Whether it’s a lack of staffing, an increase in invoices that need to be processed, or outdated manual processes causing costly delays, many businesses turn to accounts payable outsourcing services to get back on track.

While not a solution for every business, accounts payable outsourcing streamlines AP workflows, can lower operational costs, provide real-time financial data, and simplify the bookkeeping process for your business.

Understanding Accounts Payable Outsourcing

Accounts payable outsourcing is handing over the reins to a third-party provider that specializes in offering accounting services which should include the following accounts payable functions:

Invoice Receipt

When you outsource AP functions, vendor invoices will be directed to the company that you’ve hired to process your accounts payable.

The company will receive both hard copies of invoices and those that are sent electronically.

Invoice Verification

Every invoice that is received will be verified for authenticity.

The verification process should include matching invoices against purchase orders and shipping receipts for accuracy.

This process also helps spot fraudulent invoices and identify duplicates.

Invoice Processing

The key to processing invoices promptly is using automation.

Companies managing AP will typically scan an invoice automatically into their system, extracting data from the invoice into a payables item.

In addition, invoice processing will also handle any subsequent debit or credit memos relating to accounts payable.

Invoice Approvals

The approvals process routes invoices directly to designated staff members based on approval rules established by your company.

Managing Vendors

An important aspect of accounts payable is properly managing vendors.

In most cases, this would include vendor onboarding, ongoing vendor management, answering questions, and handling any correspondence and potential disputes.

Payment Processing

A reputable AP service will ensure that the invoices they receive are paid at the appropriate time, which helps maintain positive cash flow for your business.

Reporting and Reconciling

An outsourcing service will regularly reconcile all AP-related accounts, which helps maintain accuracy, identify issues that need to be addressed, and produce accurate reports.

The Benefits of Outsourcing Accounts Payable

There are numerous benefits to using an accounts payable outsourcing service that should be taken into consideration when determining if outsourcing is right for your business.

Cost Savings

Choosing to outsource AP can result in significant cost savings for businesses, including reduced invoice processing costs, labor costs, and the ability to take advantage of early payment discounts.

However, costs can change and cost savings alone should never drive the decision to outsource. Instead, consider the value outsourcing brings to your business.

Timely Processing

One of the biggest benefits derived from outsourcing accounts payable is the timely processing of invoices using AP automation which scans, extracts data, and populates invoices for payment.

Timely payment processing also means that companies are able to take advantage of early payment discounts while avoiding late fees.

Fraud Reduction

Outsourcing AP tasks reduces the chance of payment fraud, particularly for businesses that are using manual processes or writing paper checks to vendors.

Reduces Common Processing Errors

Data entry errors can lead to duplicate payments, payments made in the wrong amount, or late payments.

By scanning invoices into an automated system, manual data entry is bypassed, reducing or even eliminating many of the common invoice processing errors.

Enhanced Reporting and Visibility

Having access to real-time expense reporting can lead to better cash flow management while also providing the information needed to make more informed decisions.

Cost Savings Through Accounts Payable Outsourcing

For businesses operating on a small budget, using an outsourcing service to process accounts payable can be more cost-effective than hiring an experienced accounts payable team.

Even if you currently have a full AP team, outsourcing can result in lower costs if the department currently relies on manual or outdated AP processing.

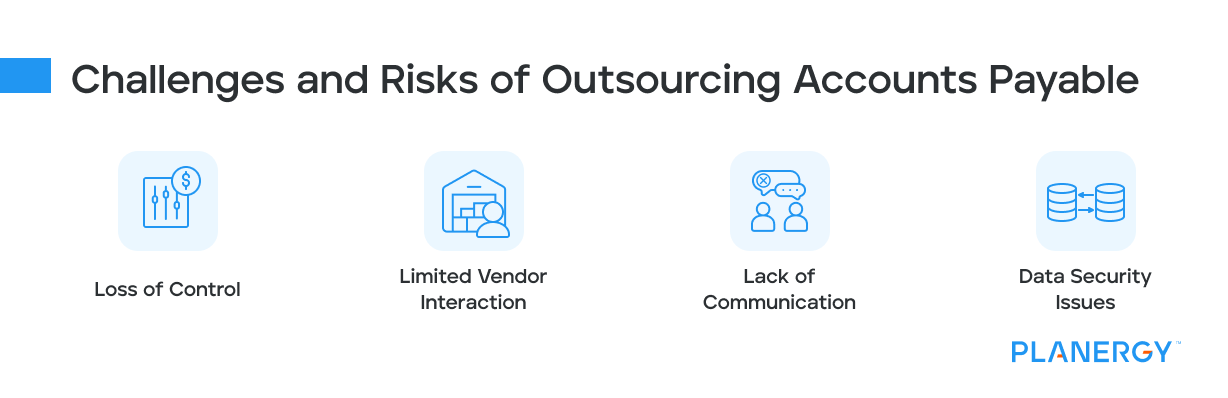

Challenges and Risks of Outsourcing Accounts Payable

While the benefits of outsourcing accounts payable are significant, doing so brings its own set of challenges and risks.

