From purchase to payment, many steps take place. How a company manages that process from the beginning to the end can have a major impact on its bottom line.

The small individual costs of slow, manual processes add up to big ones when you multiply the cost per PO or cost per invoice by the overall number of purchase orders and invoices your company processes.

Streamlined and automated processes can provide a competitive advantage.

In this article, we’ll examine the procure-to-pay (P2P) process and how you can automate it to maximize the return on investment of every dollar spent.

What Is Procure-to-Pay?

Also known as purchase-to-pay, the procure-to-pay (P2P) process is the steps a company takes to determine their needs for a purchase, choose a suitable vendor, order goods or services from that vendor, then pay for them.

The P2P typically works across two departments: Procurement for finding vendors and making purchases and accounts payable for making payments.

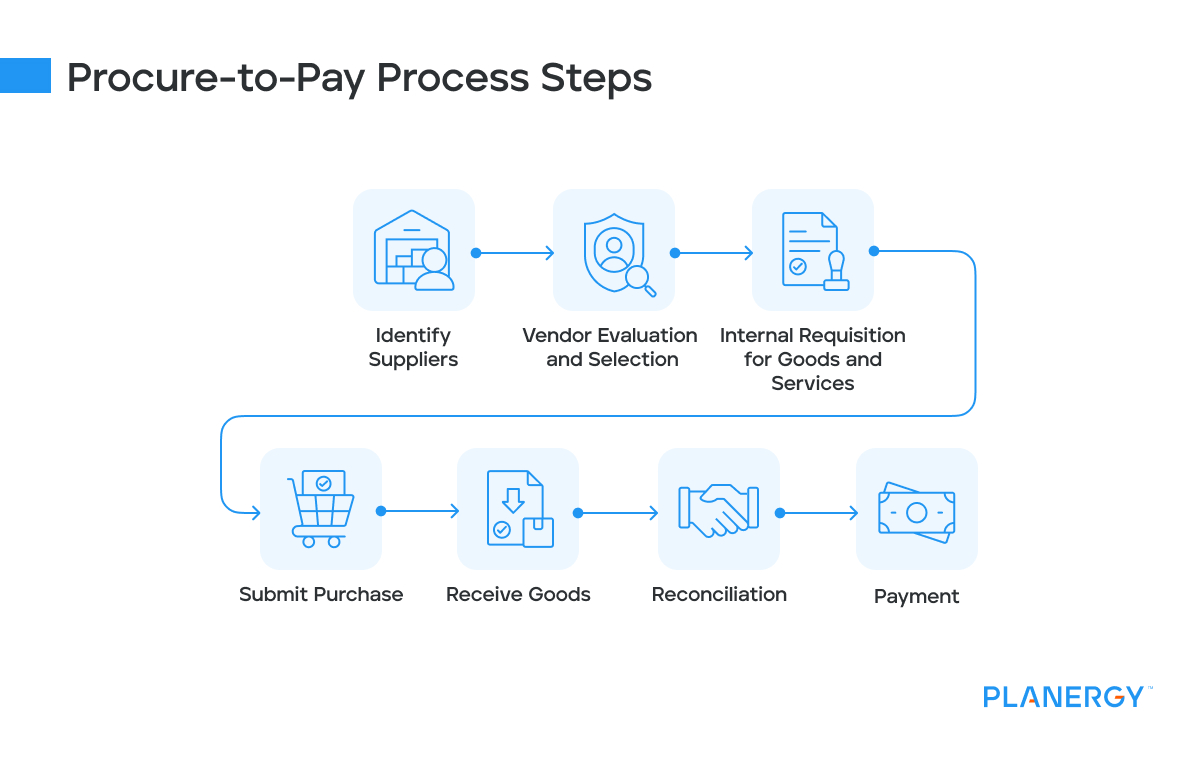

The P2P process incorporates a number of sub-processes, including the PO process and accounts payable process, and typically follows this series of steps:

Identify Suppliers

Companies search the market for suppliers and reach out to obtain pricing and discuss their ability to fulfill long-term needs. This might incorporate a sourcing event with RFQs or RFOs.

You can start building a good supplier relationship early in order to obtain favorable terms and pricing.

Vendor Evaluation and Selection

After reviewing potential vendors, procurement teams evaluate and identify the suppliers most likely to be reliable long-term suppliers. Then, they select a vendor based on pricing, quality, customer service, or other factors that matter most.

