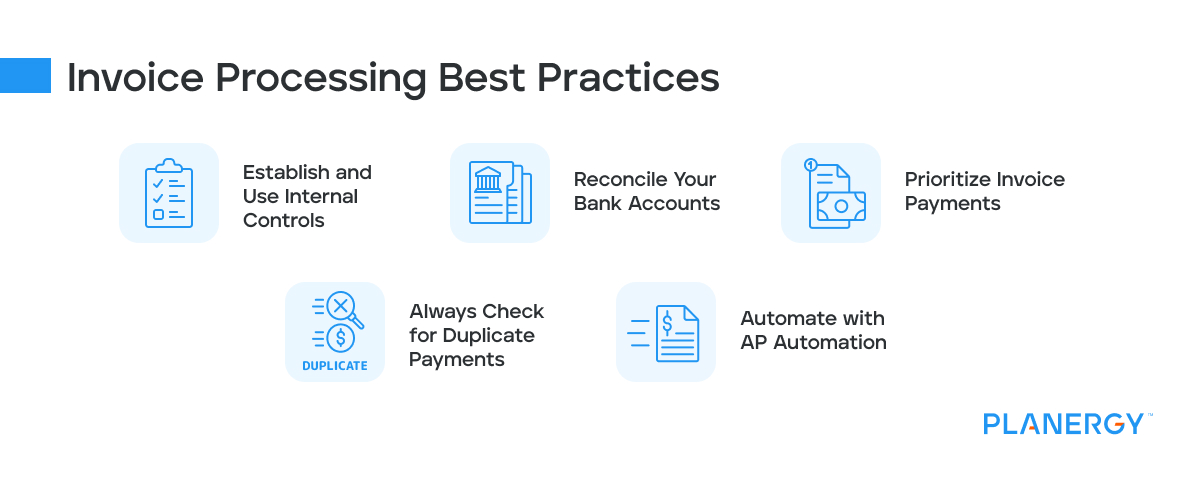

The keep your accounts payable department running smoothly, it’s a good idea to implement invoice processing best practices.

-

Establish and Use Internal Controls

Whether you’re an established business or are paying bills for the first time, creating internal controls for invoice processing and payment and using those controls is essential.

These controls should include the following:

Creating System Access Control Levels for All Employees

Giving your employees complete access to your financial systems leaves you vulnerable to fraud in accounts payable.

Instead, provide employees with the access level they need to do their job, and nothing more.

Implementing Segregation of Duties

Segregation of duties gives different parts of the AP process to different employees.

