People working in accounts payable (AP) have long endured a variety of stereotypes about the work they do; endless penny pinching and number crunching; trimming costs where they can; and then putting it all down on paper so they can do it all over again the next month.

But in the decades since digital technologies, such as automation and artificial intelligence, have made it possible to streamline many of the formerly time-consuming and tedious workflows in accounts payable.

Those stereotypes are not only irrelevant to the actual tasks at hand, but fail to describe the changing role accounts payable plays in organizations committed to digital transformation.

AP departments are leaving their dusty, paper-based manual processes behind and turn to powerful software tools to optimize workflows.

And the AP function is shifting its focus away from simple cost savings and toward more ambitious goals for value creation, business process optimization, and implementation of digital transformation strategies across the organizations it supports.

Why Accounts Payable Digital Transformation Matters

Businesses of all types and sizes share certain commonalities: stakeholders who expect results; growth and profits that hinge on operational and financial efficiency and excellence; and a desire to get the best possible return on investment (ROI).

Digital transformation makes achieving goals and meeting expectations easier by eliminating inefficiencies, bottlenecks, and errors created by manual tasks (e.g., manual data entry).

It also provides software tools for centralizing data management, eliminating the data silos that traditionally render crucial information difficult (or even impossible) to access without traversing multiple software environments.

