We’ll calculate the cash conversion cycle for Ron, who owns a manufacturing company that sells wire harnesses that are used in airplanes.

Ron is worried that it’s taking too long to get his completed wire harnesses to customers, so he decides to calculate his CCC for 2022. The entire process will take four steps.

Note that all of the calculations below are using 365 days as the multiplier. This is because Ron is calculating the CCC for the entire year.

If he were to calculate CCC quarterly, he would use the number of days in the quarter as the multiplier.

-

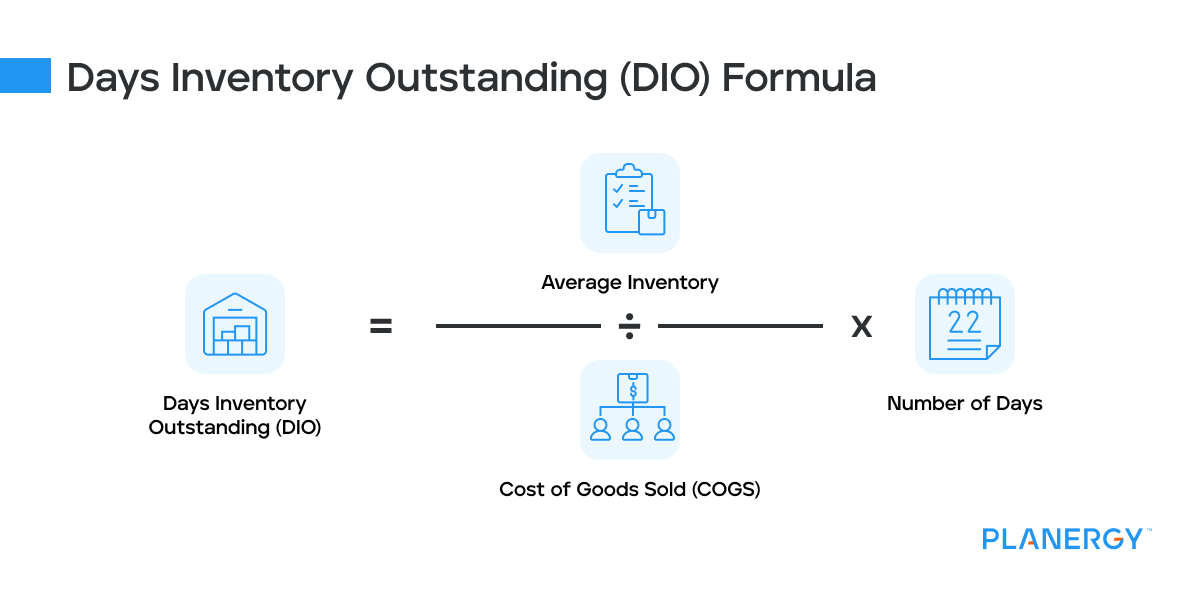

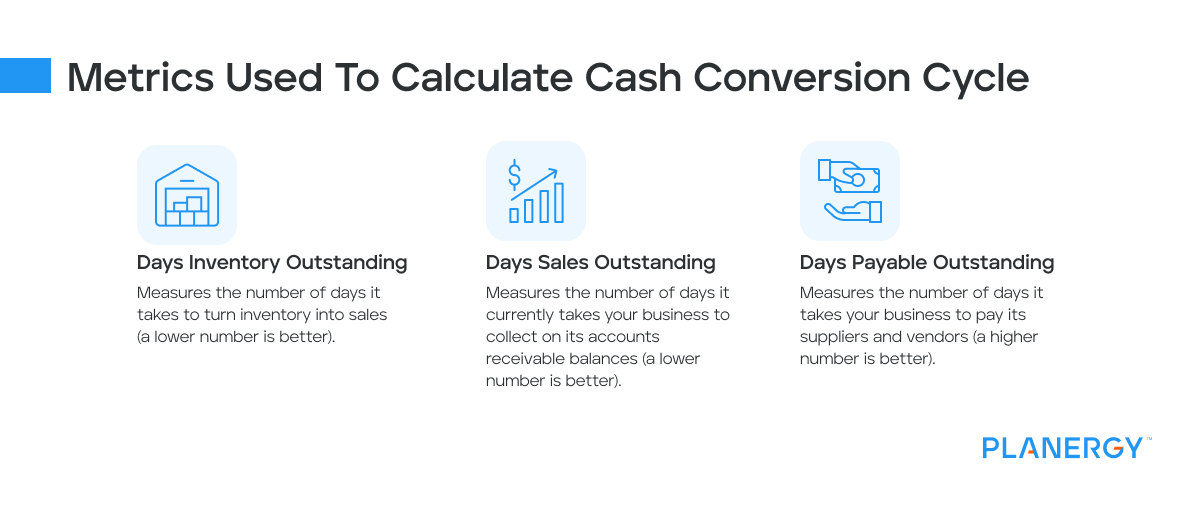

Calculate Days Inventory Outstanding

The formula for calculating DIO is:

Average Inventory / COGS x 365 – DIO

This calculation takes two steps. First, Ron will need to calculate his average inventory for 2022. He can look at his income statement for his beginning and ending inventory balances to get his average inventory.

