Working capital is a concept used in accounting to define the funds available to a business to grow, expand, and pay for daily expenses and short-term debts.

In essence, working capital is the money that a business has on hand to meet its short-term obligations.

While working capital is important for businesses of all sizes, it can be especially critical for small businesses and startups.

That’s because small businesses often have less cash on hand than larger businesses and may not have access to the same lines of credit or other forms of financing.

As a result, managing working capital can be the difference between a small business succeeding or failing.

What is Working Capital?

Working capital is the difference between a company’s current assets and liabilities.

This metric is important because it shows how much of a company’s assets are liquid (cash or cash equivalents) and how much is tied up in long-term investments.

This metric is a good indicator of a company’s financial health because it shows whether it has the funds available to meet its short-term obligations.

For example, if a company has more current liabilities than assets, it could sign that it will have trouble paying its bills on time.

On the other hand, if a company has a large amount of working capital, that could be a sign that it is over-leveraged and may not be using its funds efficiently.

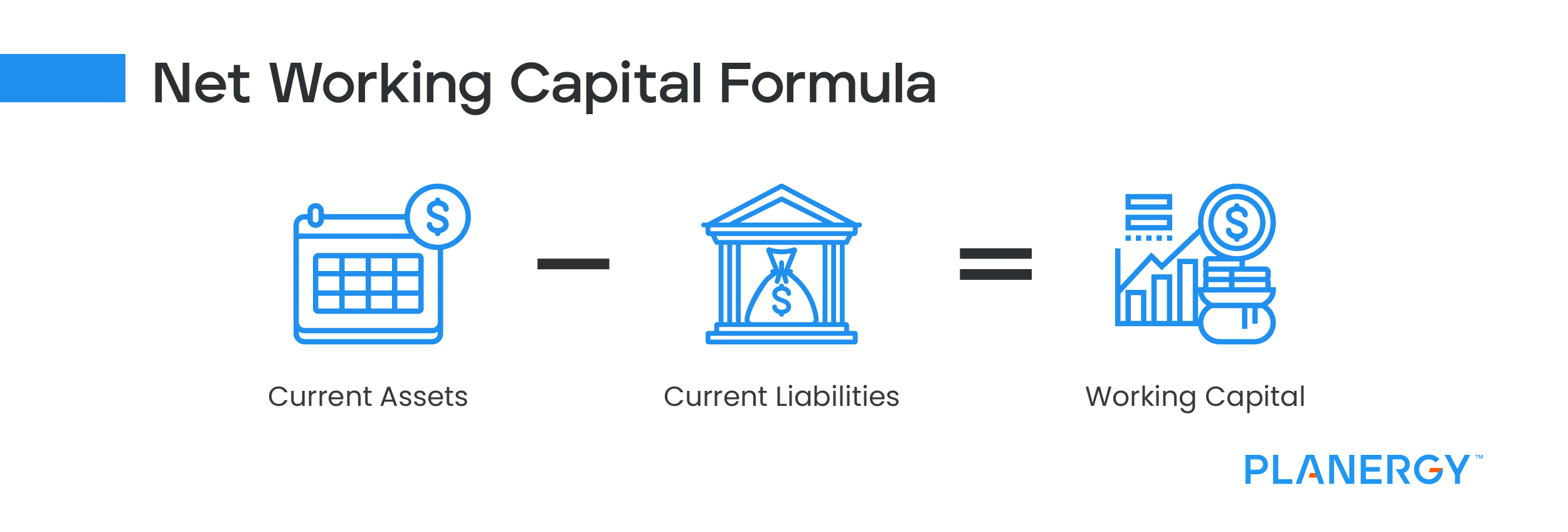

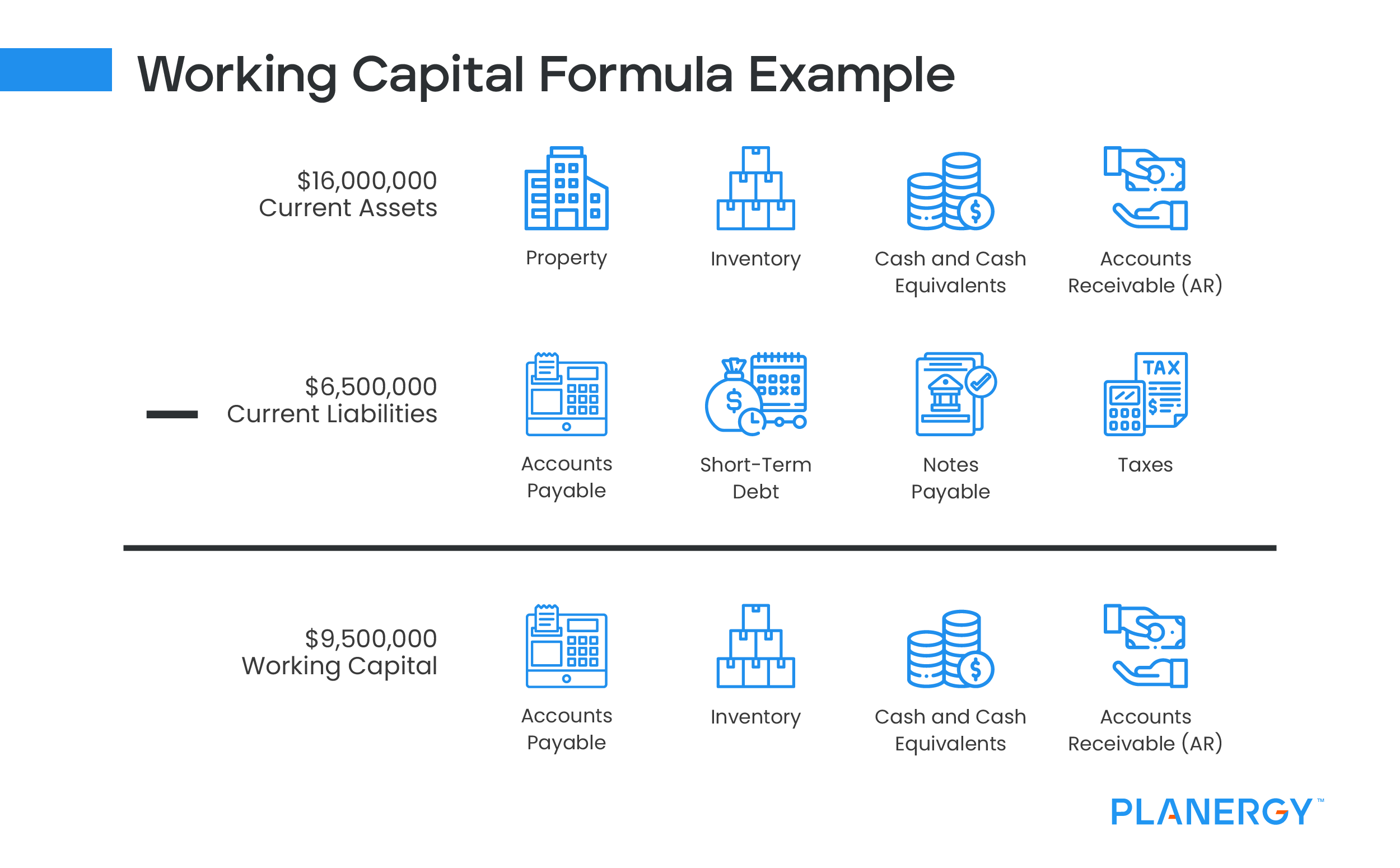

How to Calculate Working Capital

Working capital is calculated by subtracting a company’s current liabilities from its current assets.

This calculation provides a snapshot of a company’s financial health and liquidity at a given point in time.

The working capital formula is:

Current Assets – Current Liabilities = Working Capital

For example, let’s say Company XYZ has $100,000 in inventory, $50,000 in receivables, and $75,000 in payables.

