Regardless of whether you sell peanuts or plywood, you have an order-to-cash process that ensures timely order processing and payment receipt.

Clearly defining this process offers a host of benefits including prompt order fulfillment and timely payments.

If you’re not sure what the order-to-cash process is or how to create one for your business, we’ll explain the process from end-to-end.

What is the Order-to-Cash Process?

The Order-to-cash process or order-to-cash cycle, typically abbreviated as the OTC process or the O2C cycle, refers to the customer order process, starting with the initial order and ending with the posting of the customer’s payment.

Having a clearly defined O2C process helps businesses better manage cash flow by reducing the amount of time between order receipt and the customer’s payment.

For instance, if you receive an order on May 1 and your order fulfillment department doesn’t process the order until May 7, that extends the amount of time between the initial order receipt and payment.

However, if the order is processed on May 2, that reduces the time between the order receipt and payment receipt by five days.

What Are the Steps in the Order-to-Cash Process?

There are multiple business processes in the order-to-cash process.

These steps usually include different parties, which is why having a company-wide O2C process in place is vital.

Order Management

Having an efficient order process is the first step in the O2C process.

Regardless of whether order placement is completed electronically through an ecommerce website, brought in by a salesperson, or emailed or faxed, once the customer order is in hand, the O2C process begins.

Managing Credit

The next step is to consider any existing credit issues.

Does the customer placing the order have existing credit with your company or will you have to preapprove the customer purchase?

The answer to that question will impact the next step; approving credit for the new customer or sending the received order to order fulfillment.

Fulfilling the Order

Depending on the system that you’re currently using, order fulfillment may be completed electronically or manually.

When a sales order is received, it’s up to the order fulfillment department to determine first whether the order can be filled.

If there’s sufficient inventory, the order can move on to the shipping phase.

If an item is out of stock, the order will need to be pulled and the customer notified.

During this process, the inventory count will need to be updated as well.

If you’re using an automated system, inventory management is a simple process that is completed automatically, while a manual system will require an inventory count adjustment.

Shipping

While the order shipping step may seem straightforward, if the shipping department does not promptly handle the shipping process, it can create a bottleneck for the entire O2C process.

The shipping process includes preparing the product for shipment, scheduling product pickup from the chosen carrier, and regularly auditing the process for accuracy and speed.

Invoicing

Invoice generation or invoice creation should be completed promptly, with AR staff receiving invoicing details daily.

If you’re using an automated invoicing system, this process can be completed immediately after the order fulfillment process.

However, if you’re still processing orders manually, you’ll need to wait for order fulfillment and shipping to get their information to the AR staff before an invoice can be created.

Completing this process manually often results in payment delays.

Accounts Receivable Management

The receivable process is an important part of the O2C cycle.

Once an invoice has been prepared and sent to the customer, it’s up to the accounts receivable department to regularly monitor outstanding invoices by sending payment reminders and beginning the payment collection process when necessary.

If a customer disputes an invoice or an error is found, a correct invoice should be sent promptly.

Payment Receipt and Follow-Up

An invoice payment should be recorded in the general ledger upon receipt.

For invoices that are coming due, a payment reminder sent days before an invoice is due can be useful in securing payment.

Once an invoice has been identified as past due, the AR department should promptly begin collection activity including contacting the customer regarding the balance due, making any payment arrangements, and advising the late-paying customer about any late payment fees or penalties due.

In addition, a system should be in place that prohibits a customer with a past-due balance from purchasing anything until the past-due invoice has been paid.

Again, much of this process can be automated, but regardless of the system you have in place, it will need to be completed.

Reporting and Analysis

Having a system in place to track O2C performance can help you pinpoint areas that need improvement as well as what’s being done right.

For example, if there’s a lag between order receipt and fulfillment, review the current process to identify any potential trouble spots, since the lag could be centered in the credit area or the fulfillment area.

Knowing where the delays occur can help you address the issue.

What Are the Common Challenges Faced During the Order-to-Cash Process?

The order-to-cash process requires that multiple departments work together to form a cohesive team.

This in itself can often present a challenge, particularly when one department is up to speed, but another is causing costly delays.

But other challenges need to be addressed in the order-to-cash process, including:

Manual Processes

Using manual processes can present significant challenges during the order-to-cash process.

If you’re still processing customer orders manually, you’re relying on the next person to complete their part of the process.

For example, you receive an order, print it out, and then send it to the credit manager, who then has to verify the customer or run a credit check on a new customer.

Then, the order is forwarded to the fulfillment department, which then sends the information to the person responsible for invoicing.

Each one of the steps requires that the next person completes their task promptly and forwards the information to the next person.

Unfortunately, manual processes can also create delays in order shipment and invoice payment.

Poor Credit Management

A lot of payment delays are the result of poor credit management, which can be anything from not running the appropriate credit check on a new customer to not giving customers the appropriate credit terms.

