Completing and adhering to a budget of financial plan is one of the easiest ways to control spending.

When coupled with a planning tool such as encumbrance accounting, businesses can proactively manage future financial commitments or obligations.

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with PLANERGY.

Completing and adhering to a budget of financial plan is one of the easiest ways to control spending.

When coupled with a planning tool such as encumbrance accounting, businesses can proactively manage future financial commitments or obligations.

There are two types of encumbrances; property and financial. A property encumbrance is used in real estate to place a specific limitation on a property.

Mortgages, property taxes, and liens are examples of property encumbrances.

A financial encumbrance refers to a commitment to allocate or set aside funds for a specific purpose during the fiscal year.

While encumbrance accounting is used more often in government and nonprofit accounting, it can also be used by the general business sector as well.

Encumbrance accounting or commitment accounting is a budgetary control method used to ensure that money is set aside for future financial expenses or commitments.

This type of budgetary control is required in both government accounting and nonprofit accounting since future expenses need to be accounted for properly to ensure that money is available.

But encumbrance accounting isn’t only for the government.

Both privately owned and publicly owned businesses can use encumbrance accounting to better manage their upcoming commitments and expenditures.

To use encumbrance accounting, you’ll need to create two general ledger accounts; an encumbrance account and a reserve for encumbrance account.

When an upcoming commitment or expenditure is identified, it will be posted to these accounts, serving to reserve the required funds until the purchase is complete.

Later, when a purchase order or purchase requisition is processed, the original entry will be reversed, with the actual expense posted to the appropriate GL accounts.

Encumbrance accounting can be used for any type of upcoming expenditure.

For example, you know that you need to purchase new machinery for your small factory and that the equipment will cost $10,500.

Because you’ll be purchasing the equipment in the next quarter, you’ll want to set aside or encumber the funds needed to prevent them from being spent elsewhere.

To record the encumbrance, you’ll need to complete the following encumbrance accounting processes by recording the following journal entries.

| Account | Debit | Credit |

|---|---|---|

| Encumbrances | $10,500 | |

| Reserve for Encumbrances | $10,500 |

The next quarter you purchase the equipment, which ends up costing $10,775.

You’ll need to complete two entries at this time, the first to reverse the encumbrance you created.

| Account | Debit | Credit |

|---|---|---|

| Reserve for Encumbrances | $10,500 | |

| Encumbrances | $10,500 |

The second entry will be to record the actual equipment expense.

| Account | Debit | Credit |

|---|---|---|

| Equipment | $10,775 | |

| Accounts Payable | $10,775 |

At the end of the year, if you have a balance remaining in the encumbrance reserve account, you’ll need to determine if those commitments are still valid or if they will need to be adjusted.

