Even though accounts payable is an expense your company incurs when purchasing goods or services on credit, properly managing accounts payable can result in a long list of benefits for your business, including increasing your cash flow, if you plan carefully.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

King Ocean

Download a free copy of "Preparing Your AP Department For The Future", to learn:

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Accounts Payable Cash Flow: How AP Impacts Cash Flow and Your Cash Flow Statement

Category

- Written by Mary Girsch-Bock

- 19 min read

Last edited

July 2, 2024

IN THIS ARTICLE

- What Are Accounts Payable?

- How Does an Increase in Accounts Payable Affect Cash Flow?

- How Does a Decrease in Accounts Payable Affect Cash Flow?

- How Can You Manage Accounts Payable to Improve Cash Flow?

- How Accounts Payable Affects Cash Flow

- Are Accounts Payable Included in Cash Flow?

- Best Ways To Improve Cash Flow Management

- What Is The Flow of Accounts Payable?

- What Is the Difference Between Cash Flow and Accounts Payable?

- Where Does Accounts Payable Fit on a Cash Flow Statement?

- Other Ways To Improve Cash Flow

- Improving Accounts Payable Management Improves Cash Flow

What Are Accounts Payable?

Accounts payable are the goods and services purchased by a company on credit with a short-term due date.

An accounts payable balance on your general ledger represents the amount of money you currently owe for those goods and services and is always classified as a liability.

Historically, the AP department has been viewed as the department that paid the bills, but recently, businesses have begun to view AP in a different light, understanding the important role the AP department plays in their business.

As a result of this increased awareness and better AP management, businesses large and small are better able to reap the benefits that improved AP management brings, including increased cash flow.

How Does an Increase in Accounts Payable Affect Cash Flow?

An increase in accounts payable can positively affect your cash position since accounts payable is money owed to a vendor or creditor that has not yet been paid.

Even though accounts payable is a liability on your income statement, since the payment has yet to be made, an increase in accounts payable means an increase in available cash flow for that accounting period.

How Does a Decrease in Accounts Payable Affect Cash Flow?

A decrease in accounts payable decreases liability on your income statement but it will also decrease cash flow.

Though a decrease in accounts payable has a positive impact on your financial statements, it reduces the total amount of cash available, with the decrease representing the total amount of cash transactions that have been paid over a specific period of time.

How Can You Manage Accounts Payable to Improve Cash Flow?

Better AP management always starts with better credit terms. For instance, if your typical credit terms are currently Net 30, that means that you only have 30 days to hold onto cash before you’re required to pay vendors and suppliers.

However, if you could negotiate Net 45 or Net 60 terms, you’d be able to hold onto cash for an additional 15 days or even longer.

Of course, improving your cash flow is not a good reason to delay payment on accounts payable past their due date, since a delayed payment often results in late payment fees, increased interest, and a possible change in your current credit terms.

How Accounts Payable Affects Cash Flow

Your accounts payable balance should always be considered a source of cash since it represents money not paid to vendors or suppliers. Here’s how.

If your typical turnaround time to pay vendors is 30 days, and your average AP balance is around $50,000, if your payment terms were to change to 60 days, you would increase your short-term cash flow by $50,000.

This increase in cash flow can help you pay bills that are due earlier, invest in equipment, purchase additional supplies for resale, or make other investments in the company.

On the other hand, if you were to default on your regular payments and your vendors were to reduce your payment terms from Net 30 to Net 15, this would have a negative impact on your cash flow, reducing available cash by half.

Whatever your current payment terms are with your vendors and suppliers, it’s essential that you pay your bills by the due date and maintain a good relationship with your suppliers across the board.

Are Accounts Payable Included in Cash Flow?

Cash flow is always calculated on a cash basis, dealing directly with cash inflows and cash outflows.

For example, on your income statement, which displays revenue and expense balances that are based on accrual accounting, the accounts payable balance is listed as a negative against revenue, since it’s money that is owed to vendors and suppliers.

However, on your statement of cash flows, which is calculated on a cash basis, accounts payable is not considered a negative, since the accounts payable balance represents money that is owed, but not yet paid.

As an example, let’s say you have $250,000 in income and $40,000 in accounts payable.

