Starting a business is not for the faint of heart.

Along with your expertise in the products or services you’re offering, you’ll also need to master the financial aspect of doing business.

While most fledging entrepreneurs are already experts in their line of business, managing the financial part of a new business can be daunting to a new business owner.

While experience doing the books for your business typically comes over time, there’s one financial task that needs to be mastered before your business is operational and that’s financial projections.

Creating startup financial projections can sound scary to a novice, but once you learn the ins and outs, you’ll be on your way to creating financial projections for your new business.

What Is a Financial Projection?

It’s likely that you’ve given considerable thought to how much it would cost to start a business.

A financial projection formalizes those calculations you’ve been doing in your head since you first began thinking about opening a business.

Financial projections allow you to estimate expenses and revenue, create a growth strategy, and are a necessity if you’re looking for outside investors or are applying for a business loan.

There are two types of financial projections.

Short-term projections cover up to a year and usually include month-by-month totals while long-term projections cover between three to five years and are a necessity for strategic planning.

It’s important not to confuse a financial projection with a financial forecast.

Though often used interchangeably, there are significant differences between the two.

A financial projection looks at the bigger picture and examines various what-if scenarios to determine what could happen.

For example, if you’re trying to decide if you should sell clothing for both children and adults or just adults, you would project financial outcomes for both options.

In contrast, a financial forecast is usually completed for the short term (usually a year or less) and is based on what a business expects to happen.

For example, if you decide that you’re only selling adult clothing, you can then complete a financial forecast using that information.

What Financial Projections Mean for a New Business?

Creating a financial projection before you start your business can help you avoid some of the pitfalls that startups may encounter, including:

- Inaccurate product or service pricing

- Cash flow shortages

- Inability to secure funding for the business

Completing a financial projection for your business also allows you to determine whether your potential venture would be profitable before you sink your time and financial resources into it.

What Are the Key Elements of a Financial Projection for Startups?

There are five key elements to completing a financial projection for your startup.

The first two steps should be completed before starting your business, while the last three financial statements can be used for your projection before your business is operational as well as afterward to keep you on track. SCORE, a small business organization in partnership with the U.S. Small Business Administration, offers various financial projections templates that can be downloaded and used to create financial projections.

Estimating Expenses

The startup expense budget should include all start-up costs such as cost of goods sold (COGS), fixed costs, variable costs, and operating expenses.

When creating your initial expenses, be sure to include a buffer for any unexpected costs that may pop up during the first year.

Forecasting Revenue

Creating a sales forecast can be daunting.

After all, you’ve likely already identified many of your startup expenses, but since you no historical data to use in your sales projections, you’ll have to estimate what your revenue totals will be in your first year in business.

Creating a Profit and Loss Forecast (income statement)

Using the information from your expense and revenue forecasts, you can create a profit and loss statement or income statement using those estimates.

Once the business is up and running, the income statement can be run regularly to provide gross profit and net income.

Creating a Cash Flow Statement

You won’t be creating a cash flow statement or cash flow projection until your business is fully operational, though you can create one for your startup based on estimated revenue and expenses.

Creating a Balance Sheet

A balance sheet is a valuable tool for viewing both asset and liability totals, as well as the equity interest in the business.

Knowing exactly where the business is starting from can help you stay focused on where the business is going.

What Methods Are Used To Estimate a Startup’s Future Financial Performance?

If you’re looking for operating capital for your startup you need to provide potential investors and lenders with a detailed financial projection.

Since your business doesn’t have a track record yet, you’ll have to complete your projections using some outside sources.

Market Research

Perhaps the most important task you can complete before starting your business is market research.

Taking the time to extensively research the industry your startup is in will give you much-needed information on expected income and expenses.

During your research, you should also analyze locations to determine which one is best for your business.

Startup Expenses

While it’s challenging to estimate revenue before you’re able to sell your products and service, you’ll know ahead of time what many of your expenses will be.

Typical startup expenses may include:

Incorporation Fees – Legally forming a business costs money. Whether you incorporate immediately or are an LLC, you’ll need to pay a fee. You may need to pay for a business license as well, depending on where you operate.

Attorney or CPA Fees – Before starting your business, you’ll want to use the services of an attorney or CPA, or preferably, both. Be sure to factor those fees into your startup costs.

Office or Retail Space – Whether you’re buying or renting commercial space, be sure to include the cost. If the business is online, you can skip this expense.

Inventory – Determine what a good starting inventory level is for your business and include the cost in your startup expenses.

Equipment – Equipment costs vary depending on the type of business you’re starting, though any business will require computers.

Furnishings – Like equipment, the furnishings for your business will depend on the type of business you’re opening. For example, if you’re opening a gift shop, you’ll need high-grade commercial shelving and display cases.

Payroll – If you’re initially going it alone, you won’t have payroll costs. However, if you need to hire employees immediately, be sure to factor in both wages and payroll taxes.

Marketing and Advertising – Marketing and advertising should start before the business opens. Be sure to include those costs.

Project Your Return on Investment

After all of your expenses are factored in, you can ideally project your return on investment.

Many startups struggle in their first year to earn enough revenue to offset startup costs.

By using your estimated revenue and projected startup costs, you can better forecast your return on investment before your business is up and running.

Consider Multiple Scenarios

Regardless of the amount of market research completed, when you’re creating financial projections for your startup, you’re working with estimates, not actuals.

By creating multiple “what-if” situations, you’re letting interested parties know that you’re ready to handle any possible road bumps.