Their net working capital would be $75,000 (($100,000 + $50,000) – $75,000)).

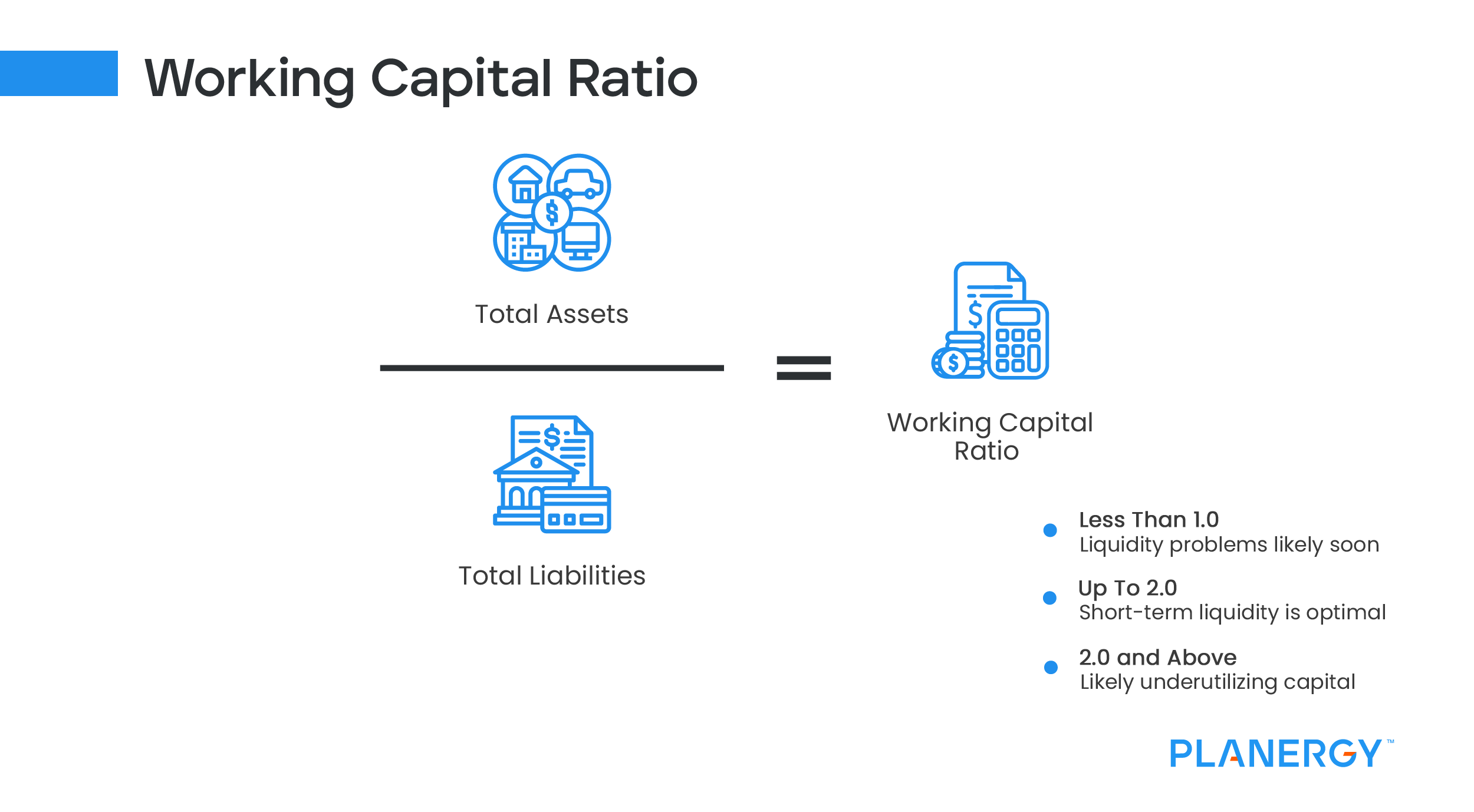

Working Capital Ratio

The working capital ratio is a financial ratio that measures a company’s ability to pay its current liabilities with its current assets.