Part of the credit management process should also include periodically reviewing current customer accounts to see if a new credit check needs to be completed or payment terms updated.

Inefficient Payment Options

If you’re still sending your customers a paper invoice with a return envelope, you’re missing the opportunity to get paid a lot quicker.

Providing your customers with multiple payment options makes it easier for them to pay you, resulting in earlier payments.

Inadequate Cash Flow

Challenges created by using a manual order-to-cash process frequently result in inadequate cash inflows.

Every time a customer pays an invoice late, it directly impacts your available cash flow and your working capital.

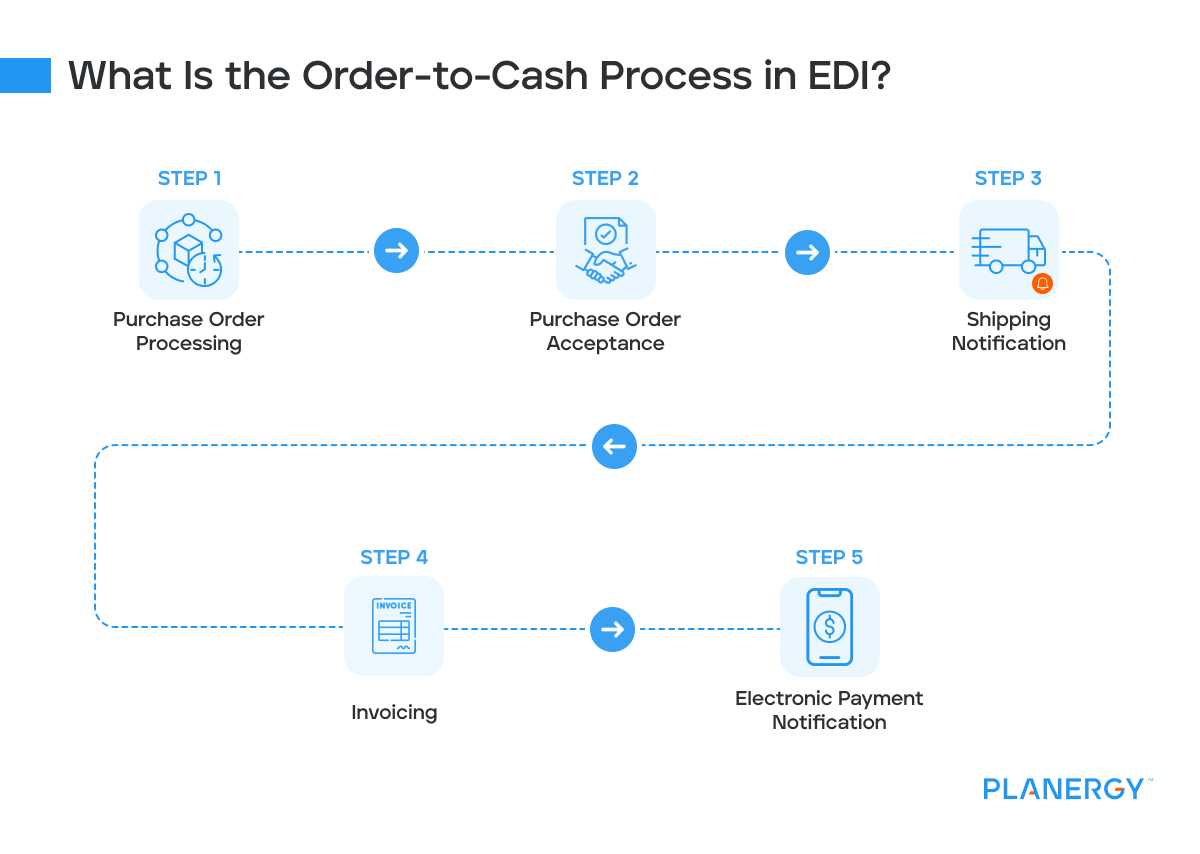

What Is the Order-to-Cash Process in EDI?

The cash-to-order process using electronic data exchange or EDI streamlines the entire process by eliminating the need for human involvement.

Using EDI, the order-to-cash process follows this sequence:

Purchase Order Processing

The first step in the O2C process is to create a purchase order.

Using EDI, the purchase order is sent electronically to the vendor or supplier, eliminating the need to create, send, and process the order manually.

Purchase Order Acceptance

The next step in the process is the acceptance of the purchase order as it was sent.

If there are any questions or the vendor or supplier rejects the purchase order as written, it will be electronically returned to the buyer for correction.

Shipping Notification

Once an order has been processed and is ready to ship, the buyer will be automatically notified by the vendor or supplier with information such as shipping date, expected delivery date, a tracking number to check on the progress of the shipment, along with a complete description of the item(s) being shipped.

Invoicing

Once the order has been shipped to the customer, an invoice is automatically created and sent electronically.

The invoice includes relevant data including a unique invoice number along with payment options, the due date, and the total amount due.

