Building and maintaining a strong business credit profile can be a game-changer for your company.

From securing better loan terms to winning more clients, the benefits of good business credit are hard to ignore.

This comprehensive guide will dive into business credit, its importance, and how to establish and build your credit effectively.

Understanding Business Credit

Business credit, also known as commercial credit, measures a company’s ability to meet its financial obligations.

Similar to personal credit, business credit is tracked by credit bureaus and is reflected in a credit score.

This score indicates the creditworthiness of a business and helps lenders, vendors, and other stakeholders make informed decisions when working with the company.

Deciphering Business Credit Scores

A business credit score is a numerical representation of a company’s creditworthiness.

It’s typically calculated based on factors such as credit history, outstanding debts, payment history, and public records like bankruptcies, liens, or judgments.

The most well-known business credit scoring system is the Dun & Bradstreet PAYDEX score, which ranges from 1 to 100, with higher scores indicating better creditworthiness.

Other major business credit bureaus include Experian and Equifax, each with its own scoring system. The FICO Small Business Scoring Service (FICO SBSS) ranges from 0 to 300, for instance.

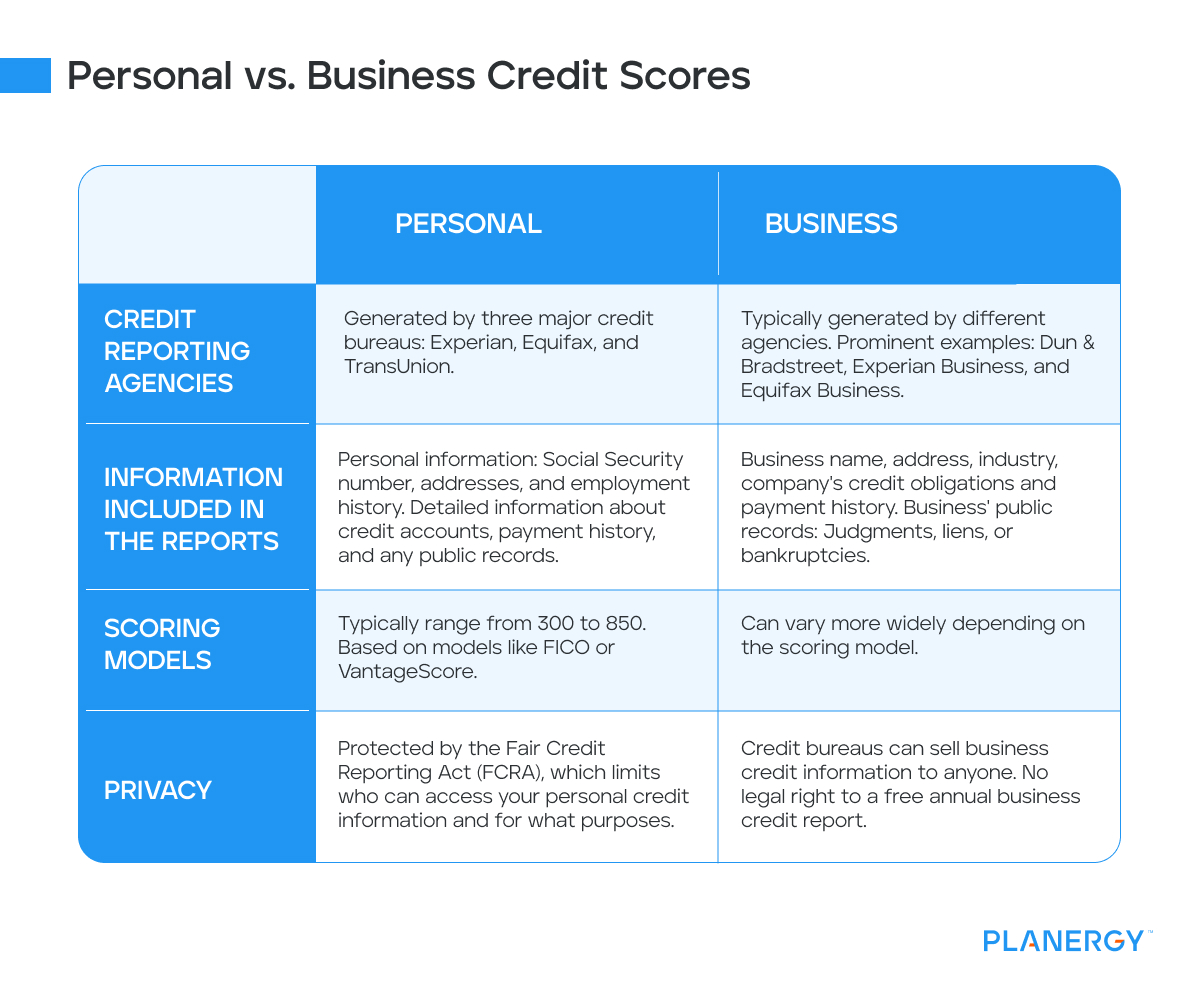

Personal vs. Business Credit Scores

While both business and personal credit reporting share the common goal of providing a measure of creditworthiness, there are a number of key differences between the two.

-

Credit Reporting Agencies

Personal credit reports are generated by three major credit bureaus: Experian, Equifax, and TransUnion. These agencies track and record your personal credit history, which includes credit cards, mortgages, student loans, and other personal debts.

On the other hand, business credit reports are typically generated by different agencies, the most prominent being Dun & Bradstreet, Experian Business, and Equifax Business.

These bureaus track credit information related to businesses, such as business credit cards, trade credit from suppliers, and business loans.

-

Information Included in the Reports

A personal credit report includes personal information like your name, Social Security number, addresses, and employment history. It also contains detailed information about your credit accounts, payment history, and any public records such as bankruptcies or tax liens.

Business credit reports, however, focus on the business’s details. They include the business name, address, industry, and information about the company’s credit obligations and payment history. They may also contain information about the business’s public records, such as judgments, liens, or bankruptcies.

-

