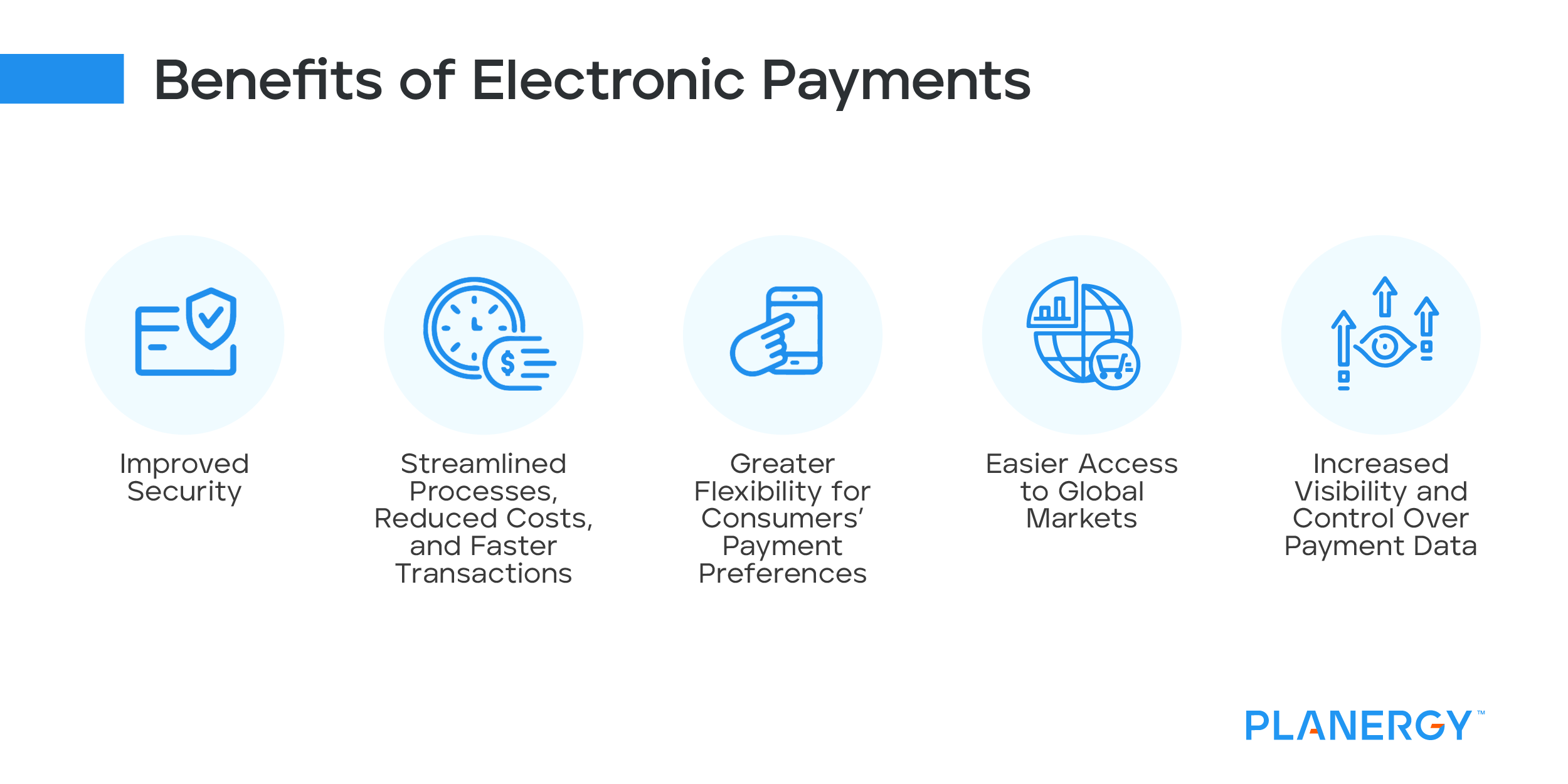

These forms of payment offer greater convenience for both customers and businesses.

