In today’s fast-paced business environment, efficiency and accuracy are paramount. One area where these two areas converge is accounting automation. But what is it? How can you leverage it in your organization?

In this post, we’ll demystify accounting automation, explain its benefits, how it works, and provide a step-by-step guide for implementing it into your accounting processes.

Whether you’re a small business owner, or a manager in a larger corporation, understanding and embracing this concept can drastically streamline your financial processes and drive growth.

What is Accounting Automation and Why Should Businesses Implement It?

Accounting automation is the process of using software or applications to perform regular accounting tasks that were traditionally done manually.

This includes procedures like invoicing, payroll, reporting, and tax preparation.

Automating these tasks aims to enhance efficiency, accuracy, and convenience.

Businesses should consider implementing accounting automation because it eliminates the chances of human error, reduces time-consuming tasks, and prevents financial discrepancies.

It also allows businesses to focus more on strategic planning and decision-making rather than worrying about mundane accounting tasks.

How Accounting Automation Works

At the heart of accounting automation lies machine learning (ML), artificial intelligence (AI), and robotic process automation (RPA).

Using these technologies, computers can learn from experience and make predictions or decisions without being explicitly programmed to do so.

In accounting, machine learning algorithms can analyze historical financial data to detect patterns, predict future trends, and even flag potential fraud.

This allows for more accurate financial forecasting and more proactive financial management.

AI, on the other hand, automates data input and matching, making processes faster and less prone to error. It can quickly and easily identify discrepancies and irregular entries in records and statements, ensuring your financial data remains accurate.

RPA, refers to bots that are programmed to perform routine tasks within digital systems that generally require human intervention.

In accounting, RPA is what handles repetitive and rule-based tasks, including data entry, invoice processing, bank statement reconciliation, and generating financial reports.

Challenges of Managing Manual Accounting

Years ago, accounting teams relied on manual processes using Excel spreadsheets to keep track of everything.

This made things incredibly difficult because you never knew if you were looking at the most recent version of a file, or if the data was correct.

Labor Intensive

Manual accounting is, by nature, a labor-intensive process. It requires substantial human effort to record transactions, balance accounts, and create reports.

This can be particularly challenging for small businesses where resources are already stretched thin.

It’s not just the time taken that’s an issue – manual accounting also puts a significant cognitive load on employees, which can lead to fatigue and reduced productivity.

Error Prone

When accounting tasks are performed manually, there’s always a risk of human error.

These errors could be as simple as a misplaced decimal point or a transposed number, but they can have serious consequences.

Errors in accounting can lead to incorrect financial statements, which can mislead business decision-making, result in regulatory penalties, and even damage a company’s reputation.

Time-Consuming

Manual accounting is not only labor intensive, but it’s also time-consuming. Tasks such as data entry, reconciliation, and report generation can take up much of your team’s time.

This time could be better spent on more strategic tasks, like financial analysis and planning.

Additionally, the slower pace of manual accounting means that financial reports are often out of date by the time they’re completed, hindering timely decision-making.