Loss of Control

When you turn over the accounts payable process to a third party, you assume that they will carry out their end of the agreement, which includes processing payments accurately and timely.

If they don’t, your business reputation, your vendor relationships, and possibly even the business itself will bear the consequences.

Limited Vendor Interaction

Conversations and correspondence with vendors will become the job of the business that you contract with to manage your accounts payable.

This can become a problem if vendor questions are not promptly answered or worse, ignored entirely.

Lack of Communication

When outsourcing, communication challenges may arise, leaving you powerless to handle potential issues such as late or erroneous payments, or other vendor or supplier issues.

Depending on where the outsourcing company is located, there may also be a time difference, making it difficult to maintain contact during regular business hours.

For example, if an outsourced AP department is late paying a bill, you may not even know about it, since all correspondence will be between the outsourcing company and your vendor.

Data Security Issues

AP outsourcing companies have access to confidential financial information such as credit card and bank account details.

Are you comfortable that they are doing everything they can to keep that information safe?

How to Choose the Right Accounts Payable Outsourcing Partner

When choosing an accounts payable outsourcing company for your business, look closely at the following categories.

Expertise and Reputation

Does the outsourcing provider have significant experience in the field?

Do they offer access to current clients for references or case studies for review?

Does that have a good reputation in the industry? These are all things you’ll want to take a look at before signing a contract.

Technology Available

Does the service provider use advanced technology when processing AP for businesses?

This should include cloud connectivity, electronic invoicing, invoice extraction using OCR technology, data capture, and electronic approvals.

You’ll also want to take a very close look at how they secure their systems to ensure that they are compliant with all regulations and that sensitive data will remain inaccessible to unauthorized users.

Customization

Every business is different.

Is the outsourcing provider able to offer custom services to suit your business needs or do they offer a one-size-fits-all option?

For example, if you wish to retain vendor communications in-house, will you be able to do so?

Services Available

Does the AP outsourcing provider offer a long list of services for you to utilize?

You may only want to simply hand over the bill payment portion of your business, but if you’re ready to relinquish control of the entire department, is that an option?

Communication and Support

Clear communication with any AP outsourcing provider is vital.

Does the company maintain regular communication with their customers?

Are they notified if there are vendor issues? Most importantly, will your questions and concerns be addressed in a timely fashion or put on the back burner?

Technological Tools in Accounts Payable Outsourcing

The companies that provide AP outsourcing typically utilize a variety of automated tools to streamline the entire accounts payable process.

After all, there’s no point in outsourcing your payables if the business you’re outsourcing to is still using antiquated processing techniques.

Here’s a rundown of the technology that should be available at AP outsourcing companies.

Cloud-Based Technology

Cloud-based technology is a must for companies processing AP.

A cloud-based application allows real-time access to data and reports and utilizes an entirely paperless process, eliminating the need to file and store documents.

Complete Automation

One of the most time-consuming tasks for the accounts payable department is entering and approving invoices.

Manual data entry is ripe for errors and paper invoices are often lost in the routing process, ending up on the wrong person’s desk.

Using the latest technology which includes machine learning and artificial intelligence allows outsourcing companies to extract and capture invoice data, electronically route the invoices to the appropriate approvers, and process the invoice for payment in days, not weeks.

Mobile Capability

With the current workforce becoming extremely mobile, the system used must be completely accessible to employees, whether they’re working at the office, at home, or a local coffee shop.

Real-Time Reporting

With real-time reporting, you’ll have immediate access to complete accounts payable reporting including spend totals, allowing staff and the CFO to make more informed decisions.

Enhanced Security

AP outsourcing companies use a variety of security measures to ensure that data is kept secure.

These measures can include data encryption, controlled system access, regular security audits, and other safeguards designed to prevent unauthorized system access.

Scalability

Businesses handling outsourced accounts payable should be able to scale operations up as your business grows, so you won’t have to search for a new provider.