Internal Requisition for Goods and Services

Before making a purchase, most companies require that teams submit a request for internal approval to do so, called a purchase requisition.

Submit Purchase Order

Once the requisition is approved, companies send an official purchase order (PO) to the vendor.

The PO states what goods or services are being purchased, the price, quantity, and terms and conditions of the purchase (e.g. when the order will be paid).

Receiving Goods

Taking delivery of physical goods and documenting the details is known as ‘receiving’. You can follow a similar process for services tracking that the service was provided satisfactorily.

This step can include adding these items to the inventory management and accounting systems.

Reconciliation

This step involves reviewing the vendor invoice and comparing it to the original PO to verify all information is correct, including costs and fees.

Many companies use a system called ‘three-way matching’, where they must match the invoice to the PO and the packing slip or receipt. If it doesn’t match, they go back to the vendor to query and possibly dispute the invoice.

Payment via Accounts Payable

After the invoice is reconciled, the AP department submits payment to the vendor. They then add the amount paid into the company’s accounting system and the procure-to-pay process is complete.

Tackling this process manually (without the help of dedicated procure-to-pay software) can be tedious, time-consuming, error-prone, and labor-intensive.

It creates a higher potential for costly human error and is more easily susceptible to accounts payable fraud both internally and from vendors.

What is Procure-to-Pay Automation?

Procure-to-pay (P2P) automation streamlines the entire P2P process with software that either shortens or automates each step.

Procure-to-pay software enables organizations to achieve this while also providing other benefitssuch as spend visibility and automated spend analysis, tools to enforce compliance with internal policies and a better way to communicate with suppliers.

By automating the P2P cycle effectively, companies can cut costs, strengthen supplier relationships, and gain more control over their supply chain.

Additionally, P2P solutions can integrate with accounting software and enterprise resource planning (ERP) systems—allowing you to uncover benefits for every part of your business.

P2P automation has proven to pay off. A report by research firm The Hackett Group found that companies who fully leverage procurement process automation workflows were able to gain 68% more productivity over those who don’t.

Procure-to-pay automation transforms a time-consuming process into a rich opportunity to streamline processes, reduce costs, capture important data, and create long-lasting value.

How Do You Automate the P2P Cycle?

Automating the P2P cycle involves using procurement solutions to optimize each step of the P2P process.

An automated procure-to-pay cycle simplifies operations, strengthens collaboration between internal departments, reduces maverick spending, and improves relationships with suppliers—all of which lead to better business outcomes.