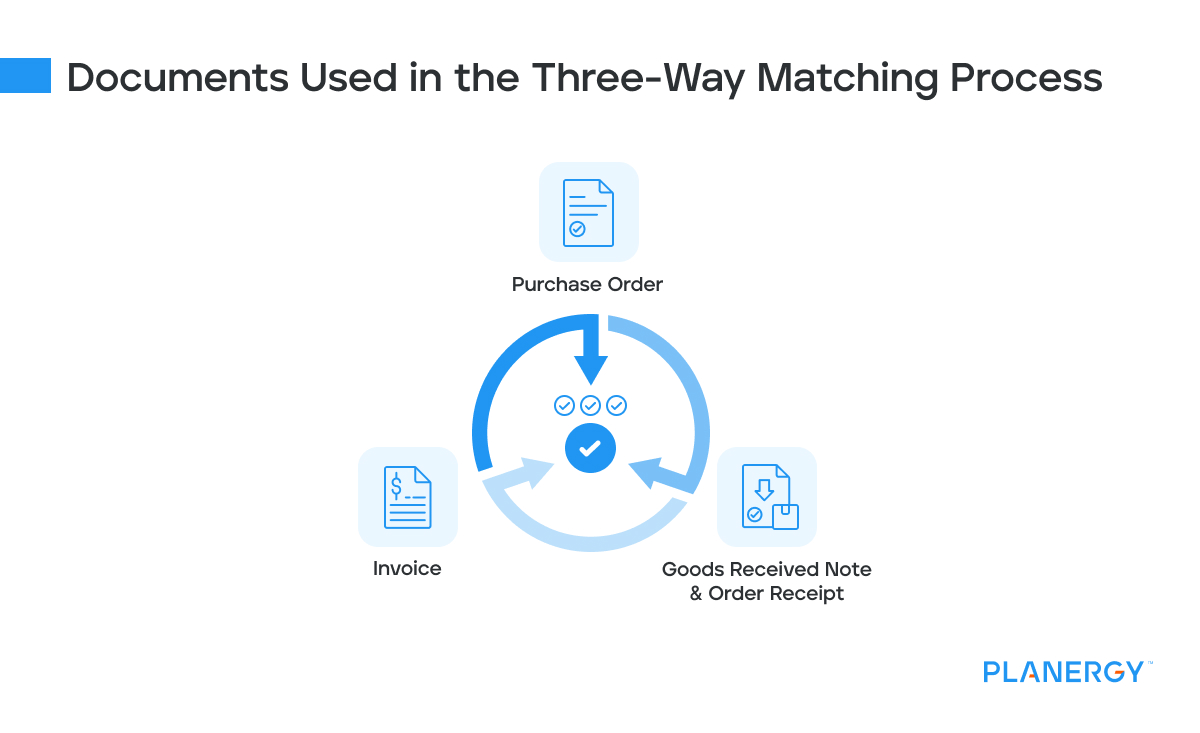

For example, the employee that approves an invoice should not be the same employee performing the three-way match.

In another example, the employee authorizing payment should not be the same employee that signs the checks or approves ACH transfers.

Very small businesses with limited resources may be only able to segregate AP tasks between two people, but a single person should never be solely responsible for approving, entering, and paying an invoice.

-

Reconcile Your Bank Accounts

You won’t know if a vendor hasn’t cashed their check if you don’t regularly reconcile your bank accounts.

Even if most AP payments are issued electronically, keeping your bank accounts reconciled can help spot potential fraud or other unauthorized charges.

-

Prioritize Invoice Payments

Prioritizing payments to take advantage of available discounts while waiting to pay invoices with longer payment terms can be a useful strategy and can also help maintain adequate cash flow.

-

Always Check for Duplicate Payments

Duplicate payments can be an issue if you’re still processing invoices and payments manually.

While you think you may recognize a duplicate payment immediately, if you tend to order the same products from the same vendor, it’s highly likely that you’ll receive invoices for the same amount.

Always review invoices for the same amount even if the invoice number is different.

This should be done before making a payment since it can be challenging to get a refund from a vendor for an overpayment.

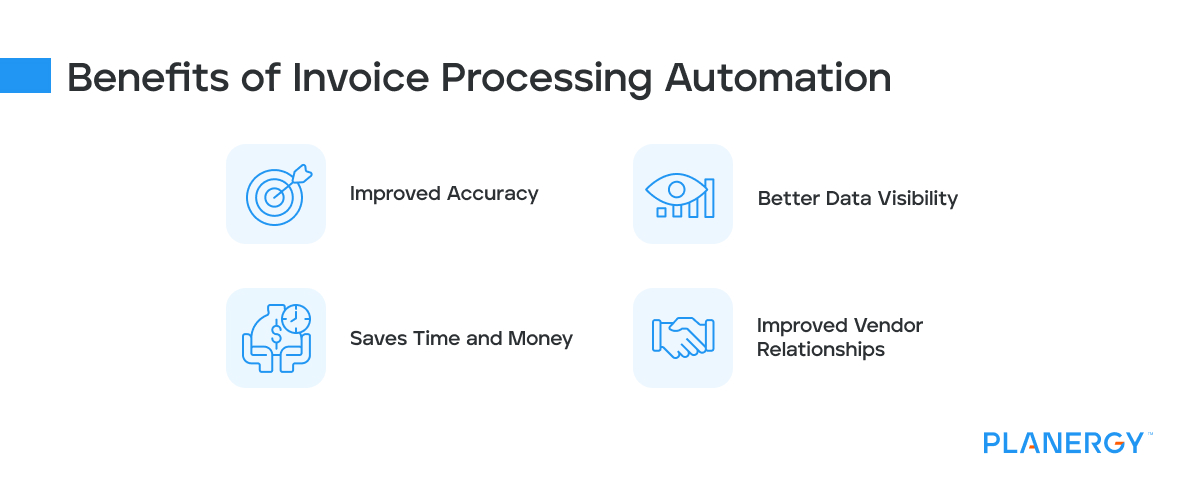

Of course, the best way to handle invoice processing is to make the switch to an automated workflow.