The Impact of Accounts Payable Outsourcing on Cash Flow and Working Capital

Outsourcing accounts payable can be an effective solution for smaller businesses that have struggled with slow invoice processing times or consistently pay invoices late, as the decision will directly impact cash flow and working capital.

But how do accounts payable balances affect cash flow? It’s simple.

Any money not being spent is considered short-term cash flow and can be used for other purposes.

For instance, an increase in your accounts payable balance will also increase short-term cash flow since it’s an indication that money has not yet been spent.

On the other hand, a decrease in your accounts payable balance will reduce cash flow since it’s an indication that cash has been spent.

Let’s say you have Net 30 terms with most of your vendors. If you pay an invoice well before it’s due, you’ll be decreasing your cash flow.

However, if you wait until it’s due to pay the invoice, your available cash flow increases, allowing you to pay bills that are due earlier or invest the extra funds in the business.

Outsourcing AP can also indirectly impact cash flow, particularly if your business has struggled to make timely payments in the past since paying bills on time can lead to better AP terms, product discounts, and cost savings.

Even a small change like moving from Net 30 to Net 45 terms will increase your short-term cash flow for an additional fifteen days.

However, should your vendor change your payment terms from Net 30 to Net 15 as a result of late payments, you would effectively reduce your cash flow by fifteen days.

Future Trends in Accounts Payable Outsourcing

Look for accounts payable outsourcing providers to continue to utilize the latest technology to streamline the business process.

This includes using the latest AI and Robotic Process Automation (RPA) to improve services end-to-end.

Outsourcing companies are also beginning to focus more on vendor and supplier management, as well as provide more in-depth analytics to their customers.

And with new threats appearing every day, outsourcing companies are looking for better solutions to prevent data breaches and unauthorized access to customer information.

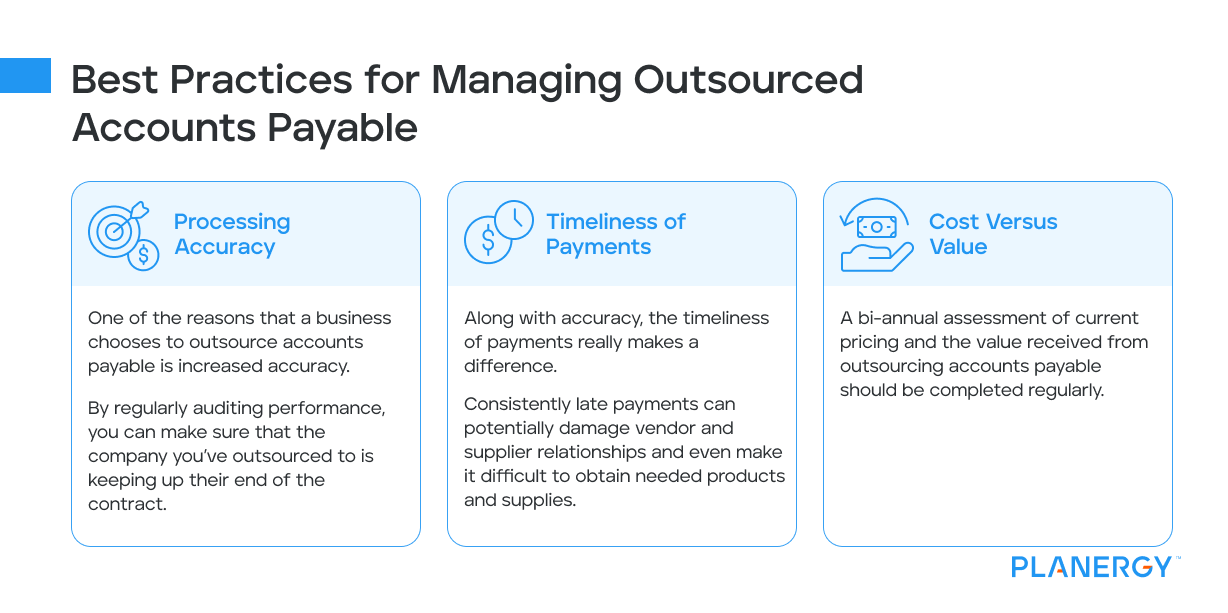

Best Practices for Managing Outsourced Accounts Payable

Turning over your accounts payable to an outsourcing company is only the beginning.

Ongoing oversight of their performance is key to maintaining a good working relationship while also ensuring that your vendors and suppliers are paid accurately and on time.

Before committing to a specific outsourcing company, be sure that they will provide monthly reports that provide detailed information in the following categories.