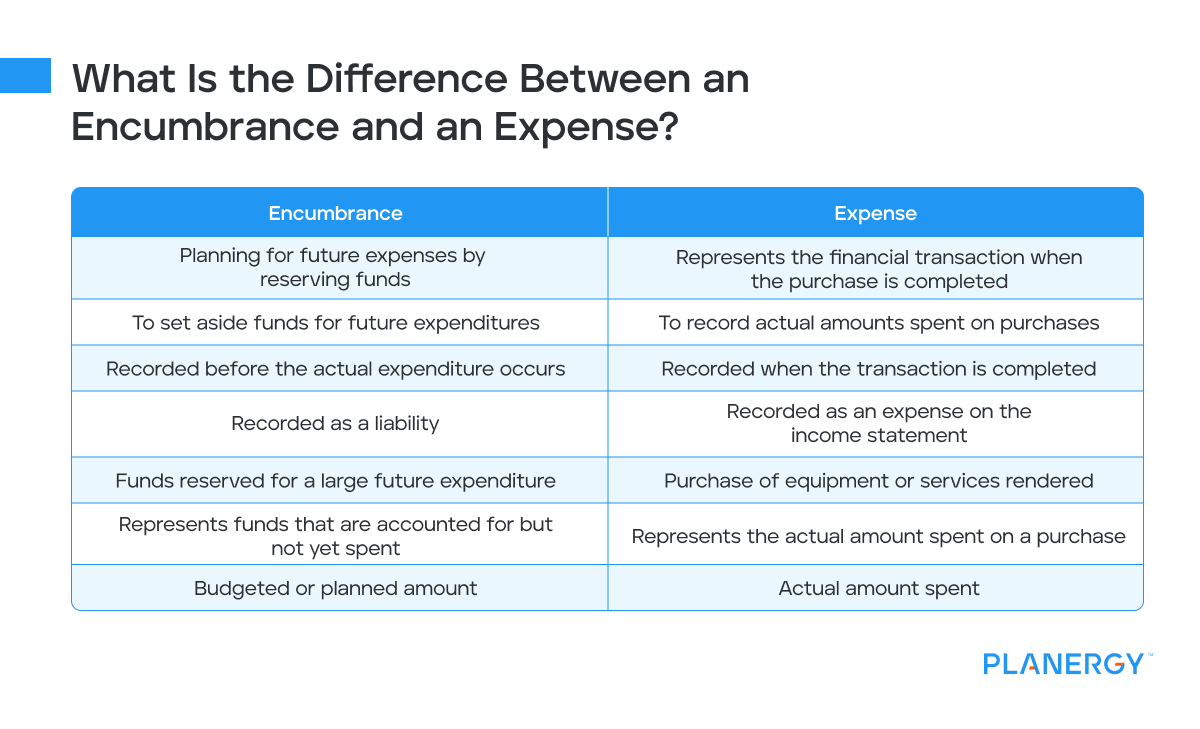

Encumbrances and expenses may seem similar since both represent a cost to your business.

However, an encumbrance is used to plan for future expenses by reserving the funds necessary to cover those expenses.

An expense represents the financial transaction that takes place when the purchase is completed.

For instance, using the example above, the company’s CPA knew that there was a large expenditure pending for the company, but because the expenditure would not be taking place until the next quarter, it could not be recorded on the income statement as an expense.

In addition, because the pending expenditure was for a significant amount of money, the CPA wanted to set aside those funds so that they were not spent elsewhere.

Encumbrances are recorded as a liability on your financial statement, representing funds that are accounted for, even though they have not yet been spent.

On the other hand, an expense represents the actual, not the budgeted amount of something that has been purchased.

An expense occurs when a transaction is completed, such as the receipt of an item or services rendered.

Again, using the example above, once the equipment has been purchased, it is no longer an encumbrance and is considered an expense.

| Encumbrance | Expense |

|---|---|

| Planning for future expenses by reserving funds | Represents the financial transaction when the purchase is completed |

| To set aside funds for future expenditures | To record actual amounts spent on purchases |

| Recorded before the actual expenditure occurs | Recorded when the transaction is completed |

| Recorded as a liability | Recorded as an expense on the income statement |

| Funds reserved for a large future expenditure | Purchase of equipment or services rendered |

| Represents funds that are accounted for but not yet spent | Represents the actual amount spent on a purchase |

| Budgeted or planned amount | Actual amount spent |

Companies may elect to use encumbrance accounting for a variety of reasons, including the following.

Using encumbrance accounting allows companies to better plan for and manage both current and future financial commitments within the budgeting process.

Using a budget also helps businesses refrain from overspending.

For example, you can choose to use encumbrance accounting for the following purposes:

For example, if you live in a flood zone or a hurricane zone, you may want to place funds in an encumbrance account for potential damages that may be incurred.

If the year passes without using the funds, you can choose to either reverse the encumbrance entry or keep it for another year.

For government agencies and nonprofits, many of the funds received are earmarked for a specific project or department.

Using encumbrance accounting helps maintain the appropriate allocations while making sure that the funds are not used for another purpose.

Properly earmarking funds for future commitments promotes financial transparency, a must for investors and financial institutions that have a stake in your business.

