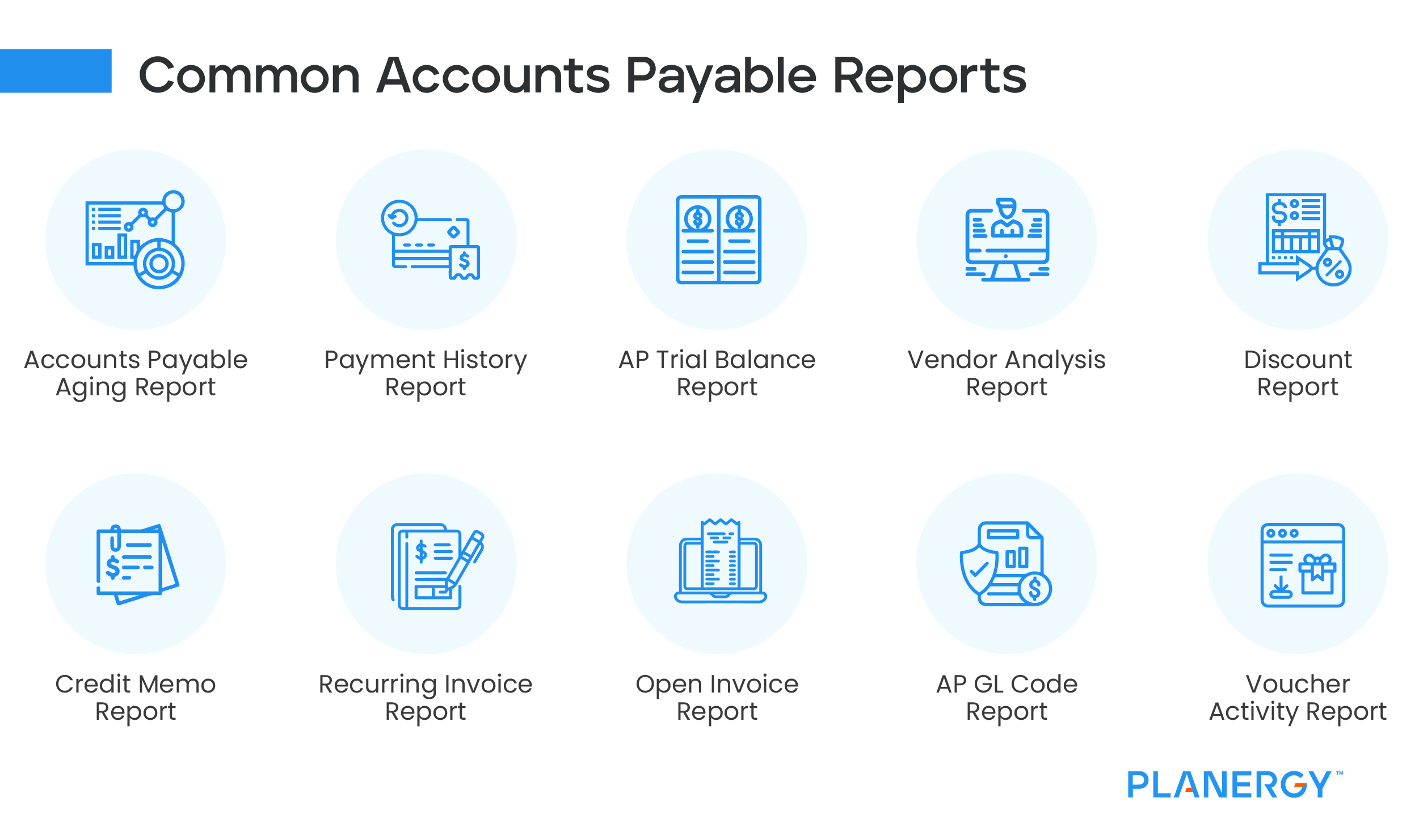

There are numerous AP reports available for your business to run, with ten reports particularly important.

-

Accounts Payable Aging Report

The accounts payable aging report is one of the top three AP reports essential for managing AP properly. The AP aging report is a detail report that displays all invoices currently entered into the AP system, sorting them by the due date, with invoices sorted in 30-day increments.

For example, a report would show current bills, 1-30 days past due bills, 31-60 days past due, 61-90 past due, and more than 90 days past due.

While smaller businesses can run the AP aging report monthly, for companies that process a high number of invoices each week, running the report weekly would be more useful.

And if you’re reviewing accounts payable KPIs, the information found in the AP aging report can be used to calculate Days Payable Outstanding or DPO, which is used to determine how long it takes a company to pay its bills.

-

Payment History Report

The payment history report provides a detailed listing of all vendor payments made in a specified period of time. The payment history report is helpful if you’re looking to see exactly how much you’ve paid a particular vendor or supplier during a certain time frame.

The payments report can also be used to determine payments made in a specific account or category and can be useful when comparing budget to actual totals for a specific date range.

-

AP Trial Balance Report

The AP trial balance report is a useful month-end account reconciliation report. Use this report to match all trial balance entries against the general ledger to double-check that all payments have been properly recorded.

Any missing payments or payments that don’t match should be investigated further. When there are payments that don’t have a matching entry or have an entry that doesn’t match correctly, it indicates that vendors may have been paid too much or too little, a payment was issued to the wrong vendor, or no payment was issued.

-

Vendor Analysis Report

The vendor analysis report allows you to view the total amount of payments made to your vendors, so you can easily view exactly what you’ve paid to each vendor. This report can be helpful for a variety of reasons, including when preparing year-end budgets.

This vendor analysis report is also a useful resource if you’re looking to renegotiate pricing or payment terms with suppliers, and can be particularly helpful in pinpointing potential overspending.

-

Discount Report

A discount report can help companies take advantage of early payment discounts. While paying an invoice early may not always be an option, particularly for businesses with limited cash flow, for companies in a position to make an early payment, this report allows you to view potential discounts and prioritize payments when necessary.

Business owners can also run the discount report to view how much in potential discounts they’ve missed.

-

Credit Memo Report

A credit memo may be received for a variety of reasons, including product returns and incorrect pricing, but once entered, they’re easy to forget. Enter the credit memo report, which provides detailed information on all outstanding credit memos, allowing you to choose when to process them.

-

Recurring Invoice Report

Everyone has recurring invoices that they pay regularly such as rent, utilities, insurance, subscriptions and other recurring expenditures.

Running a recurring invoice report allows AP personnel to review current bills, and investigate any anomalies such as a bill higher or lower than normal while helping to ensure that the bills are paid on time.

-

Open Invoice Report

The open invoice report should be run and reviewed weekly.

The open invoice report allows managers to review all open invoices and current due dates, review amounts due for accuracy, determine cash requirements for the week, and view any open credit memos against an invoice.

The open invoice report can also be used when reconciling the GL accounts payable summary account to make sure that all open invoices also appear in the GL account.

A Goods Received Not Invoiced (GRNI) Report (GRNI) Report gives further visibility of invoices likely to be received soon.

If you have received the goods or services from the supplier and the invoice has not yet been received, then the invoice can be expected.

-

AP GL Code Report

Though not run as often as some of the other AP reports, the AP GL code report is helpful for managers and supervisors to review once invoices have been entered.

While miscoding an invoice may not appear to be a major issue, expense errors can distort financial statements, overstating or understating expenses.

-

Voucher Activity Report

The voucher activity report can be extremely useful for companies with multiple locations, or for those that need to track departmental or project expenses.

This report helps to pinpoint current expenses, works to ensure that bills are paid timely, and provides management with a good view of business expenses for particular projects, departments, or locations.