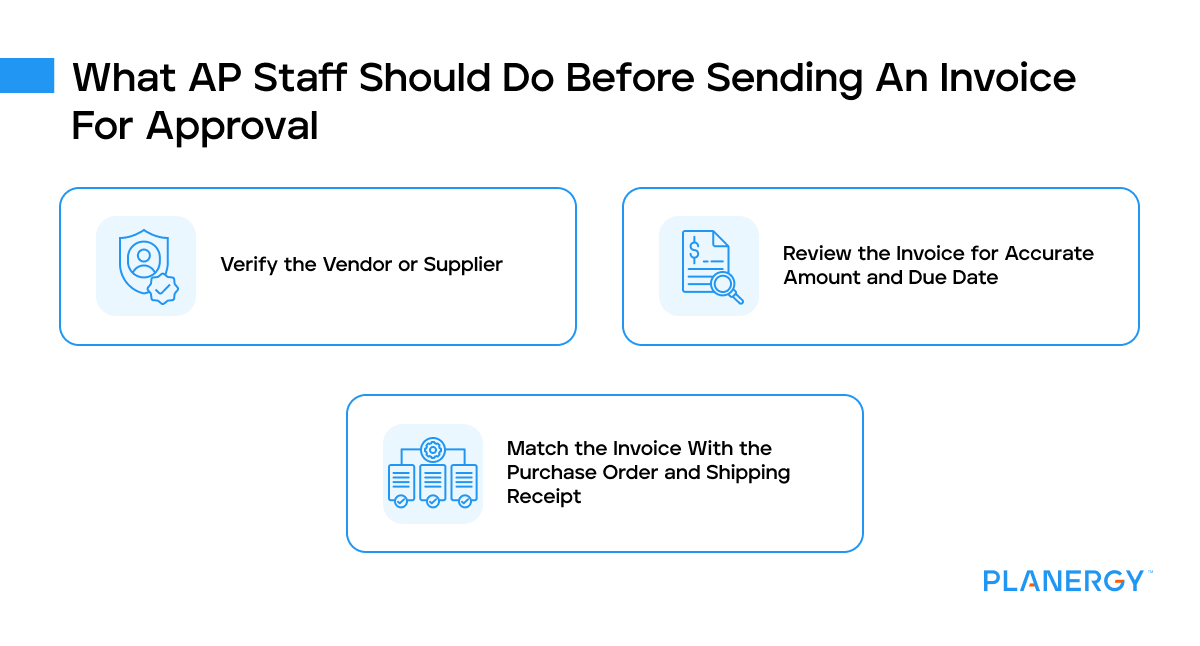

In addition, tasks such as three-way matching add an additional burden to an already overworked staff, which often contributes to human error.

Fortunately, there is a better way to process accounts payable in general, and invoice approvals.

