An organization’s procurement is a crucial part of business finances since it is how you use the money to purchase the goods and services you need for operations.

Procurement aims to acquire everything you need at the best possible price to improve profits and cash flow.

Your procurement department directly impacts up to 70% of your organization’s Revenue so it’s easy to see how closely related your procurement processes are to your financial operations. Because of this, you must:

- Make your procurement process as efficient as possible

- Focus on building strong supplier relationships over the long term

- Always look for cost-saving opportunities

- Maintain quality supply data for analysis purposes

An important data point track is a goods received note, sometimes also called a goods receipt note, or GRN. The GRN is a two-way document that acknowledges that A supplier has delivered goods and you as a customer has received them.

When you issue a purchase order, your supplier is obligated to deliver the goods or services according to the terms of their contract.

Upon delivery, the customer issues three delivery note copies to the department that requested the supplies.

They retain a copy for the finance department and hand one to the supplier. Delivery details are confirmed by all three parties before authorization.

A GRN confirms the order has been delivered and received, and it’s satisfactory for all involved parties.

Benefits of Tracking Goods Received Notes

A goods received note serves as a document to confirm that both parties have honored their portion of the contract and keeps the record on file for future reference if any disagreements arise, such as in the following situations.

Validating Quality and Quantity of Ordered Items

When a supplier delivers ordered Goods, it’s assumed that everything is made in good faith and everything is delivered according to the demand has specifications, and passes quality checks. However, customers can’t just take the supplier’s word for it.

Upon receipt, the procurement department will pass the delivered Goods to the requesting department so that they can review everything to make sure it meets their quality criteria and other specification.

If the supplies are acceptable, goods received notes, are issued to the other parties to confirm that the supplies are up to standards, which helps to avoid disagreements in the future regarding the quality and quantity in the delivery.

Quality Control

If, after the supplies are delivered, the department that requested them realizes an issue they didn’t catch it first. The goods received notes show that everything was tested and worked well. At this point, the supplier is absolved of their obligation.

They can either choose to replace the supplies in good faith or request that their customer works around it since the goods were in acceptable condition upon delivery.

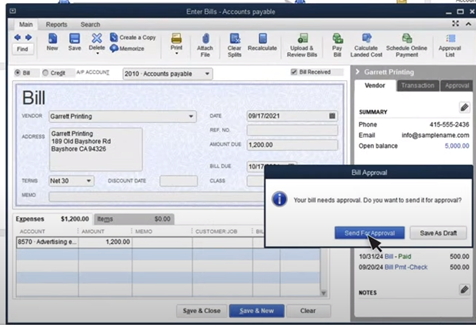

Invoice Validation for Three-Way Matching

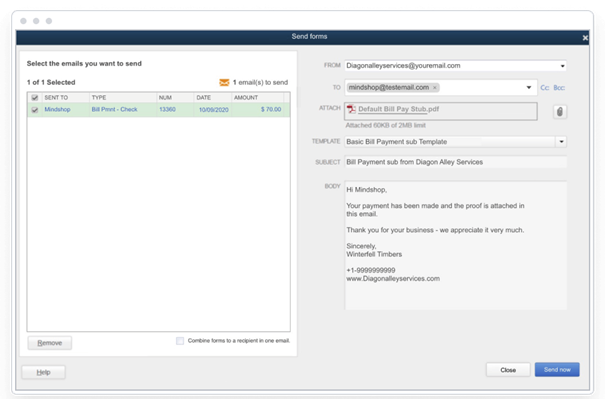

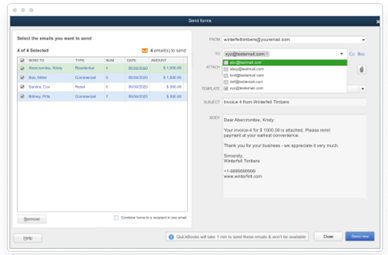

The three-way matching process helps to reduce and eliminate billing fraud across organizations.

With 3 Way matching, invoices are matched with purchase orders and good receive notes to confirm that the customer requested a certain quality and quantity of supplies, the supplier delivered upon the request, and the supplier is invoicing for the delivery at the Justified quantity and pricing according to contract terms.

When everything matches up exactly, the invoice can automatically be said to accounts payable for processing. If there’s any discrepancy anywhere between the three documents, it can be flagged for human intervention to prevent fraudulent or duplicate payments.

Inventory Management and Keeping Stock Levels Current

Goods received notes also serve as a statement of fact that a company has received the delivery of the supplies requested. The note helps as a record of goods, which makes it easier for the warehouse to account for items on hand.

