Accuracy is key to the success of any business. Nowhere is accuracy more important than when paying your bills.

Simply assuming that an invoice received from a vendor or supplier is correct can cause a variety of issues for a business, resulting in costly overpayments and unhappy vendors and suppliers.

To ensure that bills are paid properly, the accounts payable department commonly uses invoice matching.

Used to verify invoice accuracy, invoice matching can also help detect invoice fraud and ensure that invoices are paid promptly, a significant benefit for both your business and your vendors.

What Is Invoice Matching?

Invoice matching is used to verify that invoice details match other accounts payable documents.

Most businesses use three-way matching, which verifies information from the following supporting documents:

The Original Purchase Order or PO

The purchase order is created by the purchasing business and is sent to the vendor.

The PO specifies the goods and services that are being purchased, the quantity purchased, the price of the goods and services, and the payment terms.

This is done so that both the buyer and the seller agree on all terms and conditions.

Receiving Documents

The seller includes receiving documents when shipping goods to the buyer.

Receiving documents such as a packing list, shipping manifest, or order receipt provide a detailed description of what is included in the shipment.

If services are ordered, the buyer will not receive a receiving document.

Vendor Invoice

The invoice is sent from the vendor to the buyer and should contain the same information that is found in the corresponding purchase order.

- A unique invoice number

- The invoice amount

- An invoice date

- A due date

- A remittance address or way to pay

- The total due

- Any available credits or early payment discounts if available

Once all three of these documents are available, they are matched for accuracy by the AP team.

How Does Invoice Matching Work?

The invoice matching process workflow works differently if you’re using a manual processing system or an automated one.

With a manual workflow system, the buyer creates a purchase order, sends it to the vendor or supplier, and when the products have been received, matches the original purchase order to the receiving documents and the invoice.

If there is an exception or deviation, further investigation will be required before the invoice can be approved for payment.

However, if you’re using an automated system, the matching process is completed automatically once the invoice has been scanned and read, flagging exceptions if one is found.

This automation also eliminates the need to enter invoices manually.

What Are the Different Types of Invoice Matching?

The most common type of invoice matching is 3-way matching, mentioned earlier, which matches a vendor invoice against a PO and receiving documents.

However, there are other types of invoice matching that can be used, depending on your business model.

2-Way Matching

2-way matching is used to verify that the information on the PO matches the vendor invoice.

2-way matching is commonly used in businesses that a purchasing a service and are not receiving a product.

4-Way Matching

4-way matching verifies invoice accuracy by comparing information on four documents; the purchase order, the receipt of goods document or shipping manifest, the vendor invoice, and an inspection report, which provides information such as quality and compliance with specifications.

An inspection report can also contain information on the acceptance or rejection of goods received and the reason for the rejection.

What Is a Deviation?

A deviation, also known as an invoice exception occurs when the information on an invoice does not match the PO or the shipping receipt.

Two of the most common deviations are the price deviation and the quantity deviation.

If a deviation occurs during the matching process, further investigation is required to determine if the deviation is accurate or if an adjustment is needed.

In any case, the invoice cannot be processed for payment until the deviation or exception has been investigated and the issue resolved.

Deviations can also occur should the line items on a purchase order not be included in the invoice.

Why Is the Invoice Matching Process Performed?

The invoice matching process is performed for several reasons, including the following:

- It helps prevent erroneous or duplicate payments

- It can help detect invoice fraud

- It ensures that the products received match the quantity ordered and invoiced

- Prevents unauthorized purchases or rogue spending

Invoice matching is a vital part of the accounts payable process.

Invoice matching helps a business maintain accuracy and helps businesses identify any potential issues with vendor or supplier invoicing so that recurring issues can be addressed.

