How to Implement an Accounts Payable Audit Program

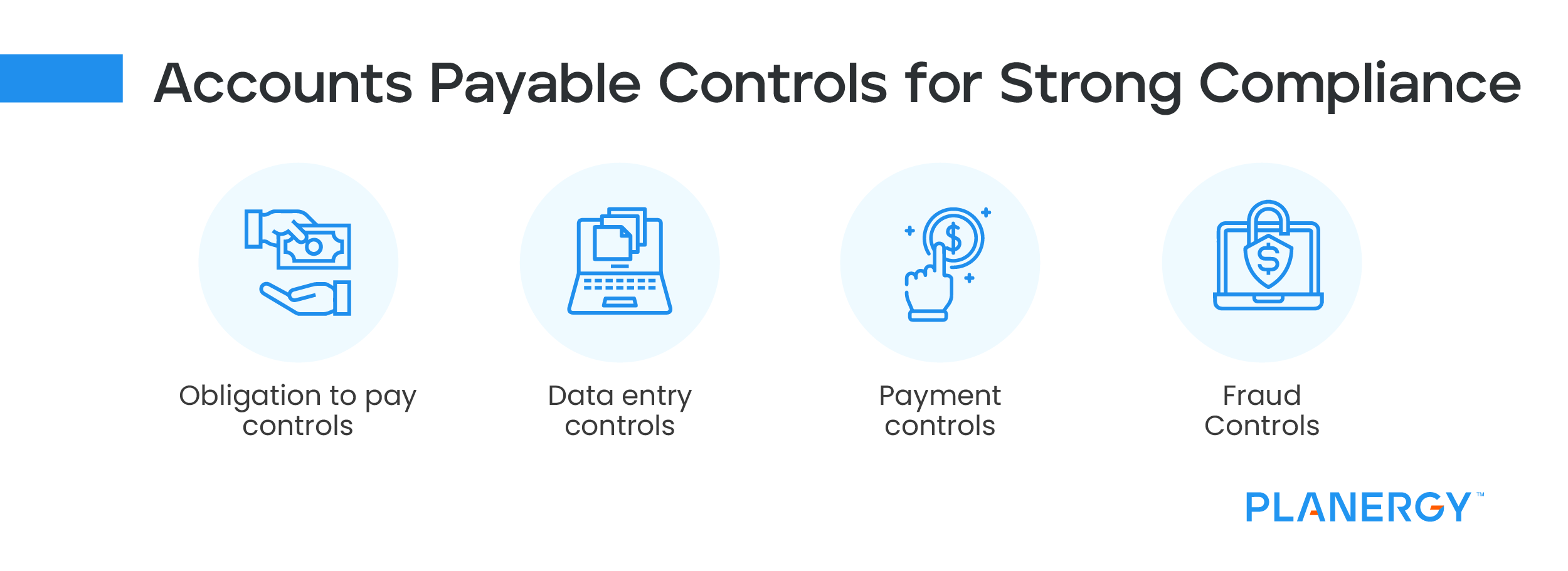

Internal controls play an important role in any business, helping to mitigate fraud, reduce human error, and ensure that established procedures and processes are followed.