On your income statement for April, you’ll subtract the $40,000 from the $250,000, leaving you with $210,000 in net income for the month.

For your cash flow statement, you start with $210,000 in available cash and need to add back the $40,000 accounts payable balance since it hasn’t been paid yet, leaving a cash flow balance of $250,000.

Remember that you would have to adjust any accounts receivable balances as well.

For example, if you had an accounts receivable balance of $50,000, you would need to subtract it from your cash flow statement, since the money has not yet been received, leaving you with an available cash balance of $200,000.

It can be confusing to switch back and forth between accrual accounting and cash accounting, but it’s necessary to calculate your net cash flow.

Best Ways To Improve Cash Flow Management

Improved cash flow management starts with better accounts payable management.

One of the easiest ways to improve AP management is to make the switch to using AP Automation.

An automated AP application like Planergy, which eliminates time-consuming manual AP processes while providing you with real-time reporting and up-to-date, accurate accruals.

Other ways to improve cash flow include:

Improve Invoice Processing Time

Improving invoice processing time can save you a significant amount of time and money, while also eliminating late fees and other penalties.

Improving invoice processing time also reduces labor hours, which in turn reduces payroll costs, while also allowing you to take advantage of any early payment discounts that may be offered.

The best way to achieve this is by introducing AP Automation into your accounts payable process.

Improve Visibility of Committed Spend

Committed spend is part of the spend management process, which is used to manage company funds using measures such as procurement, outsourcing, and supply chain management to better meet established company spending goals.

Committed spend refers to goods and services that have been ordered but not yet paid for.

Having real-time spend visibility of spend allows you to better manage cash flow by understanding when you will be required to make payments related to purchases.

Centralized spend data helps to achieve this. Committed spend report is a standard report in Planergy.

Properly Account for GRNI

Another form of committed spend is goods received not invoiced or GRNI. GRNI accounts are useful for businesses that utilize an automated perpetual inventory system.

Any goods received will be automatically recorded into your accounting software application before an invoice has been received. Once an invoice has been received, you can reverse the original GRNI entry.

Have Access to Real-time Reports

Having access to real-time reports gives you a more concise look at both AP and cash flow.

Instead of having to add and subtract items from your financial statements, having real-time reports gives you an accurate picture of both your AP balance and your cash flow balance on demand.

Use Automation to Better Forecast Your Cash Flow

Using automated spend management software and an automated accounting software application lets you better monitor both incoming revenue and outgoing expenses.

Part of managing cash flow is knowing how much money you expect to have at any given moment while offering more accurate budgeting capability.

What Is The Flow of Accounts Payable?

Since accounts payable is considered a current liability, it is recorded on a company’s balance sheet as soon as an invoice is entered.

As invoices are added to accounts payable, the balance of the liability account increases; increasing available cash flow as well. The longer a business is able to hold onto company funds and not pay an invoice, the more consistent its cash flow levels will be

What Is the Difference Between Cash Flow and Accounts Payable?

Your company’s cash flow is the money that flows into and out of your business and is always calculated based on real-time activity, not accruals.

This incorporates both accounts receivable, for incoming cash, and accounts payable, for outgoing cash.

For example, when you purchase goods and services on credit, you’re actually increasing your cash flow level, while also increasing your accounts payable balance. When it’s time to pay for those same goods and services, your cash flow balance will decrease.

If you purchase pens and paper from your local office supply store and pay for them immediately, you immediately reduce your cash flow balance.

However, if you purchase pens and paper on credit, with Net 30 terms, your cash flow increases until the pens and paper are paid for.