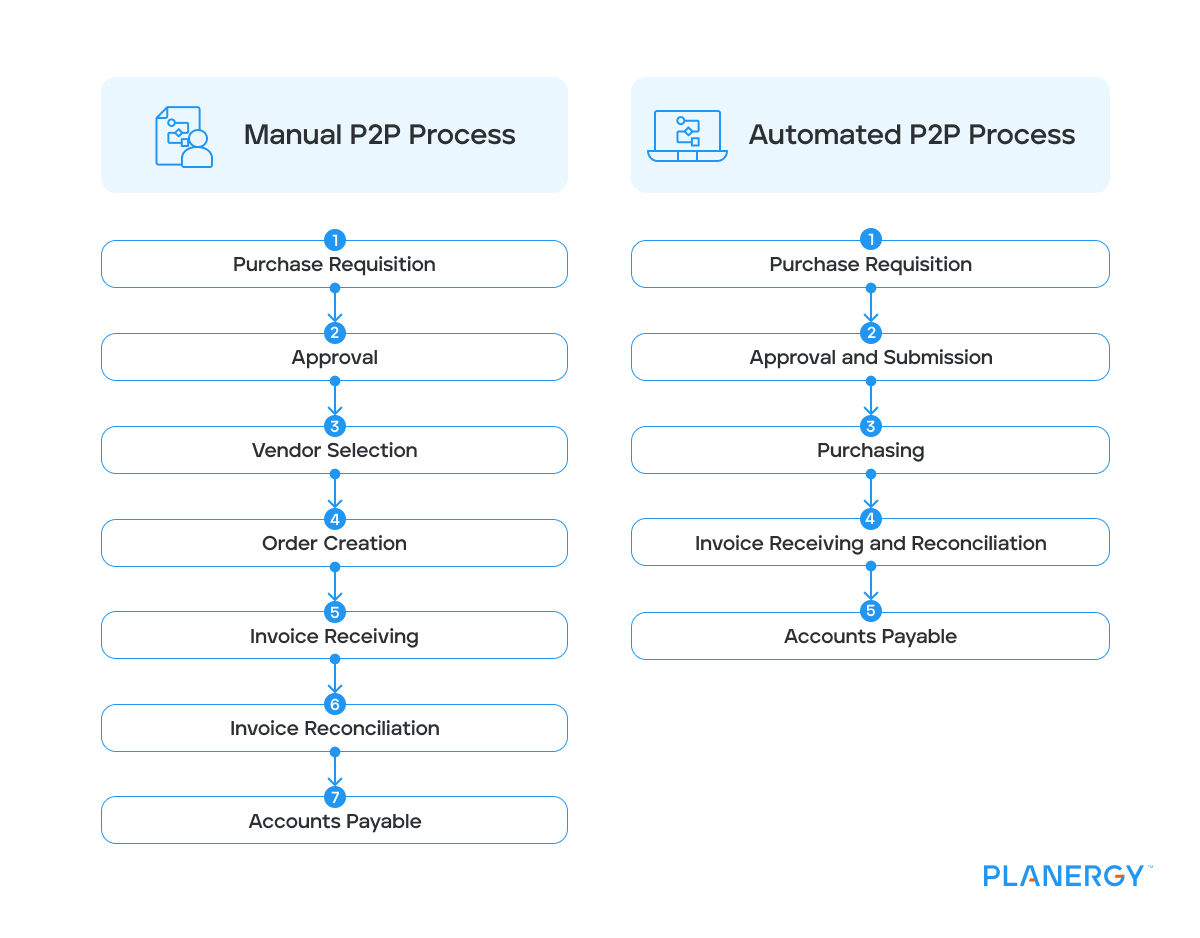

With automation software in place, the P2P process looks more like this:

Purchase Requisition

A centralized guided buying catalog of pre-approved goods and services from approved and preferred suppliers enables staff to choose what they need to purchase and submit a digital purchase requisition.

Approval and Submission

Routing approvals automatically to the appropriate internal reviewers based on pre-determined approval flows. Reminders are generated if a requisition gets stuck in the purchase order approval process.

Purchasing

Once the purchase request is approved, a purchase order is automatically created. The PO is auto-linked to the requisition and approval, and digitally submitted to the vendor through the P2P software system.

Receiving

Goods received or services delivered are logged in the P2P system, which is integrated with the inventory and accounting systems.

Order receipts, shipping documents, goods received notes, and packing lists are linked to the original PO and vendor invoices for reference and comparison.

Accounts Payable

Cloud-based data and document management make invoice processing faster.

AP automation software automatically processes invoices, digitally archives the documents, matches invoices against the upstream information on the PO, and identifies any exceptions.

This enables staff to easily verify all relevant information from the P2P system and submit payment with full confidence.

What Are the Benefits of P2P Automation?

P2P automation helps procurement teams achieve their main objective: to squeeze the maximum ROI out of every transaction. It also reduces the amount of work the finance team need to do when processing invoices.

By doing so, these process automations create several high-value benefits for any organization, including the following:

Total Visibility

Every transaction is a gold mine of information. Visibility into your transaction data can help you meet your spend management goals. With a procure-to-pay solution, you can track every transaction at every step of the process.

Tracking spend against budget, reporting on procure-to-pay KPIs, and offering spend analytics to identify saving opportunities in your spend.

This gives you the ability to identify bottlenecks, develop new process flows to handle exceptions, and identify potential process improvements.

You can also find opportunities to negotiate more favorable terms or pricing with vendors and create detailed financial reports.

Fraud Reduction

Fraud is an unfortunate concrete “cost of doing business” that affects companies on a global scale.

Adding centralized automation to your procurement function reduces fraud risk by enforcing internal purchasing controls and drawing hard lines between request, approval, and purchasing powers.

It also makes it difficult for “phantom” vendor invoices sent by scammers to enter the system.

When you have total visibility and control—and when slow manual processes are eliminated—there is much less room for fraud to slip through the cracks.

Better Supply Chain Management

As a side benefit, P2P automation solutions create a full knowledge database of your vendors.

Centralized document management connected to your ERP system makes it easier to keep track of each vendor’s terms and conditions, current and potential discounts, and overall performance.

