Keeping track of expenses is one of the top priorities for business owners, especially when it comes to tax season.

Claiming expenses is one of the best ways to reduce your taxable income and ensure you don’t overpay your taxes.

But how can you ensure that your expenses are legitimate? By tracking and saving your expense receipts, you can provide proof of purchase for your business expenses.

In this blog post, we’ll explore what expense receipts are, why it’s essential to track them, and how you can keep track of them for your business.

What is an Expense Receipt?

An expense receipt is a document used to prove that a transaction occurred and that money was spent on a specific expense. It usually contains information such as the date, vendor name, and expense cost.

Expense receipts are necessary for businesses to track expenses and support claims for tax purposes.

What is a Valid Proof of Purchase?

A valid proof of purchase is any document that proves that a transaction occurred and provides details about the expense.

Examples include invoices, receipts, and credit card statements. It is important to note that digital receipts are just as valid as paper receipts as long as they contain the necessary information.

Common Types of Employee Expenses and Valid Proof of Purchase for Each

Meal Expenses

Receipts from restaurants, bakeries, and even grocery stores work to satisfy proof of payment requirements for meal expenses for a single employee.

If the meal is paid for as part of a group situation, such as a conference or industry event – where clients or customers are invited – it becomes more of an entertainment expense.

That changes the rules a bit – based on the kind and nature of the entertainment, as well as who makes the arrangements and who pays for them.

Keep receipts for the meal to cover your bases, and record the names of all the guests and the companies they work for, their titles, and the event purpose. This thorough account of the event expense helps with taxes later.

Mileage

To qualify for mileage costs reimbursement, an employee must provide copies of their vehicle registration, along with the make and model, and list price.

Cars registered after January 1, 1998, must also have an approved carbon dioxide emission figure.

Employees must note the trip’s reason, the trip’s total mileage, and travel dates. You, as the employer, must keep a copy of all the relevant information to support your tax filing.

You’re also required to process reimbursement consistent with current government rates. The rate may change every year, so ensure it’s accurate before processing payments for business travel.

For example, in the U.S., the mileage rate for 2022 is 58.5 cents per mile driven for business use – up 2.5 cents from 2021.

To make mileage tracking easier for your employees, choose an app that works well with your accounting software, and require your team to use it.

Transportation Costs

Keep any and all documentation related to employee business travel, including the use of public transportation, rideshare services, etc.

You can also cover the cost of the trip from an employee’s home to their place of departure (e.g., a station or airport), so long as you gather all supporting documentation. Remember that any travel expenses related to the daily commute between home and work don’t qualify for reimbursement.

Lodging and Accommodation Expenses

Like with transportation costs, sp[ecific rules apply to employee reimbursement for lodging and accommodation costs.

At the end of the fiscal year, you must provide the cash equivalent or relevant amount to the employee.

To prove accommodations, you must have a detailed invoice that includes:

- The number of nights on the trip

- All charges billed to the room, apartment, or house

- A zero balance for outstanding charges

Exemptions apply to paying for employee accommodation expenses, such as when the employee is a family member or a family member who also works for your company. It’s your responsibility to be familiar with these exemptions.

Miscellaneous Expenses

These expenses don’t clearly fall into another category but are still business related.

Regardless of the nature of the expense, you must always justify it and provide supporting documentation for any reported business expense.

Do I Need Receipts for All Expenses?

Yes, it is important to keep receipts for all business-related expenses. Failure to do so may result in losing out on valuable tax deductions.

The IRS requires businesses to keep accurate records of all transactions, and expense receipts are a necessary part of that record-keeping process.

In the UK, you’ll need receipts to satisfy HMRC requirements.

Expense Receipt Examples

An example of an expense receipt may include a receipt from a restaurant for a business lunch, a hotel bill for overnight travel, or a receipt for a taxi or Uber ride.

These receipts should include the necessary information, such as the date, vendor name, and cost of the expense.

