One of the best ways to reward customers is to offer a discount on credit sales.

These discounts, called trade credits, offer a slight discount if an invoice is paid within a certain number of days.

If the invoice is not paid within the allotted discounted timeframe, the terms revert to their original status.

For buyers who routinely order materials and supplies from the same group of vendors, taking advantage of trade credits allows them to save money, sometimes a significant amount, on routine purchases.

Fast payment turnaround times can also improve buyer/seller relationships and prompt payments can help improve credit ratings, which can directly impact payment terms with other vendors.

If you’re unfamiliar with payment terms or trade credits, we’ll explain what they mean, how trade credits are used with standard payment terms, and the advantages and disadvantages of offering or taking a trade credit.

What Does Net 30 Mean?

Net 30 payment terms mean that the net amount of the vendor or supplier invoice, otherwise known as the total amount due, is due within 30 days of the invoice date.

For example, if an invoice for $4,500 is issued on June 1 with payment terms of net 30, the total amount of $4,500 would be due by June 30.

If the payment is received later than that, it will be considered late.

However, many businesses offer their customers an incentive to pay early.

One of the more common incentives offered is a trade credit such as 2/10 net 30.

What Is 2/10 Net 30?

2/10 net 30 is a common invoice term that sellers may offer to buyers to provide an incentive for early payment by offering a percent discount.

In this instance, a buyer will receive a 2% discount on the invoice total if it’s paid within 10 days.

If the invoice is not paid within 10 days, the terms revert to net 30, which means that the full invoice amount is due within 30 days of the invoice date.

How To Calculate Terms 2/10 N 30

It’s easy to calculate the amount due on an invoice with 2/10 net 30 trade credit terms.

Let’s go ahead and calculate the trade discount on the sample invoice below using the following parameters:

- The total invoice amount: $5,250

- The purchase was for: Inventory

- The invoice date: July 15, 2024

- The invoice due date: 30 days or August 13, 2024

- Discount if paid within 10 days or by July 24, 2024: 2%

- Now, we’ll calculate the discount: 100% – 2% = 98% x $5,250 = $5,145

- That means that if you pay the invoice on July 24 or before, you can pay the reduced amount of $5,145 a savings of $105.

- However, if the invoice is paid on July 25 or later, you’ll need to pay the entire amount due of $5,250.

Advantages and Disadvantages of 2/10 Net 30

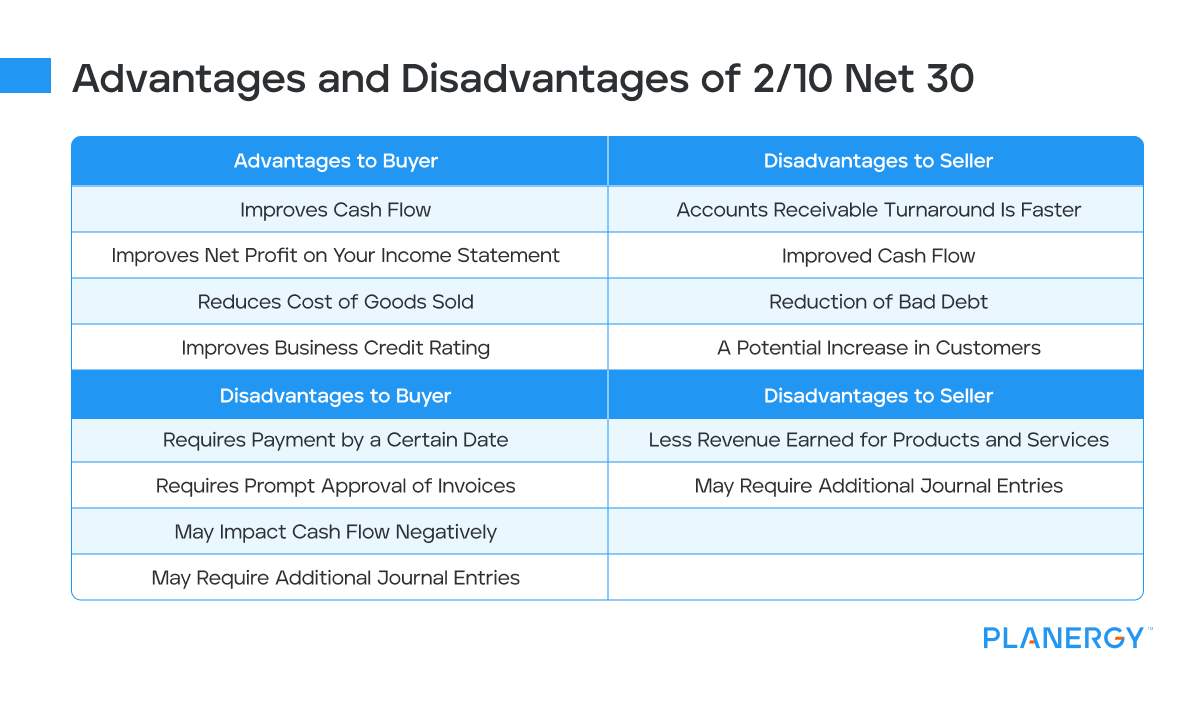

There are advantages and disadvantages for both the buyer and the seller when it comes to 2/10 net 30.