Processing Accuracy

One of the reasons that a business chooses to outsource accounts payable is increased accuracy.

By regularly auditing performance, you can make sure that the company you’ve outsourced to is keeping up their end of the contract.

Timeliness of Payments

Along with accuracy, the timeliness of payments really makes a difference.

Consistently late payments can potentially damage vendor and supplier relationships and even make it difficult to obtain needed products and supplies.

Cost Versus Value

A bi-annual assessment of current pricing and the value received from outsourcing accounts payable should be completed regularly.

Circumstances change and what may have been cost effective in the past may not be part of your long-term plan.

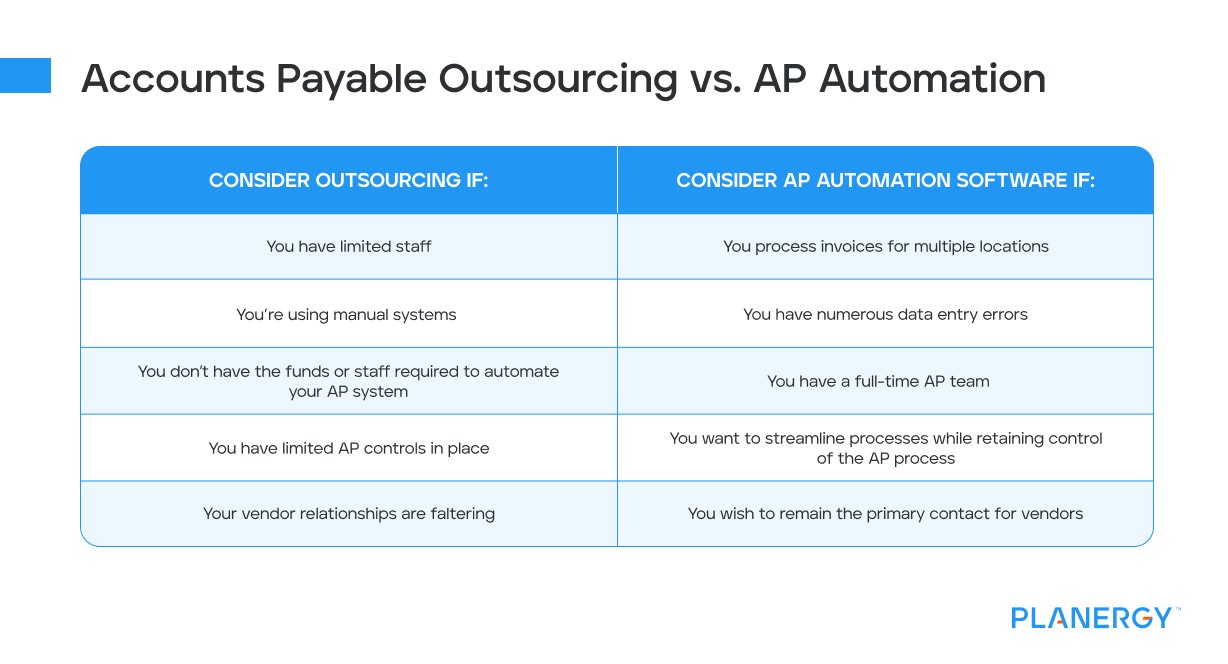

Accounts Payable Outsourcing vs. AP Automation

Business owners have two viable accounts payable solutions.

For small businesses with limited staff or financial resources, utilizing accounts payable services may be the best solution.

However, if you currently have an accounting staff but are struggling with manual processes, instead of outsourcing, you may want to consider updating your in-house accounts payable processes with an automated accounting system or ERP.

Using automation will provide everything that outsourcing provides, and may be a better option for businesses that wish to retain complete control of their AP process.

| Consider Outsourcing if: | Consider AP Automation Software if: |

|---|---|

| You have limited staff | You process invoices for multiple locations |

| You’re using manual systems | You have numerous data entry errors |

| You don’t have the funds or staff required to automate your AP system | You have a full-time AP team |

| You have limited AP controls in place | You want to streamline processes while retaining control of the AP process |

| Your vendor relationships are faltering | You wish to remain the primary contact for vendors |

Outsourcing solutions and accounts payable automation both use the latest technology to streamline the entire AP process from invoice receipt to vendor payment.

It’s up to each business to examine the pros and cons for each and decide which option works best for their short-term and long-term goals.

For many organizations, using an in-house accounts payable automation solution like PLANERGY offers the efficiency benefits of outsourcing while maintaining complete control over financial processes.