What Do You Do If You Lose an Expense Receipt?

If you lose an expense receipt, try and obtain a duplicate. You may be able to contact the vendor or service provider and request a copy of the receipt.

Some credit card companies may provide copies of receipts for purchases made with their cards.

What is the $75 Receipt Rule?

In the United States, the IRS has a $75 receipt rule. It is a regulation that allows employees to forego providing receipt information for expenses under $75.

However, this rule only applies if the expense is considered incidental or infrequent. Examples of incidental or infrequent expenses include meals, transportation, and some office supplies.

What are the Qualifications for the $75 Receipt Rule?

To qualify for the $75 receipt rule, the expense must be incidental or infrequent, and the employee must have an expense report that is submitted within a reasonable amount of time.

Additionally, the employer must have a reasonable accounting policy that ensures that expenses are properly accounted for and documented.

What Happens if You Don’t Comply with Rules and Regulations?

In the UK, you must justify all reimbursed costs. If you attempt to claim reimbursements without the proper supporting documentation, you could face serious consequences, including legal trouble.

It’s best to collect and keep receipts in addition to invoices. Why? Receipts contain more information, such as the transaction date, what was purchased (usually listed as line items), and the payment method.

On the other hand, invoices only provide information about the supply and nature of the purchase. While invoices are good documents to have, they don’t provide proof of payment.

In the United States, you run similar risks of issues with fines, fees, and legal trouble. Even if the IRS accepts your return initially, there’s always the possibility of an audit.

If you’re audited, you’re expected to provide all documentation to support your expense claims.

Whether a large or small business – self-employed or corporate, track business expenses carefully.

Mobile apps make this easy, with receipt scanning and email receipts. They connect with software like Quickbooks to help you store all the information you need in one place.