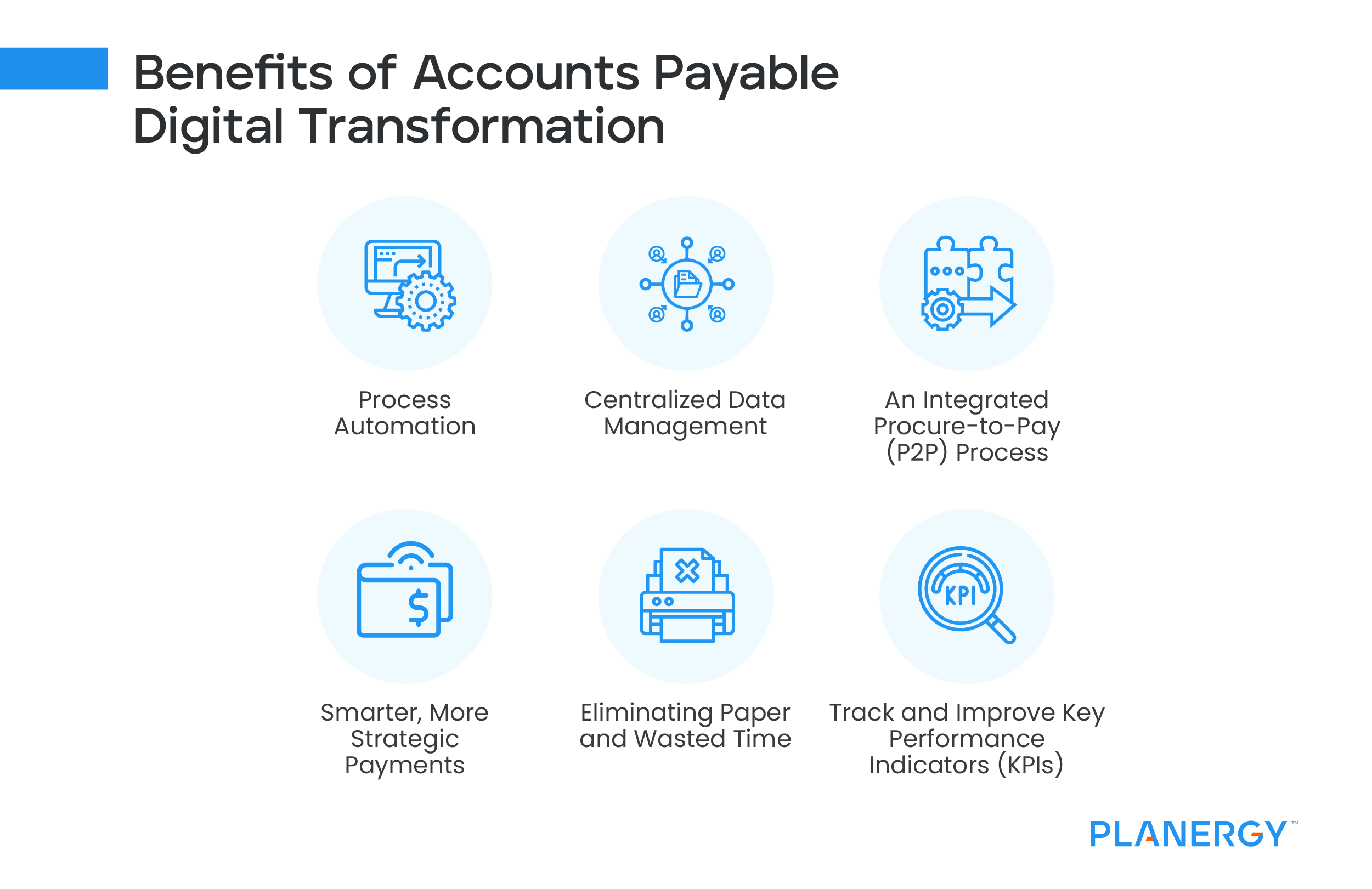

For AP teams, choosing a complete software solution such as PLANERGY brings immediate and concrete benefits, including:

Process Automation

Many high-volume, time-consuming tasks can be readily automated, eliminating human error and improving speed and accuracy to superhuman levels. Automation also allows for contingencies and customized subroutines.

In approval workflows, for example, purchase orders that would have once languished in the inbox of a vacationing manager can instead be automatically routed to another for approval, or even automatically approved if they fall within the proper budget parameters.

Centralized Data Management

Supplier and invoice data are captured and populated automatically for much smoother processing. Connecting your existing accounting software with your enterprise resource planning system (ERP system), customer resource management (CRM) system, etc., a cloud-based, centralized solution facilitates smoother communication and collaboration.

Standardized file types, complete data capture, and real-time, role-appropriate access to all data through intuitive dashboards makes it much easier to mine your company’s data for actionable insights and apply them while they’re still fresh.

An Integrated Procure-to-Pay (P2P) Process

Accounts payable teams work closely with their counterparts in procurement as part of the procure-to-pay process.

An AP automation solution that fully integrates with procurement makes it possible to capture optimal value from a number of interrelated processes through workflow automation and optimization via continuous improvement, from the creation of a purchase request through the final approval of a vendor invoice.

Working in sync eliminates rogue spend, combats invoice fraud, and, with help from a guided buying environment, ensures every purchase is made from the correct vendor at the best pricing and terms—and every transaction is captured, verified, recorded and paid by AP.

AP automation also supports procurement by providing financial data procurement teams can use to refine the supply chain.

Eliminating or rehabilitating under-performing, non-compliant vendors, securing contingency-based suppliers to guard against supply chain disruptions and protect business continuity, and developing more advanced, strategic relationships with key vendors are all much easier with fully transparent data available in real time.

Smarter, More Strategic Payments

With full integration with procurement, paperless information exchange, and automated workflows, AP teams are able to make more strategic payment decisions. Digital invoices and lower cycle times mean more breathing room and better cash flow management.

They can capture early payment discounts, avoid late payments, or take advantage of special promotional payment terms as needed to ensure working capital needs are met while still meeting their obligations—and protecting valuable supplier relationships.

Eliminating Paper and Wasted Time

Automating high-volume processes not only frees up staff to focus on more strategic priorities, but slashes the often substantial expenses that come with printing, storing, accessing, and maintaining paper documents, whether on premises or at a dedicated storage facility.

Eliminating paper also improves a company’s environmental footprint, providing soft savings and value from better customer engagement and incentives from government and industry environmental awareness programs.

Track and Improve Key Performance Indicators (KPIs)

Digital data management and process automation make it possible to track and refine processes over time. More importantly, machine learning makes it possible for these systems to teach themselves how to improve.

But human oversight and insight are still required for optimal results. Developing and implementing AP performance and compliance metrics that guide everything from budgeting to supply chain management is much easier with the help of artificial intelligence and a fully interconnected, automated AP function.

But the true value of paperless AP automation is about more than faster cycle times across the AP process or cost savings from eliminating paper invoices and manual data entry.

AP professionals can use immediate and demonstrable savings, supported by key performance indicators (KPIs). The KPIs monitored can provide a template for tracking and improving efficiency, performance, and compliance in every area of the business. For example, the gains in efficiency and accuracy can quickly improve important metrics such as average invoice processing cost.