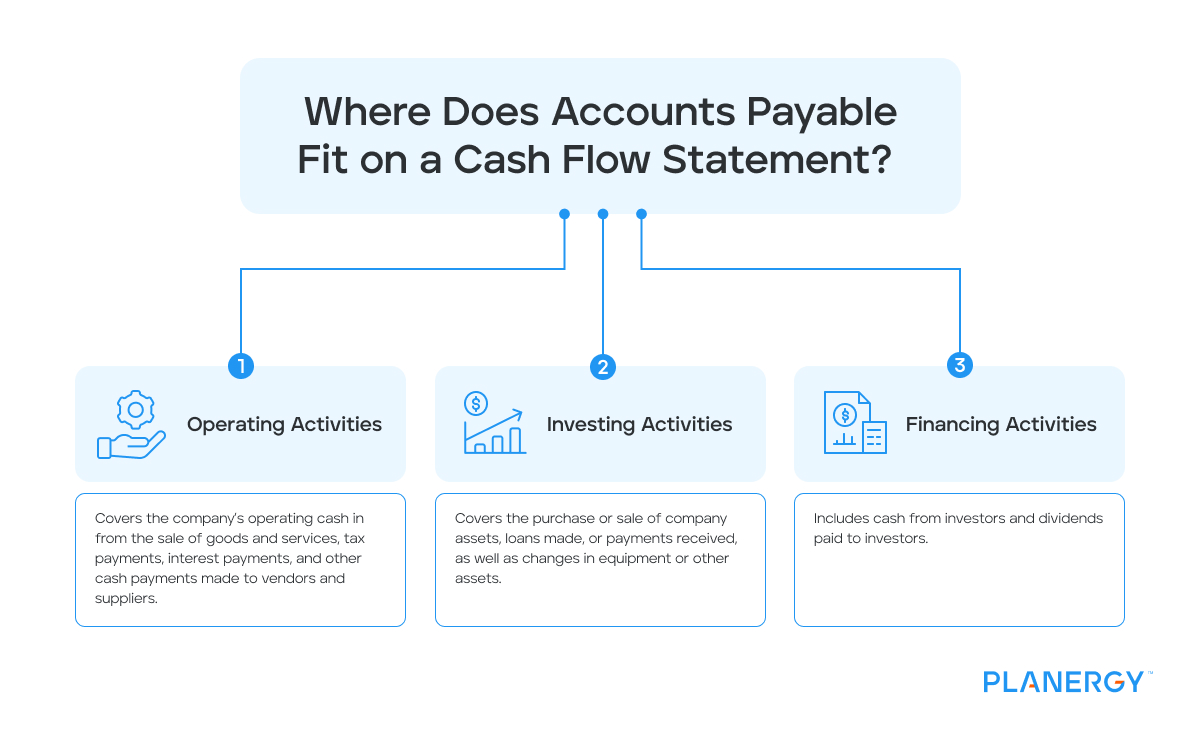

Where Does Accounts Payable Fit on a Cash Flow Statement?

Accounts payable activity falls under operating activities, which is the first section of the cash flow statement.

In total, there are three activities sections on a cash flow statement.

Operating Activities

Cash flow from operating activities covers the company’s operating cash in from the sales of goods and services, tax payments, interest payments, and other cash payments made to vendors and suppliers.

Cash flow from operations also includes employee wages and payments made for general business activities.

Investing Activities

Cash flow from Investing activities covers the purchase or sale of company assets, loans made, or payments received, as well as changes in equipment or other assets.

For example, if you purchase new equipment for your factory, the cost would be considered investing activity. If you decide to sell the old equipment, the proceeds from the sale would also be considered an investing activity.

Financing Activities

Cash flow from financing activities includes cash from investors and dividends paid to investors.

There are two methods commonly used when preparing a cash flow statement.

The direct method uses only cash and real-time totals and is useful for small businesses that use cash basis accounting, while larger businesses will want to use the indirect method, which uses information from a balance sheet and income statement.

