Accounts payable (AP) is no longer just a back-office function—it has become a core driver of financial efficiency and resilience.

In 2025, AP departments are doubling down on automation, AI-powered tools, and advanced analytics to achieve greater cost savings, reduce manual workloads, and optimize cash flow. These advancements continue to position AP as a strategic asset rather than a transactional function.

Market Growth and Generative AI Adoption in AP

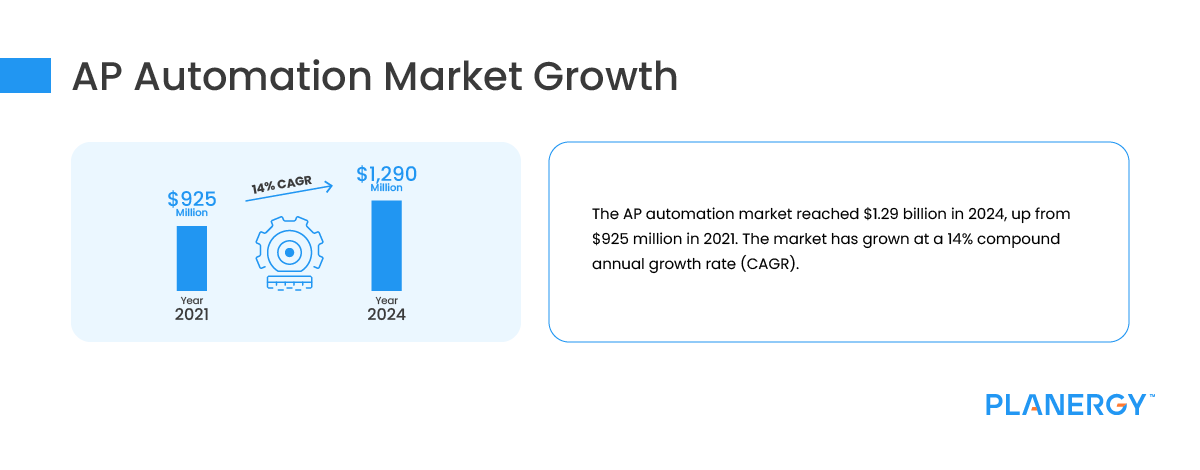

The AP automation market is continuing its upward trajectory in 2025, with spending on accounts payable invoice automation (APIA) and e-invoicing solutions expected to reach $1.47 billion, up from $1.29 billion in 2024, maintaining its 14% CAGR. [2]

Generative AI is playing an even larger role in reshaping AP processes, automating tasks such as invoice processing, approvals, and payment reminders.

AP teams adopting AI-driven tools are significantly reducing manual workloads, allowing staff to focus on higher-value activities like cash flow analysis and fraud prevention [3].

These innovations continue to reinforce AP’s ability to deliver measurable financial value across organizations.

Digital Transformation and Compliance: The New Face of AP

In 2025, hyperautomation—which integrates AI, machine learning (ML), and Optical Character Recognition (OCR)—continues to redefine AP efficiency. OCR technology now boasts accuracy rates of up to 98%, with widespread adoption across industries significantly reducing manual data entry errors.

Organizations leveraging AI-powered OCR have cut invoice processing times by an average of 35%, allowing for seamless invoice workflows [2][4].