These savings, paired with the projected value created by soft savings from greater efficiency and more strategic business intelligence, can be used effectively to gain buy-in from the C-Suite for implementing digital transformation across entire organizations.

Since every dollar the company spends flows through AP, capturing maximum value for each of those dollars through process improvements, advanced analytics and more intelligent, data-driven decision making can help the entire business thrive.

Better still, connecting the disparate software environments with a centralized solution removes additional data silos and allows for an even richer data set to be used in analysis, forecasts, budgets, and reports.

By shifting accounts payable to the center and extending process automation and analytics capabilities to the rest of the company, the AP function (along with procurement) becomes a value creation center by providing accurate and complete budgets, better cash flow management, and invaluable insights senior management can use when innovating with new products, targeting new markets, or seeking strategic partnerships.

AP professionals can use immediate and demonstrable savings, paired with the projected value created by soft savings from greater efficiency and more strategic business intelligence, to gain buy-in from the C-Suite for implementing digital transformation across their entire organizations.

Making Accounts Payable the Heart of Organizational Digital Transformation

With Big Data technologies making it more important than ever to transform information into action, and the growing importance of continuous improvement to competitive strength, it’s no surprise digital transformation in accounts payable is a high priority for so many organizations.

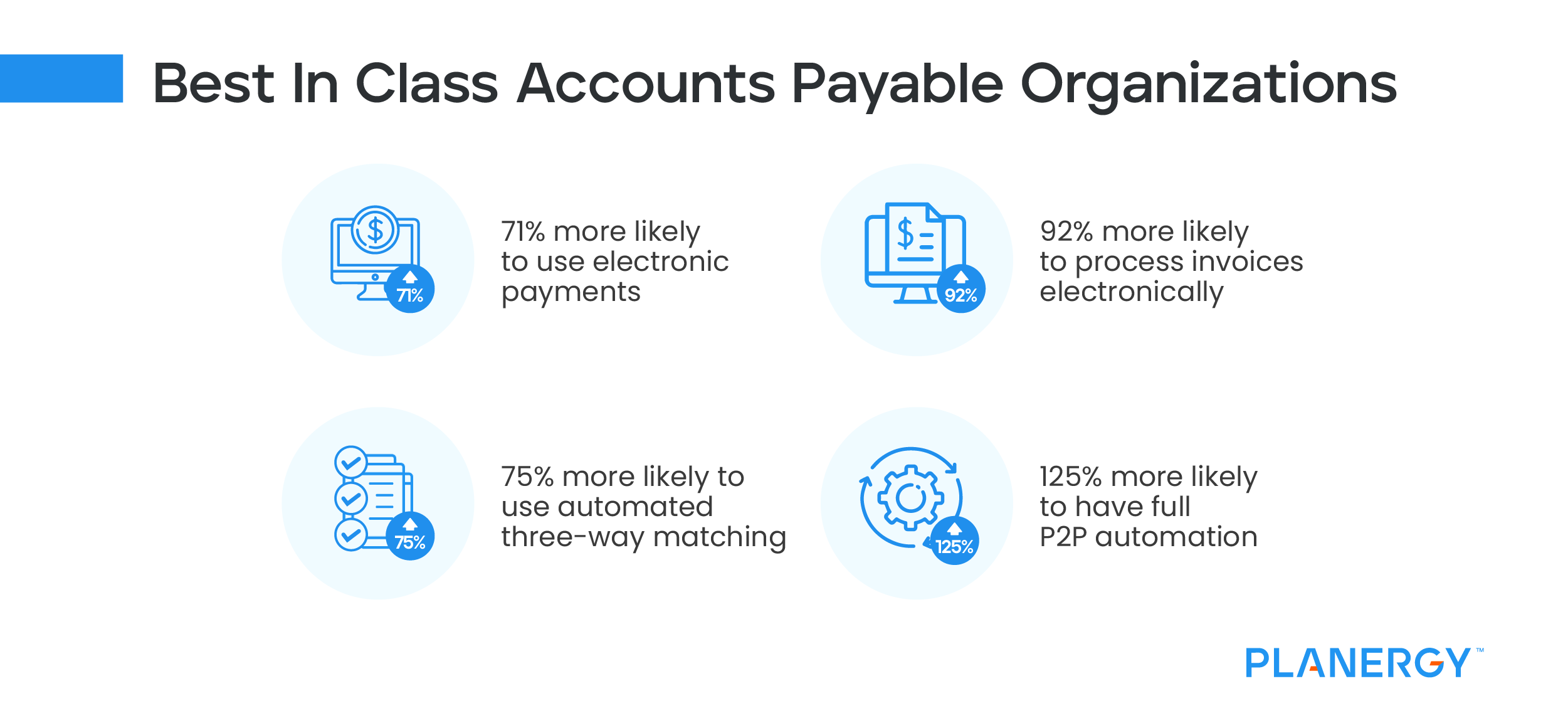

In fact, a 2020 survey conducted by Ardent Partners found “Best in Class” organizations were 71% more likely to use electronic payments compared to underperformers, and 92% more likely to process invoices electronically. They were also 75% more likely to use automated three-way matching, and a staggering 125% more likely to have full P2P automation.

But while no one’s arguing AP automation is beneficial and necessary, automating payable processes remains a struggle for many businesses. In the same survey, Ardent Partners found:

- 62% of respondents reported struggling with excessive exceptions.

- 40% reported using too much paper.

- 55% said invoice processing and payment approvals took too long.

- AP staff spent, on average, 22% of their time responding to supplier inquiries.

- Nearly half (49.7%) of incoming invoices were still being processed manually.

- Just 3% of respondents said they were “heavily automated” in accounts payable.