For Ron’s company, the beginning inventory total was $95,000 while the ending inventory balance was $104,000. Ron’s total cost of goods sold (COGS) for the year was $615,000. Ron will calculate his DIO as follows:

($95,000 + $104,000) / 2 = $99,500 Average Inventory Cost

Now that Ron has his average inventory cost, he can calculate DIO.

$99,500 / $615,000 x 365= 59.05

This result means that it took Ron 59 days to turn his inventory into sales in 2022. A lower DIO value is best since it indicates that inventory turnover is faster, which means increased sales.

A higher DIO can indicate that it’s taking too long to convert inventory and other supplies into a saleable product.

-

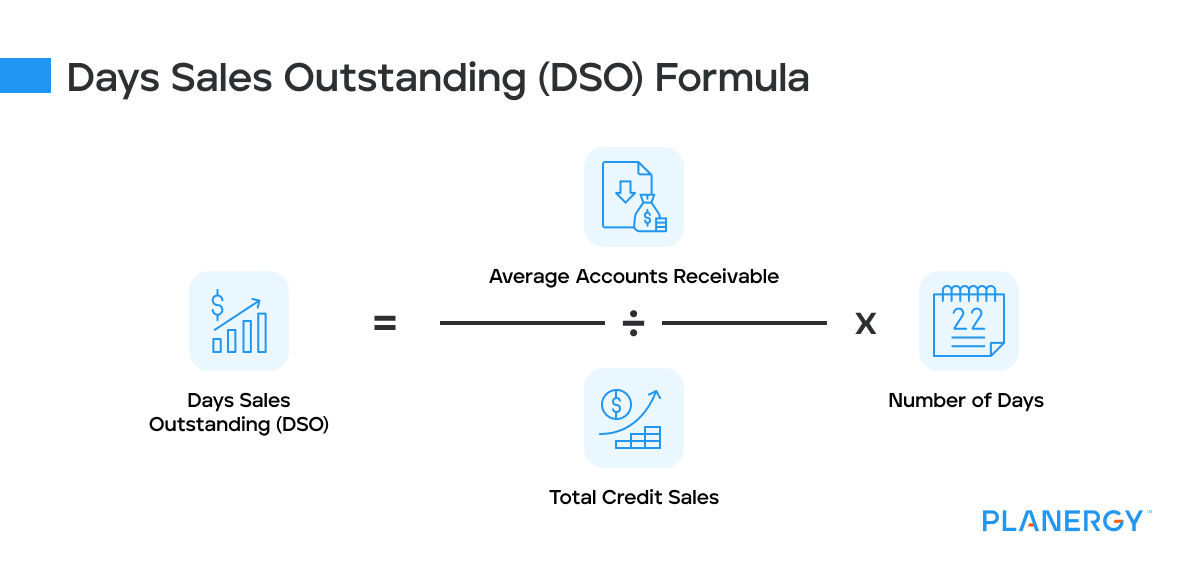

Calculate Days Sales Outstanding

The formula for calculating DSO is:

Average Accounts Receivable / Total Credit Sales x 365 = DSO

Days sales outstanding or DSO is an important metric even if you don’t calculate CCC since it measures the number of days it takes for you to collect on accounts receivable balances.

Like DIO, calculating DSO is a two-step process. First, Ron needs to calculate his average accounts receivable balance for the year.

In this case, Ron’s beginning accounts receivable balance was $75,000, with an ending balance of $87,000, with both obtained from his balance sheet. His total credit sales for the year are $870,000.

But before he can calculate DSO, he’ll need to find his average accounts receivable balance.

($75,000 + $87,000) / 2 = $81,000 Average Accounts Receivable Balance

Now, Ron can calculate his DSO:

$81,000 / $870,000 x 365 = 33.9

This means that it’s taking almost 34 days for an invoice to be paid. Ron’s result is fairly good, but again, a lower DSO is better, since the lower the result, the quicker your customers are paying you.

-

Calculate Days Payable Outstanding

The formula for calculating Days Payable Outstanding or DPO is:

Average Accounts Payable / Cost of Goods Sold x 365 = DPO

DPO is another important metric for businesses to calculate, independent of the CCC.

Days payable outstanding (DPO) is the average time it takes to purchase and pay suppliers, creditors, and vendors. Again, calculating DPO is a two-step process.

For 2022, Ron had a beginning accounts payable balance of $91,000 with an ending balance of $84,000. His cost of goods sold, which we mentioned earlier, was $615,000.

($91,000 + $84,000) / 2 = $87,500 Average Accounts Payable.

Now, Ron can calculate his DPO:

$87,500 / $615,000 x 365 = 51.93

That means that it takes Ron nearly 52 days to pay his suppliers and vendors.

Unlike the first two calculations, a higher DPO is optimal, because the longer it takes to pay your accounts payable balances, the better your cash flow management.

-

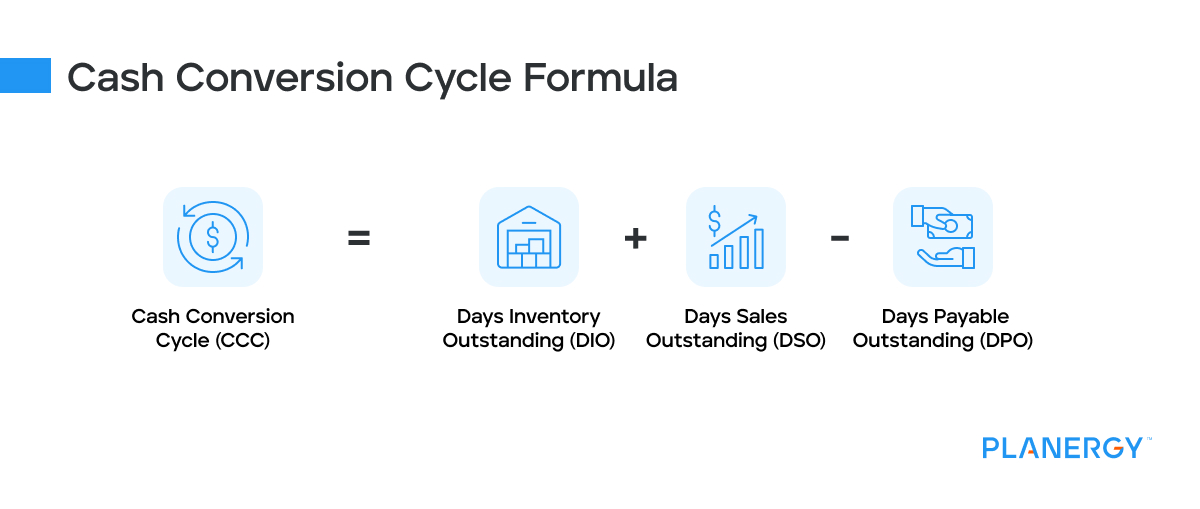

Calculate Cash Conversion Cycle

Now that Ron has calculated the days inventory outstanding, days sales outstanding, and days payable outstanding, he’s ready to calculate the cash conversion cycle using the CCC formula.

DIO + DSO – DPO = CCC

59.05 + 33.9 – 51.93 = 41.02

This result means that Ron’s business is taking 41 days to turn inventory into cash.