Be Conservative

Even if you’re 100% convinced that your products or services will be an instant hit, it’s best not to include that in your future financial projections.

Being cautious never hurts anyone and if your sales projections turn out to be low, you can factor the excess revenue into planning for the upcoming year.

What Are the Common Mistakes To Avoid When Creating Financial Projections for a Startup?

Startup businesses don’t have a financial history, meaning that your revenue and expense projections may end up being close to target or vary widely.

One way you can help ensure that your projections are more accurate is to avoid these common mistakes.

Underestimating Expenses

When estimating startup expenses, be sure to include all expenses, no matter how small, in your estimates.

Even if your revenue estimates are on target, underestimating your expenses can have a detrimental effect on your business bottom line.

Unrealistic Revenue Estimates

No one goes into business expecting to lose money.

Will your business take the world by storm?

Maybe, but until you’re up and running, forecast your revenue conservatively.

If revenue growth is higher than expected, you can adjust your metrics accordingly.

Not Researching the Market

It’s difficult to create an accurate forecast if the proper market research isn’t completed.

Learn about your potential customers, what they’re looking for, and what they’re willing to pay for the product or service you’re offering.

For example, if you’re opening a coffee shop, you’ll want to check out the competition, what they offer, how much they charge, and what customers like about them.

Ignore Risks

Your main supplier goes out of business. Your office is destroyed in a hurricane.

A new competitor enters the market and undercuts your pricing.

Risk is always there, waiting to strike at the most inopportune time. Accept that and include it in your forecast.

What Is a Balance Sheet Forecast?

A balance sheet forecast for startups provides a projection of a business’s assets, liabilities, and owner’s equity.

For startups without a financial history, they can create a projected balance sheet that can be used for potential investors or financial institutions.

How To Build a Balance Sheet Forecast

When creating your balance sheet, remember the accounting equation that assets equal liabilities plus equity.

For those struggling to create a balance sheet for the first time or are unfamiliar with accounting or bookkeeping practices, seeking the guidance of an experienced CPA or accountant is paramount.

When you’re ready to get started, follow these steps:

Select the Date for the Balance Sheet

A balance sheet reflects the most recent financial data according to the date it was prepared.

When you’re creating a balance sheet for your startup, you’ll want to gather all the necessary data to include in the balance sheet.

You can create a balance sheet using Microsoft Excel or by downloading a balance sheet template from SCORE.

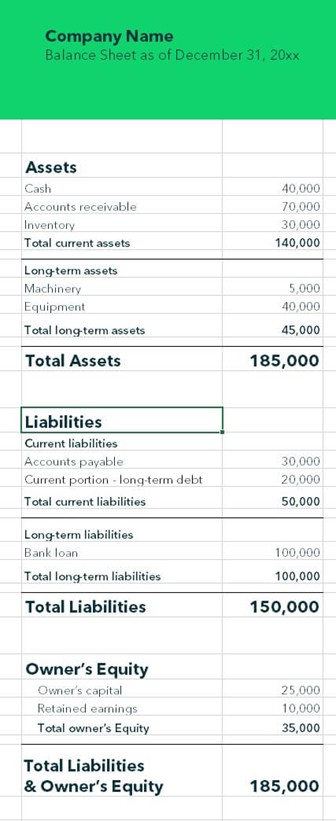

This sample balance sheet format from QuickBooks shows how assets, liabilities, and equity are recorded.

Record Assets

On the balance sheet, current assets are recorded first, followed by long-term assets.

Current assets include cash, accounts receivable, and inventory totals, while long-term assets include machinery and equipment.

Current assets and long-term assets are totaled separately and then added together to determine total assets.

Record Liabilities

Next, Liabilities are recorded, with current liabilities displayed first, followed by long-term liabilities.

Current liabilities will include accounts payable as well as any short-term loans that will be paid off in less than a year.

Long-term liabilities include things like bank loans or mortgages.

Current liabilities and long-term liabilities are totaled separately, with the totals added together to determine total liabilities.

Record Equity

Finally, you’ll create the equity section, which includes the amount of money you have invested in the business.

Once operational, you’ll also include retained earnings in the equity section of your balance sheet.

Keep in mind that you may have to estimate many of the figures included in the balance sheet.

Once you’ve entered the appropriate totals, whether actual or estimated, you’ll need to ensure that the balance sheet balances.

This is done by adding liability and equity totals, which should match your asset totals.

What Are the Best Practices for Creating Realistic Financial Projections for a Startup?

Every business model is different, so the process of creating a realistic financial projection will be different as well.

Following these guidelines can help you create the most accurate financial projection you can.

Know Your Business

Before you begin to enter numbers, be sure that you know your new business inside and out.

That means identifying needs in the community, knowing your potential customers and their desires, and creating a price point that fits your offering.

Putting this information into a cohesive business plan will make financial forecasting easier.

Create Multiple Scenarios

By creating multiple financial models, you’ll be in a better position to handle risk, plan for growth, and adjust financial expectations as your business grows and evolves.

Be Realistic

Everyone wants their business to be a success immediately.

While planning for immediate success can be useful, you also have to factor in the possibility that it may take months, or even years for your business to reach its full potential.

Make sure that your financial forecast includes both.

Use the Right Tools

Using the right technology tools from the start can help you create and maintain financial accuracy.

Using the appropriate accounting software like PLANERGY provides you with complete control over all of your financial data while providing complete transparency.

Starting a new business can be a challenge, but with the proper planning, can prove to be profitable for years to come.