For a long time the finance function has started moved away from doing just accounting and bookkeeping.

The pace of this change has increased in the last few years. It’s no longer a back-office function now.

Finance has firmly moved towards leveraging strategic roles that drive value, innovation, and growth for the organization.

In the current hyper-competitive markets, leveraging the finance function has become the deciding factor between sinking or swimming—organizations with digitally native finance teams show much higher resilience, tighten their market positions, and grow shareholders’ value even if the stock markets tumble.

These organizations can manage crisis better and can recover and excel faster once markets return to normal.

Furthermore, they also mitigate the risk posture better than those organizations that lag behind in financial transformation.

An important question arises: how can organizations turn finance from passive controller to proactive strategist?

It can be achieved by deploying business intelligence in the finance function—a powerful data-driven tool that CFOs and their finance teams can utilize to improve strategic planning and decision-making by analyzing big data, leveraging information to collect actionable insights, and sharing it seamlessly across the organization.

However, here’s a catch—only 21% of CFOs leverage business intelligence to identify new value for their organization.

It is a considerable challenge. Caused partly by the fact traditional business intelligence lacks the forward-looking functionalities and business modelling capabilities required by modern CFOs to add strategic value to the company.

Here, organizations need to understand the vital difference between traditional business intelligence and finance business intelligence to grow the strategic value of finance.

What Is the Difference Between Finance Business Intelligence and Traditional Business Intelligence?

Typical business intelligence primarily focuses on and is designed for data analysis and visualization—conveying historical data in a meaningful format that can be easily understood and interpreted by people without advanced programming or data analytics experience.

It sees a business through a rear-view mirror and improves the efficiency of existing processes rather than the pursuit of change.

On the other hand, Finance Business Intelligence focuses on both past performance and future forecasts to help CFOs inform function-level, entity-level, or enterprise-level strategic decisions.

CFOs require tools like dynamic modelling, forecasting, and predictive analysis that traditional business intelligence fails to provide.

Because of this, finance teams are forced to plaster over those gaps and fill voids by using spreadsheets for different tasks such as driver-based modelling, deployment of different profit and loss and balance sheet schemas, financial reporting, planning, consolidation, and reconciliation.

It defeats the purpose of deploying business intelligence in the first place. Moreover, since spreadsheets are static, difficult to update in real-time, and can’t incorporate data sources from either external or internal sources, they create severe problems for the finance teams.

Troubleshooting becomes challenging in case a fault arrives in data collection or calculation. As a result, inaccuracies in spreadsheets lead to inconsistent BI analytic findings and models.

Dedicated business intelligence in finance solves these inherent issues by integrating multiple ledgers, different entities within the same group, and cross-company data into a single unified view.

Legacy Business Intelligence tools bundled with ERP applications couldn’t meet modern CFOs’ requirements since they were not necessarily designed to operate beyond -their own operating environment. However, today’s application-independent BI tools are intuitive enough for finance teams to manipulate extensively and reduce dependence on IT resources to conduct new and novel analyses.

Finance BI applications, like Microsoft Power BI, Tableau, etc., provide data visualization capabilities as part of a larger platform and can integrate various processes such as planning, consolidation, closure, cost allocation, and profitability analysis.

Finance Business Intelligence has a variety of approaches in its arsenal—from looking backwards to evaluate past financial performance to forward-looking scenario planning and predictive modelling, which makes it an automatic choice for CFOs to wring strategic value from their organizations’ financial activities.

What Is Finance Business Intelligence?

Finance Business Intelligence is a term used to describe methods to collect, process, and analyze financial data from databases in real-time and make better business decisions with the help of professional financial business intelligence software.

Business intelligence solutions extract data and information from both internal data sources (operations, finance, marketing, etc.) and external data sources (market data, competitor data, social media, etc.) for centralized, accessible, and comprehensive data management and analysis.

It positions finance as a business partner with Operations and enables CFOs to grow the strategic value of finance by:

- Stepping out from traditional silos

- Identifying opportunities to save costs

- Deriving new insights through data-sharing capabilities

- Working proactively with the enterprise to optimize operational cashflow

When properly deployed, business intelligence in finance appropriately manages consolidation, driver-based allocation, and closure process. It also enables the finance team to determine and analyze profitability across product lines, sales channels, customer pools and geographical regions.