As such, they are helpful when it comes to managing inventory and keeping stock numbers accurate.

![]()

GRNs are an important document for procurement, as they keep a detailed record of what was ordered vs. what was received, when and by whom.

What Information the GRN Requires

The GRN ensures suppliers and customers can keep their binding agreement and empowers companies to maintain stock of inventory levels. As such, the document requires:

- Name of the supplier

- Product details, including name, size, type, specifications, etc.

- Product quantity

- Purchase order number

- Delivery date and delivery time

- Name and signature of supplier representative

- Name of your organization as the receiver

- Name and signature of the person at your company who will receive the order

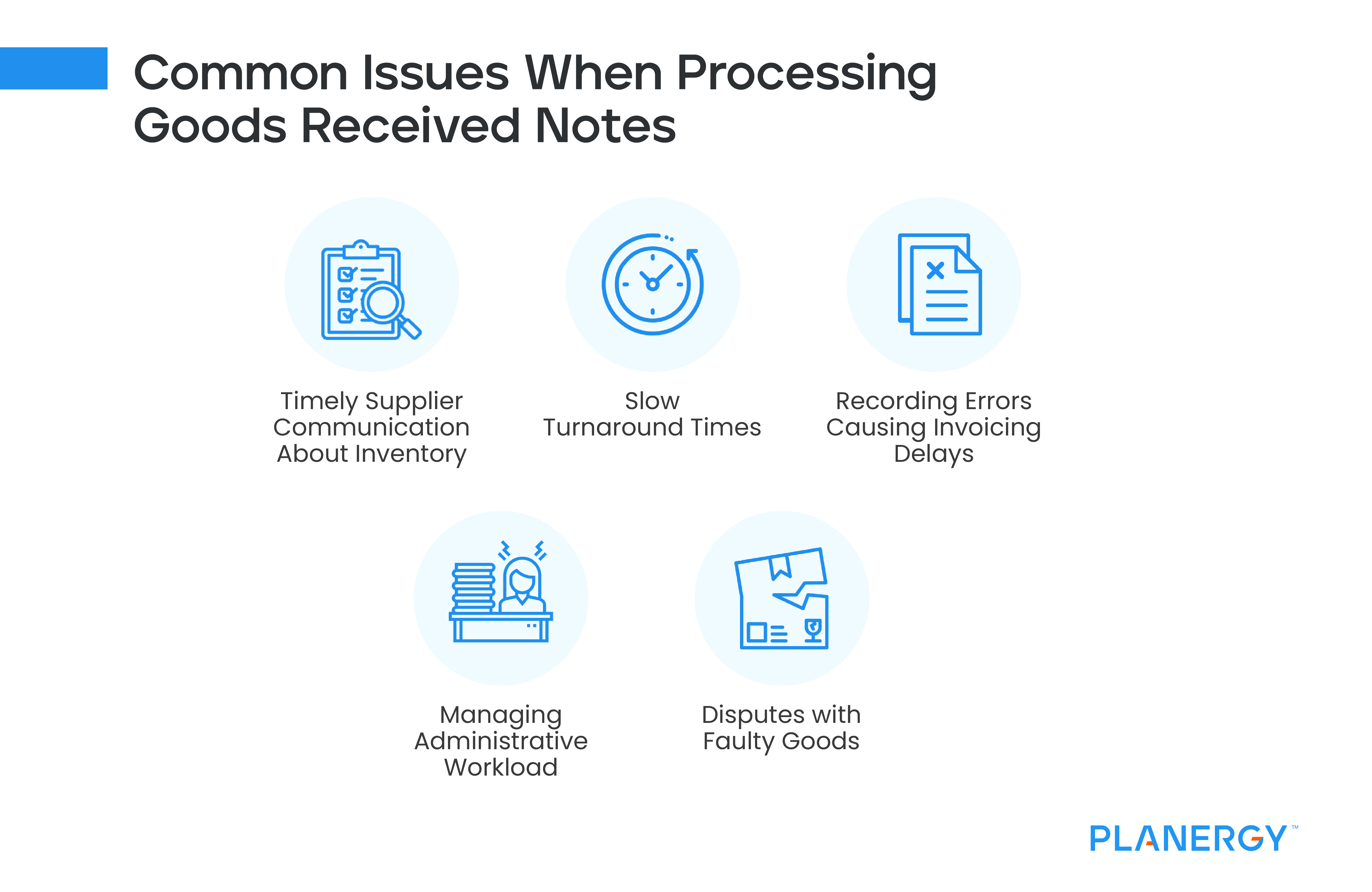

Issues to be Aware of with GRN Processing

Like everything else in procurement, there is always the potential for a few issues.

