Everyone is tired of hearing about the COVID-19 pandemic, but the fact is that it changed how companies do business.

Instead of choosing to wait to adopt new technology, many businesses found themselves in a position that required them to utilize new technology if they wished to remain in business.

But whether your employees are doing work from your office or their dining room table, automating the AP process can provide you with a healthy return on investment (ROI) while streamlining processes. The following are a few other reasons why automating AP will be beneficial for your business.

-

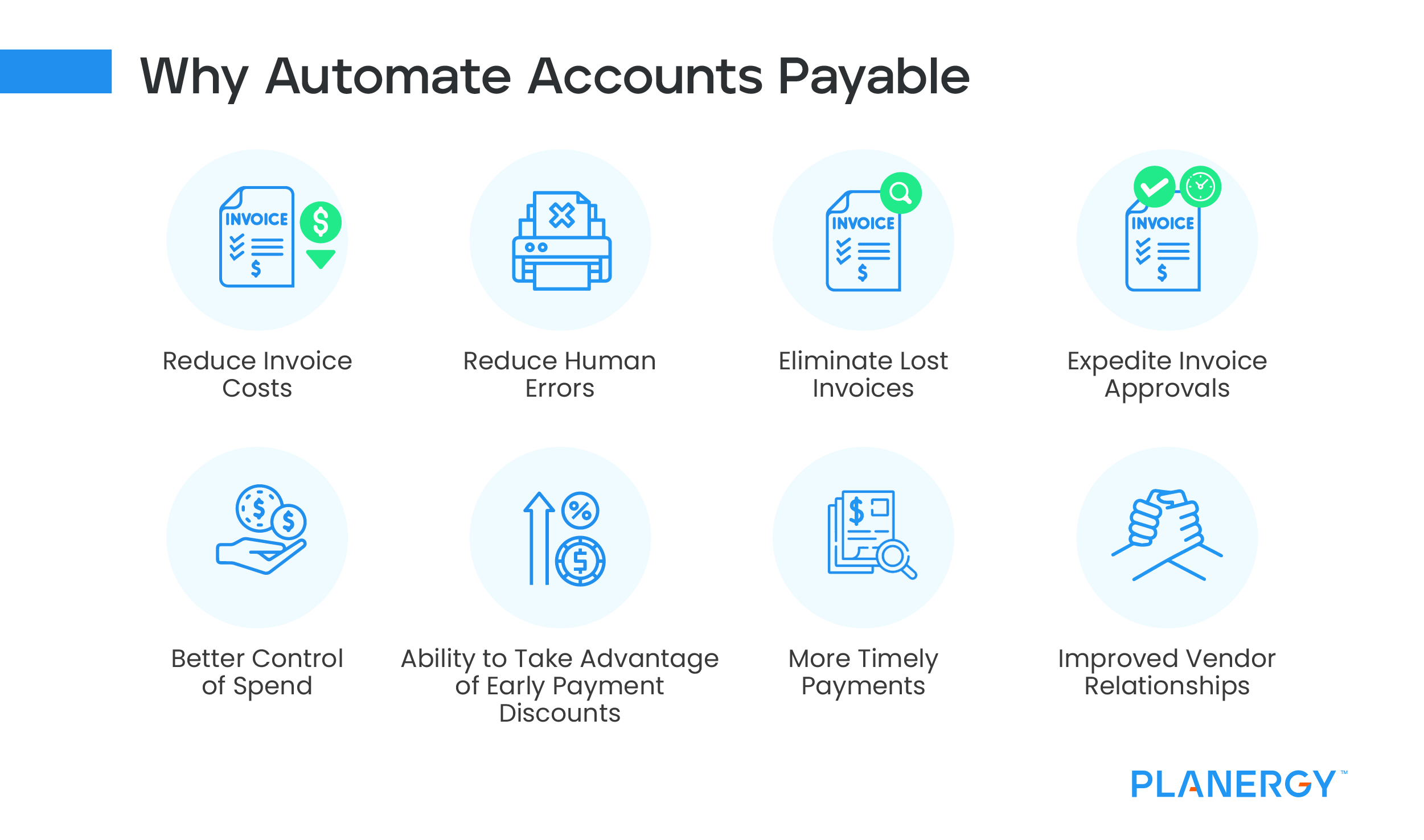

Reduce Invoice Costs

One of the best reasons to make the move to AP automation is the reduction in invoice processing costs. Even with more streamlined processes in place, and a 15% drop in processing costs across the board, Ardent Partners estimates that the average cost to process an invoice is still more than $9.

Even if you process only 10 invoices a month, that is still $90 spent to pay your bills, with larger businesses processing considerably more invoices each month.

-

Reduce Human Errors

Mistakes happen. But mistakes are more likely to happen when using manual processes such as entering invoice information manually. Busy AP departments are more likely to see mistakes since employees often spend the majority of their time manually performing tasks such as three-way matching, invoice review, and invoice data entry.

Manual systems are also breeding grounds for duplicate invoices and overpayments.

-

Eliminate Lost Invoices

AP managers know how too well how easy it is to misplace an invoice. This results in lost productivity hours that are instead spent looking for the invoice in question, only to end up requesting a duplicate invoice from your supplier or vendor. That’s not the way to grow a business relationship.

-

Expedite Invoice Approvals

Even if your invoice doesn’t go missing, chances are good that it may sit on a desk or in an inbox a lot longer than it should. Delayed approvals can wreak havoc on your AP department. Improving your invoice approval process by automating AP can eliminate this issue immediately.

-

Better Control of Spend

Spend management is a large part of the accounts payable process. Sure, you can look at invoices paid for the month, but what about invoices that are still on someone’s desk waiting to be approved and aren’t currently showing up in your expense totals?

Making the move to AP automation gives you better control over spending, by offering dashboards that outline current spending levels, and outstanding invoices that have just come in, allowing you to set and track key metrics to help you stay on track.

-

Ability to Take Advantage of Early Payment Discounts

Remember those invoices that are still sitting on someone’s desk two weeks after they were sent over? Chances are at least some of those invoices included a discount for early payment.

Of course, that option is no longer viable for invoices that aren’t paid immediately, but don’t you ever wonder just how much money you’re leaving on the table each time you let another discount opportunity go by?

-

More Timely Payments

Sometimes there are advantages to paying invoices close to their due date, particularly if you have cash flow problems. But most businesses don’t pay their invoices early because of slow invoice processing times.

The time they need to spend matching invoices with POs and delivery receipts, routing them to colleagues for approval, entering them in your accounting software, and then completing a check run to pay them takes too long.

An automated payment process allows you to get rid of bottlenecks so you can take advantage of discounts, better manage cash flow, and always know how much you’re paying for everything.

-

Improved vendor relationships

When you send an invoice to your customers, aren’t you happier when they pay quickly? Your vendors and suppliers value rapid payment as much as you do, and are more apt to give you benefits such as pricing flexibility or early payment discounts.

If your suppliers are an essential part of your business success, maintaining a good vendor relationship is paramount.