Scoring Models

Personal credit scores typically range from 300 to 850, based on models like FICO or VantageScore. These scores take into account factors such as your payment history, amounts owed, length of credit history, types of credit used, and new credit.

Business credit scores, however, can vary more widely depending on the scoring model used by the credit bureau. These scores consider factors such as the business’s payment performance, credit utilization, length of credit history, and the company’s size and industry risk.

-

Privacy

Personal credit reports are protected by the Fair Credit Reporting Act (FCRA), which limits who can access your personal credit information and for what purposes. You’re also entitled to one free personal credit report from each of the three major bureaus every year.

Business credit reports, however, do not have these same protections. Credit bureaus can sell business credit information to anyone willing to pay for it, and there’s no legal right to a free annual business credit report. This makes it even more crucial for businesses to monitor their business credit reports and ensure the information is accurate and up-to-date.

Starting With an LLC

When you first form a limited liability company (LLC), it doesn’t automatically have a business credit score.

You’ll need to take steps to establish credit for your LLC, starting with setting up a separate business entity, opening a business bank account, and getting an Employer Identification Number (EIN) from the IRS.

Once these initial steps are taken, you can build your business credit profile by obtaining credit from vendors, securing loans, and making timely payments.

Note: A sole proprietorship cannot establish business credit, as it is not considered a separate legal entity from the person who operates it.

While entrepreneurs who are just getting started can benefit from a sole proprietorship because of how easy it is to start, it makes sense to form an LLC or corporation as a business grows.

Startups seeking venture capital or other forms of funding to expand their business must be an LLC or a corporation.

The Importance of Building Business Credit

Establishing and maintaining strong business credit offers several advantages.

A good business credit score can help you secure better loan terms and lower interest rates, reducing borrowing costs.

This gives you additional flexibility and options for cash flow management, liquidity management, and for managing your working capital.

Lenders are more likely to approve larger loans and lines of credit if your business has strong credit. Suppliers often offer more favorable payment terms and discounts to businesses with good credit.

A solid credit profile can also make your business more attractive to potential investors and clients, who may view it as a sign of financial stability and competence.