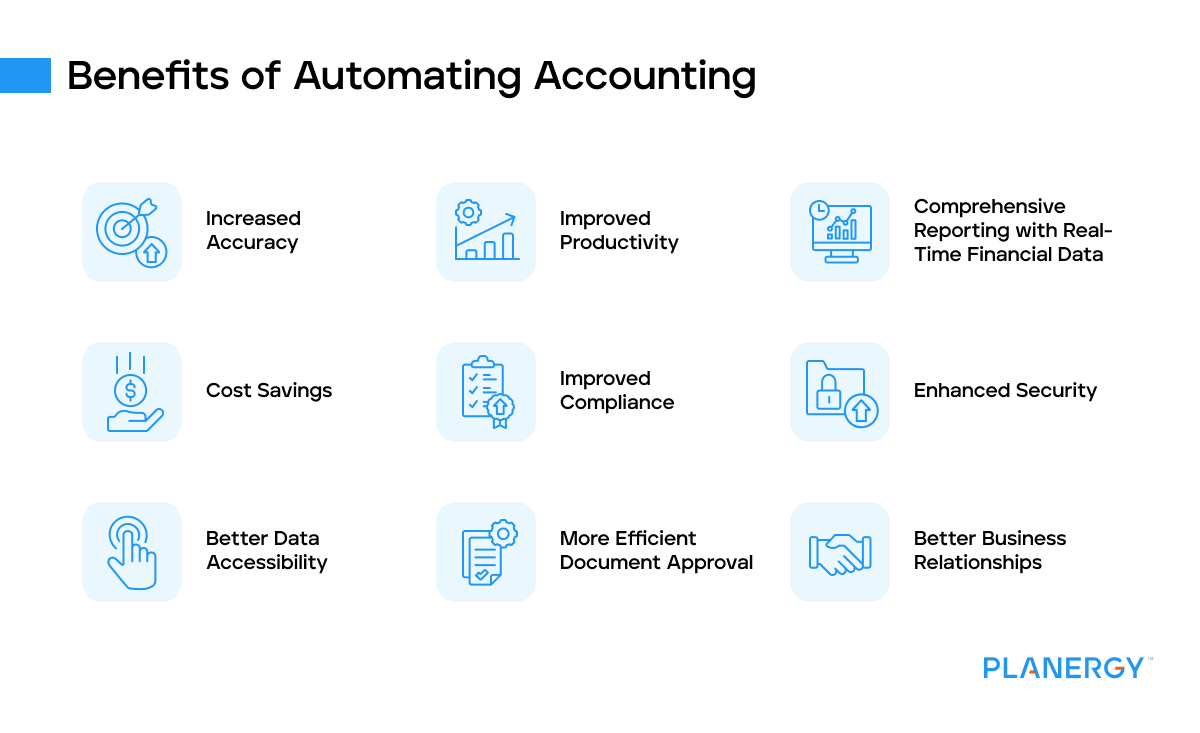

Benefits of Automating Accounting

Increased Accuracy

Human error is a common challenge in manual accounting. However, automated accounting systems significantly reduce the chance of mistakes.

The software accurately performs calculations and entries, ensuring your financial records are correct.

This gives you peace of mind and can help avoid costly errors down the line.

Improved Productivity

One of the main benefits of automating accounting is increased efficiency. With automation, tasks that once took hours can now be completed in minutes.

With those time savings, accounting firms have more time to focus on strategic tasks like planning and analysis.

Plus, because the software completes these tasks automatically, they can be done outside of traditional working hours, further boosting productivity.

Comprehensive Reporting with Real-Time Financial Data

Automated accounting systems offer real-time financial data, giving you up-to-date insights into your business’s financial health.

This can empower you to make informed business decisions quickly, rather than waiting for month-end reports.

Cost Savings

While there may be an initial investment in an automated accounting system, the long-term cost savings can be substantial.

By reducing the time spent on manual accounting tasks, your team can focus on more valuable activities.

Plus, reducing errors can save you money through avoided fines and penalties.

You can use it to reconcile purchase orders against invoices and address accounts payable automatically.

Automating invoice processing and payment ensures your bills are paid on time.

This not only helps to maximize your cash flow, but can keep your supplier relationships strong and help you leverage early payment discounts for even more savings.

Improved Compliance

Compliance with financial regulations is a key concern for many businesses.

Automated accounting systems can help ensure you’re meeting these requirements.

Many systems have built-in compliance checks and balances, helping you avoid potential legal issues.

Enhanced Security

Finally, automated accounting systems often have robust security measures in place to protect your financial data.

This includes encryption, secure user authentication, and regular backups. Knowing your sensitive financial information is secure can give you peace of mind.

Better Data Accessibility

Accounting process automation centralizes your data and record-keeping on a single platform.

Rather than sifting through numerous spreadsheets or stacks of paper for important documents, accounting professionals can simply input the necessary search terms into their system and locate what they need in sections.

More Efficient Document Approval

Documents, like purchase orders and vendor agreements are automatically uploaded and made available to relevant team members, which helps to eliminate approval process bottlenecks.

