Expense reports are a necessary part of expense management but can also be tedious and time-consuming.

Fortunately, expense report automation tools are now available that can simplify the process and save businesses time and money.

What is an Expense Report?

An expense report is a document that details all the expenses an employee incurs while on business-related travel.

This report aims to provide both the employer and employee with an accurate record of all expenses associated with a particular trip, including transportation, lodging, meals, entertainment, and other relevant costs.

Expense reports help businesses keep accurate spending records and manage their finances more efficiently.

Manual expense reporting is a labor-intensive process requiring employee time to manually enter expenses into an accounting system or spreadsheet.

This can present challenges in accuracy, consistency, and scalability.

What is Expense Report Automation?

Expense report automation is an adaptable software solution designed to make the process of recording and submitting expenses a breeze.

This technology automates key functions such as capturing receipts, categorizing expenses, and submitting claims.

This can result in cost-effective and efficient management of expenses for businesses of all sizes.

How Expense Report Automation Compares to the Manual Expense Reporting Process

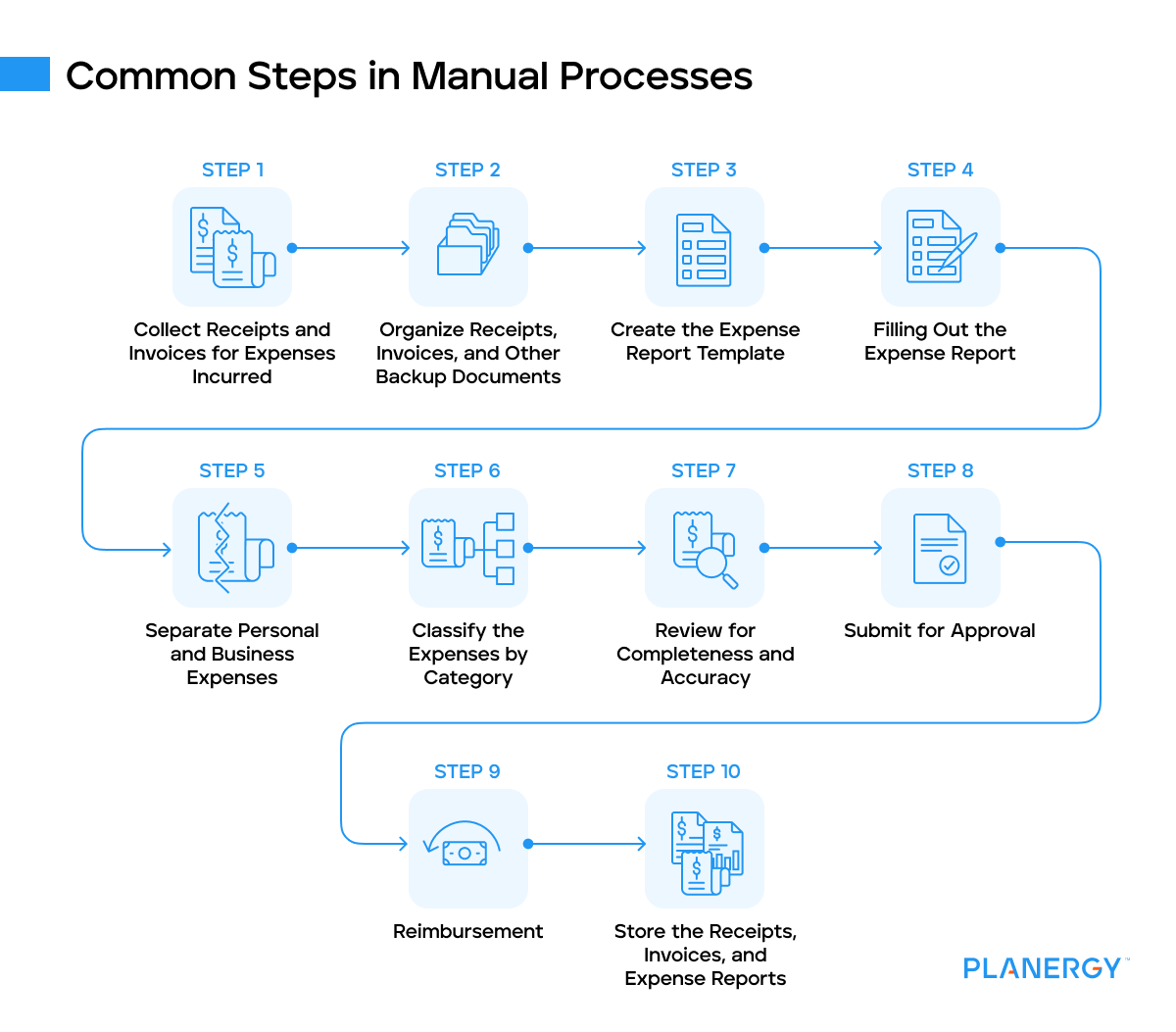

Common Steps in Manual Processes

Collect Receipts and Invoices for Expenses Incurred

All employees or personnel who incur expenses, including those who use company credit cards or personal funds, must keep and accumulate all receipts, invoices, and backup documents relating to their expenses.

Organize Receipts, Invoices, and Other Backup Documents

Organize all receipts and invoices for expenses incurred, grouping them according to the type of expense or category.

For example, if an employee had meals and incurred travel expenses during a business trip, separate the receipts into two groups and classify them based on the type of expense.

Create the Expense Report Template

Create an expense report form that will be used by employees or personnel to declare their expenses.

Ensure the form contains all necessary fields for accurate information gathering, such as dates, categories, amounts, brief descriptions, etc.

Filling Out the Expense Report

When filling out the expense report, ensure all necessary information is provided accurately.

For example, increasing emphasis should be placed on the expense’s purpose, the expense’s date, the expense’s amount, and the expense’s category.

Separate Personal and Business Expenses

Employees and personnel must separate their personal expenses from their business expenses to ensure that only business-related expenses are reported and reimbursed according to company policy.