The working capital ratio is calculated by dividing a company’s current assets by its current liabilities.

Current Assets / Current Liabilities = Working Capital Ratio

A company with a higher working capital ratio has more liquid assets and can better pay its short-term obligations.

A company with a lower working capital ratio may have difficulty meeting its short-term obligations.

The working capital ratio is an important financial metric for procurement professionals to consider when assessing suppliers.

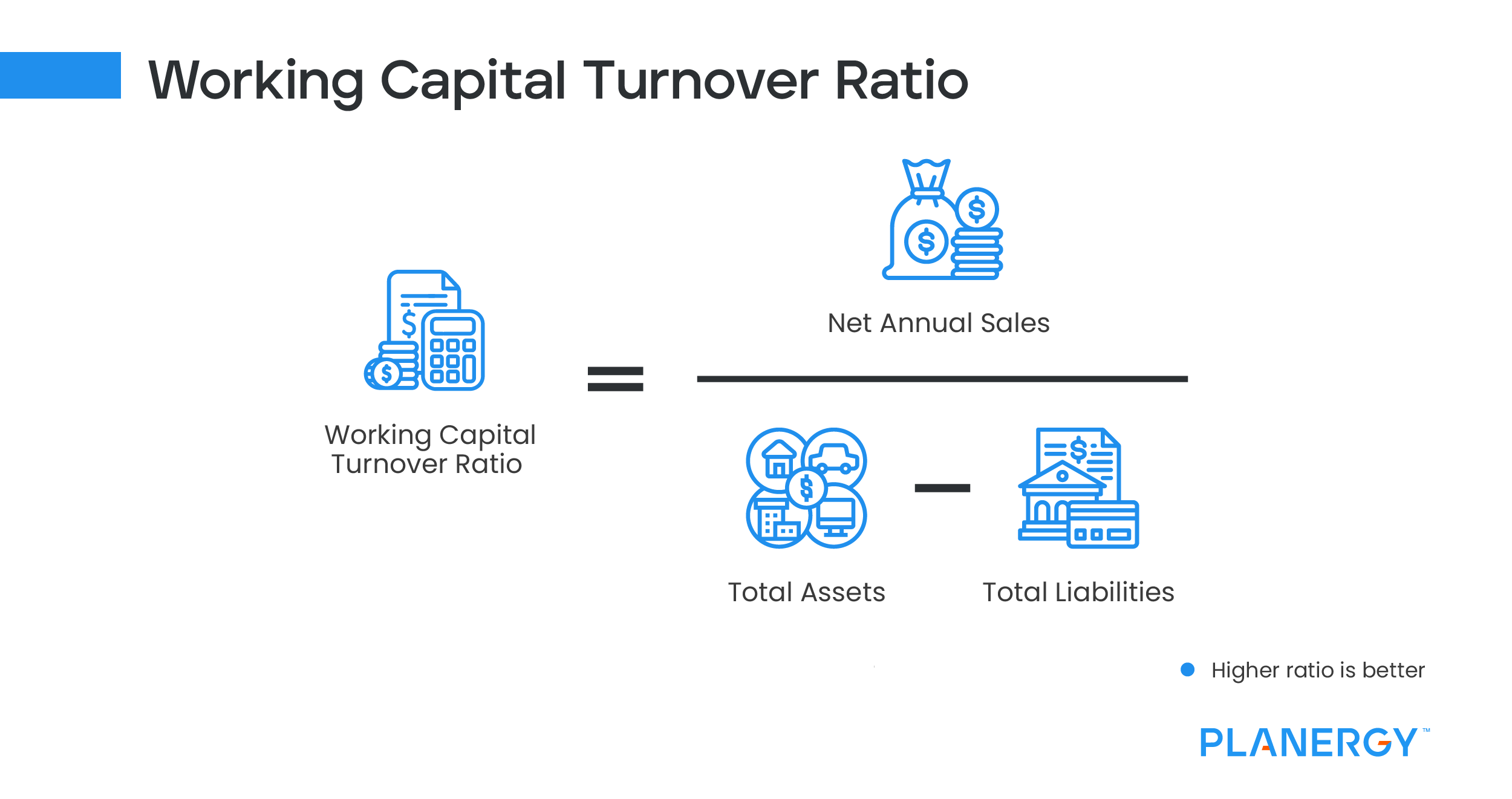

Working Capital Turnover Ratio

The working capital turnover ratio is a financial metric that measures a company’s efficiency in using its working capital.

Working capital is the difference between a company’s current assets and liabilities.

The working capital turnover ratio is calculated by dividing a company’s sales by its working capital.

A high working capital turnover indicates that a company efficiently uses its working capital to generate sales.

Conversely, a low working capital turnover ratio indicates that a company is not efficient in using its working capital to generate sales.

The working capital turnover ratio is an important financial metric for procurement professionals to monitor. It can be used to assess a company’s financial health and identify opportunities for improvement.

A supplier with a strong working capital position is likely to be more financially stable and meet its contractual obligations.

A supplier with a weak working capital position may risk defaulting on its debt obligations.

A positive working capital balance indicates that a company has enough cash to pay its short-term obligations, while a negative balance suggests that it does not.

However, it’s important to remember that a positive working capital balance doesn’t necessarily mean that a company is profitable—it only means that the company’s liquidity can meet its short-term obligations.

To determine whether a company is actually profitable, you’ll need to look at other financial metrics, such as net income and gross margin.

Why is Working Capital Important?

Working capital is important because it can impact a company’s ability to finance its day-to-day operating expenses, fund expansion plans, and take advantage of new opportunities as they arise.

For example, if a company has strong working capital management, it may have the flexibility to invest in new product development or enter new markets without putting strain on its cash flow.