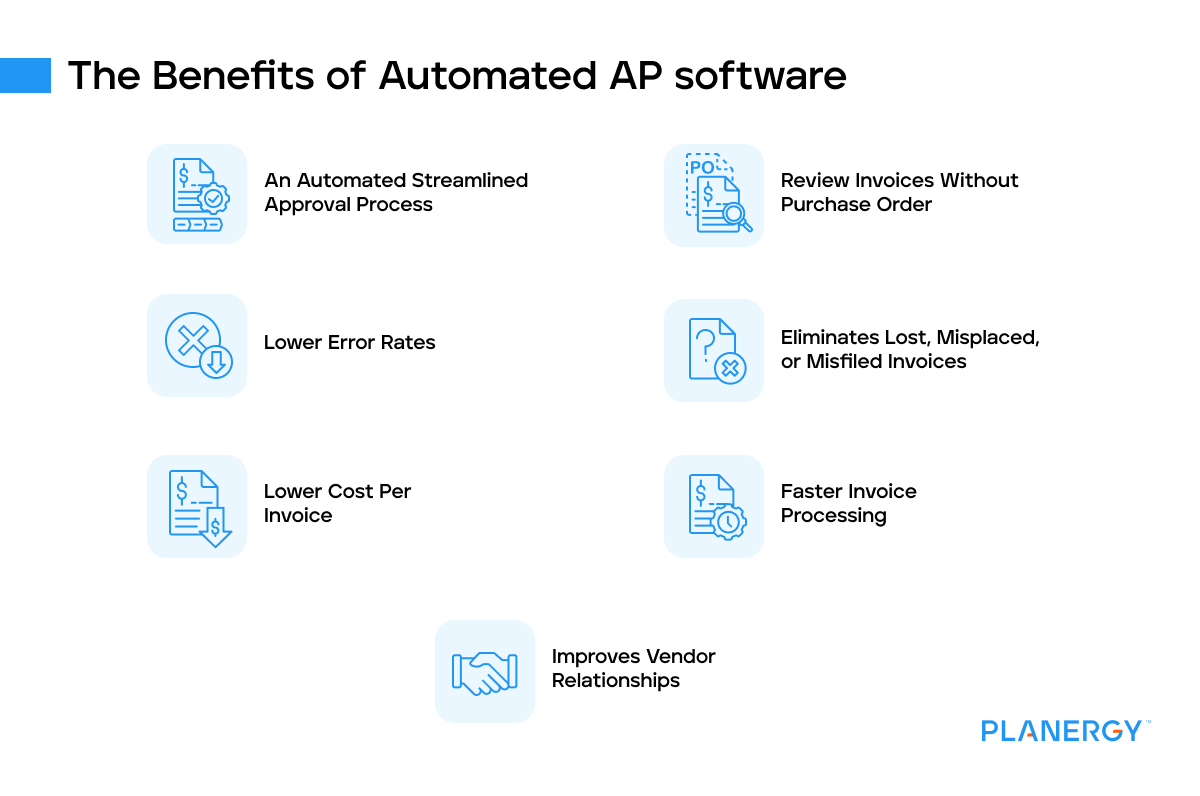

Invoice processing software automates not only repetitious tasks such as invoice matching but also provides a way to expedite the entire invoice approval process.

Invoice approval workflow software is incorporated into a broader AP solution to deliver an automated invoice approval system that helps eliminate paper invoices entirely.

When coupled with AP automation software, many of the time-consuming tasks that have traditionally saddled the AP department simply disappear.

Invoice approval software also eliminates invoices lost in transit or the very common issue of vendor invoices sitting on someone’s desk or buried under a stack of papers.

This complete automation solution also eliminates the very real issue of an invoice being sent to the wrong department or manager altogether.

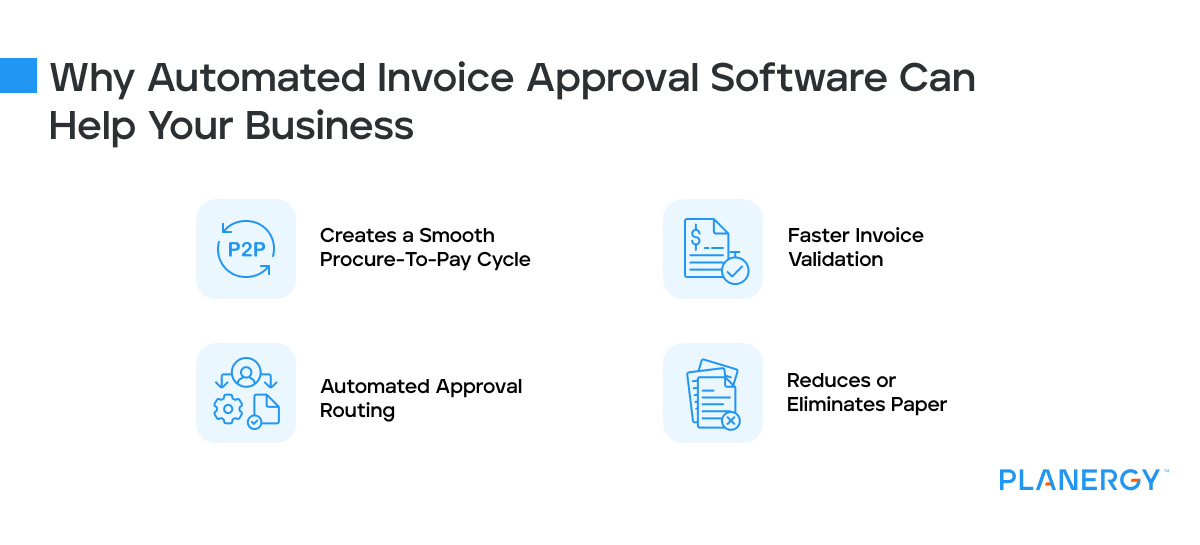

Today, there are a variety of invoice approval software applications on the market to choose from, with different apps popping up all the time.

But while they may automate the invoice approval process, their usefulness is limited if they don’t communicate with your core accounting application.

Instead, if you’re in the market for an automated invoice approval software application, look for one that offers complete invoice management features such as procure-to-pay capability, AP automation, and the approval process in one complete package.