Advantages to Buyer

- Improves cash flow

- Improves net profit on your income statement

- Reduces cost of goods sold

- Improves business credit rating

Advantages to Seller

- Accounts receivable turnaround is faster

- Improved cash flow

- Reduction of bad debt

- A potential increase in customers

Disadvantages to Buyer

- Requires payment by a certain date

- Requires prompt approval of invoices

- May impact cash flow negatively

- May require additional journal entries

Disadvantages to Seller

- Less revenue earned for products and services

- May require additional journal entries

To implement an early payment discount, it’s essential that there’s an existing relationship between the buyer and seller, and that the terms of any discount offered are advantageous for both parties.

Differences Between the Net Method and Gross Method for Recording Payments

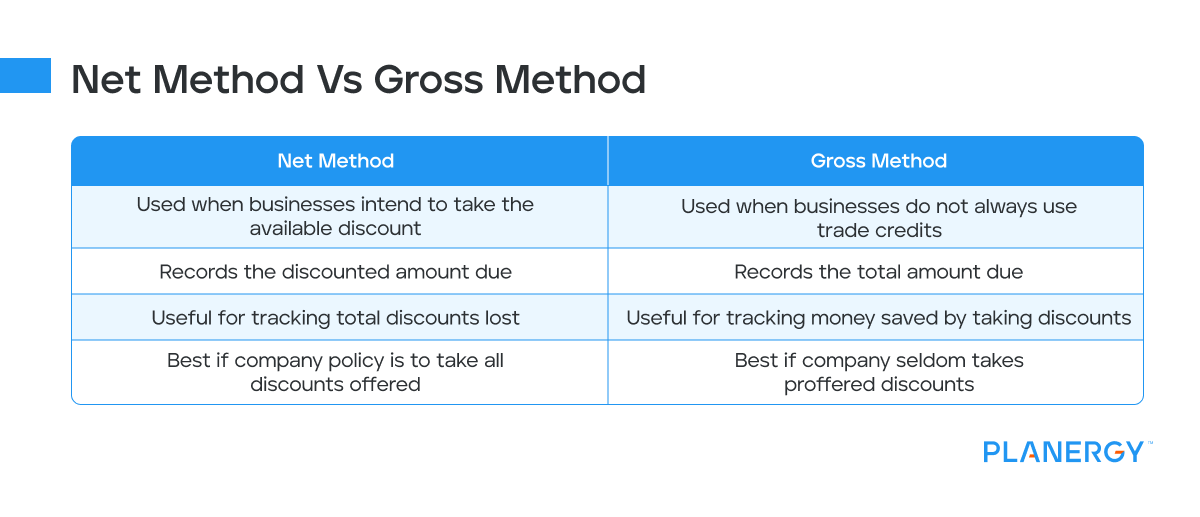

Net method and gross method refer to the method used to record payments made on an invoice that offers a trade discount.

It’s important to note that the method you’re currently using to process AP will have a direct impact on whether you use the net method or gross method for your business.

For example, if your invoice approval time typically takes more than a week, it’s next to impossible to take advantage of a trade credit, since the payment will be due before the invoice is entered for payment.

Cash flow can also play a role in whether a discount is taken.

If your cash flow is limited, you may not be able to pay the invoice before the early payment discount deadline. In some cases, depending on the total amount due, a buyer may not find the discount is worth the savings.

These issues will all play a role when determining whether to use the net method or the gross method when recording an invoice with a trade credit.

The Net Method

The net method is used when businesses intend to take the available discount.

Instead of recording the invoice in accounts payable for the total amount due, the discounted amount due would be recorded.

For example, using the invoice above, if your business paid the invoice on July 24 or before, they would record the transaction using the net method.

The first transaction would be recorded as follows:

Account Debit Credit Inventory $5,145 Accounts Payable $5,145 When the invoice payment is made (July 24 or before), the next transaction will be recorded as follows:

Account Debit Credit Accounts Payable $5,145 Cash $5,145 However, if you’ve used the net method to enter the invoice, but don’t pay the invoice on or before the early payment deadline, you’ll need to complete an additional entry that accounts for the difference in payment.

This entry debits your purchase discount contra account, which shows the potential discount that you weren’t able to take advantage of.

Tracking this number may be useful for small businesses who want to see their total discounts lost.

Account Debit Credit Purchase Discounts (Contra account) $105 Cash $105 The Gross Method

If your business does not always use trade credits, you may want to record the invoice using the gross method, with the initial entry looking like this:

Account Debit Credit Inventory $5,250 Accounts Payable $5,250 Once the amount is paid, you’ll complete the following entry:

Account Debit Credit Accounts Payable $5,250 Cash $5,250 However, if you do end up taking the trade credit, you’ll have to make the following entry instead, which debits the original accounts payable entry, reduces your cash balance by the amount you paid, and credits your purchases discount account, which reduces your total:

Account Debit Credit Accounts Payable $5,250 Cash $5,145 Purchase Discounts $105 Again, you may want to keep track of this number which can show you how much money you’ve saved by taking advantage of trade credits throughout the year.

