Recently on the blog, we talked about financial planning and analysis (FP&A) software.

We’re going to continue that discussion today with a closer look at the eight best financial management tools to help your business run smoothly. After all, it’s financial management that often separates successful companies from those that struggle.

What is Financial Management?

Financial management refers to activities related to planning, organizing, directing, and controlling an organization’s financial activities, including procurement, investment decisions, budgeting, financial planning, billing and payments, and more.

The goal of proper financial management is to ensure the company has enough money to take care of operations at all times, to ensure that all stakeholders receive adequate returns, maintain optimal funds utilization, keep investments safe, and plan a solid capital structure.

Financial management estimates capital requirements, determines the capital composition, chooses the sources of funds, chooses how to invest funds, determines how to dispose of surplus, manages cash, and establishes financial controls to keep the entire system in check.

Considerations for Financial Management Tools

As you choose the business tools to use within your organization, you must first consider a few things.

- Your Budget: How much are you willing to allocate to these tools? How much can you really afford to allocate to them? Depending on the size of your company and its operations, you may need more integrated tools and platforms, meaning costs could vary widely.

- Security: As you move from paper recordkeeping to an online system, your financial information must be kept safe. The more granular the access control, the better.

- Making the Switch to the Cloud: On-premise systems are expensive to maintain, and less than ideal for many companies. A cloud-based approach gives you the freedom and flexibility to keep records and workflows accessible anytime, anywhere, as long as an internet connection is available.

- Scalability: The tools you use have to evolve with your business as it grows. If you have to spend money converting to new, more appropriate systems later, then the hassle and expense of using something else aren’t worth it.

- Efficiency with Automation: Moving to cloud-based financial tools saves time and money. Working with companies like PLANERGY for easy requisition and ordering helps to modernize your financial processes while making your approval workflows and hierarchies more efficient as your business grows.

The right tools with the right features save you time and money, allowing you to focus efforts on more value-added activities.

Build Your Financial Planning Framework with Certinia

All CFOs need solid tools to support them, and while automatic and integrated tools can help make operations more efficient, sometimes, companies need a broader solution.

Certinia is an enterprise resource planning (ERP) software designed to track spending, profitability, resource availability, and more.

It’s a cloud-based solution designed to help you streamline your opportunity to cash process, so you can make more money faster and put your financial data to use. Get access to your company’s financial health in real-time.

Handle Accounting with Xero

Any collection of business tools you’re considering will include an accounting tool.

Using Xero, you’ll be able to access everything from mobile devices and integrate with a variety of third-party apps, including integrating Xero with PLANERGY’s spend manage software.

Xero’s features include automated recordkeeping, expense calculation, invoicing, and report generation.

You can also manage sales orders and inventory with this platform, so you don’t have to worry about manual data entry and the error potential that comes with it.

Plans start at $20/month. While it is great for small to medium businesses, the starter version does limit your monthly transaction volume.

It is missing advanced features that advanced financial teams may require.

Bill Customers Easily with FreshBooks

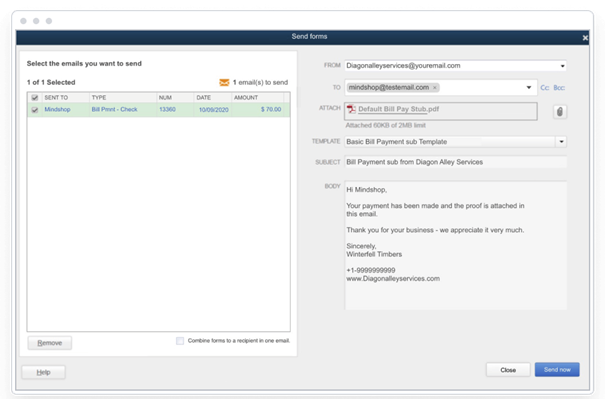

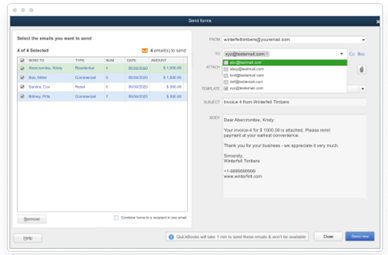

Customers expect nothing short of perfection when it comes to online billing processes.

FreshBooks can help make your billing process smooth and seamless. Basic online billing solutions are good enough for most businesses, but additional features with flexible pricing are all the better for everyone.

Since Freshbooks is a cloud-based billing system, you can be sure that your company is following best practices, for a value-added experience that helps to boost customer satisfaction and foster customer loyalty.

Designed for small business, FreshBooks automates various important accounting tasks.