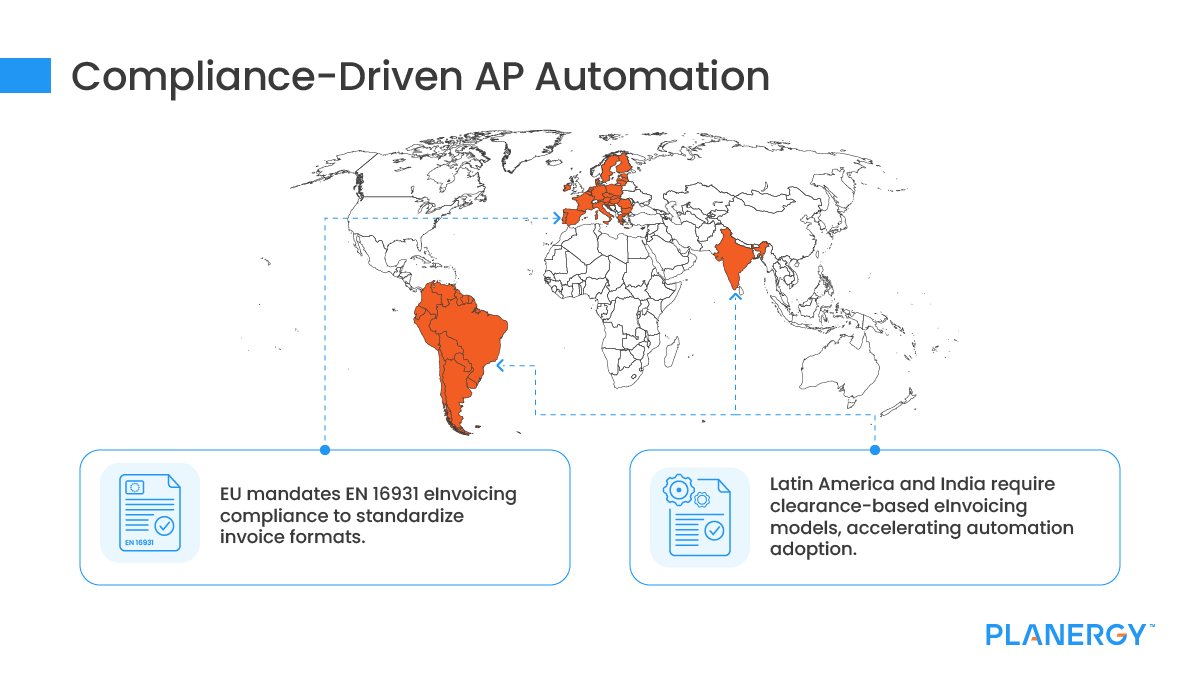

Compliance remains a key driver of AP automation. The European Union’s eInvoicing standard (EN 16931) is now a regulatory requirement in multiple member states, reinforcing the need for structured, standardized invoice data to ensure seamless tax validation and cross-border transactions [10].

Similar mandates in Latin America and India are accelerating automation adoption to reduce compliance risks and improve reporting accuracy. Companies that fail to digitize risk penalties for non-compliance, making automation not just an efficiency play but a necessity for regulatory adherence. [2].

From Cost Center to Profit Center: The Financial Benefits of AP Automation

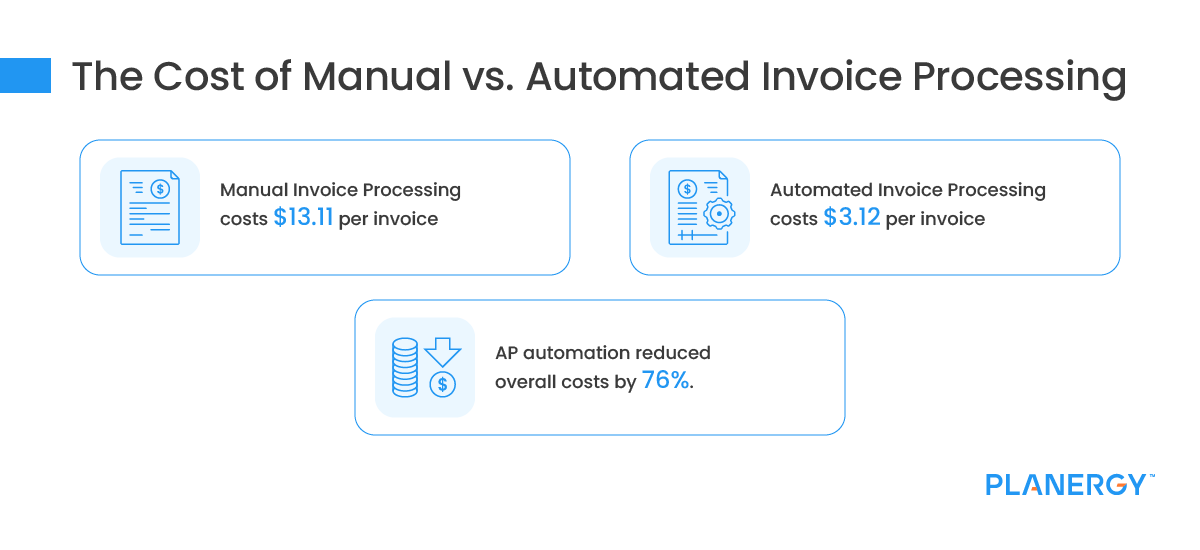

Automation is turning AP into a profit-generating function in 2025.

Organizations that have embraced AI-driven AP solutions are experiencing up to a 76% reduction in invoice processing costs, with best-in-class teams processing invoices for as little as $2.75 per invoice, compared to $13.11 for manual setups [6].

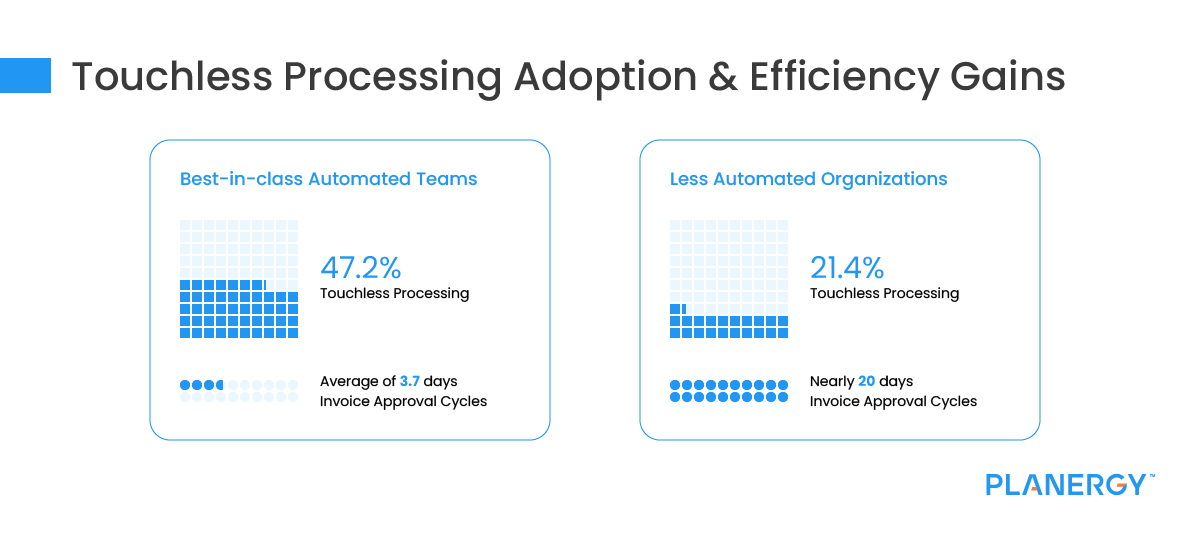

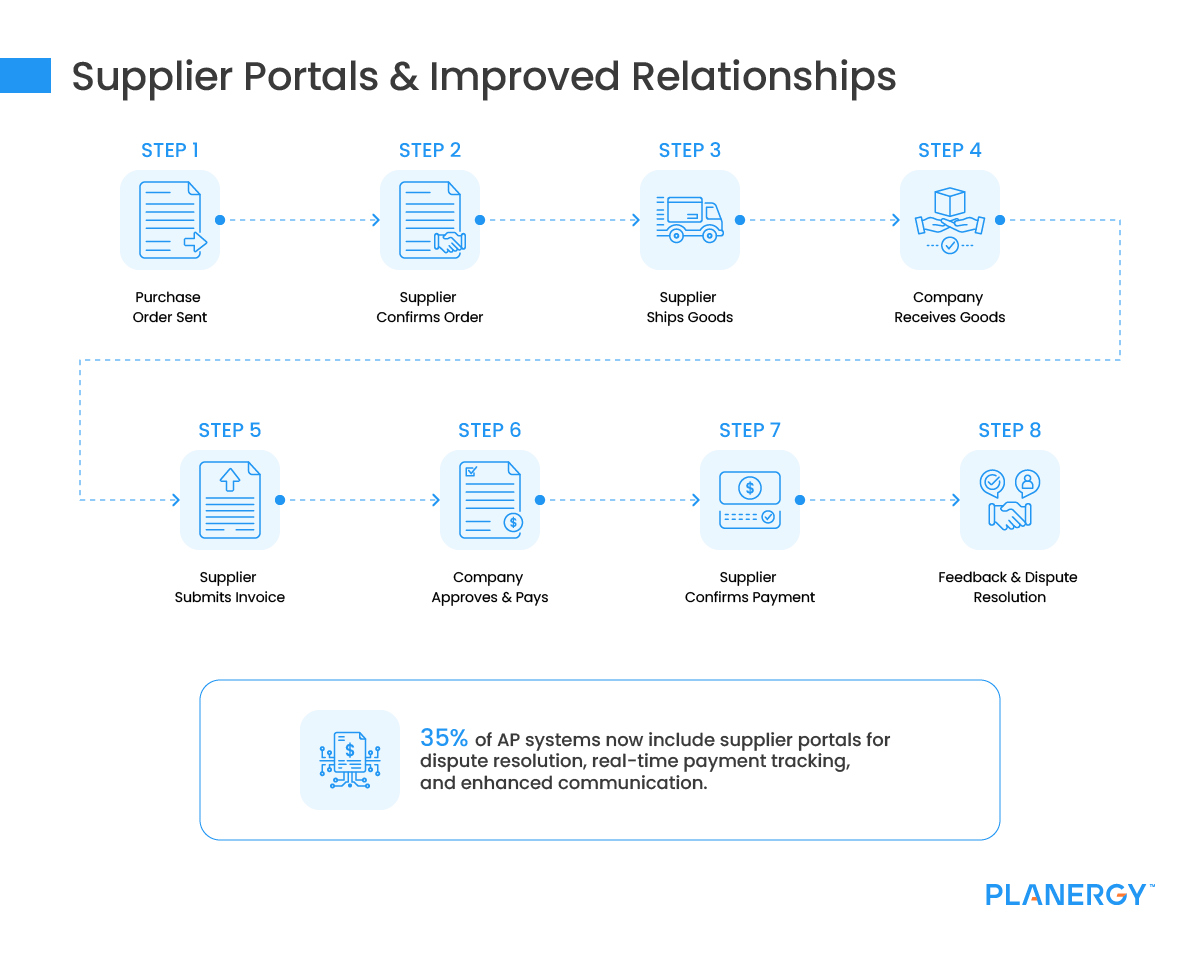

Beyond cost savings, early-payment discounts remain a major financial incentive, with automation enabling faster invoice approvals and discount capture rates improving by 30%. Leading AP teams have reduced invoice approval cycles to an average of 3.2 days, down from 19.5 days in non-automated systems, strengthening cash flow and supplier relationships [6].

By improving financial visibility and reducing inefficiencies, AP automation is shifting the department from a cost center to a strategic contributor to profitability and working capital optimization.

Touchless Processing Delivered Unprecedented Efficiency

Touchless processing continues to be a major goal for AP teams in 2025, with automation delivering even greater efficiency gains.

Best-in-class AP departments now achieve touchless processing rates of 52.8%, up from 47.2% in 2024, further reducing manual intervention and processing errors [6].

AI-driven tools, including advanced OCR and intelligent document processing (IDP), allow invoices to move seamlessly through workflows with minimal human oversight.

Organizations adopting these technologies have seen a 40% drop in invoice exceptions, cutting delays and inefficiencies. The result?

AP teams can focus on higher-value activities like fraud prevention, cash flow optimization, and supplier negotiations, rather than spending time on manual approvals and data entry [2].

Capturing Early-Payment Discounts and Enhancing Cash Flow

The ability to capture early-payment discounts remains a standout financial benefit of AP automation in 2025. Organizations that automate invoice processing are capturing discounts 35% more frequently than those relying on manual methods.

The fastest AP teams have shortened invoice approval cycles to just 3.2 days, down from nearly 20 days in manual systems. This speed allows businesses to capitalize on vendor discounts that would otherwise be lost due to processing delays [6].