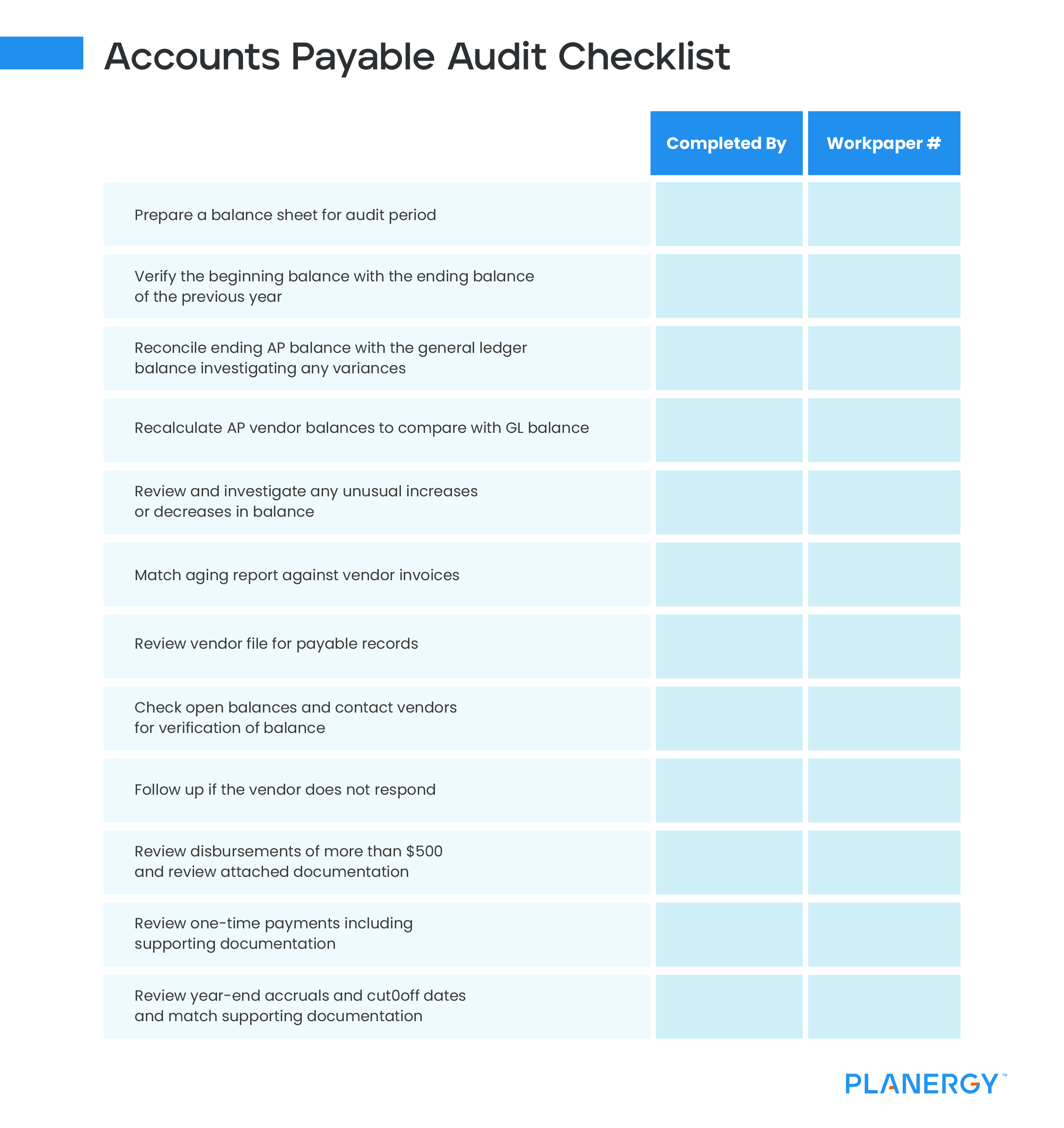

Nowhere is this more important than the accounts payable department. Because of its proximity to business finances, it’s important that any business, large or small, conducts an audit of its AP department annually and maintains good internal controls for managing accounts payable.

And for some businesses it’s a requirement.

For example, the Sarbanes-Oxley Act requires all public businesses to submit records yearly to a third party for an external audit. Private companies that apply for loans or credit must also have a routine audit performed, with these audits typically completed by a third-party auditing or CPA firm.

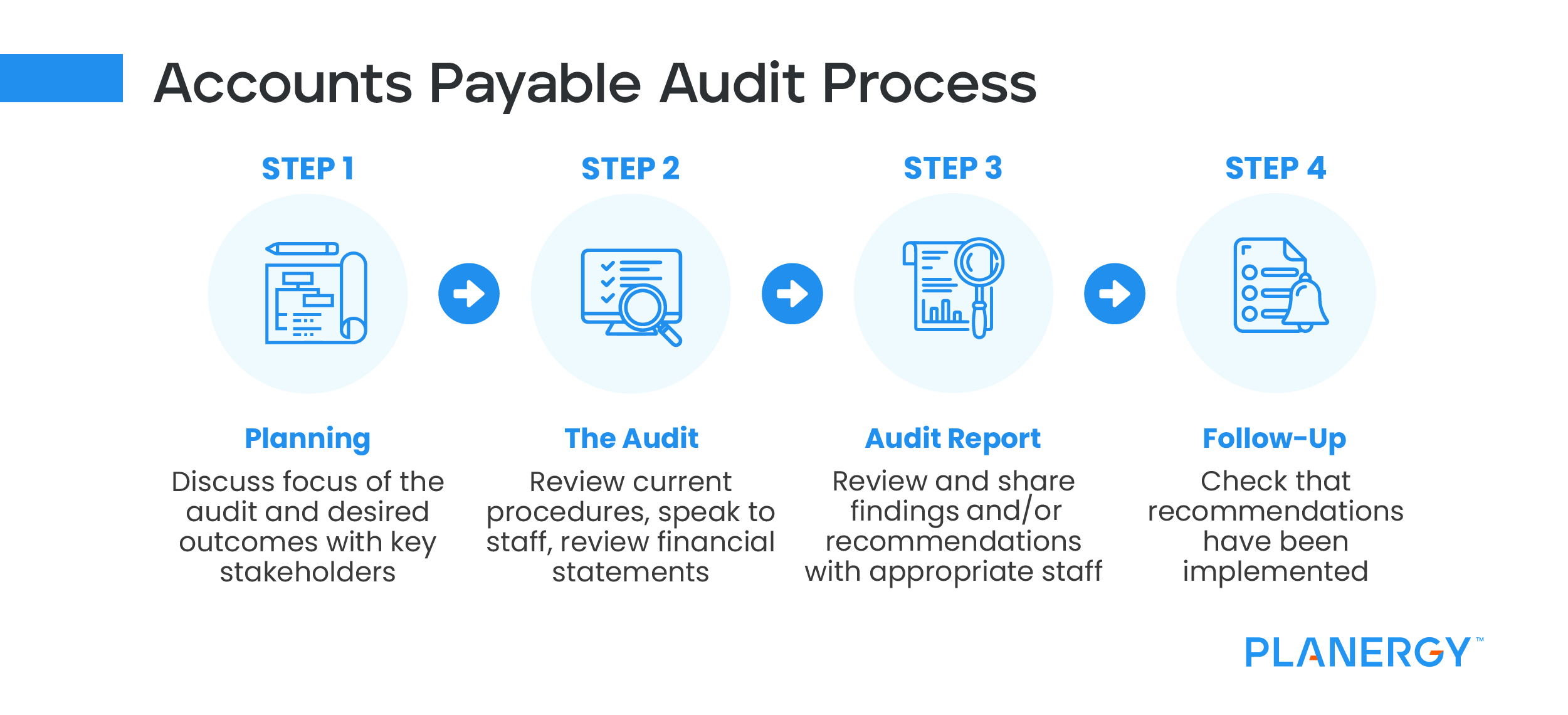

But even if not required, small and mid-size businesses should regularly audit business finances, particularly accounts payable. The best way to do this is to create an internal AP audit program. Auditing AP annually can also help spot potential trouble spots before they become a more serious issue.