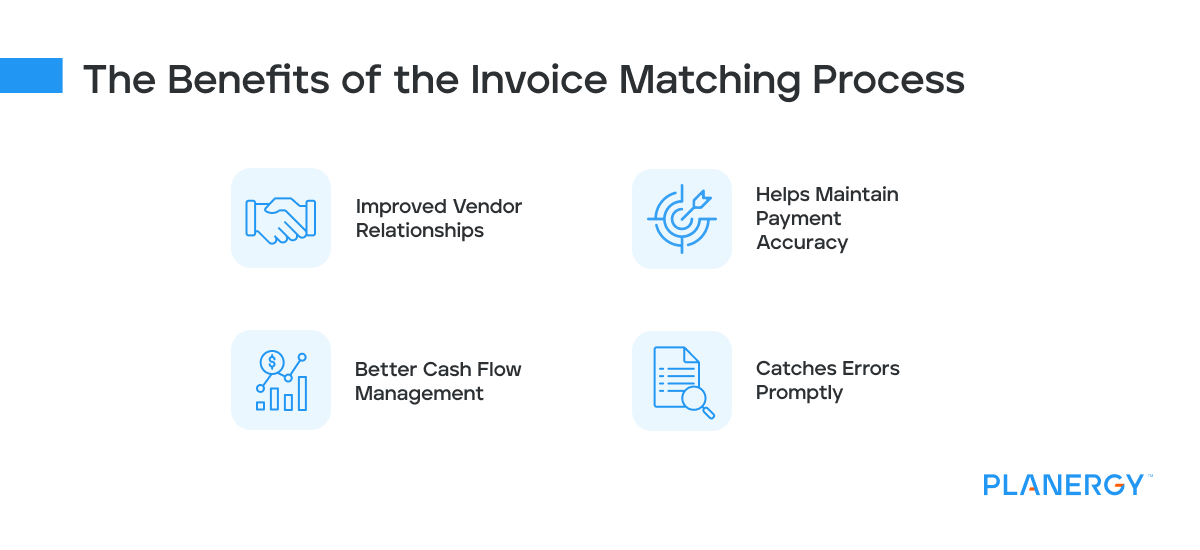

What Are the Benefits of the Invoice Matching Process?

One of the most significant benefits of invoice matching is that it provides a level of protection against both overpayments and underpayments.

But there are other benefits to using the invoice matching process, including:

Improved Vendor Relationships

Everyone wants to be paid on time and your vendors are no exception.

When you use the invoice matching process, you can quickly approve accurate invoices for on-time payment while identifying those that may need further investigation.

Better Cash Flow Management

Cash flow is directly tied to the invoice approval process. And the invoice approval process is directly tied to the matching process.

Timely invoice matching allows you to keep track of your cash flow in real-time, providing you with the working capital you need.

Helps Maintain Payment Accuracy

Your purchase order should include the cost of the goods or services you are purchasing. This amount should agree with the amount billed on the invoice.

If you don’t use invoice matching, you may be paying too much for an item or service.

Catches Errors Promptly

Invoice matching can help you catch potential issues before they become a real problem.

For example, if you overpay a vendor for products ordered, it may be difficult to obtain a refund from the vendor, particularly if you don’t plan on ordering from them again.

How Can Discrepancies Be Resolved During the Invoice Matching Process?

The two most common exceptions or deviations found during the matching process involve price and quantity, though exceptions can also be found in these areas:

- Different payment terms

- Missing lines on the original purchase order

- Sales tax calculations

- Contact information

The accounts payable department should have an established process in place for handling any exceptions, including having clear roles and responsibilities defined for those responsible for handling exceptions.

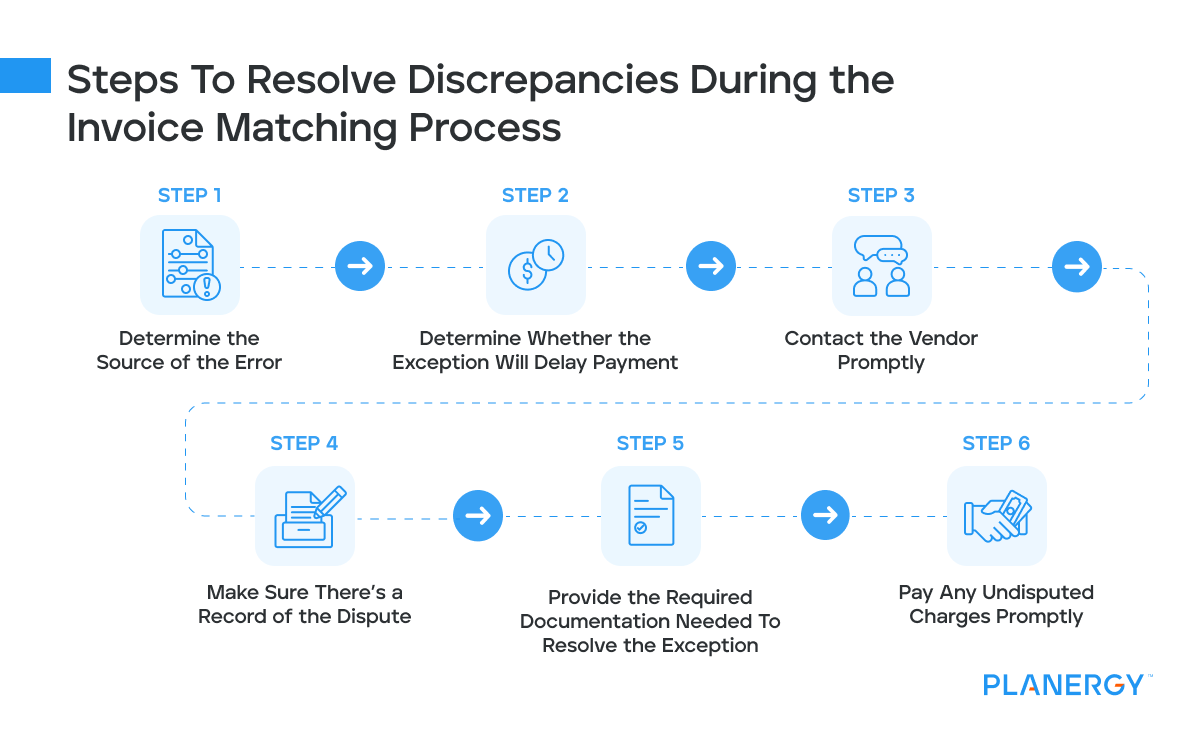

Once those roles have been defined, the following steps should be taken to resolve the discrepancy:

Determine the Source of the Error

Not every exception is the fault of the vendor or supplier.