Beyond discounts, faster approvals improve supplier relationships and strengthen cash flow management. Companies leveraging AI-powered AP automation report a 25% increase in cash flow predictability, allowing finance teams to optimize working capital and reduce reliance on external financing.

By reducing late payments and improving liquidity, AP is playing a direct role in enhancing overall financial health and stability [3].

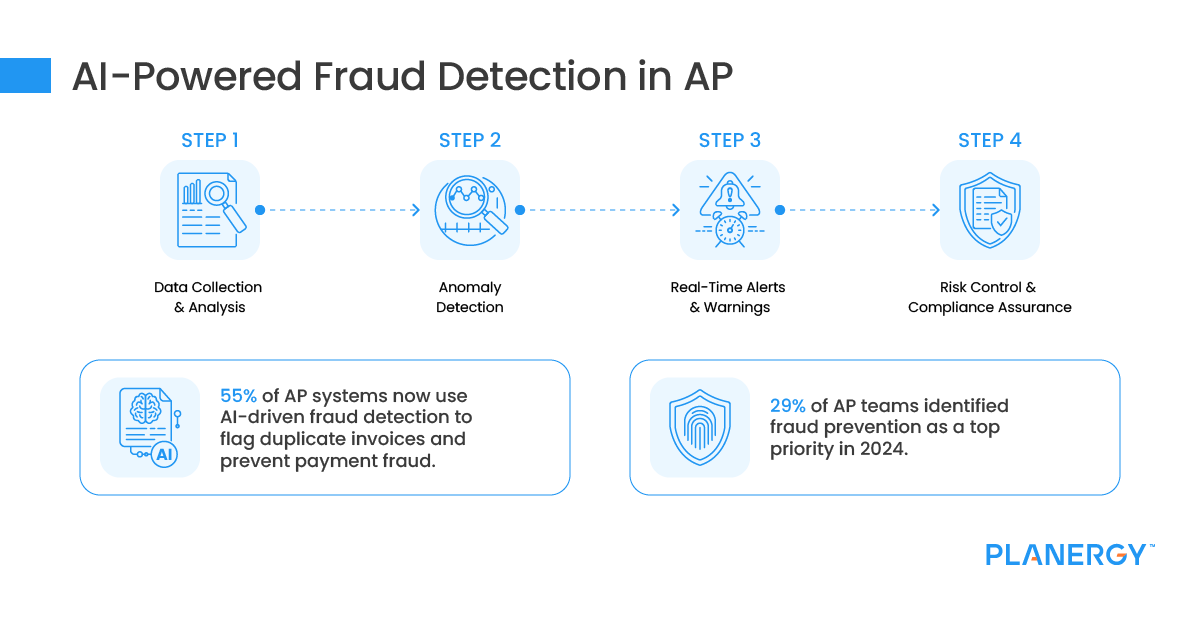

Fraud Detection Improved Security and Trust

Fraud detection remains a top priority for AP departments in 2025, with global transaction volumes increasing and cyber threats becoming more sophisticated.

AI-powered fraud detection is now integrated into 61% of AP systems, up from 55% in 2024, helping organizations identify and block fraudulent transactions in real time [2].

Machine learning algorithms analyze vast amounts of transaction data to flag duplicate invoices, unusual payment patterns, and vendor inconsistencies before they become financial risks. Organizations that have adopted AI-driven fraud prevention tools report a 37% reduction in financial losses due to fraudulent activity [9].

Additionally, compliance regulations around eInvoicing and B2B payments are tightening, further reinforcing the need for secure, automated AP systems.

Businesses that fail to modernize their fraud detection strategies risk not only financial losses but also regulatory penalties.

In response, CFOs are investing in real-time transaction monitoring, biometric authentication, and blockchain-based invoice validation to enhance security and trust in AP operations.

