There are ways to avoid common AP errors, starting with a review of your internal controls. And if you don’t currently use controls, you may want to consider implementing some.

-

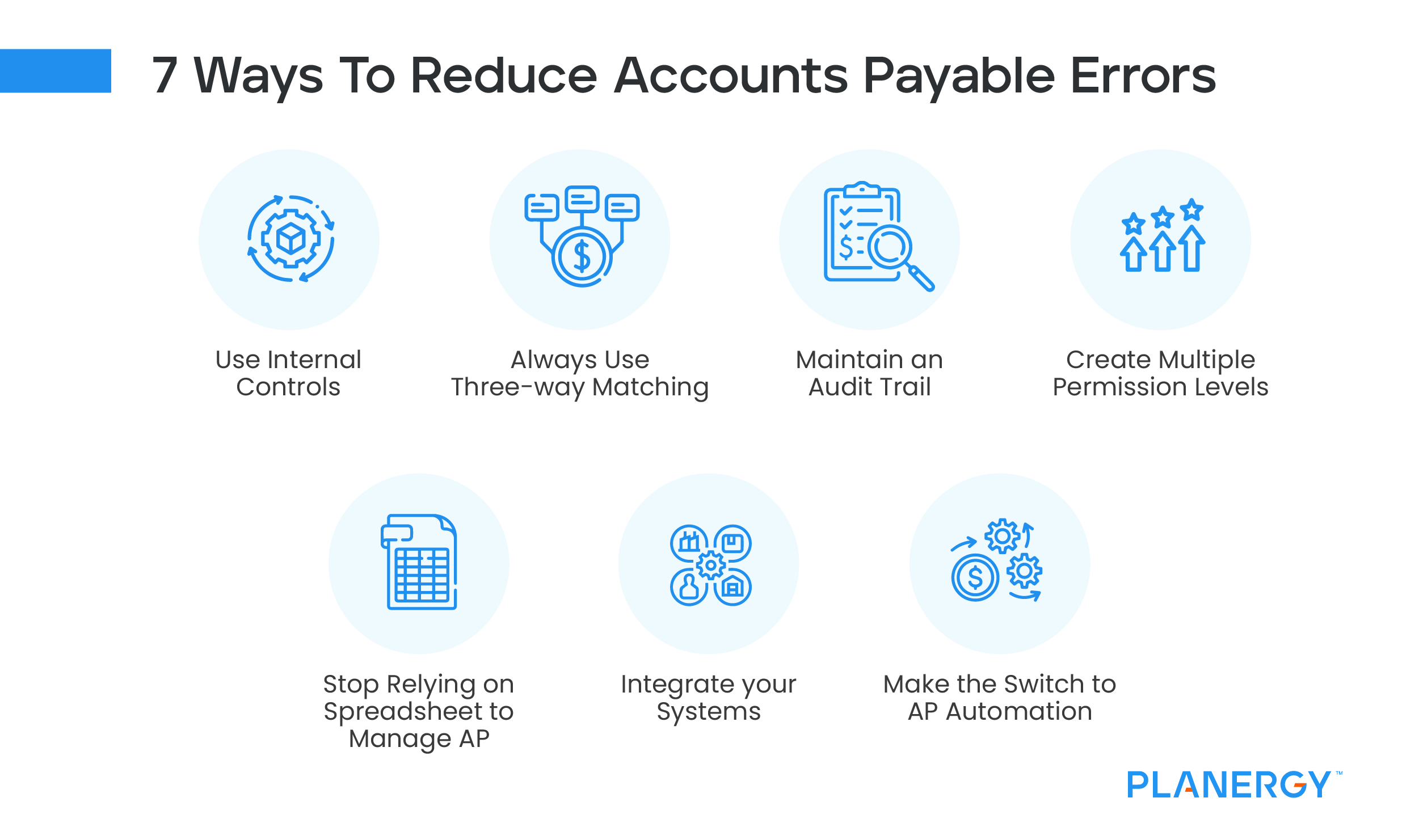

Use Internal Controls

Using internal controls can go a long way toward reducing and even eliminating AP errors. Common internal controls include:

• Obligation controls – which verify that your business is responsible for paying any invoice it receives.

• Data entry controls – these controls include a process for when an invoice should be entered in the system; prior to approval or after approval. Data entry controls should also establish a set process for entering invoices, such as including or omitting zeros in an invoice number.

• Payment controls – payment controls should use separation of duties. In other words, the person approving the invoice should not be the person processing the payment, or the person signing the check.

-

Always Use Three-way Matching

This simple process matches a purchase order, an invoice, and a shipping or receiving document, with all three documents matching. If there is a discrepancy, it should be investigated.

For example, if you order 1,000 wood panels, your shipping document should show that 1,000 wood panels were received, while your invoice should bill you for 1,000 wood panels. Further investigation is needed if one of the three documents doesn’t match.

Using three-way matching can help eliminate multiple AP errors. Using three-way matching, you won’t pay an invoice before the product or service has been delivered because you need to include the shipping or service receipt during the matching process.

Duplicate payments will also be avoided since you may have a second invoice from a vendor or supplier, but you won’t have the other documentation required to complete three-way matching.

-

Maintain an Audit Trail

The AP process should remain transparent at all stages including vendor review, purchase order approval, delivery receipt, invoice approval, and payment, so management and auditors can easily view the entire payable process from beginning to end.

-

Create Multiple Permission Levels

All things are not created equal in your business, including system access. Depending on your business and accounting software, permissions can be as simple as access/no access, or you can institute advanced permissions for different employee roles. It’s important that employees are given the appropriate system access to do their jobs, but nothing more.

-

Stop Relying on Spreadsheet Applications to Manage AP

Spreadsheet programs like Microsoft Excel can be vital for any business, but they should never take the place of a true procurement program like PLANERGY. Similar to using a manual AP process, Excel requires data entry, making it ripe for many of the same problems you may be experiencing by entering AP data manually.

Keep Excel for other things, and focus on implementing an application that will make your job easier, not more difficult.

-

Integrate Your Systems

Are you finding yourself having to enter information into two or more applications because they don’t integrate? While buying multiple applications can be a cost-saving measure, in most cases, running various applications ends up costing you a lot of time and efficiency. Before you download the latest app, make sure it works with your current system.

-

Make the Switch to AP Automation

Better than integrating multiple systems, using AP automation allows you to eliminate many of the programs you may be using. Transitioning to automated AP also eliminates paper, putting the issue of lost invoices to rest. An automated AP system like PLANERGY automates three-way matching, eliminates time-consuming data entry, produces real-time reporting, keeps accruals accurate, and gives you an easy view of spending.