For example, spending money on a second airline ticket for a family member to accompany you on the trip is a personal expense that shouldn’t be reported for reimbursement.

Classify the Expenses by Category

Classify all expenses by category or type, such as office supplies, travel, meals, entertainment, rental, and any other expense type.

This will help quickly identify the types of expenses incurred and easily report on various expense data.Review for Completeness and Accuracy

The expense report should be reviewed for completeness and accuracy, ensuring that all necessary information is included and the right amount is provided.

Ensure that all receipts and invoices for the expense are attached to the expense report.

Submit for Approval

Submit the expense report to the supervisor or manager for approval. Once reviewed, the manager or supervisor will either approve, deny, or partially approve the expense report.

Reimbursement

If the expense report is approved, reimburse the employee promptly for the expenses incurred.

Reimbursement can be in cash or by check, based on the company’s reimbursement policy.

Store the Receipts, Invoices, and Expense Reports

Finally, store the expense report, receipts, and invoices for future reference. These documents should be archived for tax and audit purposes.

Overall, creating a clear expense reporting process can help reduce errors, establish a clear system for reimbursing expenses, and provide accurate reporting and insights into the company’s spending.

As you can see, a manual expense reporting process is fairly labor-intensive and has plenty of room for error.

When keeping paper receipts, copies of reports, etc., not only do you need more room for storage in your office, but there’s plenty of room to lose the documentation you must keep on file.

Digitizing everything with an expense management system can help, but automation removes even more hassle.

Why Automate Expense Reporting?

By automating expense reports, businesses can enjoy improved accuracy, reduced time spent on manual tasks, decreased errors, lower instances of expense fraud, and lower processing costs.

According to a survey by Certify, automating expense reports resulted in 27% time savings with a 20% decrease in error rates.

Automating the process frees up resources and allows employees to focus on more strategic and valuable work.

Automation also provides more granular data control and streamlined logic based on policies set by management.

Additionally, automated processes are more secure because reports can be stored in the cloud instead of on local machines, which can open up security risks.

PLANERGY will soon release a module to automate expense management, to speed up your expense reporting and approval processes.