If the information on an invoice does not match the information on a purchase order, the invoice will be flagged for review.

Electronic Payment Notification

The customer will send a payment confirmation directly to the vendor or supplier that provides payment details, including the amount paid and the payment method.

Used as an electronic check stub of sorts, the notification streamlines payment processing considerably.

How Can Invoice Processing Be Optimized for Faster Payments?

The longer it takes for you to process an order, the longer it takes to invoice your vendors and suppliers.

And the longer it takes to complete customer invoicing, the more your profitability levels will be impacted.

The best way to optimize invoice processing is by automating the entire procure-to-pay process with an accounting software application like PLANERGY, which automates the entire accounts payable process including the order processing system and the approval process while providing real-time reporting capability with complete workflow optimization.

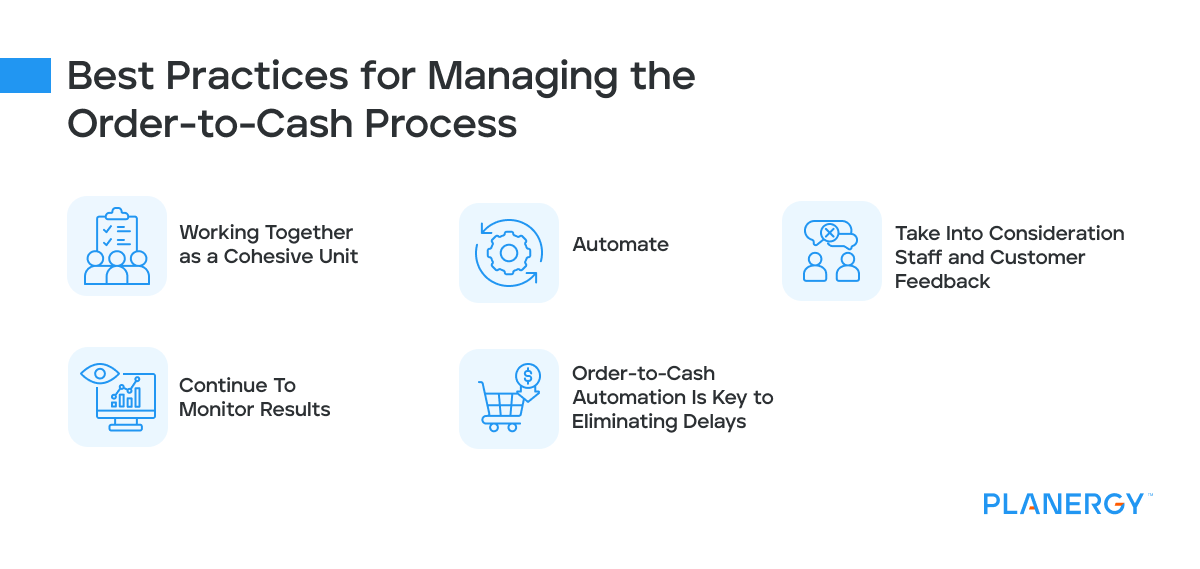

Best Practices for Managing the Order-to-Cash Process

If your business is continually struggling with delays in the order-to-cash process, it’s best to utilize a step-by-step analysis of the area(s) causing the problem.

For instance, are you still processing purchase orders manually?

Does your team struggle to get orders fulfilled on time?

Are payments always late because your team isn’t getting them out to your vendors and suppliers on time?

Once the problem areas are identified, you can then move towards automating those processes.

Other best practices include:

Working Together as a Cohesive Unit

In most companies, the order-to-cash process requires that multiple departments work together seamlessly.

To eliminate potential issues, make sure that you have established standards in place and that all departments are on board with those standards.

Automate

Using multiple software applications in your business can feel like a step up from processing orders and invoices manually, but it can create just as much of a delay.

Instead, commit to integrating your entire system so that the purchasing department is using the same application or ERP system that the order fulfillment department and the AP department use.

Otherwise, things will continue to fall through the cracks.

Take Into Consideration Staff and Customer Feedback

Customer satisfaction plays a large role in the success of your business.

If you’re receiving constant complaints about shipping times or lost or erroneous invoices, that’s a red flag that needs to be addressed immediately.

Ignoring those complaints can result in a negative customer experience, and ultimately destroy your customer relationship.

Likewise, if your staff repeatedly identifies trouble areas in the O2C process, be sure to take their feedback seriously.

Continue To Monitor Results

You’ve identified the bottlenecks and taken the necessary steps to correct them.

But even after the changes are complete, you’ll still want to monitor the process end-to-end for any issues that may remain.

Order-to-Cash Automation Is Key to Eliminating Delays

Lost purchase orders, delayed order fulfillment, or lost invoices will quickly become a thing of the past when the O2C process is automated.

More than ever, customers expect their orders to be shipped quickly and vendors and suppliers expect payment promptly. With automation, you can do both.