For instance, if an AP clerk enters the wrong price in the purchase order, the pricing may be adjusted by the vendor during the invoicing process.

If an error is internal, make sure the necessary steps are taken to correct the issue to ensure timely vendor payment.

Determine Whether the Exception Will Delay Payment

Many businesses establish a tolerance level that allows a payment to be processed, even if an exception is discovered.

For example, your business has set a tolerance level of 5% variance for pricing.

On your completed purchase order, the unit price of the item ordered is $8 per unit, but the invoice displays the price as $8.50.

In this case, the tolerance level would be exceeded, requiring you to pull the invoice for review.

On the other hand, if the vendor billed the item at $8.25, it would fall within the tolerance level, meaning that it can still be processed for payment while the difference is being investigated.

Quantity exceptions almost always delay invoice processing, unless the items are shipped in two or more deliveries.

If that’s the case, it’s helpful to wait until both deliveries have been received before approving the invoice for payment.

Contact the Vendor Promptly

Any time an exception or deviation is flagged, the vendor or supplier should be contacted immediately.

Following up immediately helps jump-start the review process necessary to correct any issues promptly, eliminating late payments.

Make Sure There’s a Record of the Dispute

If you contact your vendor or supplier by phone, make sure that you provide additional documentation in writing as well.

For example, if you inform your vendor about a pricing dispute, follow up the conversation with an email detailing the issue.

Provide the Required Documentation Needed To Resolve the Exception

If there’s a pricing or quantity dispute, be sure to provide your vendor or supplier with copies of the original purchase order as well as the invoice.

In theory, they will have these documents as well, but providing them makes it much easier for the vendor to begin their investigative process.

Documentation should include:

- A detailed description of the exception

- A copy of the vendor’s or supplier’s invoice

- A copy of the purchase order

- A copy of the shipping receipt

Pay Any Undisputed Charges Promptly

If you have a pricing dispute on one item, but all the other items are accurate, be sure to pay the undisputed amount promptly.

Find out if your vendor prefers to send an updated invoice or will issue a credit memo for the disputed balance.

In either case, paying the balance of the invoice on time will help preserve your business relationship.

How Can I Improve My Company’s Invoice Matching Process To Increase Efficiency?

The matching process is a necessity for any accounts payable department.

Unfortunately, when done manually, the process is time-consuming and can result in payment delays.

The best way to improve your company’s invoice matching process is by introducing AP automation, which introduces features that can streamline the entire matching process.

Optical Character Recognition (OCR)

Optical character recognition or OCR converts electronic invoices from their original format (PDF and image files) to a searchable format that then extracts the data from the invoice into searchable and editable text.

This eliminates the need to enter invoice data, reducing data entry errors and freeing up valuable staff time.

Artificial Intelligence (AI)

Artificial intelligence is the centerpiece of automation, able to analyze and recognize patterns in unstructured data.

Once identified, the pattern is remembered over time.

Robotic Process Automation (RPA)

Robotic process automation works directly with OCR technology to automatically process invoices once data has been extracted.

Once the data is processed, it is matched against an existing purchase order and delivery receipts, eliminating the need to manually complete 2-way or 3-way matching.

An application like PLANERGY uses artificial intelligence and machine learning to streamline the entire procurement and accounts payable process, offering the following features:

The ability to centralize data collection and organization for easy access to important documents.

Online cloud-based document storage that reduces paper use and provides access from any location.

A reduction in human error by eliminating manual processes.

Seamless integration with numerous accounting software applications and ERP systems for a complete financial solution.

The ability to record all pertinent vendor information, payment terms and conditions, and complete pricing automatically without the need for data entry.

Automation of the entire invoice matching process, enabling AP staff to identify and resolve exceptions quickly while eliminating the time-consuming manual invoice matching process.

Automated approval workflow to ensure that invoices are approved and paid on time.

Invoice Matching Is Here To Stay – Why Not Automate It?

The invoice matching process remains one of the most important processes completed by the accounts payable department.

Unfortunately, manual invoice matching is tedious, time-consuming, and uses up valuable AP staff time.

If you’re still struggling to keep current with manually matching invoices, consider implementing accounts payable automation.

Automation provides your business with more flexibility, enables the AP department to work remotely from any location, and eliminates many of the errors made during the manual AP process. In addition, automated invoice processing can help identify and flag fraudulent invoices before they’re paid.

Paying your bills accurately and on time starts with the invoice matching process, helping your business maintain healthy vendor and supplier relationships, eliminate costly overpayments, and reduce labor costs. It’s hard to argue with those results.