Better Business Relationships

Mismanaged invoices and delayed payments can create tension between businesses and their suppliers or clients.

Automation helps accelerate the entire procure-to-pay cycle, ensuring everyone is satisfied.

Potential Pitfalls of Accounting Process Automation

Change Management

Implementing new technology often involves a significant shift in how tasks are performed, which may be bet with resistance from employees who are comfortable with existing systems.

This resistance can slow the implementation process and lead to errors if not managed effectively.

It’s important to have a well-thought-out change management plan in place that includes clear communication about the benefits, as well as hands-on training for users.

Workflows May Need Updates

Your workflows may need to be updated or redesigned to fit with the new technology.

This can be time-consuming and may require various stakeholders to be involved, to ensure that the new workflows meet business needs and are efficient.

In some cases, businesses may find their existing processes to be overly complex or redundant once automation begins, requiring further changes.

Employees May Need Upskilling

While automation can handle repetitive and mundane tasks, you’ll still need human intervention for decision-making and problem-solving tasks.

Because of this, employees may need to learn new skills to work effectively with the new system.

This could include technical skills to operate the software or analytical skills to interpret the data.

Adequate training and support for employees during the transition is crucial to success.

While accounting automation has many advantages, it’s not something to rush into. Proper planning and implementation can make all the difference.

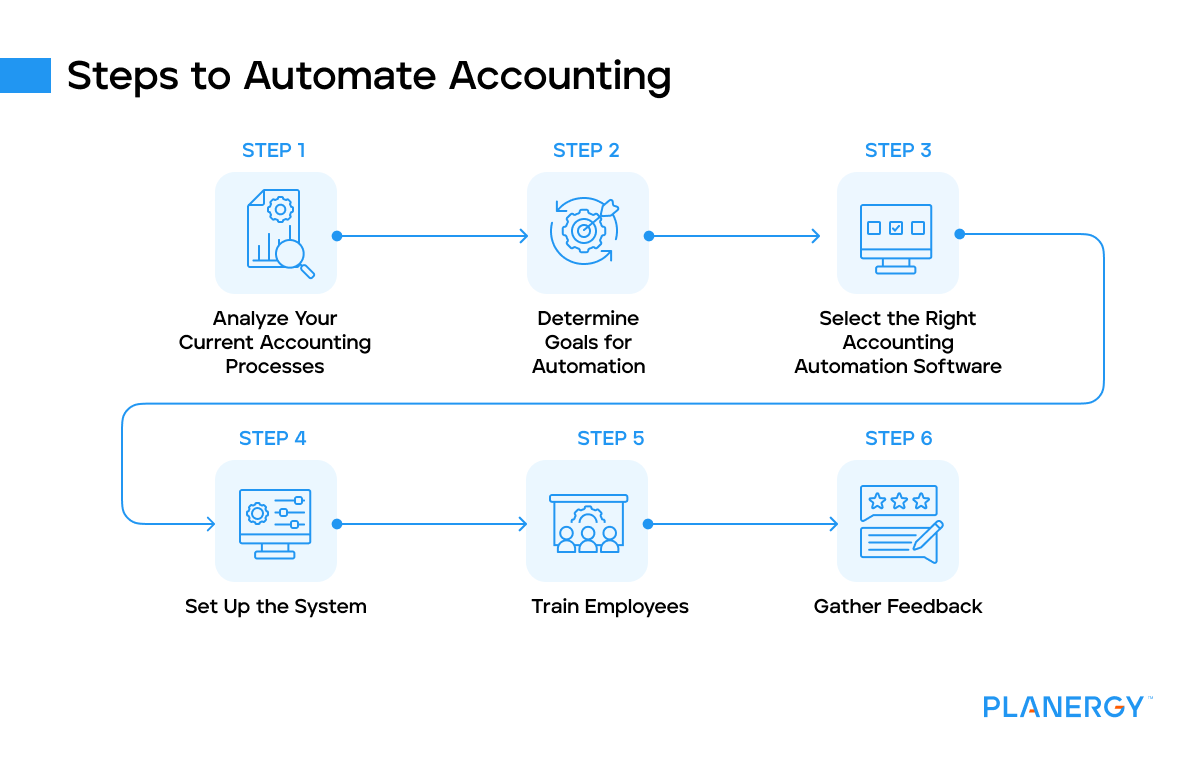

Steps to Automate Accounting

The good news is that implementing accounting automation into your workflow is fairly easy.

