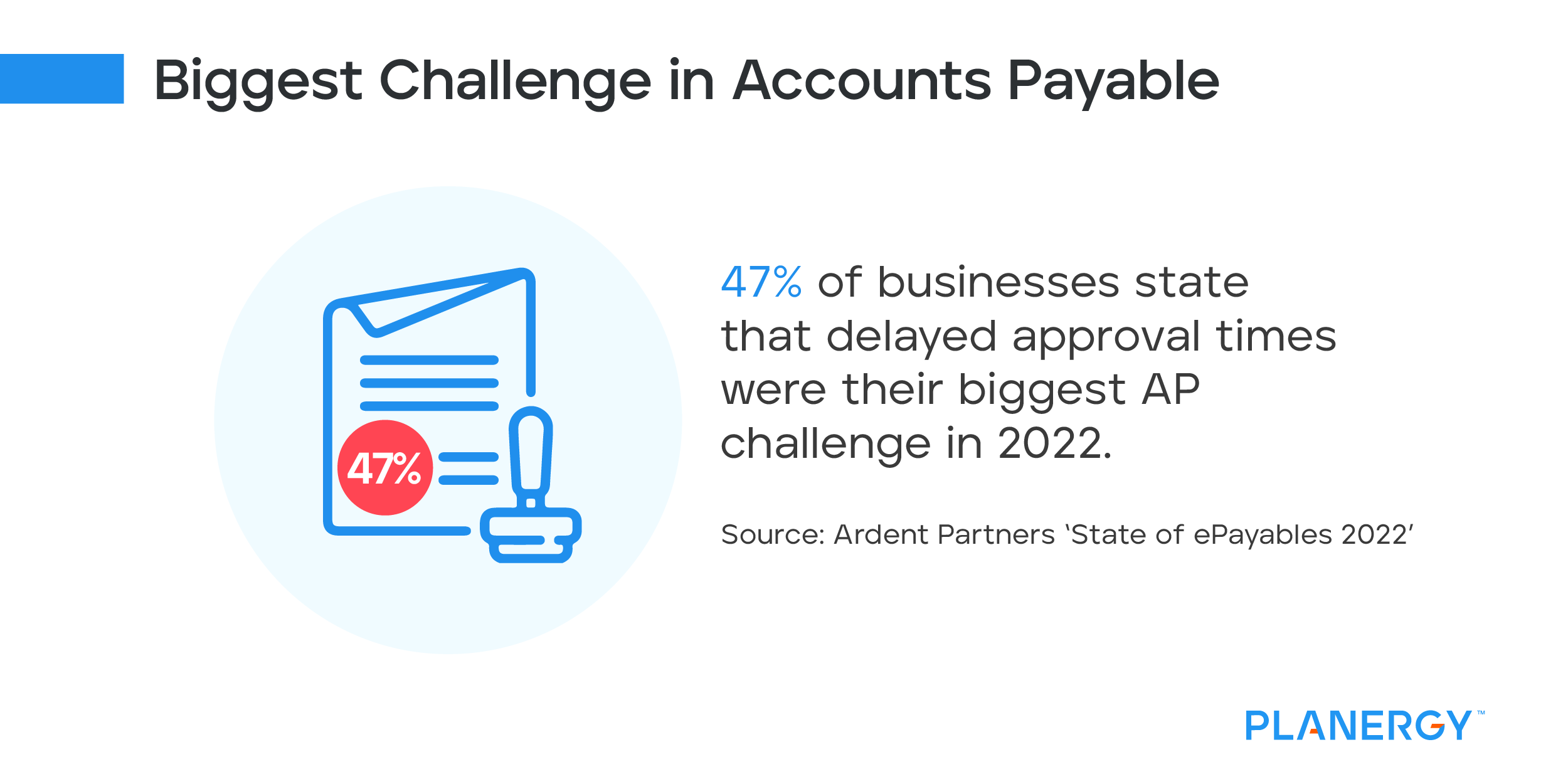

The biggest problem faced by accounts payable is inefficient manual processing and a lack of internal controls. Without controls in place, errors, delayed invoice approvals, late fees, and fraud incidents will likely increase to unsustainable levels.