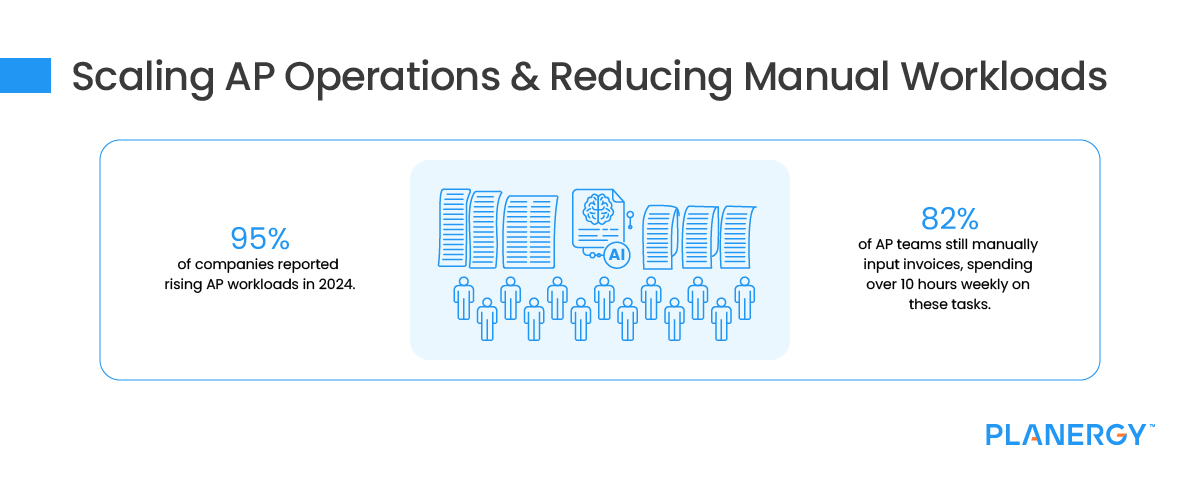

Scaling AP Operations to Meet Rising Volumes

With AP workloads continuing to grow in 2025, scalability remains a key challenge. With 95% of companies now report an increase in invoice volumes, with many struggling to keep up without automation.

Despite this, only 39% of organizations have upgraded their AP systems in the past 12 months, indicating a significant gap in readiness [7].

Automation is proving to be the solution. Companies that have digitized invoice processing and eliminated manual data entry are handling 20-30% higher invoice volumes without adding headcount.

Advanced AP automation platforms now include AI-driven data extraction, predictive analytics, and smart routing, allowing teams to scale efficiently while maintaining accuracy [8].

For businesses still relying on manual processes, the risk of bottlenecks, late payments, and compliance issues grows each year.

By investing in scalable, AI-powered AP solutions, companies can future-proof their operations, ensuring greater efficiency, cost savings, and resilience as invoice volumes continue to rise.

Strategic Role of AP in CFO-Led Transformations

In 2025, accounts payable continues to play a critical role in finance transformation strategies led by CFOs. With automation, AI, and real-time analytics driving efficiency, AP is no longer just a transactional function—it is now a key provider of financial intelligence.

51% of CFOs in high-performing organizations are now leveraging AI-driven AP tools to enhance fraud detection, monitor cash flow, and improve spend visibility, up from 48% in 2024. These tools allow finance leaders to forecast liquidity needs, optimize working capital, and identify cost-saving opportunities [1].

This shift is elevating AP’s status within organizations. Instead of focusing solely on processing invoices, AP teams are now delivering real-time data that informs executive decision-making.

Companies that prioritize AP modernization and digital transformation are seeing significant benefits, including faster approvals, stronger supplier relationships, and improved financial performance.

Reducing Dependency on Spreadsheets

Spreadsheets have long been a pain point for AP departments, causing errors, inefficiencies, and a lack of real-time visibility. In 2025, 45% of AP leaders have made eliminating spreadsheets a priority, up from 43% in 2024 [9].

By replacing manual data entry with automated workflows, companies are reducing errors and improving reporting accuracy.

Organizations that have transitioned to cloud-based AP solutions and real-time analytics platforms report:

- 27% fewer invoice processing errors

- 35% faster financial reporting cycles

- Greater audit readiness and compliance with global regulations

For businesses still relying on manual spreadsheets, the risks include delayed approvals, missed early-payment discounts, and compliance issues.