Encumbrance accounting can be useful for businesses during the financial planning process since encumbrances allow businesses to set aside funds for future projects without jeopardizing current expenses.

Using encumbrance accounting is a great risk management resource since the process allows businesses to set aside funds for future projects or potential issues that may arise.

For example, if a business has a large contract with a supplier coming up, the expected amount can be encumbered or set aside so that when it’s time for the purchase to be made, the funds have already been allocated toward that project, eliminating a potential fund shortage.

Another example is a pending lawsuit against your company.

Since the outcome of the lawsuit has yet to be decided, it’s a good idea to set aside some funds just in case the decision is not in your favor.

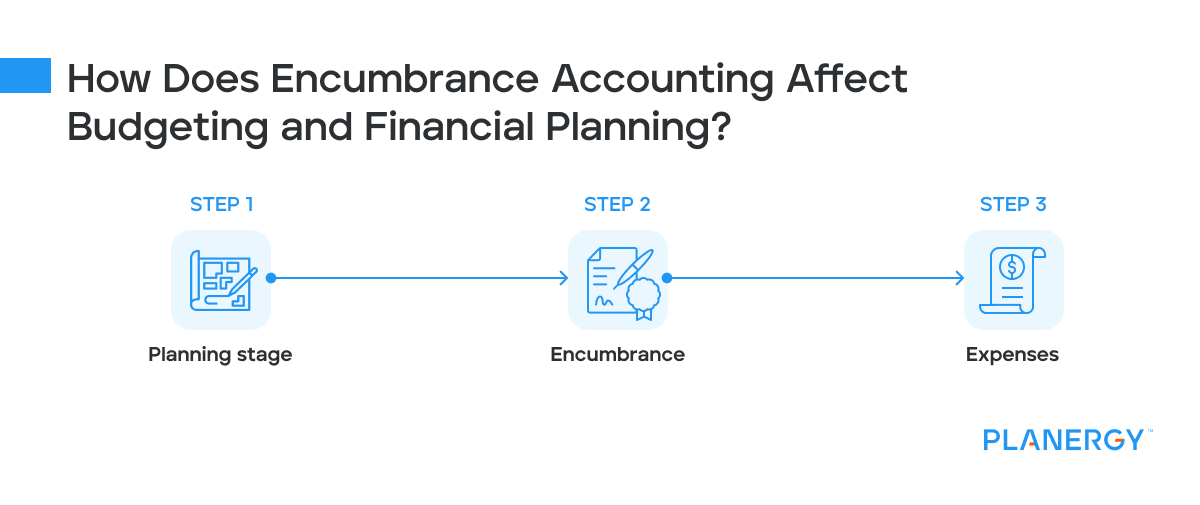

There are three steps involved in the encumbrance process that directly impact budgeting and financial planning.