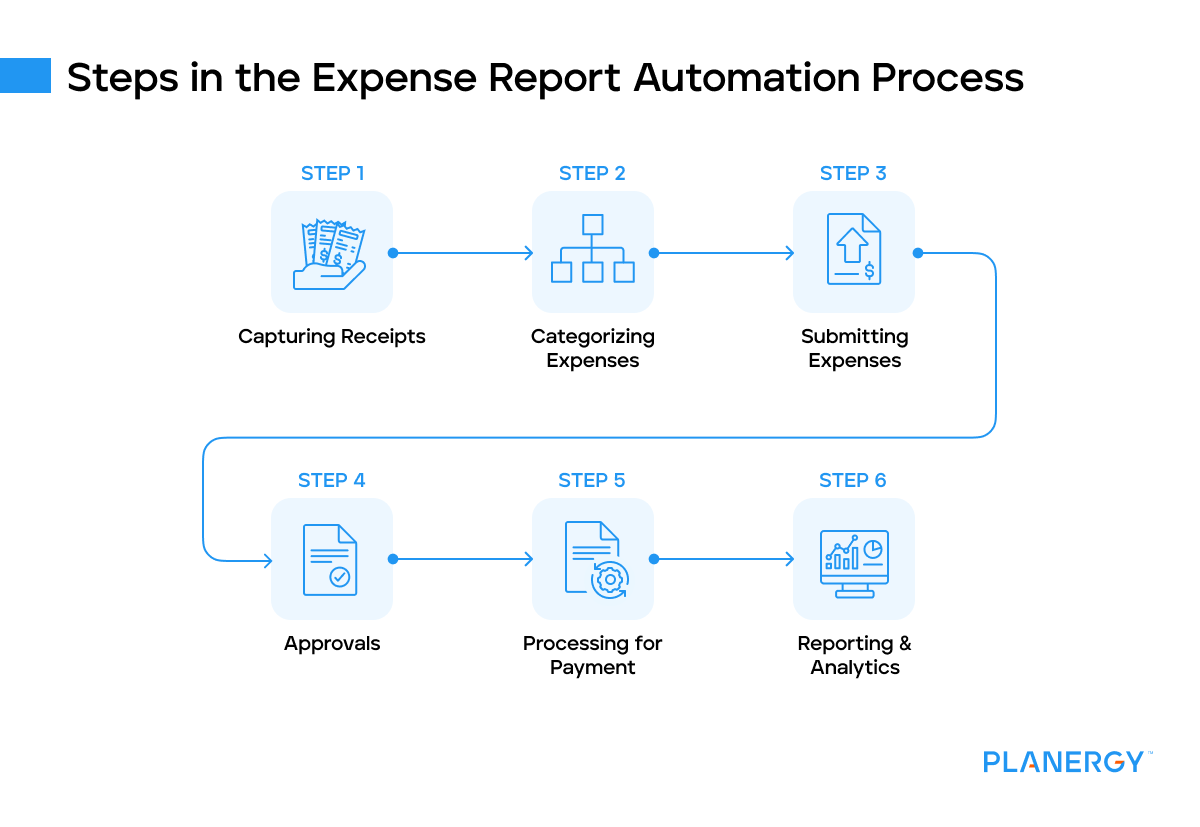

Steps in the Expense Report Automation Process

Capturing Receipts

The process starts with capturing expense receipts.

This can be done through various methods such as mobile applications, OCR scanners, or integrated credit card statements, eliminating the need for manual data entry.

Categorizing Expenses

Once the receipts are captured, the system categorizes the expenses using predefined rules that align with the business policies around allowable expenses.

Submitting Expenses

After the expenses are categorized based on the rules, employees can submit them for review and approval. This can be done via a mobile app or web-based interface.

Approvals

Once the expense reports are submitted, they are reviewed and approved by the necessary authority, such as HR, finance team, or management.

Processing for Payment

Finally, the approved expenses are entered into the ERP system and processed for payment with the accounting team.

This includes paying vendors or reimbursing employees. Ideally, your expense management solution should integrate with your accounting software to make for easier workflows.

Reporting & Analytics

Any expense receipts data is captured in a CRM system throughout this process. This allows users to run reports and analytics on their spending, with real-time insights.

Manual reporting may work for small businesses initially, but it’s not practical at scale. Automation is key to fostering growth.