-

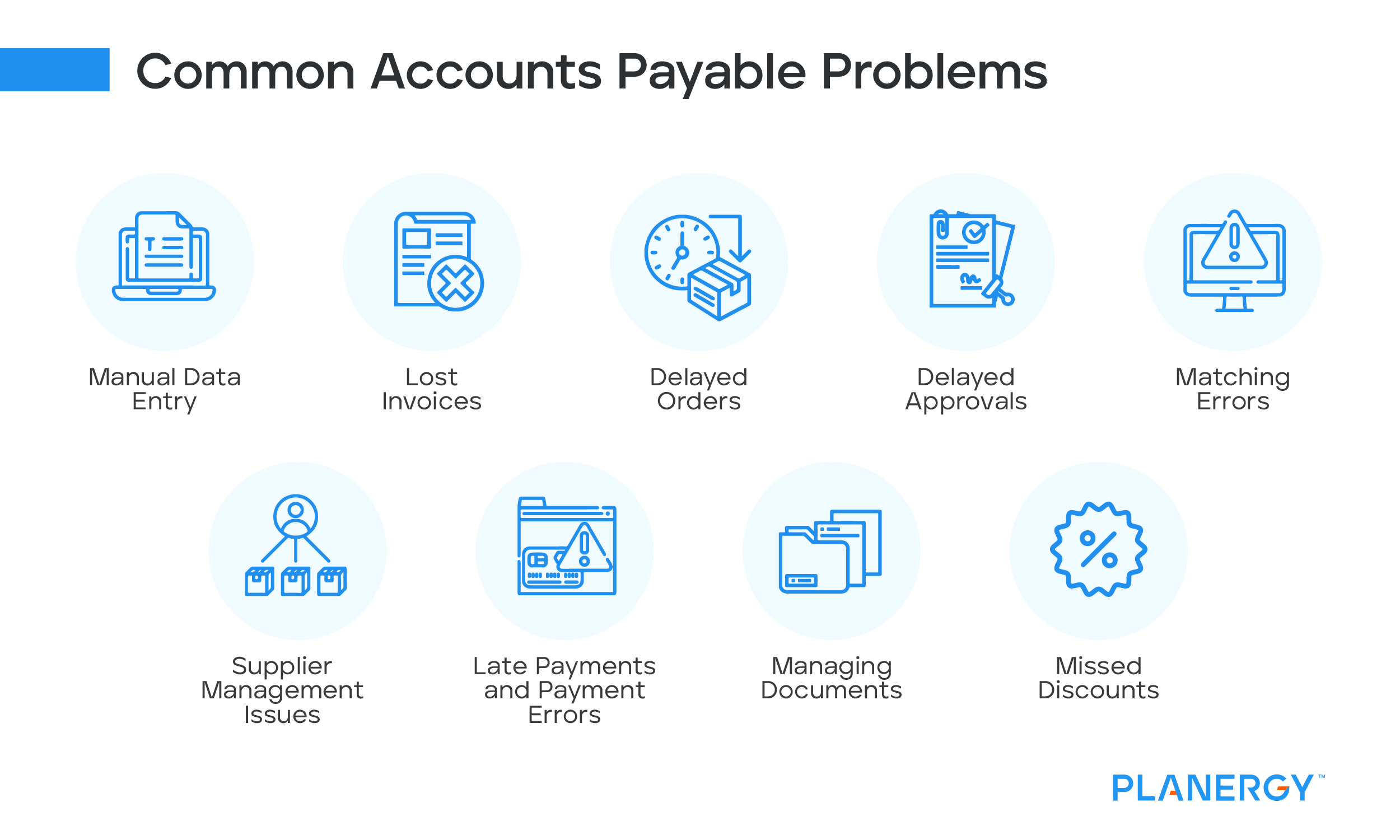

Challenge #1. Manual Data Entry

Manual data entry is responsible for many of the errors incurred in accounts payable. This is particularly true if manual data entry is required for each step of the AP process, starting with purchase order creation.

If the information on a purchase order is incorrect, mistakes are likely to occur throughout the entire AP process.