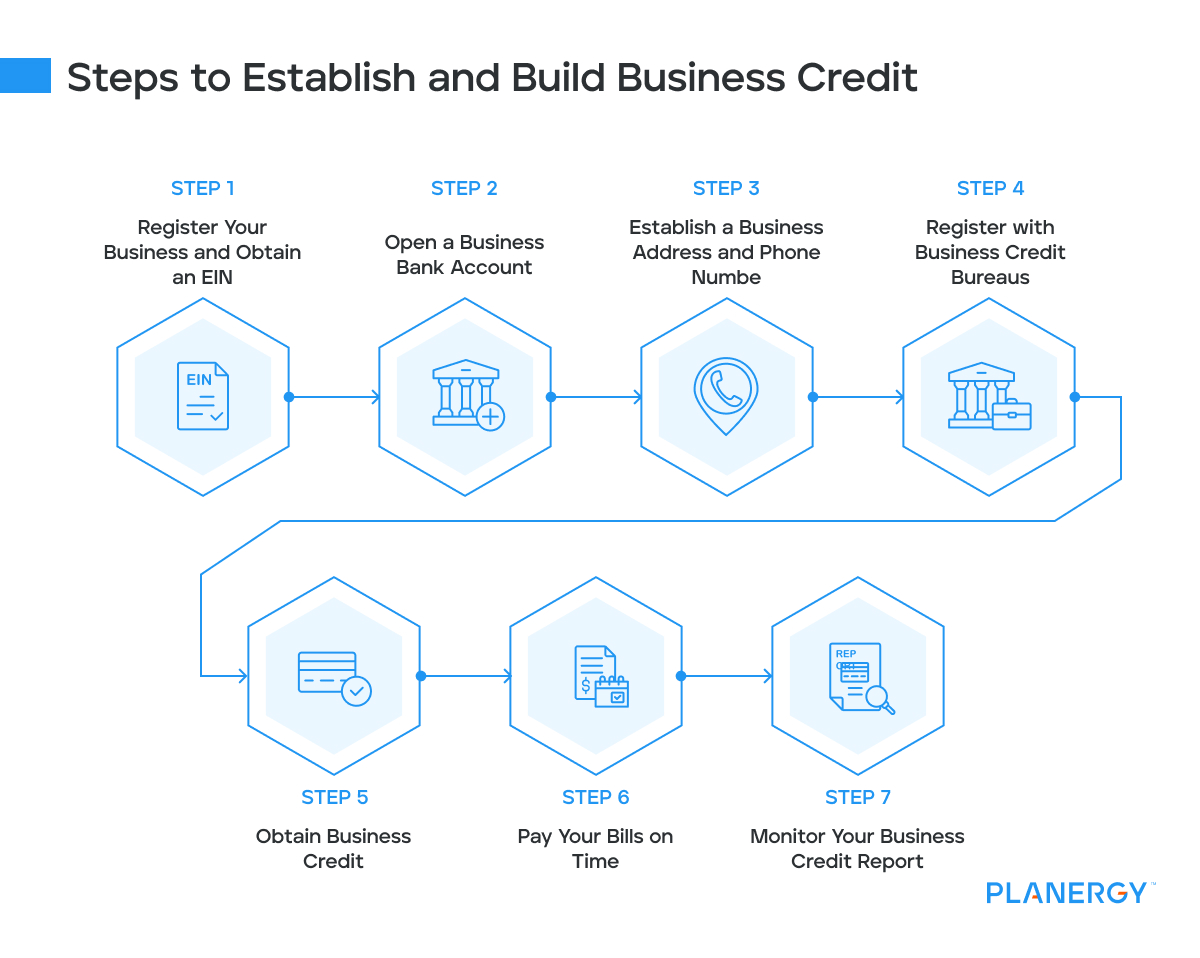

Steps to Establish and Build Business Credit

-

Register Your Business and Obtain an EIN

For a business to establish its own credit, it must first be recognized as a separate entity from the owner. This involves registering your business with your state’s Secretary of State office. The type of registration (e.g., LLC, Corporation) will depend on your business structure.

Next, you’ll need to get an EIN from the IRS. An EIN is like a Social Security number for your business and is used by the IRS to track your business’s tax obligations. It’s also required by most banks to open a business bank account, or run payroll.

For example, if Joe wants to start his coffee shop as an LLC, he would first register his business with his state’s Secretary of State office.

After receiving confirmation of his LLC status, he would apply for an EIN through the IRS website. Many companies that put together business filing packages for you charge for obtaining an EIN, but you can do it for free. Once you have it, don’t lose it! You’ll have to call the IRS to obtain it again.

-

Open a Business Bank Account

After your business is registered and has an EIN, the next step is to open a business bank account. This helps reinforce the separation between your personal finances and your business operations. It makes managing business expenses, tracking cash flow, and preparing for taxes easier.