The best thing you can do is to anticipate the issues and develop systems along with processes to address them should they ever come up, to keep the supplier relationship in good standing.

Timely Supplier Communication About Inventory

If during the process of testing the supply goods your organization discovers an issue or two with them, you may run into some issues with timely communication.

Smaller organizations may be able to reach the supplier and let them know right away, but larger organizations may have to log the issue for another staff member to process.

This results in delays in the customer’s and supplier’s operations because the procuring organization is stuck trying to handle unusable Goods while the vendor has cash and inventory tied up with the customer.

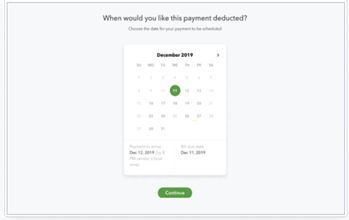

Slow Turnaround Times

Ideally, a GRN needs to be issued when suppliers make the deliveries. But, sometimes, this won’t be the case since the department within your organization that orders the goods needs to get hands-on with the supplies to make sure they are as expected.

This can cause delays with issuing suppliers needing to wait until the customer has completed their due diligence. In larger organizations, it can take up to a week for a GRN to be issued.

Recording Errors Causing Invoicing Delays

Three copies of the GRN are issued to the ordering department, the procurement team, and the supplier.

Over the course of recording, it’s easy for one team to miss it smaller detail in their own copy. When it’s time to settle the suppliers in voice, this creates delays until the human error is resolved.

Worst case scenario, this could overextend your organization and lead to supplier invoices accruing interest because they were paid late.

Managing Administrative Workload

Properly managing GRNs is hard administrative work. When issues come up with GRNs, there’s even more work involved.

If all of that word is handed to the procurement department for them to manually address each issue to contact various departments and the suppliers to find a solution, you’re adding more to the procurement department’s workload without adding value to the company and improving the bottom line.

That’s why goods received not invoiced (GRNI) reconciliation process is paramount to operational efficiency.

Disputes with Faulty Goods

Regardless of how strict your vetting process is, it’s always possible for a single bad piece of inventory to go unnoticed. And when it happens, it makes sense that you’d try to get the issue resolved with the supplier.

However, once you sign off that you’ve received the delivery and everything is up to your standard, it will harder to get recourse.

The supplier has already handled quality and quantity compliance checks on their end, and when you submitted the GRN, you agreed that the delivery of goods was satisfactory.

Handle GRN and Reconciliation with PLANERGY

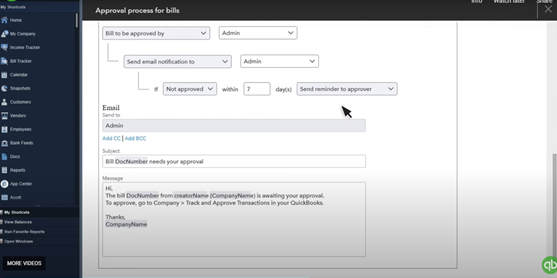

PLANERGY is designed to give your organization the tools you need to manage the entire procure to pay process, including GRNs. With PLANERGY, you can:

- Build custom workflows and processes to match how your company already does things

- Manage all your vendors and contracts from a single place

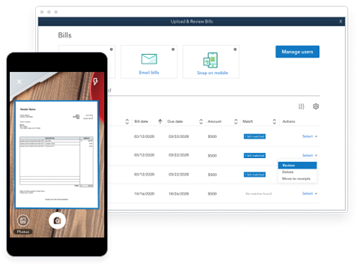

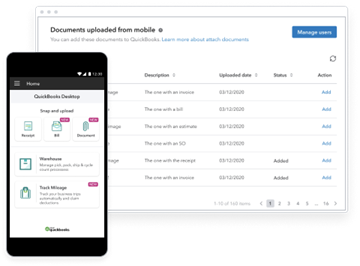

- Integrate with your accounting department’s tools

- Keep an eye on who took what actions and when with the audit trail

- Automate processes with three-way matching and routing rules

- Keep things moving when someone’s out of the office with inheritable and temporary user permissions

- And more…

PLANERGY simplifies the procurement process so you can maximize its impact on your bottom line and let the team focus more time and effort on value-added tasks.