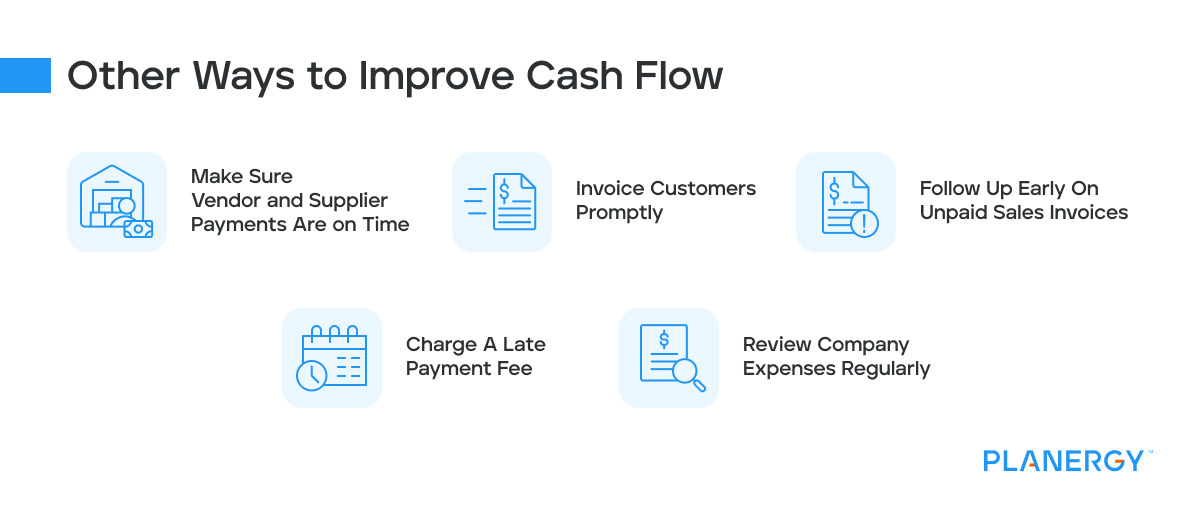

Other Ways To Improve Cash Flow

Aside from properly managing accounts payable, there are other ways to improve cash flow for your business.

Make Sure Vendor and Supplier Payments are on Time

Having a strategy in place that takes advantage of vendor payment terms to improve cash flow is a great strategy, but not if you pay your vendors late.

This can result in invoice late fees, lost early payment discounts, and negatively impact supplier relationships.

While it may be tempting to withhold payment to hold onto cash, the long-term ramifications of that decision such as a change in payment terms, revocation of credit, and additional interest rates can quickly negate any advantages you may incur.

Invoice Customers Promptly

Your shipping department may be on the ball, but if you don’t promptly invoice your customers for orders, your cash flow will suffer.

Invoice when an order is shipped and be sure to provide your customers with plenty of different payment options, such as accepting credit cards, ACH transfers, or direct deposit.

Also, be sure to request an upfront deposit for any large orders or orders that require extensive customization.

Follow Up Early On Unpaid Sales Invoices

Don’t wait until an invoice is past it’s due date to follow up with your customers.

Sending reminders before the payment is due can be extremely helpful. And it’s important to continue to send those reminders until payment has been received.

Charge a Late Payment Fee

If your customers are routinely late paying their invoices, consider implementing a late payment fee.

Explain the particulars of the fee to all of your customers and be sure to follow through on assessing the penalty for any customer that sends in payment late.

Review Company Expenses Regularly

While managing AP properly can go a long way towards improving your cash flow, spending time reviewing company expenses across the board may also improve cash flow for your business.

Improving Accounts Payable Management Improves Cash Flow

Positive cash flow is the goal of CPAs and bookkeepers alike.

Better management of accounts payable can help you avoid negative cash flow, manage a comfortable level of liquidity for your business, and keep business operations running smoothly.

In many instances, having enough cash on hand can mean the difference between remaining in business and closing your doors.

If you’re still processing AP manually, switching to a dedicated procure-to-pay software that incorporates an automated AP application, like Planergy, can streamline the entire AP process, provide real-time financial reporting options, and help increase your cash flow.

What’s your goal today?

1. Use Planergy to manage purchasing and accounts payable

We’ve helped save billions of dollars for our clients through better spend management, process automation in purchasing and finance, and reducing financial risks. To discover how we can help grow your business:- Read our case studies, client success stories, and testimonials.

- Visit our Accounts Payable Automation Software page to see how Planergy can automate your AP process reducing you the hours of manual processing, stoping erroneous payments, and driving value across your organization.

- Learn about us, and our long history of helping companies just like yours.

2. Download our guide “Preparing Your AP Department For The Future”

Download a free copy of our guide to future proofing your accounts payable department. You’ll also be subscribed to our email newsletter and notified about new articles or if have something interesting to share.3. Learn best practices for purchasing, finance, and more

Browse hundreds of articles, containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.