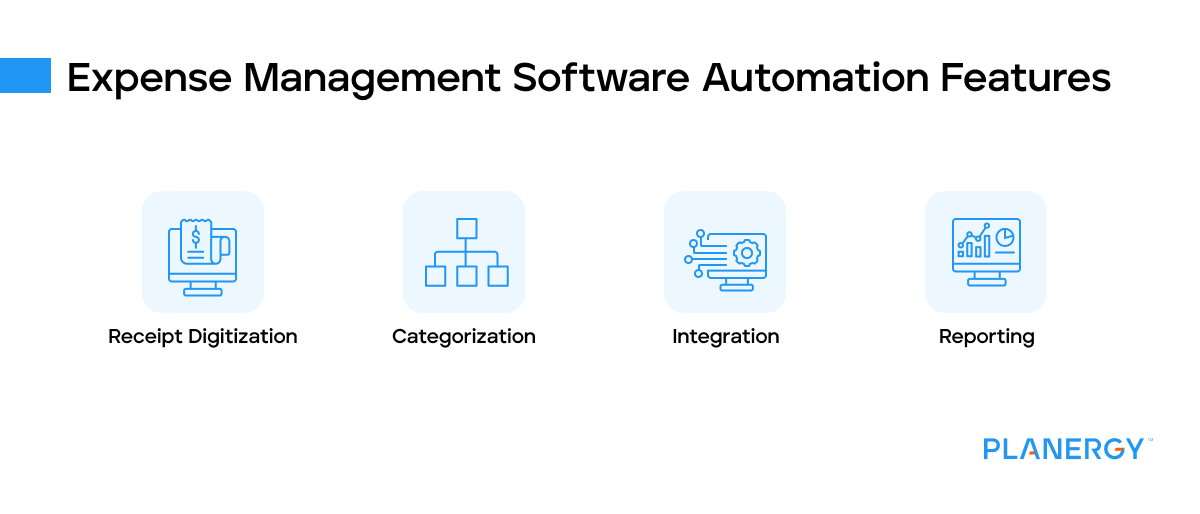

Expense Management Software Automation Features

Receipt Digitization

Automated expense reporting accepts scanned or photographed receipts, thus capturing the correct information and saving time.

Employees use the camera on their mobile device to snap a photo, and it’s saved to be attached to the expense report.

Categorization

These tools can automatically categorize expenses by analyzing the receipts, making tracking costs easier and ensuring compliance with company policies.

Integration

Automated expense reports integrate with accounting systems, further streamlining the process by automating the transfer of information.

Reporting

Automated expense reports can generate reports that provide a clear overview of spending, making it easier for business owners to identify opportunities to cut costs and reduce unnecessary expenditures.

Best Practices for Automated Expense Reporting

Start with a Clear Expense Policy

A solid expense report policy can set clear rules on which business expenses are reimbursable and which ones are not.

As you consider your policy, think about things such as:

- Will a corporate credit card be required? Can you assign people virtual cards?

- Will there be a limit on total employee spending for each business travel trip?

- How long will employees have to submit expense claims?

- How long will it take for employees to receive their reimbursement?

- What happens if someone doesn’t follow policy?

Get Buy-in from Employees

Ensure your employees understand the importance of expense report automation and provide training to ensure they can use the tool efficiently.

When they understand the importance of what you’re doing, you’ll end up with better policy compliance, making the process smoother for everyone.

Ask for input on the expense reporting software, to make sure everyone has a say.

Monitor Usage

After implementing expense management automation, track how the system is working, and identify areas of potential improvement or additional automation.

Expense Management vs. Spend Management

Expense management and spend management are two important processes for managing a business’s financial flow.

Expense management focuses on tracking and approving employee-initiated expenses, such as travel and reimbursable items.

In contrast, spend management involves analyzing spending trends to identify areas where money can be saved.

Though they both have different objectives, it is important for businesses to consider both when looking to improve their bottom line.

Proper expense tracking can help identify potential cost savings, while effective spend analysis enables more informed decisions about managing finances in the long term.

By combining these two approaches, businesses can increase efficiency and decrease unnecessary costs.

Expense Management in the Future

As technology evolves, we expect to see more innovations in expense management.

For example, machine learning technologies can help categorize expenses automatically, and artificial intelligence could provide more insightful analysis of spending patterns.

These technologies will likely lead to even more efficiency, cost savings, and accuracy in expense report automation.

Businesses can see significant advantages by automating their expense reporting system.

The latest automation tools are user-friendly and cost-effective, and they can streamline and simplify the expense management process while helping businesses manage costs and improve efficiency.

Investing in an automated expense report system can save businesses valuable time and money, allowing them to focus on other critical aspects of their business to ensure success for years to come.