As AP continues to evolve, eliminating spreadsheet dependency is a crucial step toward efficiency, accuracy, and financial agility in 2025 [5].

The Growing Importance of Data and Analytics

In 2025, data and analytics are playing a bigger role in optimizing accounts payable operations.

Over 55% of AP leaders have prioritized agile analytics, up from 50% in 2024, to track spending trends, identify savings opportunities, and forecast cash flow needs [6].

AI-powered AP solutions are now providing real-time visibility into transactions, allowing teams to:

- Proactively flag risks and fraud patterns

- Monitor supplier payment performance

- Optimize working capital based on historical trends

Companies using AI-driven AP analytics report improved cost control, faster decision-making, and better alignment with broader business objectives.

By leveraging predictive analytics, AP departments are moving beyond transactional tasks and becoming strategic advisors within finance teams [4].

Conclusion: The Strategic Future of Accounts Payable

As we move further into 2025, AP is solidifying its role as a critical driver of efficiency, cost savings, and financial strategy.

Automation, AI, and advanced analytics have transformed invoice processing, fraud detection, and cash flow management, allowing AP teams to deliver measurable business value.

Key milestones in AP transformation include:

- Invoice processing costs reduced by 78% due to automation

- Touchless processing rates exceeding 50% in best-in-class organizations

- Approval cycles dropping to just 3.5 days, improving cash flow and supplier relationships [4][5][6].

Beyond efficiency gains, AP is now a strategic pillar of financial performance. Organizations that prioritize automation and analytics will continue to optimize working capital, prevent fraud, and enhance supplier collaboration.