The easiest way to avoid having to record an additional entry is to use the method that your company normally uses to record and pay invoices.

If your company policy is to take advantage of all discounts offered, using the net method will be best, while if your company seldom takes proffered discounts, the gross method will be best.

Alternative Early Payment Discount Terms to 2/10 Net 30

2/10 net 30 is the most common trade credit used by sellers and taken by buyers, but other payment terms may be offered. These include:

2/10 Net 45

2/10 net 45 means that the buyer can take a 2% discount if paid within ten days of the invoice date or they must pay the entire balance due within 45 days of the invoice date.

3/10 Net 30

3/10 net 30 provides buyers with a 3% discount if paid within ten days of the invoice date or they must pay the entire amount due within 30 days of the invoice date.

3/20 Net 60

3/20 net 60 provides buyers with a 3% discount if paid within ten days of the invoice date or they must pay the entire amount due within 60 days of the invoice date.

2/EOM Net 45

2/EOM net 45 provides buyers with a 2% discount if paid by the end of the month, other the full amount is due within 45 days of the invoice date.

Net 20 EOM

Net 20 EOM means that the buyer must pay the amount due within 2o days after the end of the month.

What Is the Cost of Credit for Credit Terms of 2/10 N 30?

If you’re still undecided about taking a trade credit, you can calculate the cost of credit or the implicit credit rate before doing so.

Doing so can help you determine whether it’s worth it to take a discount early.

Looking at a trade credit as a form of financing can help you make that decision since if you choose to ignore the discount offered, you will be paying a surplus, similar to the cost of a loan.

For example, if you choose to not take advantage of an early payment discount with terms of 2/10 net 30, you will be paying 2.04% interest to extend the terms of payment from 10 to 30 days each time a discount is not taken.

Let’s calculate to see how much you’ll pay in annualized costs if you choose to forego the discount.

Step

Determine the percentage of a 360-day year to which you will apply the discount period.

The discount period is the number of days between when the discount is still in place and when the invoice is due.

For example, if terms are 2/10 net 30, the number of days between the last day you can take advantage of the discount and the last day when payment is due in full is 20 days.

Step

Divide the 20-day discount period into 360 days, which gives you a multiplier of 18. 360 / 20 = 18.

Step

Subtract the discount rate from 100%. For example, if the discount rate is 2%, you would subtract that from 100%. 100% – 2% = 98%.

Step

Divide the discount percentage by the newly calculated discount rate. 2% / 98% = 0.0204.

Step

Complete the calculation by multiplying the result of Step 4 by the results of Step 2. 0.0204 x 18 = 36.7% which is the annualized cost of credit for 2/10 net 30 terms.

Because 36.7% is a high loan interest rate, it may be beneficial to take the early payment discount and borrow funds from another financial institution at a lower interest rate if additional funds are needed.

Can a Vendor Charge Interest on Overdue Invoices With Terms 2/10, Net 30?

That would depend on the original terms offered to the seller by the buyer.

If a buyer does intend to charge penalties or interest on late payments, that information must be relayed to the buyer, with the interest rate indicated on the terms and conditions information which should be included on the invoice or on any written contract or agreement currently in place between the buyer and the seller.

What Are Buyer-Initiated Early Payment Programs?

Buyer-initiated early payment programs are managed through accounts payable using one of two methods.

Dynamic Discounting Method

The dynamic discounting method places the responsibility for initiating a discount on the buyer, not the seller.

For example, a buyer can choose to offer a 2% discount for early payment to one vendor or supplier, while offering a 1% discount to another vendor or supplier, with the seller responsible for approving the discount offered.

This method works best if a solid relationship exists between the buyer and the seller.

Supply Chain Method

The supply chain method allows buyers to take advantage of trade credits by having a third-party finance company pay the invoice early.

Since this is considered a loan, the buyer then pays back the finance company at the agreed-upon terms.

While this is not an ideal method, it allows buyers with limited cash flow to still take advantage of seller credit terms.

Should You Be Taking Advantage of Early Payment Discounts?

Timely payments can save you a significant amount of money while improving your bottom line.

For buyers with sufficient cash flow, taking advantage of early payment discounts can improve their bottom line, though cash flow problems may preclude a business from doing so.

For sellers, offering an early payment discount can mean faster payment and increased cash flow.

However, it’s important to note that the implementation and use of an early payment discount may mean additional work for both buyers and sellers, depending on their current accounting system.

For some small businesses, it may be more difficult to take advantage of discounts offered if accounts payable processes are still completed manually.

For instance, by the time an invoice has been approved, the discount window may have passed, which means that the full payment will need to be made.

The best way to ensure that your business can take advantage of trade credits is to implement AP automation, with an application like PLANERGY which automates the invoice approval process, completes three-way matching, and provides quick payment processing.

Eliminating these potential roadblocks will allow you to take advantage of the trade credits offered.