One of the more important jobs that department managers are tasked with is preparing a department budget.

New managers, in particular, may find the budget process daunting at first glance, but following a common-sense approach saves a lot of time and anxiety, and results in an accurate budget.

What Is a Business Budget?

Before you can prepare a budget, you have to understand the purpose behind the budget you’re preparing.

There are several types of budgets that a business usually prepares, with a department budget playing an important role in the overall company budget.

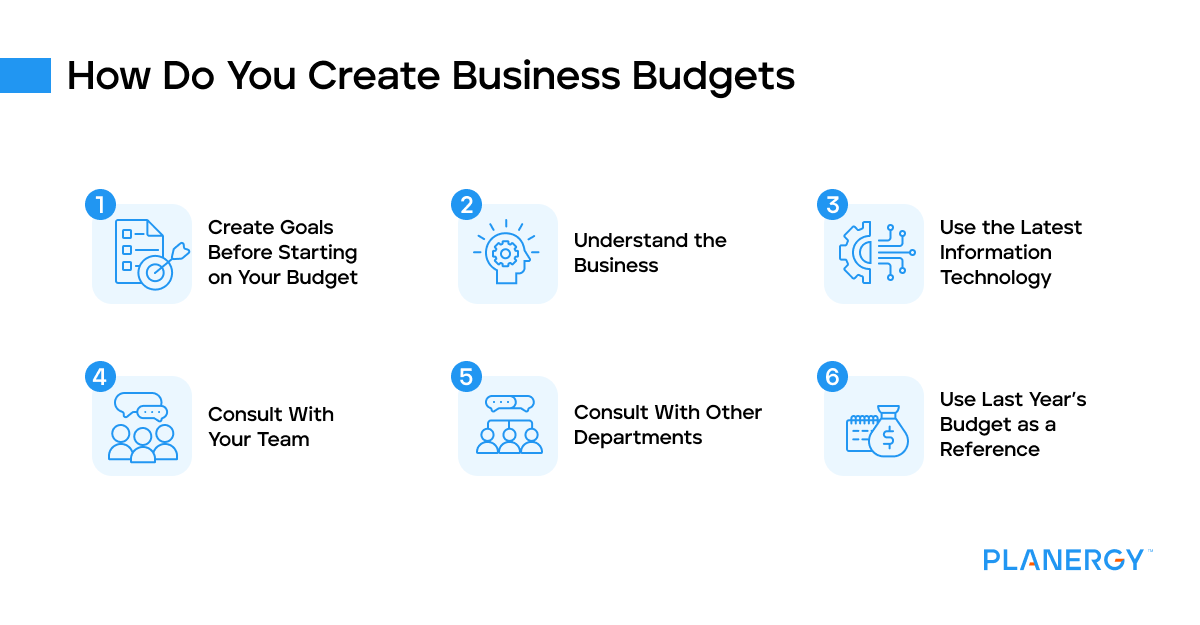

How Do You Create Business Budgets?

Whether you’re creating an operating budget for the entire company or a single department, the strategy remains the same.

By following these simple steps, the budgeting process should be relatively painless.

Create Goals Before Starting on Your Budget

A budget should be an accurate reflection of not only what you expect will occur, but should also reflect any goals that have been set for the upcoming year.

For example, if your goal is to add an employee to your department, you’ll want to factor in their salary in the upcoming budget.

Understand the Business

Even if you’re creating a budget solely for your department, you must have a thorough understanding of the business and its goals for the upcoming year to better prepare a departmental budget that fits in with the overall goals of the organization.

Use the Latest Information Technology

Sure, Microsoft Excel works well for creating budgets.

However specialized budget software works even better while providing budget managers with a way to better manage the budget.

Consult With Your Team

Creating a budget is not a one-person job. Instead, talk to your team and get their input during the budget creation process.

This will not only help ensure more accurate numbers, but it will also give you a much better idea about the workings of the department.

Consult With Other Departments

While they may not be directly involved, consulting with those outside your department will give you a much better picture of the business overall, particularly if one department’s budget will directly impact your own.

Use Last Year’s Budget as a Reference

Using the prior year’s budget can help guide you when preparing a budget for the next year. Pay careful attention to budget totals.

Were revenues understated or overstated? Did expenses exceed the budget? Was the overall budget fairly accurate or was it off?

Answering these questions will make creating a new budget much easier and more accurate.

What Is Budget Management?

Budget management includes planning, creating, and monitoring a budget.

Larger companies typically have multiple budgets that need to be created and monitored and are usually managed by a high-ranking finance professional such as a CFO, Vice President of Finance, or a controller.

However, department heads can also assume responsibility for managing their portion of a prepared budget plan as well.

A good budget manager not only keeps on top of all revenue and spending activity but also incorporates any changes that may occur.

However, managing a budget is not only preparing for and creating a budget but also monitoring and analyzing financial activity that occurs after a budget has been created.

That means that spending totals and incoming revenues should be actively tracked in real-time against the amount budgeted, while variances should be analyzed and corrected when necessary.

Some budget managers find it helpful to monitor a budget for the first half of the fiscal year and then create budget adjustments to better fit current revenue and expense levels.

Using a report like a Budget vs. Actual serves as an excellent starting point for managing budgets, providing a summarized view of what was budgeted against actual expenses incurred and revenues received.

This allows you to take corrective action moving forward by adjusting the budget for better accuracy.

How Do You Structure a Department Budget?

Let’s take a look at a sample department budget template for the first quarter of 2025.

| Income | January | February | March | Total |

|---|---|---|---|---|

| Sales Revenue | ||||

| Other Income | ||||

| Total Revenue | ||||

| Expenses | ||||

| Wages & Salaries | ||||

| Rent | ||||

| Utilities | ||||

| Office Supplies | ||||

| Travel and Entertainment | ||||

| Sales & Marketing Expense | ||||

| Total Expenses |

You can customize the template to reflect your department.

For example, the sales department will want to include related sales expenses such as sales commissions and postage while the education department will want to include event costs and advertising.

Each department’s budget needs to reflect the activities of that particular department.

What Does a Department Budget Do?

A department budget is used to estimate income and expenses for each department in a business.

A department budget is always part of the larger, company budget, and is typically created by the department manager with assistance from key departmental employees.

How Do You Manage a Department Budget?

A department budget is managed the same way that a company budget is but on a smaller scale.

Once a budget has been created, the department manager should regularly review the budget against actual revenue and expenses, to make any necessary changes as needed.

Any changes to the department, such as the addition of a new employee or an added expense such as replacing computers or other equipment should be noted.

One of the biggest challenges faced when managing a department budget is not receiving the proper information timely.

This is common for businesses that use manual systems or are not utilizing a budgeting tool that provides data updates in real-time.

For example, let’s assume you’re managing a department budget using an Excel spreadsheet. One of your employees informs you that their desktop system has crashed and has to be replaced.

You order the computer immediately. When the computer arrives, the invoice is routed to accounts payable, where it sits on the AP manager’s desk for several days before being forwarded to you for approval.

You then move on to other work, forgetting to update your budget data in the spreadsheet.

At the end of the quarter, you review the budget vs. actual report and realize how far off your budget is from what was originally entered.

When using manual systems, it takes a lot of hands to manage all the moving parts needed to keep a budget accurate and up to date.

Unfortunately, if one person fails to do their part, the entire budget system becomes obsolete.

The best way to avoid that is to use an automated budget tool that integrates with your accounting software application, so updated actuals will be available immediately.

What Are the Best Practices for Managing a Departmental Budget Effectively?

Even though a department budget is focused on a single area of the company, it’s still part of the bigger financial management process.

That’s why it’s so important that departmental budget preparation involves others outside the department.

Here’s a list of best practices for preparing a department budget.

Gather Budget Information From Multiple Sources

Talk to department staff as well as those outside the department to get a better idea of where the company is financially.

While looking at previous budgets is a good starting point, getting information from others regarding the direction the company is going in is essential for preparing an accurate budget.

For example, management may be planning an expansion that will directly impact your department, but if you don’t know about it, it won’t be included in the budget.

Plan for Multiple Scenarios

As much time as you put into the budget preparation process, there’s no guarantee that revenues and expenditures will follow the path presented in your budget.

Instead, consider creating multiple scenarios based on the ‘what if’ process.

What if the department has an unexpected expense?

What if you have to hire additional staff? What if you lose a supplier and business production drops?

While many of these things may never happen, preparing for them within your budget can help you manage them much better.

Use a Budgeting Tool That Integrates With Your Accounting Software

While Excel offers excellent budget templates, using a budgeting application that integrates with your accounting software helps ensure that you’re up to date on all revenues and expenses and don’t have to worry about forgetting to enter expenses or revenue in your spreadsheet.

Make Room for Flexibility

Flexibility is key when preparing a budget.

Things can change overnight, and you’ll need to be able to adjust your budget when necessary.

Why Do We Need Budget Allocation?

Budget allocation is used to effectively allocate resources and expenses across multiple departments.

For example, if your business pays health insurance for its employees, you would need to allocate the expense across multiple departments rather than have one department pay for it all.

Revenue from sales also has to be allocated across all departments, with each department receiving a share of revenue, so it will know how much money is available to spend.

How much revenue is allocated to a department depends on several things starting with company priorities.

If an organization’s goal is to increase sales, a larger amount of revenue will likely be allocated to production, advertising, and sales than it is to administrative or overhead costs.

Revenue is also an important consideration when determining allocations. If a company is expecting a revenue increase, it may be more amenable to allocating additional revenue to a department for expenses.

Finally, the needs of each department and their relationship to the company’s overall goals are another consideration.

If a company plans to ramp up production, they are more likely to allocate additional funds for adding employees or upgrading equipment.

What Are Some Effective Strategies for Managing a Department’s Budget To Avoid Overspending?

The best way to avoid overspending is to use a dedicated procurement software like PLANERGY that includes real-time business intelligence reporting along with committed spend vs. budget reports so you don’t have to wait for an invoice to account for spending totals.

Using PLANERGY also eliminates overspending by requiring additional approvals on any items that exceed budgeted totals, notifying you when your spending comes close to reaching the previously budgeted amount.

What Tools Can Help With Managing a Department Budget?

The best way to easily, and accurately manage a department budget is by using a budget preparation software application that integrates with your core accounting software application.

While many companies continue to use Excel for managing budgets, there are drawbacks to doing so, including manual input errors, formula errors, and the inability to share budget details with multiple departments.

And when you’re using an automated budgeting tool, you don’t have to remember to manually update your spreadsheets.

Why Is a Budget Important for Your Business?

Good business operations start with creating a budget that helps your small business use its financial resources wisely.

Preparing and adhering to a business can also help you manage cash flow while reducing rogue spending.

Budget preparation is also an important part of completing a strategic plan.

Finally, a budget serves as a guide for setting and reporting on specific goals while giving businesses the flexibility to adjust the budget should circumstances change.

Remember, effective budget management starts with using the proper tools to better manage your budget.

Doing so helps your business obtain its financial goals, maintain financial stability, and create an accurate financial plan for the future.