Solution

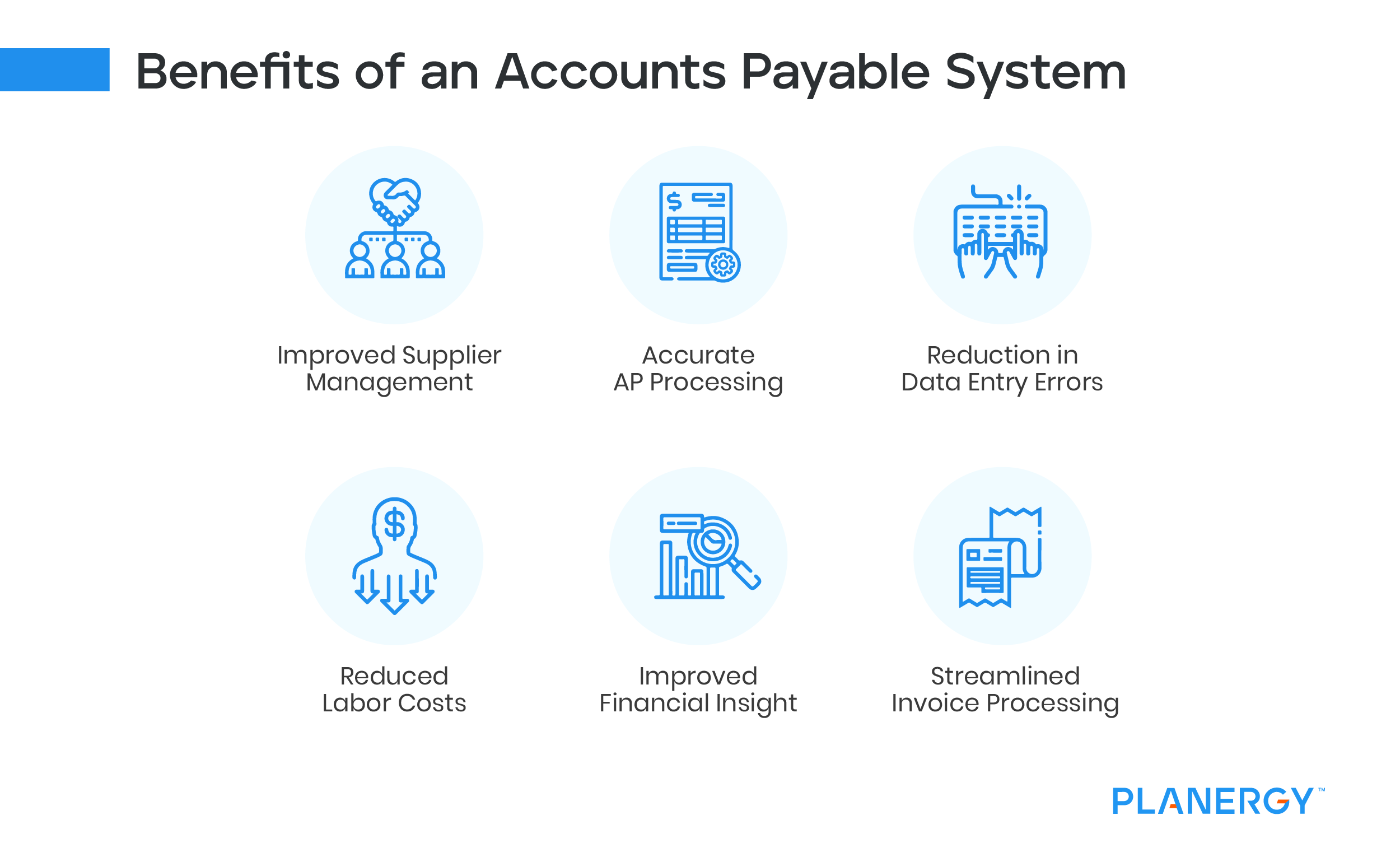

To reduce or eliminate data entry, consider using a procure-to-pay application such as Planergy that uses optical character recognition (OCR) and artificial intelligence to significantly reduce the amount of data entry necessary.

-

Challenge #2. Lost Invoices

If you regularly deal with paper invoices, you know how frequently they go missing. But an even bigger problem may be never receiving an invoice in the first place.