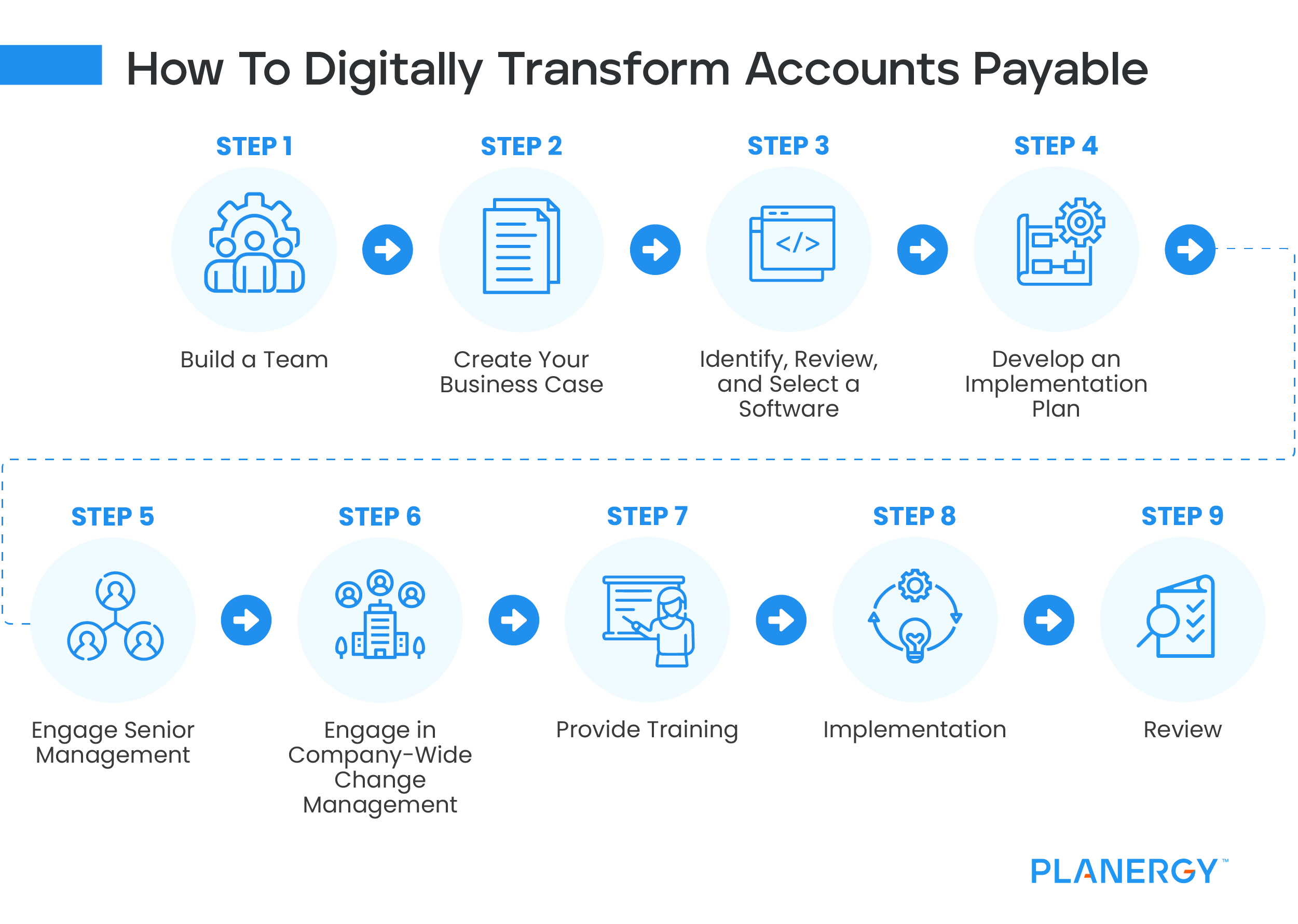

Making the move to “Best in Class” begins with a clear plan. Your accounts payable department can kick start digital transformation for your organization by following a few simple tips.

Build a Team

Create a dedicated team focused on implementing digital transformation in AP. Secure an executive sponsor from the jump, both so you can access the resources you’ll need and to ensure you have someone in your corner when it’s time to make the case for implementation and, in the future, expansion of your digital transformation strategy.

The chief financial officer (CFO) is a good choice, since they’re likely to see the immediate appeal of cost savings and value creation from accounts payable automation.

Create Your Business Case

- Decide which metrics you want to measure to provide demonstrable savings and value.

- Set clear and measurable goals based on existing data (cycle times, average cost to process an invoice, exception rates, digital versus paper invoicing, etc.).

- Use predicted business outcomes to secure a budget and any other necessary resources.

Identify, Review, and Select a Software

Choosing the right AP automation solution requires careful consideration of your goals, budget, and timeline for digital transformation. Keep these considerations in mind, based on your priorities:

- Is the software cloud-based, on-premises, or a hybrid of the two?

- What are the parameters of each solutions’ service-level agreement (SLA)?

- What software and hardware tools will be required to implement each solution?

- What cultural changes and training will be required to secure buy-in from all team members and stakeholders? What kind of timeframe will this require? Does the vendor supply training and educational materials?

- Is the solution customizable? Does it integrate neatly with the existing software environment? Is it flexible enough to accommodate future upgrades as needed?

Develop an Implementation Plan

The considerations from Item 3 will come into play as you customize your new software solution to meet your specific needs. Identify potential bottlenecks and obstacles to a successful implementation (including the culture shift that can come with moving from paper to paperless AP) and make sure your timeline accommodates the necessary solutions.

Engage Senior Management