While some payment options require the user to have a formal bank account with a financial institution, others do not.

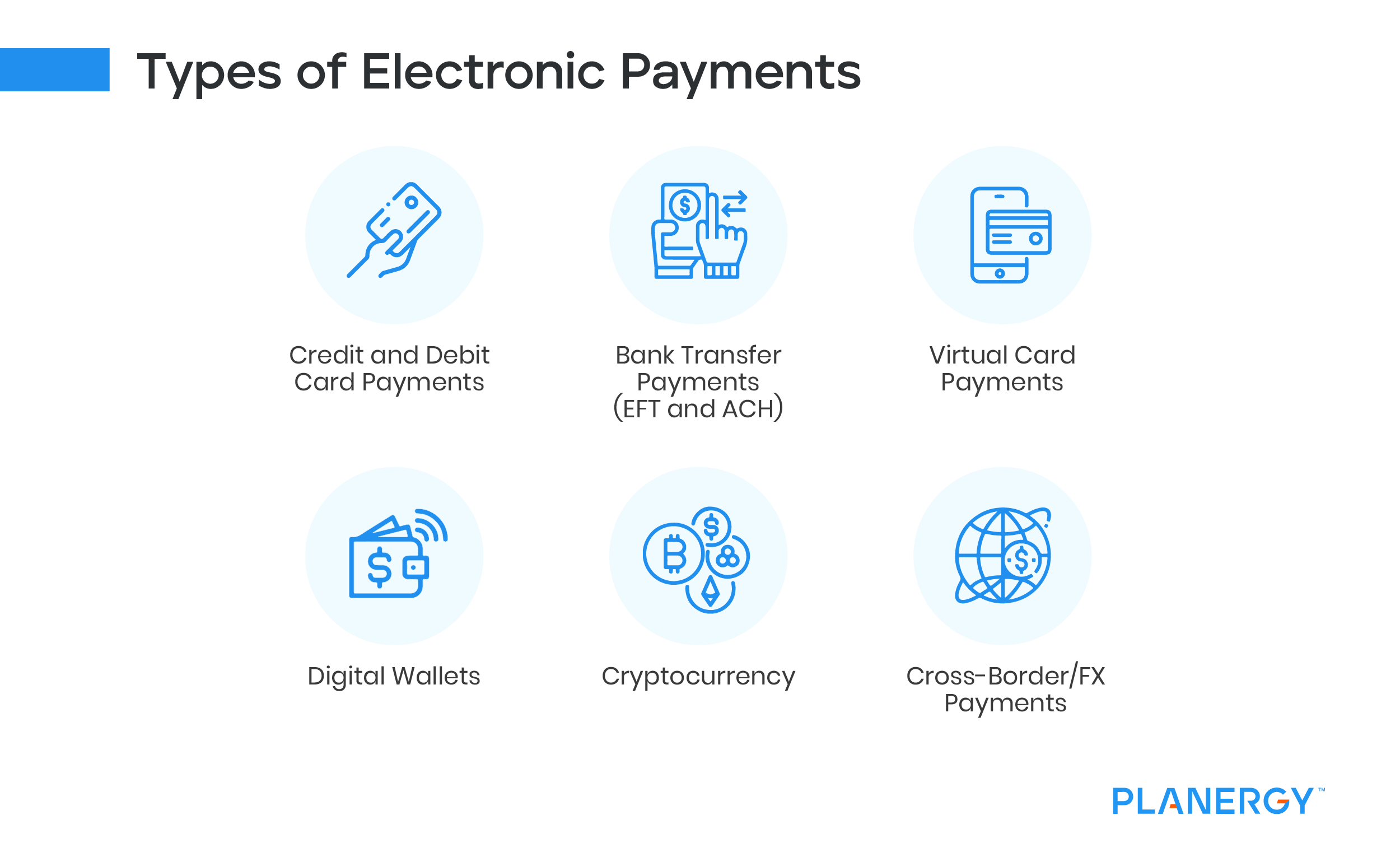

Credit and Debit Card Payments

Credit and debit card payments allow customers to purchase goods or services online using their bank-issued credit or debit cards.