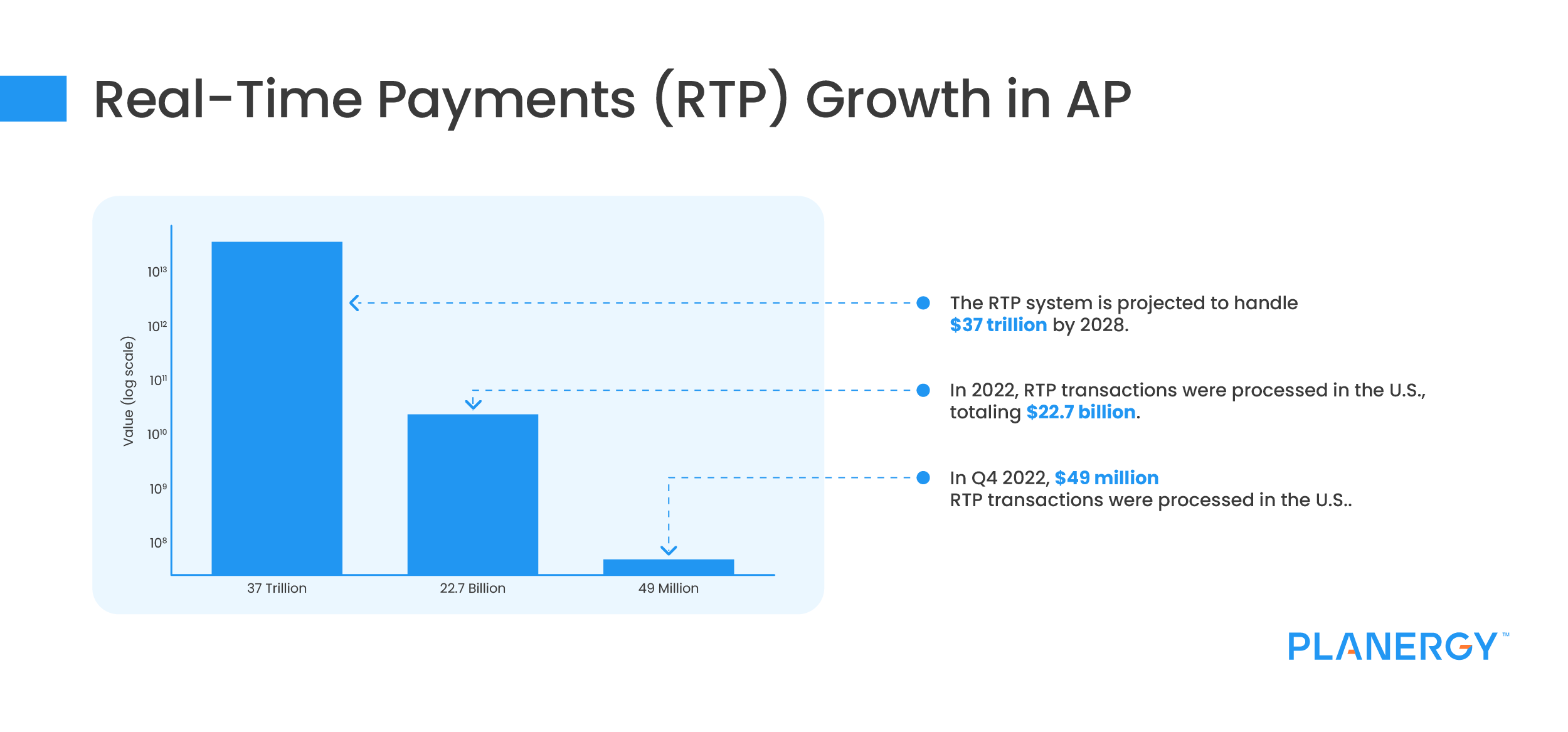

Looking ahead, the evolution of AP will be shaped by further AI adoption, global compliance mandates, and the continued shift toward real-time payments.

Businesses that embrace these trends will position their AP teams as drivers of financial resilience and long-term success in 2025 and beyond.

References

[1] EY. “CFO Evolution: Strategic Vision and Tech in Modern Finance.” EY. Available at: https://www.ey.com/en_us/services/consulting/finance-consulting-services/cfo-evolution-strategic-vision-and-tech-in-modern-finance [Accessed on: 10 March 2025]

[2] Gartner. “CFO Survey Highlights 2023.” Gartner. Available at: https://www.gartner.com/doc/reprints?id=1-2DNDPWDY&ct=230515&st=sb. [Accessed on: 10 March 2025]

[3] Deloitte. “2024 Working Capital Roundup.” Deloitte. Available at: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/Advisory/rfa_8818769_workingcapitalroundup_2024_v5_050724.pdf. [Accessed on: 10 March 2025]

[4] PYMNTS. “Leveraging Digitization and Automation to Improve AP.” PYMNTS. Available at: https://www.pymnts.com/accounts-payable/2023/pymnts-intelligence-leveraging-digitization-and-automation-to-improve-ap/. [Accessed on: 10 March 2025]

[5] Deloitte. “Strategies for Optimizing Your Accounts Payable.” Deloitte. Available at: https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/finance/ca-en-FA-strategies-for-optimizing-your-accounts-payable.pdf. [Accessed on: 10 March 2025]

[6] Ardent Partners. “Accounts Payable Metrics that Matter 2023.” Sponsored by Tradeshift. Available at: https://tradeshift.com/wp-content/uploads/2023/02/ArdentPartners-AP-MTM2023-Tradeshift-FINAL.pdf. [Accessed on: 10 March 2025]

[7] PYMNTS. “Manual Payments Processes Often Slow Small Business Growth.” PYMNTS. Available at: https://www.pymnts.com/accounts-payable/2023/manual-payments-processes-often-slow-small-business-growth/. [Accessed on: 10 March 2025]

[8] SAP Concur. “AP Automation Trends 2023 Survey Report.” SAP Concur. Available at: https://www.concur.com/sites/default/files/ap_automation_trends_2023_survey_report_v2.pdf. [Accessed on: 10 March 2025]

[9] Ardent Partners. “The State of ePayables 2024: Money Never Sleeps.” Andrew Bartolini, Founder & Chief Research Officer, Ardent Partners. Available at: https://ardentpartners.com/ardent-partners-the-state-of-epayables-2024/. [Accessed on: 10 March 2025]

[10] European Commission. “Compliance with eInvoicing Standard.” European Commission. Available at: https://ec.europa.eu/digital-building-blocks/sites/display/DIGITAL/Compliance+with+eInvoicing+standard. [Accessed on: 10 March 2025]