Working with your executive sponsor, prepare and present the savings and value generated by the implementation to secure buy-in from the C-suite first. It’s important to have top-down support from the get-go, since leadership sets the tone for major projects—especially those that can radically change day-to-day workflows for your team.

Engage in Company-Wide Change Management

Once you have support from the C-Suite, it’s time to engage with team members across the entire organization. It may take time and resources to educate everyone on the importance of the implementation and how supporting it helps the company achieve its goals for profitability and performance. Securing buy-in before implementation can help prevent major headaches later, and help everyone feel truly engaged in the success of the implementation.

Provide Training

Be prepared to provide training before, during, and after implementation, and take advantage of resources from your vendor to provide additional educational or technical expertise as needed.

Implementation

Take your new AP software solution live and begin tracking your chosen metrics.

Review

Carefully track the performance of the system over multiple time periods (for example, performance over a month, quarter, and year), using your selected KPIs. Identify areas of improvement as well as those in need of additional refinement. Once you have sufficient data, you can use the successful implementation of AP automation as a foundation to begin bringing digital transformation to your whole organization (as time, resources, and budget permit).

AP Automation Can Kickstart Digital Transformation Success

If you’re looking to add the powerful arrows of continuous improvement, business process automation, and data-driven, actionable insights to your company’s quiver, start at the heart.

By developing and implementing digital transformation in your AP department, you’ll gain more than big savings. You’ll also build value from greater efficiency and accuracy in your financials and a stronger, more strategic supply chain.

And with those savings and value, you’ll also have the perfect use case to present to the C-Suite when securing funding and support for organization-wide digital transformation—helping ensure your company is ready to seize new opportunities and compete more effectively in today’s global economy.