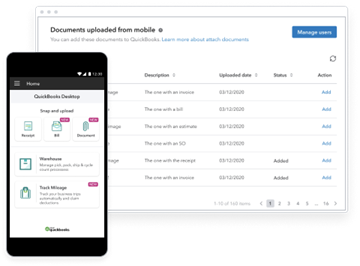

With its support, finance teams can collect, collate, and organize everyday data the Finacne offce needs.

They can also create different P&L schemas (such as IFRS, local GAAP, managerial schemas, or XBRL disclosures) according to different timelines (monthly, quarterly, half-yearly, year-to-date, quarter-to-date, etc.).

An efficient BI solution enables an organization to optimize its processes and use powerful insights like spend analytics to identify opportunities for cost savings.

For instance, PLANERGY has helped save billions of dollars for clients through better spend management, process automation in purchasing and finance, and reducing financial risks.

How Can Finance Business Intelligence Be Used?

Today’s forward-thinking financial professionals—particularly Chief Financial Officers—can drive innovation by applying digital finance transformation in big data at scale.

They can leverage business intelligence to collect, organize, and analyze information in order to harvest business-critical insights and drive value through process improvement.

Having access to real-time data enables CFOs to move from impulsive to thoughtful decisions and back their responses with accurate, up-to-date financial data. It leads to cost-effective, efficient, and forward-thinking choices and decisions based on objective and unbiased information.

For instance, PLANERGY provides real-time spend visibility with our Spend Analysis Software which helps finance teams keep a tab on how every cent is accounted for—who spent it and with which vendors.

Besides, it also automates accountability and provides budget vs actual spend reports to better inform business decisions.

What Are the Benefits of Business Intelligence In Finance?

With digital transformation pushing finance into strategic roles, organizations are placing

greater demands on the Finance Function in general—and the CFO in particular—to help them ride out uncertainty.

CEOs, COOs, and other C-level executives are relying heavily on the Finance

Function to not just improve the bottom line and provide an accurate picture of the financial health of the enterprise, but also assist them in understanding how emerging and potential shifts in key market factors and fast-moving strategic decisions will affect the organization.

Business Intelligence begins with helping the finance function achieve its traditional goals such as accounting, bookkeeping, preparation of financial statements, tax filing, etc.

Once traditional goals are met, finance can attend to forward-looking activities such as financial planning and forecasting—modelling and assessing the impact of various events on the cash position, driving portfolio cash investments and initiatives to maximize profitability or supporting the decision-makers in prioritizing, approving, and managing capex investments.

Business Intelligence enables finance to:

- Improve forecasting and reduce variance in estimations from different departments – this can encourage finance to shrink the size of reserved cash buffers and free up working capital.

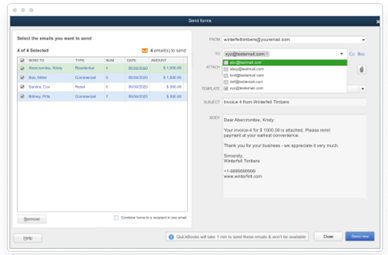

- Shorten reporting times, provide timely insights, and speed up time-to-value through faster and optimized automated cashflows

- Prevent reporting duplication

- Streamline and optimize business processes

- Reduce risk exposure

- Pursue healthy organizational change

Risk management is another crucial benefit that CFOs can obtain from financial business intelligence.

Dashboards exhibiting key performance metrics that demonstrate the firm’s financial performance and a comprehensive perspective of market and credit risk ensure that management is aware and ready to quickly respond to abnormalities.

Besides, business intelligence also brings more credibility to data by providing periodic data cleansing to prevent bad data from getting in.

BI differentiates between good and bad data and eliminates the chances of inaccurate analysis or negative financial impact arising due to the presence of bad data.

Equally important, business intelligence and data analytics help an organization identify and respond more effectively to customer expectations, improve the overall user experience and turn potential clients into paying customers.