Considering that many accounting software solutions like QuickBooks already have automation built-in to a degree, it simplifies everything.

You’re likely already automating a bit because of features like:

Automatic Categorization of Expenses: This feature automatically sorts your expenses into categories, making tracking and managing them easier.

Automated Bank Feeds: This feature syncs transactions from your bank account with the software, eliminating the need to enter each transaction manually.

Integration With CRM Systems: Many accounting software can connect with your enterprise resource planning (ERP) software and customer relationship management (CRM) system, providing a holistic view of customer interactions and financial data.

Analyze Your Current Accounting Processes

Before you can start automating your accounting processes, you must understand how they currently work.

This will allow you to identify the areas that are most in need of automation and help you set clear goals for the process.

Look at each step of your accounting process, from data entry to reporting, and consider where automation could improve efficiency or accuracy.

Determine Goals for Automation

Once you clearly understand your current accounting operations, you can start setting goals for your automation project.

These might include reducing the time spent on manual data entry, increasing the accuracy of your financial reports, better expense management, or improving compliance with financial regulations.

Having clear goals will help you choose the right software and measure the success of your automation project.

Involve key stakeholders in this process. The more input you have, the better. It can make finding the right software much easier.

Select the Right Accounting Automation Software

Many accounting automation tools are available, so it’s essential to choose one that fits your business’s needs and budget.

Consider the features and capabilities of each tool, as well as its compatibility with your existing systems.

Don’t forget to consider the vendor’s reputation and the quality of their customer support.

Meet with multiple vendors to see demos of the software and learn more about it.

Consider pricing, business needs, and ease of use before choosing the final solution.

Set Up the System

Once you’ve chosen software, the next step is to set it up and configure it to align with your business processes.

This might involve importing your existing financial data, setting up automatic bank feeds, and configuring reports.

Depending on the complexity of your accounting processes, you might need assistance from a professional or a software vendor.

Train Employees

Even the best accounting solution won’t be effective if your team doesn’t know how to use it properly.

Provide comprehensive training and ongoing support to ensure your team feels confident using the new system.

Remember, it may take some time for everyone to adjust to the new processes, so be patient and provide plenty of support.

Gather Feedback

After your team has had a chance to use the new accounting system, gathering their feedback is crucial.

This is an often overlooked but incredibly important step in the process. Your employees use the software daily, and their insights can be invaluable.

Ask them about their experiences with the system. Are there any features they particularly like or dislike?

Have they encountered any problems or difficulties? Is the system saving them time and reducing their workload as expected?

Use their feedback to identify areas where further training may be needed or the system could be tweaked to fit your business’s needs better.

The goal of accounting automation is not just to replace manual tasks with automated ones but to improve the efficiency and accuracy of your accounting processes.

By taking on board your team’s feedback, you can ensure that your new system achieves these goals and delivers real benefits for your business.

Common Questions About Accounting Automation

Will Accounting Ever Become Fully Automated?

Many aspects of accounting will likely become automated as technology continues to evolve. However, human oversight and strategic decision-making will still be necessary.

Is Automation Replacing Accountants?

No, automation is not replacing finance professionals. Instead, it’s changing their role, shifting them away from repetitive tasks and into more strategic positions.

Accountants now have more time to focus on strategic planning and advising rather than routine tasks.

What Is the Difference Between Accounting Automation and Bookkeeping Automation?

Accounting automation refers to the automation of all accounting processes, while bookkeeping automation refers to the automation of recording and organizing financial transactions in the general ledger.

As technology continues to evolve, so will accounting automation.

Accounting professionals and finance teams will have to adapt to stay up-to-date with the latest technology and trends, but as the landscape reshapes, businesses will see unprecedented opportunities for growth and success.