You can determine the liquidity of your business by calculating several common ratios.

The results of these metrics provide you with keen insight into your current liquidity and help determine if improvements are needed.

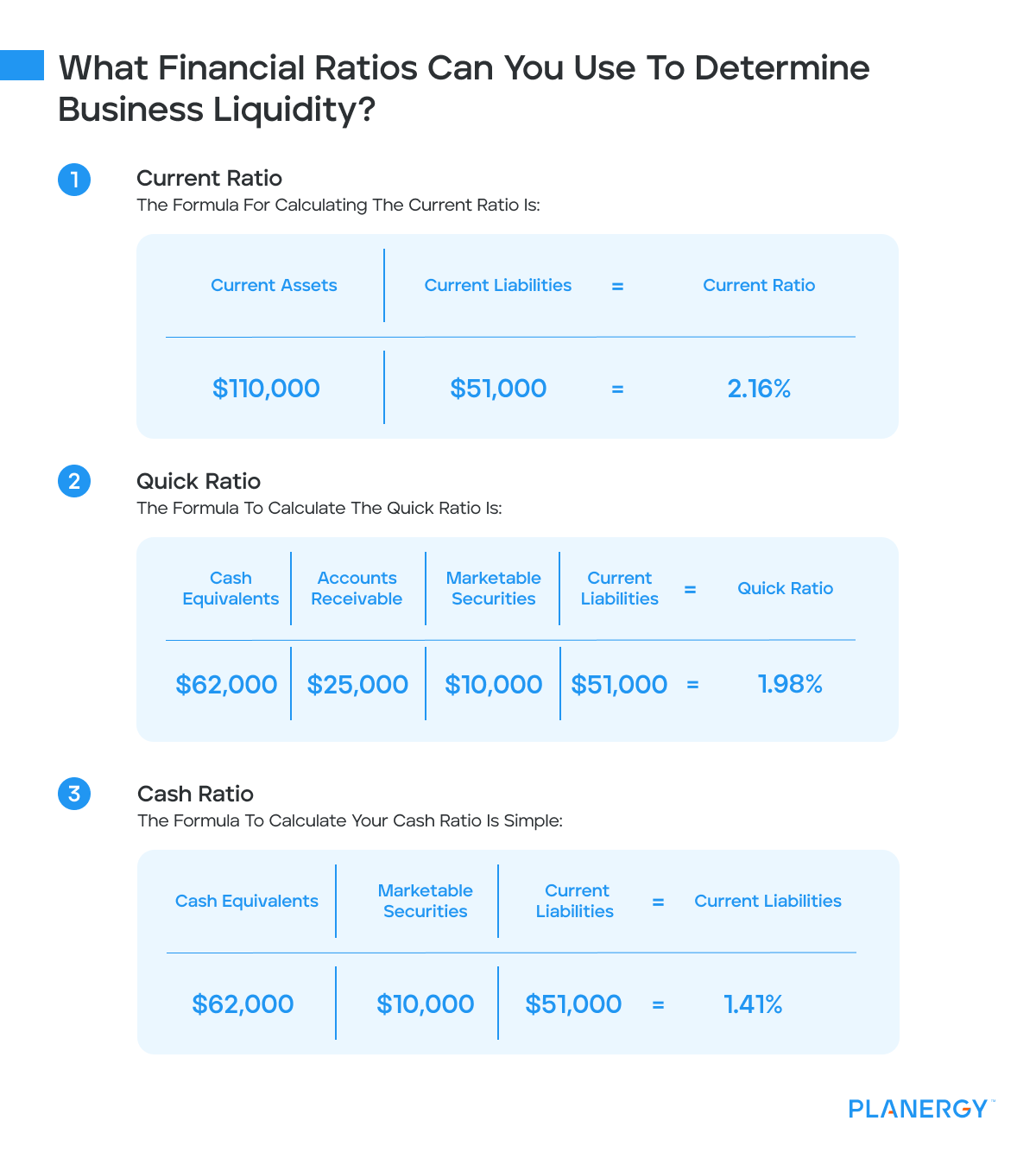

Current Ratio

The current ratio, also known as the working capital ratio, is the easiest ratio to calculate and determines the number of times a business can use its current assets to pay for its current liabilities.

The formula for calculating the current ratio is:

Current Assets / Current Liabilities = Current Ratio

Let’s say your business balance sheet shows current assets that total $110,000 and current liabilities of $51,000:

$110,000 / $51,000 = 2.16

The above result means that you can cover your current liabilities at least twice, with some funds left over.

Businesses should always strive to have a current ratio of at least 1 which indicates that you have as much in current assets as you have in current liabilities.

A current ratio below one can indicate liquidity issues, though this can vary from business to business, depending on the industry.

Quick Ratio

The quick ratio, also known as the acid test ratio is similar to the current ratio, but does not include inventory totals in the measurement.

The quick ratio also excludes prepaid expenses because it’s unlikely that prepaid expenses can be converted to liquid assets quickly.

The formula to calculate the quick ratio is:

(Cash Equivalents + Accounts Receivable + Marketable Securities) / Current Liabilities = Quick Ratio

Using the example above, we’ll want to remove inventory totals, which totaled $13,000, while including $62,000 in cash equivalents, a $25,000 accounts receivable balance, and marketable securities of $10,000, with current liabilities totaling $51,000.

We would calculate the quick ratio as follows:

($62,000 + $25,000 + $10,000) / $51,000 = 1.98

The quick ratio calculation result is less than the current ratio, but not significantly so. This would change if your inventory totals were much higher.

With a result of 1.98, you can nearly cover your current liabilities twice with your current assets.

When calculating the quick ratio, it’s important to take accounts receivable collections methods into account when analyzing your quick ratio results, since a fast AR turnover means that the funds will be available if necessary while slow AR turnover can result in a higher quick ratio but less actual liquidity.

Again, most businesses should strive for a minimum quick ratio of at least 1, even though there are occasions when it may drop below 1 without lasting damage.

Cash Ratio

The final liquidity ratio useful for determining business liquidity levels is the cash ratio.

The cash ratio includes only the most liquid assets like cash equivalents and marketable securities, while excluding both inventory and accounts receivable, which may take longer to convert to cash.

The formula to calculate your cash ratio is simple:

(Cash Equivalents + Marketable Securities) / Current Liabilities

Using the numbers from the example above, let’s run the cash ratio for the business.

($62,000 + $10,000) / $51,000 = 1.41</p

You can see that using the most conservative calculation method, your liquidity has dropped considerably, from being over 2 to less than 1.5.

While the result is still within the acceptable range, it can be helpful to calculate liquidity using all three ratios to see exactly what liquidity level your business is at when removing inventory and accounts receivable totals.