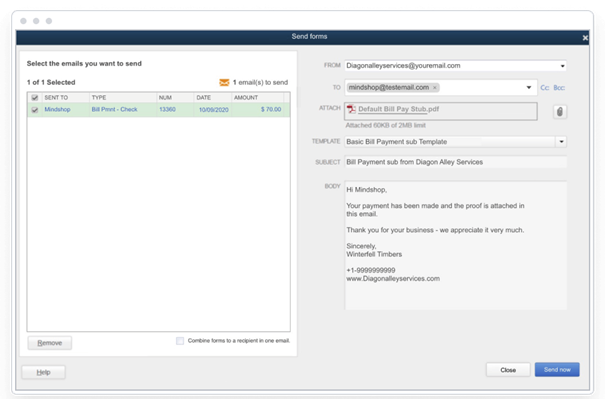

It also improves relationships with vendors by improving the invoice processing and facilitating faster payments with minimum errors or exceptions.

In a nutshell, business intelligence changes the objective of finance from preservation to progression and empowers it to unlock new business value.

Since it sets up a connection between actual results and the planning and simulation phase— finance can focus both on rear-mirror business reporting as well as forward-looking predictive analytics.

Result? CFO can address the company’s business needs through business plans, cascading goals throughout the organization, and implementing proper performance monitoring, measurement, and controlling processes.

How Is Business Analytics Used in Finance?

Real-time Business Intelligence in finance enables an organization to become more agile in the face of unprecedented external events and empowers business leaders to make informed decisions.

Data-driven business intelligence drives finance transformation by:

- Consolidating and integrating data into a shared system by pulling datasets from business applications, ERP systems, office tools, and 3rd party system data;.

- Providing a platform for scaled data utilization by processing data, transforming data, and enabling insights. Also, since it’s cloud-based, it is infinitely scalable.

- Extending to include new data capabilities such as data modelling, machine learning, AI, IoT, and Industry 4.0

- Facilitating a 360-degree view of working capital across the business and allows finance to enjoy better control and access over cash movement.

Efficient finance Business Intelligence—seamlessly connected to planning, reporting, and other functions—can predict trends with unbelievable accuracy and speed which humans or spreadsheets can’t even match.

It also eliminates human emotions or bias from the equation and exposes new, never-before-seen financial data that opens up new opportunities to pivot.

Business Intelligence takes analytics beyond charts and graphs and leverages advanced technologies to create powerful, intuitive, and accessible visual representations such as heat maps, interactive augmented reality applications, and dynamic data dashboards.

By slicing and dicing information as required, CFOs can identify opportunities for efficiencies, track performance and revenue streams, and make timely decisions to reduce risk and increase profitability.

Besides, the finance function is responsible for producing various reports in a financial year.

These reports have to be made in accordance with the guidelines prescribed by the General Agreement on Tariffs and Trade (GATT), the International Financial Reporting Standards (IFRS), and the Sarbanes-Oxley Act (SOX).

Apart from external stakeholders, internal stakeholders such as employees and management also require some reports to run the audience.

These reports have to be customized and categorized for each department and aligned to represent a ‘single version of the truth.’

Road Ahead

Once finance becomes accustomed to Business Intelligence, it can address other use cases such as improving payment terms for customers, making timely and accurate payments to vendors, assessing the resilience of the supply chain, and optimizing capex investments.

finance business intelligence can expose an enterprise to unprecedented financial data that opens up new opportunities to pivot. As a result, today’s fast-paced organizations eagerly look up to the CFO to safeguard and strengthen their competitive advantage in the current business climate.

However, finance transformation–deployment and smooth implementation of finance BI—is not a cakewalk.

The five building blocks for transformation are strategy, people, process, technology, and data in any technology adoption journey.

Out of these building blocks, the most important one is people—CFOs must make sincere efforts to combine analytics-savvy people with seasoned business communicators to achieve desired objectives and goals.

Once CFOs persuade their teams to consider themselves strategic advisors instead of traditional custodians, this mindset shift will enable the function to break down siloes, democratize the financial data, and collaborate with the wider business to create new value.

Overall, the deployment of business intelligence in the finance function can enable organizations to achieve financial transformation and earn exponential rewards.