It’s easy to create and manage entries and export them into your other systems. It’s easy to set up and comes with automatic reminders for late payments.

The highly flexible API makes it easy to integrate with a variety of third-party services so you can design the tech stack and workflow that’s best for your company.

Track Expenses and Improve Expense Management with Expensify

Maintaining accurate expense records is a tedious undertaking, but with the right tools, you won’t have to worry about keeping track of and storing paper copies of receipts.

Monitoring these expenses is often part of accounting tools, so it’s a good idea to look for a platform that integrates with your accounting software if this feature isn’t already part of it.

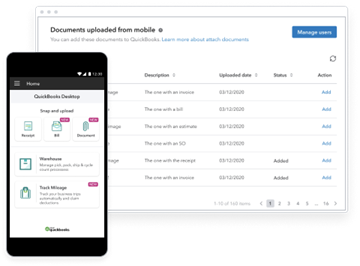

Expensify is an expense tracking tool that allows employees to scan receipts and upload cash expenses directly from their mobile devices.

Everything goes to a central repository for fast and easy expense accounting, reimbursement, and rebilling. It generates user reports, so you can easily keep an eye on who is spending how much.

Expensify integrates with a variety of third-party tools, such as Quickbooks. The Smart Scanning feature automatically categorizes certain entries to save your team time.

It includes extra features, such as GPS milage tracking. That said, the user interface isn’t all that intuitive and some users report that the receipt scanning feature is a bit slow.

Tiered pricing is available for individuals and business users.

Tackle Budgeting, Spend Management, and Inventory Tracking with PLANERGY

PLANERGY is a procure-to-pay process management tool that takes care of several business processes to help with better financial management.

It integrates with various accounting tools like Quickbooks and Xero.

With the purchase requisition and purchase order features, you can ensure your employees are only ordering products and services from approved vendors to eliminate maverick spending.

Procurement leaders can store contracts in a central repository, for easier compliance management.

With automated approval routing and workflows, you can be sure no purchase orders are left to sit in a pile on someone’s desk for weeks while they’re out on leave.

With budgeting tools, you can set realistic budgets on a departmental, project, or user level. It will prevent one person or department from making purchases above a certain threshold, at the transaction level, and at the total budget level.

Granular user permissions prevent employees from being able to access data they don’t need. Reports give you an idea of your spending habits, so you can find your most valuable vendors, where you’re wasting capital, and so on.

Inventory management features ensure that you always have what you need on hand. Three-way matching automation ensures you never pay for items you did not order or receive.

Audit trails keep track of every action taken on a vendor, purchase requisition, purchase order, and invoice so that all employees remain accountable for their actions.

Designed to help mid-size to enterprise businesses help reach their financial goals, pricing is based on each user license. A demo is available so you can see its ease of use before implementing it within your company.

Get Better Payroll Management with BrightPay

Managing wage distribution, holiday pay, sick leave, and other benefits can be challenging for companies that rely on the standard Excel spreadsheet to manage payroll.

BrightPay is a tool that makes taking care of all of this easy. It’s a cloud-based platform that your employees enroll in and can manage, giving them better visibility over their pay no matter what device they dece to use.

It’s easy to use and comes with a free trial, so you can make sure it’s right for you before committing to using it over the long term.

Prepare Taxes with Gusto

For proper financial management and to ensure adequate financial health, you need a system that helps you automate tax deductions.

Investing in tax preparation software and tools can help simplify various financial aspects of your business.

With Gusto, you can import data from a variety of sources, including inventory management, point-of-sale (POS) modules, and employee compensation systems.

Gusto is a payroll automation tool that handles the majority of the time-consuming work for you. It includes support for filing taxes at the federal and state levels along with healthcare compliance.

While there is support for automated forms and taxes, there’s no mobile app or support outside of the United States.

Conduct Cash Flow Analysis with Float

Float is a cash flow forecasting and scenario planning tool that helps you get real-time information about what’s going on with your money management.

Business owners can use this tool to make more confident decisions based on data.

It integrates with your accounting platform (Xero, Quickbooks, and FreeAgents are available as native integrations) to pull in the financial information you need.

You can use it to see how adding new employees to the mix will affect cash flow, or what happens if you lose a client, make a payment on a big bill, or receive late payments.

This helps you to better prepare for any number of situations you could find yourself in.

Running a Business is About More than the Money

Successfully running a business, whether it’s a startup or an enterprise-level business, is about the money, of course.

Without the cash to support operations, you’d close in no time.

But what matters just as much as the cash itself, is the tools you use to support your business.

If you have the right financial management software to support you, you gain access to a world of data that can help you make better decisions with your money, and grow your net worth.