In contrast, if working capital management is weak, the company may find itself unable to respond to opportunities in a timely manner or make necessary investments in its business.

This can ultimately limit growth and hamper the company’s long-term prospects.

Tips to Help You Effective Manage Working Capital

An effective working capital management strategy is essential to ensuring that a company has the money it needs to meet its financial obligations and avoid defaulting on its debt.

Make sure you have a clear understanding of your company’s working capital situation.

This means having a clear picture of your short-term assets and liabilities. To do this, you’ll need to review your financial statements regularly.

Manage Procurement and Inventory Effectively

Establish Clear Procedures and Protocols

Who is responsible for placing orders? Who is responsible for receiving goods? What quality control measures are in place? By establishing clear procedures and protocols, you can minimize errors and misunderstandings.

Use Technology

Technology can be a powerful tool in managing procurement and inventory. Several software solutions, like PLANERGY, on the market, can help you keep track of orders, monitor stock levels, and more. Utilizing technology can help you work more efficiently and effectively.

Stay Organized

Keep track of purchase orders, invoices, delivery schedules, and more. Staying organized will help you avoid errors and ensure that you have the information you need when you need it.

Keep Track of What You Have On Hand

This may seem like a no-brainer, but it is important to keep an accurate count of what you have in stock at all times. This way, you will know when you need to reorder and can avoid overordering, which can tie up capital unnecessarily.

Use software to track your inventory levels, so you always have an up-to-date picture of what you have on hand.

Don’t Wait Until You’re Out of Stock to Reorder

Waiting until you are completely out of an item, especially raw materials, before reordering is a recipe for disaster. If possible, keep at least a month’s worth of inventory on hand.

This will help ensure that you never run completely out of an item and have to go without it while waiting for a new shipment to arrive.

Use the inventory turnover ratio to help determine how often and how much you should order.

Use the Just-in-Time (JIT) inventory Method

JIT inventory management is a system in which items are ordered only as needed rather than stocked in advance. This can help reduce the amount of money tied up in inventory and free up storage space.