Credit cards issued by banks and financial institutions are a type of revolving loan that allows customers to borrow money up to a predetermined limit.

Debit cards, on the other hand, draw from a customer’s existing funds and can be linked to either checking or savings accounts.

Both types of cards provide speed and convenience for customers, as well as added security features such as fraud protection.

Two of the most popular names in global payment solutions are Mastercard and Visa.

Your credit or debit cards may have either of these logos – signifying you can use them with whatever merchants accept them.

Bank Transfer Payments

Bank transfers are a safe way to transfer money, especially when compared to a cash transaction. They are also faster, and can be used to make purchases.

There are several ways to accomplish this, from phone banking to online payments.

Also, be sure to double-check your recipient’s name and account number. If you have the wrong account, it can be tricky to retrieve the funds.

One of the cheapest and fastest ways to make an electronic payment is by using a wire transfer. A wire transfer is an electronic funds transfer (EFT) that can be sent to anyone in the world.

It works by withdrawing the funds from a sender’s bank account, and then sending them to a destination.

There are two types of automated clearing house (ACH) transfers: regular, which take a few business days, and same-day. While regular ACH transfers are free, same-day transfers can be made for a small fee.

The ACH network handled 29.11 billion payments in 2021, and the volume continues to grow. Many larger banks can process a single ACH payment in a matter of hours.

Virtual Card Payments

Virtual card payments are a type of electronic payment where customers can purchase goods or services online with a virtual card instead of a physical card.

A virtual card is a payment instrument that has the same attributes as a traditional credit or debit card but exists solely in an electronic format.

Virtual cards can be generated and used instantly, making them an ideal online purchase solution. Additionally, they offer increased safety and security compared to using physical cards.

Digital Wallets

Digital wallets offer an easy and convenient way for consumers to pay for goods and services online. These digital payments solutions eliminate the need for physical credit or debit cards.

In addition to eliminating the need for plastic, the convenience and security of electronic payments also allow users to transfer funds internationally.

Digital wallets are available for both individuals and businesses. They are a downloadable mobile app that enables customers to pay via phone.

A digital wallet is an encrypted software application that allows consumers to store their personal and financial information. The information stored includes name, shipping address, credit card details, e-coupons, and tickets.

Users can add a virtual card to their wallet and authorize it to make payments using their bank account. This helps reduce the risk of fraudulent transactions.

Some credit card issuers offer enhanced rewards when customers use their digital wallets.

Cryptocurrency

The cryptography of the blockchain system is the backbone of cryptocurrencies. It chains together a decentralized network of computers to create a distributed database.

This allows for peer-to-peer transactions. Using cryptography also makes it almost impossible to counterfeit.

Many countries have started to regulate cryptocurrencies. In the US, taxpayers are required to report the sale of cyrptocurrencies to the IRS on their annual tax returns.

Although some countries have not adopted cryptocurrencies as a means of payment, interest in cryptocurrencies has grown in recent years.

As a result, the cryptocurrency industry has increased in size. The cryptocurrency market is expected to reach $2.2 billion by 2026, with a compound annual growth rate of 7.1%.

There are currently thousands of different cryptocurrencies. Many are used for online payments. Cryptocurrency advocates argue that a decentralized system will be more secure and efficient.

Cross-Border/FX Payments

Cross-Border/FX Payments are payments that involve international currency transfers.

These payments allow customers to send and receive funds in different currencies and ensure that the correct amount is delivered to the recipient.

Cross-Border/FX Payments often have lower transaction fees than other forms of payments, making them an attractive option for customers looking to save money.