Let’s say, Joe, from our previous example, opens a business checking account under his coffee shop’s name and EIN. He uses this account to pay for all business-related expenses, such as buying coffee beans and paying employees. By doing this, he’s establishing a financial history for his business.

-

Establish a Business Address and Phone Number

Establishing a separate business address and phone number further reinforces your business as a distinct entity. It also provides credit bureaus with consistent information about your business. You can use a physical address or a registered agent service and set up a landline or virtual phone number for your business.

For instance, Joe might rent a small office space for his coffee shop and list that address for all business registrations and applications. He might also set up a separate business phone line or use a VoIP service for business calls.

-

Register with Business Credit Bureaus

Registering with the major business credit bureaus—Dun & Bradstreet, Experian Business, and Equifax Business—helps ensure your business’s credit activity is accurately tracked. For example, Dun & Bradstreet issues a D-U-N-S number, a unique nine-digit identifier for businesses.

Joe, wanting to build good business credit for his coffee shop, would request a D-U-N-S number for his business. Later, when he starts working with suppliers and lenders who report to these credit bureaus, his business’s credit activity will be associated with this number.

-

Obtain Business Credit

To start building your business credit history, obtain credit from suppliers, vendors, or lenders that report to the business credit bureaus. This could be a business credit card, a trade account with a supplier, or a small business loan.

For instance, Joe might apply for a business credit card and use it for regular business expenses. Or he might set up a trade credit account with his coffee bean supplier, where he receives the beans now but pays for them 30 days later (net-30 terms). Both activities will help establish his business credit if reported to the credit bureaus.

-

Pay Your Bills on Time

There are many reasons to pay your bills on time, including to maintain strong vendor relationships. Maintaining a strong credit rating is another reason for this.

Just like with personal credit, your payment history plays a significant role in your business credit score. Consistently paying your bills on time shows lenders and creditors that your business is reliable and financially stable.

If Joe consistently pays his business credit card bill and trade credit account on time, this positive payment history will be reflected in his business credit score, making it easier for him to secure additional credit or loans in the future.

-

Monitor Your Business Credit Report

Regularly reviewing your business credit report allows you to catch any errors or discrepancies that could negatively impact your business credit score. It also helps you understand what actions improve your score and which might hurt it.

For example, Joe might notice that one of his suppliers isn’t reporting his on-time payments to the credit bureaus. After noticing this, he might choose to switch to a supplier who does report payments, thus further building his business credit.

As with personal credit, building credit for your business takes time. The better you score, the better your financing options become.

Fast Track to Business Credit for an LLC

To quickly establish business credit for your LLC, consider the following strategies:

-

Use a Business Credit Card

Business credit cards are a powerful tool for building business credit quickly. They allow businesses to make purchases and pay them off over time, demonstrating reliability and creditworthiness to credit bureaus.

For example, a business owner could use a business credit card to pay for routine expenses such as office supplies or utility bills. By paying off the balance each month, the business establishes a history of reliable payments, which can help improve its business credit score.

Choosing a business credit card that reports to the major business credit bureaus is important. Also, manage the card responsibly – keep the balance low and make payments on time.

-

Secure a Small Business Loan or Line of Credit

Securing a small business loan is another effective way to establish business credit. When a business takes out a loan and makes regular payments, it demonstrates to lenders that it can handle debt responsibly.

For instance, a business owner might take out a small business loan to purchase new equipment. If they make their loan payments on time, this positive payment history will be reported to the credit bureaus, helping to build the business’s credit profile.

Small business loans can be obtained from various sources, including banks, credit unions, and online lenders. Some businesses might also qualify for government-backed loans from the Small Business Administration (SBA), which often have lower interest rates and flexible terms.

-

Leverage Your Personal Credit

In some cases, business owners with strong personal credit can leverage it to get business credit. This can be particularly useful for new businesses that haven’t had the chance to establish their own credit yet.

For example, some lenders offer personal guarantee business loans, where the business owner’s personal credit score is used to guarantee the loan. If the business fails to repay the loan, the lender can seek repayment from the business owner personally.

While this method can help businesses establish credit more quickly, it also carries risks. If the business fails to repay the loan, the business owner’s personal credit could be damaged. Therefore, this strategy should be used carefully and as a last resort.

Building Small Business Credit Takes Time and Effort

Building business credit takes time and effort, but the benefits are well worth the investment.

By following these steps and remaining diligent about managing your business finances, you’ll be well on your way to establishing and improving your company’s credit profile.