To make JIT work, it is important to have good relationships with suppliers and a robust system for tracking inventory levels so that you only order what you need when you need it.

Make On-Time Payments to Vendors

Bad debts reflect poorly on your company and make it hard to build solid relationships with your suppliers and investors.

If the company’s cash reserves make it impossible to pay bills on time – that’s a troublesome sign.

Your days payable outstanding (DPO) will give you an idea of how long it takes your company to pay suppliers. Aim to keep it low while paying for everything on time.

Paying things early is great if you can capture a good discount. But, if that discount comes at the expense of paying another supplier late, it’s not worth it.

With a better understanding of your working capital needs, you can optimize your processes for better cash management.

Improve Your Accounts Receivable Process

Establish Clear Payment Terms with Customers from the Beginning

When invoicing a customer, include information about when the invoice is due and any late payment fees that may apply.

This will help ensure that your customers know your payment terms and avoid misunderstandings.

Offering early payment discounts can speed up the collection and improve your cash conversion cycle (CCC.)

Stay on Top of Invoicing

The sooner you invoice a customer, the sooner you’ll get paid. Make it a point to send invoices as soon as the work is completed, or the product has been shipped.

If you wait too long to invoice, you’re more likely to run into problems getting paid on time.

Follow Up on Past-due Invoices Promptly

Don’t hesitate to follow up if a customer doesn’t pay an invoice on time. A courteous phone call or email can prompt customers to make a payment they might have forgotten about.

However, be sure not to be overly aggressive in your collections efforts – you don’t want to alienate your customers!

Consider Offering Discounts for Early Payment

Many businesses offer a discount (usually 2-3%) for customers who pay their invoices within ten days or less. This can be a great way to encourage prompt payment and improve your cash flow at the same time.

Just be sure to clearly state the terms of the discount in your invoices, so there are no surprises for your customers.

Use Accounting Software to Automate Receivables Management

Keeping track of receivables manually can be time-consuming and frustrating. By using accounting software such as QuickBooks or Xero with PLANERGY, you can automate many of the tasks associated with receivables management, freeing up your time to focus on other aspects of running your business.

Manage Accounts Payable Properly

Establish Internal Controls

Internal controls for accounts payable are procedures that help ensure accuracy and compliance with regulations. They can also help deter and detect fraud.

Examples of internal controls for accounts payable include requiring all invoices to be approved by a supervisor before they are processed and keeping detailed records of all invoices and payments.

Develop Policies and Procedures for Invoice Processing

These should cover how invoices should be received and routed for approval, how often payments should be made, and what documentation should be kept on file. Following set policies and procedures can help ensure that invoices are paid promptly and accurately.

Carefully Review Invoices Before Paying

Check the invoice date, vendor information, invoice amount, and account coding to ensure everything is correct. Reviewing invoices before they are paid can help prevent errors and save money in the long run.

Benefits of Strong Working Capital Management

Improved Cash Flow

Businesses have improved cash flow when working capital is managed well. This allows them to reinvest in the business, pay down debt, and take advantage of opportunities when they arise.

Increased Profitability

Excellent working capital management leads to increased profitability. Businesses have more money to reinvest in growth initiatives and operational efficiencies.

Better Decision Making

With improved cash flow comes better decision-making. Businesses can invest in research and development, hire key personnel, and make other decisions to help them compete and succeed in the marketplace.

Reduced Borrowing Costs

Good working capital management can lead to lower interest rates and better credit terms. Businesses have a better chance of obtaining financing on favorable terms when they have strong working capital positions.

Improved Investor Confidence

Good management of working capital instills confidence in investors. When investors see that a company is effectively managing its finances, they are more likely to put their money into the business, providing it with the capital it needs to grow and thrive.

Effective Working Capital Management is Critical for All Businesses

An effective working capital management strategy is crucial to the success of any business.

By following these tips, you can ensure that your company has the money it needs to meet its short-term obligations and avoid defaulting on its debt.