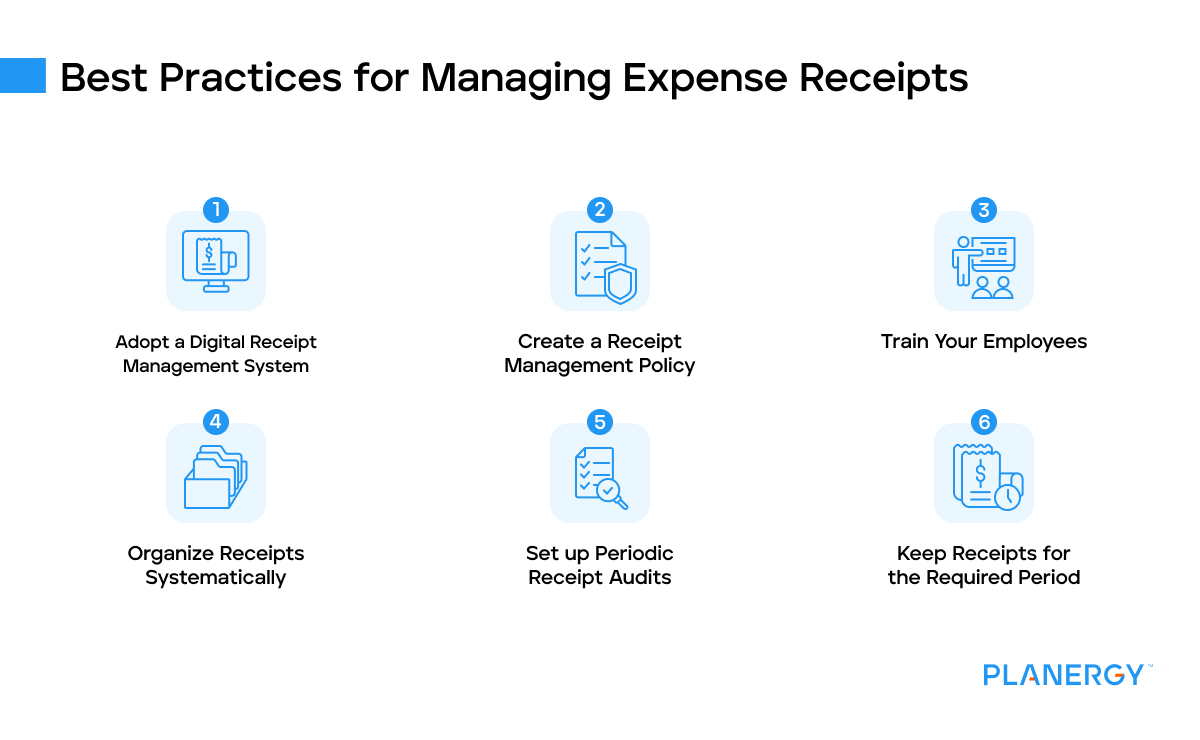

Best Practices for Managing Expense Receipts

Adopt a Digital Receipt Management System

One of the best practices for managing receipts is adopting digital receipt management.

With digital tools such as expense management software and OCR receipt scanning apps, you can easily digitize receipts and track expenses.

Digital receipt management eliminates the need to retain paper receipts, which are easy to misplace, and often result in errors. It also speeds up the creation of expense reports and minimizes the administrative workload associated with manual record-keeping.

You’ll always have receipt images on hand, should you need to reference them for anything later.

Create a Receipt Management Policy

A well-defined receipt management policy can help ensure consistency in managing receipts.

The policy should outline who is responsible for managing receipts, what types of receipts are acceptable, and the procedure for submitting, processing, and storing receipts.

Ensure the policy identifies the frequency of submitting receipts and the time frame for reimbursement. Having a policy in place can also help minimize the risk of fraud.

Your receipt management policy can be included as part of your overall expense policy, which details what kind of expense claims your staff can file.

Train Your Employees

Your employees must understand and adhere to best practices for managing receipts. You can train them on using relevant software, scanning receipts, or labeling expenses.

It will save time, prevent confusion, and minimize the chances of errors in your accounting records.

Organize Receipts Systematically

Organizing receipts logically can help you locate specific receipts when you need them. One way to organize receipts systematically is by creating categories for different types of expenses, such as travel or supplies.

You can further classify receipts within each group by date or vendor name.

Organizing receipts systematically saves you time and reduces the risk of losing or forgetting receipts.

Set up Periodic Receipt Audits

Periodic audits of expense receipts can help you promptly identify discrepancies, errors, and fraud.

At the same time, these audits can ensure compliance with company policy and applicable tax laws.

Auditing can be done via internal accounting or an external service provider and can be performed monthly, quarterly, or annually, depending on the volume of transactions.

Keep Receipts for the Required Period

For legal and tax purposes, it is essential to retain receipts for a predetermined period. The duration for keeping receipts varies depending on the type of expense and jurisdiction.

Ensure your business is aware of the laws that apply to your industry or location, and have a system for retaining receipts for the required period.

Failing to comply with necessary laws can result in substantial financial loss and legal sanctions.

Why Automating Tracking of Expense Receipts and Other Proof of Purchase Helps

Manual tracking of expense receipts and other proof of purchase can be time-consuming and prone to errors.

Automating this process with e-receipts can provide several benefits, including workflows for increased accuracy, faster processing times, and less administrative work for employees.

Automated tracking also allows for better control over spending, allowing businesses to identify potentially fraudulent activities more easily.

In addition, automated tracking can help reduce overall costs by providing visibility into the company’s spending patterns and helping identify areas where costs can be reduced.

Conclusion

Keeping track of expense receipts and other proof of purchase is crucial to managing your business finances.

It is important to ensure that your employees track their expenses and keep receipts as proof of purchase.

Remember to keep all receipts, even those under $75, and ensure they contain the necessary information. Automating this process can benefit your business, so consider using expense tracking software to simplify the process.

PLANERGY will release an expense app next year to help businesses streamline their expense tracking and reporting process.