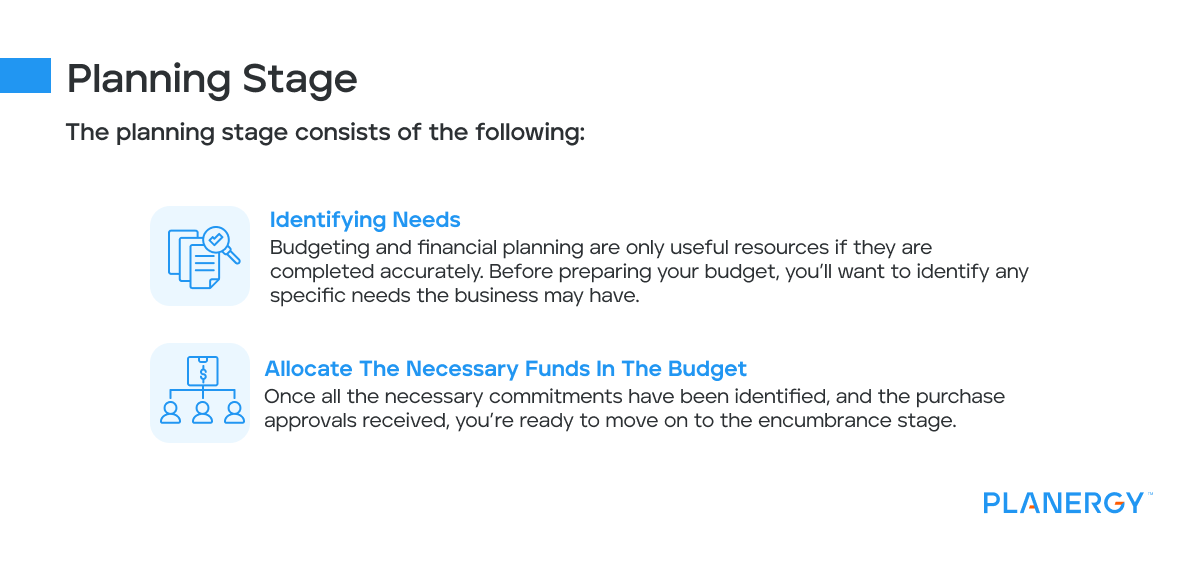

The planning stage called pre-encumbrance, is the stage that will likely impact your budgeting and financial planning processes the most.

The planning stage consists of the following:

Identifying Needs – Budgeting and financial planning are only useful resources if they are completed accurately.

Before preparing your budget, you’ll want to identify any specific needs the business may have.

For example, if you need to purchase a new delivery van, you’ll want to make sure to include that in your budget.

Allocate the Necessary Funds in the Budget – Once all the necessary commitments have been identified, and the purchase approvals received, you’re ready to move on to the encumbrance stage.

For example, once the van purchase has been approved, you’ll need to make sure that it’s properly allocated to your budget.

Once the needs have been identified, you’re ready to create an encumbrance for those financial commitments.

For instance, you prepared your budget in December for the following year, but you’re not planning to purchase the van until April.

You’ll want to set aside the funds for the purchase of the van as an encumbrance so that the funds are available when you’re ready to complete the purchase.

Businesses using an automated procure-to-pay application like PLANERGY can create a purchase order for an upcoming purchase, automatically encumbering the purchase so that it is a committed expense.

For those using a manual accounting system, you’ll need to create an encumbrance by posting the amount needed as a journal entry that works to identify the future payments.

Once the transaction is completed, it becomes an expense and is no longer considered an encumbrance.

For example, once the van is purchased in April, it will be recorded as an expense.

Once an expense is accounted for as an accounts payable item or paid, the original encumbrance entries will need to be reversed.

This may include an adjustment to zero out an outstanding encumbrance or encumbrance balance.

For example, if you encumbered $40,000 for the van but the final expense was $39,000, you will need to reverse the $39,000 from the encumbrance and then make an adjustment for the remaining balance.

At year-end, you’ll need to ensure that all actual expenditures have been properly recorded and whether an open encumbrance amount should carry forward to the next fiscal year.

While not all businesses will need to utilize encumbrance accounting, there are significant benefits for those who choose to reserve funds.

One such benefit is better control of both cash and expenditures, ensuring that funds are available when needed.

For instance, by including upcoming expenditures during budget preparation, the money needed for upcoming commitments will be reserved for that commitment, eliminating maverick spending and budget overages.

Encumbrance accounting can be particularly important for companies that have limited cash flow and want to keep funds secure for necessary expenses such as tax payments, payroll, and payroll taxes.

While small businesses may not see the need to implement encumbrance accounting, for government entities, nonprofit organizations, and businesses with multiple departments or locations, using encumbrance accounting is a must.

If you’re interested in using encumbrance accounting for your business, your first step should be to implement AP automation in your business, which will eliminate the need to manually record encumbrance journal entries.

In turn, automation will increase financial transparency, provide accurate financial reporting, and increase financial planning accuracy.

Don’t be caught struggling to pay for an upcoming financial obligation. Instead, manage your expenses proactively with encumbrance accounting.

Browse hundreds of articles, containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here.

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog