Cross-border payments are electronic payments for international transactions where the payer and payee are in different countries.

Transactions can involve people, companies, and banks. Research shows the value of these payments is projected to reach more than $250 trillion by 2027, so this area of the global payments ecosystem is growing rapidly.

Data also shows the cross-border payments market is expected to represent 27% of the total global ecommerce spend ($52.7 trillion) by 2027.

At their core, cross-border payments involve multiple intermediaries such as banks, payment processors, and foreign exchange providers.

Understanding this process is crucial for businesses aiming to streamline payments efficiently.

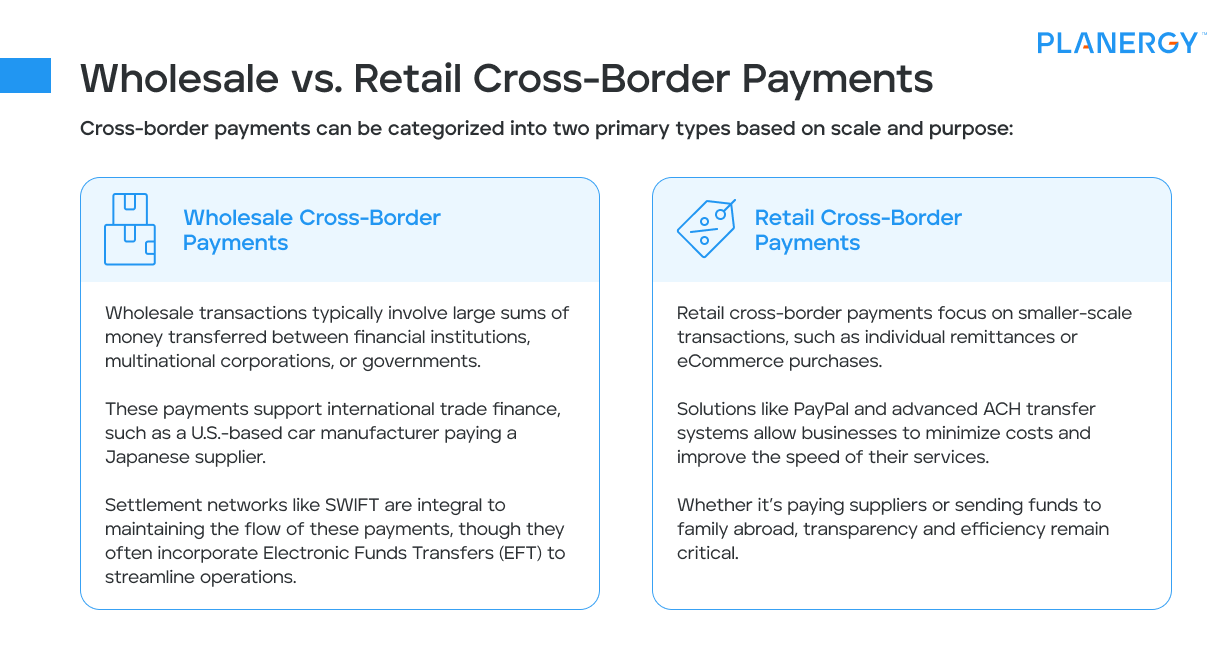

Wholesale vs. Retail Cross-Border Payments

Cross-border payments can be categorized into two primary types based on scale and purpose:

Wholesale Cross-Border Payments

Wholesale transactions typically involve large sums of money transferred between financial institutions, multinational corporations, or governments.

These payments support international trade finance, such as a U.S.-based car manufacturer paying a Japanese supplier.

Settlement networks like SWIFT are integral to maintaining the flow of these payments, though they often incorporate Electronic Funds Transfers (EFT) to streamline operations.

Retail Cross-Border Payments

Retail cross-border payments focus on smaller-scale transactions, such as individual remittances or eCommerce purchases.

Solutions like PayPal and advanced ACH transfer systems allow businesses to minimize costs and improve the speed of their services.

Whether it’s paying suppliers or sending funds to family abroad, transparency and efficiency remain critical.

How Do Cross-Border Payments Work?

Cross-border payments may seem straightforward, but the process can be pretty intricate due to the involvement of intermediaries and regulatory frameworks.

Initiation

The process begins when the payer provides payment instructions through a bank, payment platform, or other financial service provider.

For instance, a small business in the U.S. may initiate a wire transfer to pay a supplier in Japan.

The payer’s bank or platform ensures the funds are debited and flagged for transfer.

Transaction Routing

The payment is routed through several intermediaries before reaching the recipient’s financial institution.

These intermediaries often include correspondent banks, each adding a layer of processing complexity.

Automated routing, when paired with invoice reconciliation, minimizes errors and improves transaction clarity, helping businesses better manage outgoing payments.

For example, a payment from a U.S.-based bank to a European bank might pass through another European bank, serving as the middleman.

Currency Conversion

If the payment is in a different currency, it goes through a currency conversion process. Exchange rates are applied, which can fluctuate based on market conditions.

For example, a U.S. business paying in euros may face additional costs depending on the dollar-to-euro conversion rate.

Settlement

Finally, after deducting fees and adjusting for exchange rates, the funds are deposited into the recipient’s account.

This closure of the financial transaction ensures the recipient can access the funds when cleared.

Both bank reconciliation and real-time fund tracking play essential roles in ensuring the accuracy of these settlements and minimizing errors during audits.

With all these steps, it’s evident that time, regulations, and varying costs can introduce challenges for businesses unfamiliar with the nuances of cross-border payments.

Key Challenges in Cross-Border Payments

High Costs

Every intermediary in the process charges a fee. These include:

- Payment gateway fees for initiating transactions.

- Correspondent fees charged by banks that help process the transaction.

- Currency conversion markups can sometimes add 3–6% to the actual exchange rate.

For example, sending $1,000 internationally may result in recipients receiving only $950 after fees, impacting small businesses operating on tight margins.

Businesses relying on manual processes face additional challenges—but leveraging technologies like electronic invoice presentment and payment (EIPP) can significantly reduce fees and inefficiencies.

Slow Processing Times

Unlike domestic transactions, cross-border payments can take several days, sometimes even a week, depending on the payment method and the countries involved.

The delays come from:

- Time-zone differences

- Manual compliance checks

- Multiple intermediary transfers

These delays can disrupt supply chains or payroll for a company operating on tight cash flow. Blockchain-based solutions, by comparison, can settle payments instantly.

Regulatory Hurdles

While important, regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) laws can complicate cross-border payments.

Documentation requirements and audits may delay transactions, especially if businesses fail to comply with both countries’ standards.

For instance, failing to declare accurate sender or receiver information could flag and freeze the payment.

Exchange Rate Risks

Exchange rates fluctuate due to market changes.

A small business paying a supplier for goods priced in a foreign currency might pay significantly more if rates shift unfavorably in the days leading up to payment.

Fraud and Security Risks

Global transactions are susceptible to phishing attacks, fraud schemes, or even hacking during the payment process.

To secure transactions, businesses need additional safeguards, such as encryption and fraud-monitoring tools.

Understanding Costs and Fees

Transaction Fees

These are fees charged per transaction, primarily by banks or alternative payment platforms.

For instance, a wire transfer might cost $20-$30, while fintech platforms may charge lower fees but include additional processing charges.

Correspondent Bank Fees

Cross-border payments often pass through intermediary banks, known as correspondent banks.

Payments routed via multiple banks may incur fees of $10–30 per bank, especially for regions without direct network links.

Exchange Rate Markups

Payment providers often apply a markup to exchange rates, which can be significantly higher than the mid-market rate on the open currency market.

For small businesses, this hidden cost can add up quickly.

Providers often offer a less favorable exchange rate than the prevailing market rates.

For example, if the actual rate is 1 USD = 0.90 EUR, the provider might apply 1 USD = 0.88 EUR, pocketing the difference.

A U.K. company buying $100,000 worth of materials from a U.S. manufacturer could end up paying hundreds or thousands more due to hidden markups and fees.

Cross-Border Payment Solutions

Traditional Banks

Traditional banks offer reliable options for high-value transactions but frequently involve higher fees for bank transfers, processing delays, and lack the agility modern businesses require.

Fintech Platforms

Platforms like PayPal, Wise, and Revolut leverage technology to offer faster, lower-cost services designed for small and medium enterprises, that are also helpful for invoice compliance.

For example, Wise uses local bank accounts across nations to minimize fees since it processes all money transfers as domestic payments.

SWIFT and Payment Networks

SWIFT remains the backbone of international banking for secure messaging between banks. However, its reliance on correspondent networks often results in slower processing.

Blockchain-Based Solutions

Blockchain eliminates many intermediaries, allowing payments to clear much faster, often in real-time.

For example, Ripple’s XRP enables seamless currency exchanges at a fraction of the cost charged by banks.

The Role of Cross-Border Payments in E-Commerce

Supporting Global Currencies

Accepting multiple currencies makes it easy for businesses to serve international markets without logistical complexity.

For example, platforms like Shopify provide currency conversion tools for online stores selling around the globe.

Offering Fast, Secure Refunds

Customers demand fast refunds, especially when shopping internationally.

A robust cross-border payment system fulfills this need and builds trust with the customer.

Mitigating High Fees

E-commerce thrives on competitive pricing, and high payment fees directly affect margins.

Adopting cost-efficient systems enables businesses to offer improved customer pricing while sustaining profitability.

Blockchain’s Role in Revolutionizing Cross-Border Payments

Speed

Blockchain eliminates delays caused by intermediaries, offering near-instant transactions.

For example, a Bitcoin or Ethereum payment finalizes in minutes compared to days through banks.

Reduced Costs

By reducing the need for correspondent banks, businesses enjoy lower fees.

This is particularly advantageous for startups or small exporters serving global clients.

Transparency

A decentralized ledger ensures all parties can trace the payment’s path, increasing confidence in cross-border deals.

Regulatory and Compliance Issues

Documentation Demands

Cross-border payments often require tax records, export documents, and proof of transaction legitimacy, creating administrative work for businesses.

Audits

Regulatory bodies frequently audit cross-border transactions to prevent money laundering, adding layers of scrutiny.

Payment Delays

Compliance reviews may prolong transaction timelines, particularly for businesses new to these environments.

The Impact on International Trade and Economics

Faster Replenishment of Inventory

Cross-border payments ensure that payments reach global suppliers on time, reducing risks of production delays.

Global Customer Base

International payment systems empower businesses to tap into larger customer bases.

An Indian exporter, for instance, can seamlessly sell to customers in the U.S. through systems like PayPal.

Competitive Advantage

Businesses that stay ahead of payment innovations can cut costs, offer better pricing, and streamline delivery to markets before their competitors.

Emerging Trends and The Future of Cross-Border Payments

The cross-border payment landscape is transforming rapidly due to technological advancements and shifting regulatory frameworks.

Innovations like AI integration, Accounts Payable (AP) automation, and digital currencies are reshaping how businesses and individuals send and receive money internationally.

These trends can potentially make transactions faster, more secure, and cost-effective.

AI Integration

Artificial Intelligence (AI) is emerging as a game-changer in cross-border payments for its ability to enhance efficiency, security, and personalization.

Here’s how AI is shaping the future:

Fraud Detection and Prevention: AI-powered algorithms analyze patterns and flag suspicious transactions in real time.

AI systems can halt the transaction for review if a business typically processes payments under $5,000 but suddenly submits a $50,000 payment to a new account.

This proactive approach reduces fraud risks significantly.

Currency Conversion Optimization: AI can monitor foreign exchange markets to predict fluctuations in exchange rates.

Businesses benefit by timing their payments for more favorable rates, reducing exposure to exchange rate risks.

Personalized Payment Services: Payment providers use AI to analyze customer preferences and recommend tailored solutions, such as suggesting the best channels or payment methods for specific regions.

Automation of Payment Processes: AI eliminates manual work by automating compliance, reconciliation, and reporting tasks.

For instance, platforms can process multiple international invoices faster and with fewer errors.

By integrating AI, businesses and financial institutions can operate more efficiently while enhancing security and reducing costs.

Accounts Payable (AP) Automation

Managing cross-border payments manually can be time-consuming and prone to errors, especially for businesses dealing with numerous suppliers or multi-currency transactions.

AP automation streamlines these processes by digitizing accounts payable activities.

Faster Invoice Processing: Automated AP tools can detect, input, and verify invoice data instantly.

Businesses no longer need to manually cross-check foreign payment details, reducing approval times significantly.

AP automation software allows a global retailer to settle supplier invoices within hours instead of days.

Real-Time Payment Tracking: AP platforms provide transparency by offering real-time payment statuses.

Businesses can identify where payments stand in the cross-border pipeline, reducing uncertainty for both sender and recipient.

Enhanced Compliance Management: AP systems integrate compliance checks into the workflow, helping businesses adhere to international regulations like AML and KYC rules.

This reduces the likelihood of penalties for non-compliance.

Cost Efficiency: Automation reduces operational costs by minimizing human labor while lowering risks related to manual errors.

Overall, AP automation enables businesses to scale globally faster, with less friction and better financial management.

Digital Wallets and Currencies

Digital currencies, including cryptocurrencies and Central Bank Digital Currencies (CBDCs), stand at the forefront of transforming cross-border payments.

These are redefining how value is stored, transferred, and settled internationally.

Cryptocurrencies and Blockchain Technology: Cryptocurrencies like Bitcoin, Ethereum, and stablecoins (e.g., USDC or USDT) are making cross-border payments cheaper and faster.

Blockchain’s decentralized infrastructure eliminates intermediaries, allowing payments to settle almost instantly with minimal fees.

For example, a freelancer in the Philippines can receive payment from a client in Canada in seconds using stablecoins, bypassing high remittance fees.

Blockchain also provides transparency through its immutable ledger, making tracking and verifying transactions easier.

Central Bank Digital Currencies (CBDCs): CBDCs are government-issued digital currencies that function as legal tender.

Central banks across the globe, including those in the EU, China, and the U.S., are exploring CBDCs to enhance the efficiency and security of cross-border payments.

CBDCs reduce reliance on traditional clearinghouses, reducing settlement times from days to seconds.

CBDCs promise easier access to international commerce and financial inclusion for countries with underdeveloped payment ecosystems.

Hybrid Solutions: Some platforms combine cryptocurrencies with fiat systems, enabling businesses to benefit from blockchain’s speed while ensuring compliance with traditional banking regulations.

Mitigating Risks and Fraud

Cross-border payments are inherently complex, making them a prime target for fraudsters and cyberattacks.

To safeguard financial operations, businesses must adopt a proactive approach to mitigating risks.

Multi-Factor Authentication (MFA)

Multi-factor authentication requires users to verify their identity through multiple methods, such as a password, a one-time code, or biometric data.

When initiating a high-value transfer, a CEO may need to input a password and approve the transaction via a fingerprint scan on their phone.

By adding layers of security, MFA dramatically reduces the risk of unauthorized access to accounts and ensures that only verified personnel can conduct transactions.

Partnering with Trusted Providers

Collaborating with payment providers known for stringent security measures can safeguard cross-border payment methods.

Reputable platforms employ encryption, robust compliance programs, and fraud-monitoring systems to protect users.

Conducting due diligence when selecting payment partners is essential to ensuring the safety of your funds.

Regular Transaction Reviews

Fraudulent activity often goes unnoticed without regular monitoring.

Businesses should schedule routine transaction reviews to detect anomalies, such as duplicate payments, unusual transfers, or discrepancies in currency conversions.

An automated transaction audit tool could flag a payment to an unfamiliar bank account in an unexpected country.

By investigating such red flags early, businesses can take corrective measures before significant losses occur.

Employee Training on Payment Security

A well-informed team is the first line of defense against fraud.

Businesses should train employees to identify phishing emails, secure sensitive financial information, and follow best practices for online payments.

Staff should verify vendor payment requests through phone calls to ensure authenticity, especially when dealing with new or one-time transactions.

Implementing Compliance Protocols

AML and KYC regulations are critical for any business making cross-border payments.

Ensuring counterparties meet these requirements helps reduce the risk of handling payments involved in illegal activities.

Businesses can leverage automated KYC tools to streamline onboarding for their international partners while remaining compliant.

Real-Time Fraud Monitoring Tools

Advanced software solutions can track cross-border real-time payments, flagging unusual activity patterns.

AI-powered fraud detection systems can halt payments if the transaction amount differs significantly from a company’s usual spending trends.

Final Thoughts

Cross-border payments are integral to the success of modern businesses operating in the global marketplace.

You can minimize costs and maximize efficiency by understanding their complexities, leveraging new technologies like blockchain and AP automation, and choosing the right partners.

At the same time, staying ahead of trends and regulatory shifts ensures your business remains competitive in an increasingly connected world.