Whether it’s lost in the mail or sitting on someone’s desk waiting to be opened, you may not even be aware that an invoice is missing until you receive a vendor call. Though a vendor may be willing to send another copy of an invoice, continued late payments and missing invoices may cause a rift in your business relationship that will never recover.

Solution

Many businesses have begun to send invoices electronically, which is a vast improvement over receiving a paper invoice in the mail. However, if you’re not utilizing AP automation, the AP team will still have to make a copy of the invoice and route it through the approval process, which may create similar problems.

-

Challenge #3. Delayed Orders

You desperately need more products to fulfill incoming orders, but if you’re using a manual purchase order system, your odds of getting products in on time are small. Like delayed invoice approvals resulting in late payments, delayed purchase order approvals can hold up important orders.

Solution

Instead of processing purchase orders manually, consider using a procure-to-pay system like Planergy, which automates the entire purchase order and AP process.

-

Challenge #4. Delayed Approvals

How many times have staff members routed an invoice for approval only for it to disappear for days or even weeks? Approval delays are common when using manual systems. Delays can happen for a variety of reasons. An invoice may get routed to the wrong person, who then sends it on to the correct one.

A paper invoice may get buried under mounds of paper until it’s recovered weeks later, or the approver is out of the office, so the invoice sits in an in-basket until the person returns.

Solution

An electronic routing system is the best method for eliminating approval delays. This automated system routes invoices to an approver, who can quickly approve the invoice online, sending a reminder if the invoice is not approved promptly.

This system can also assign a backup approver to the approval workflow that can be utilized when the primary approver is out of the office.

-

Challenge #5. Matching Errors

Three-way matching is an important AP process that should be utilized to ensure that purchase orders, invoices, and shipping receipts all match. This can help avoid fraud and curb maverick spending.

When all three of these documents are handled manually, the chances of human error increases. And when there is a discrepancy, manual follow-up can take a significant amount of time.

Solution

Using an automated AP application will automate the three-way match process while alerting you to any discrepancies that need further investigation.

-

Challenge #6. Supplier management Issues

Do you take your vendor or supplier relationship for granted? A good supplier relationship should be beneficial for both parties. Paying vendors and suppliers well past the due date can permanently destroy what was a good, profitable relationship, and may even negatively impact your credit rating.

Solution

Having a system in place to pay vendors timely can help you maintain a good working relationship and maintain a good credit rating.

-

Challenge #7. Late Payments and Payment Errors

Late payments are often the result of lost or misfiled invoices and can result in invoice late fees or other penalties. Another common outcome of processing AP manually is duplicate payments. If there are no checks and balances in place, it’s easy to pay an invoice twice.

Data entry errors can also lead to payments made in the wrong amount, or even a paper check sent to the wrong address.

Solution

Always use three-way matching, which will flag potential problem areas by identifying potential duplicate payments or payments issued in the wrong amount.

However, if you’re not using automated three-way matching, you can quickly become bogged down by the matching process.

-

Challenge #8. Managing Documents

Manual records require a lot of labor time to properly manage throughout the AP cycle. These are just a few of the things your staff needs to do to properly manage paper documents:

- Distribute invoices to the proper department

- Make a copy of an electronic invoice for processing

- Route invoices to the proper approvers

- Perform three-way matching

- Enter the approved invoice into an accounting software application

- Run checks

- Get checks signed

- Attach check voucher to invoice

- File paperwork in the vendor file

Depending on your business, there may be even more manual processes required.

Solution

The best document management solution is one that does all the heavy lifting for you.

Instead of staff spending untold hours matching, attaching, and filing stacks of paper, consider using a paperless document management system that mimics a manual filing system, but stores documents electronically, for easy, secure access.

-

Challenge #9. Missed Discounts

Your vendors may offer you excellent payment terms including an early payment discount. But if it takes weeks to process an invoice, you’ll be unable to take advantage of those discounts, which can quickly add up.

Solution

According to Ardent’s State of ePayables 2022, the average time to process a single invoice manually is 10.9 days, with processing time dropping to 3.71 days when using automated AP, allowing you to take advantage of early payment discounts.

And using an automated system, you can pay invoices with electronic payments, eliminating paper checks entirely.