Supplier performance tracking helps identify the suppliers that you should continue to work with and those that you should consider stopping giving business to if and when you decide to consolidate suppliers.

This information can help companies form mutually-beneficial relationships with high-performing vendors. It’s also easy to see realized cost savings and ROI from through re-negotiated contracts that offer better terms and pricing.

Less Risk, Improved Compliance

P2P automation reduces human error, fraud, and poor supply chain management. It also allows you to generate accurate financial reporting documents, and keeps a detailed audit trail for each transaction.

Having complete real-time data readily available helps you stay on top of audits and compliance requirements.

P2P solutions like PLANERGY also include contract management and customizable workflow options. This helps ensure your books are accurate, vendors are meeting your expectations, and every dollar spent is returning as much value as possible.

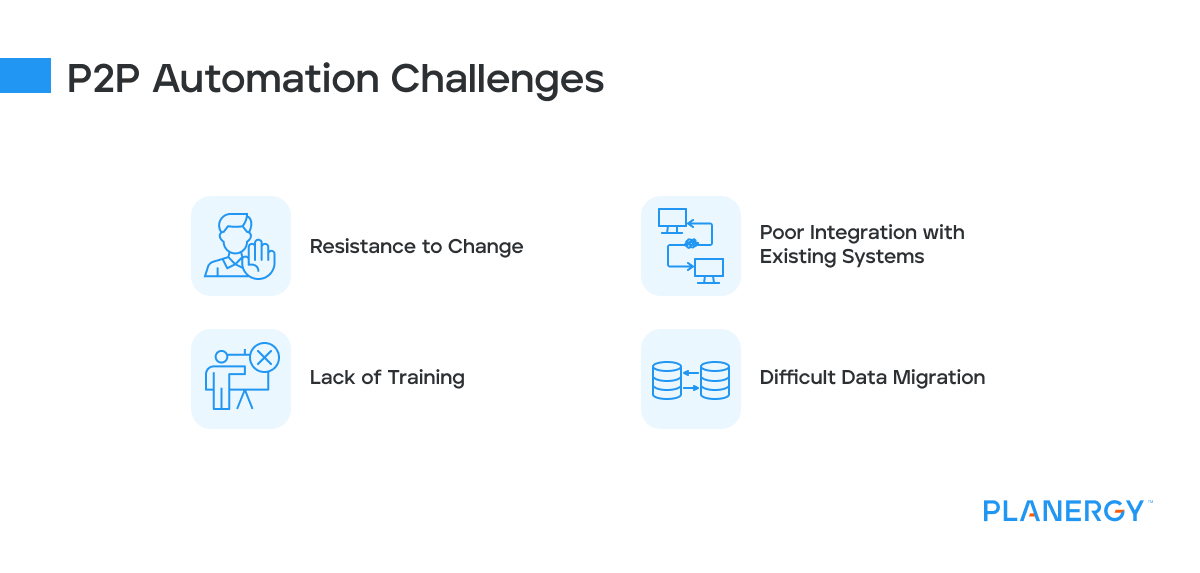

What Are the Challenges When Automating P2P?

Implementing new procurement software comes with its own set of challenges. Just like any new software implementation, there are obstacles to overcome and people who are used to doing things a certain way.

To prepare to overcome these challenges, it’s best to be aware of them ahead of time.

Some of these challenges include:

Resistance to Change

When implementing P2P automation, you should naturally expect resistance from employees and stakeholders who are accustomed to doing things the old way or are concerned about job security.

Openly communicating the benefits of automation can help get more buy-in, so don’t be shy about promoting increased efficiency, cost savings, and simplified processes.

Open communication helps alleviate the fear of automation. Instead of making people think they will get replaced, it helps them understand that they are getting a new tool that will help them be more productive and even enjoy their jobs more.

Poor Integration with Existing Systems

Integration with systems like ERP or accounting software can pose challenges due to compatibility issues.

It’s important to choose a solution that makes integration easier by having pre-built integrations or custom options to integrate with your accounting software or ERP.

Plan ahead for integration with your technical teams before you make the switch.

Lack of Training

Poor training, or no training, can create frustration and abandonment of a new system. To avoid misunderstandings, slow adoption, and incorrect usage, make a plan to train your employees as part of the onboarding process.

Planning for user adoption by ensuring training during the initial onboarding and implementation stage is key to success for any new software.

Each role can have its own unique training session or you can do large group training for all.

Difficult Data Migration

Importing legacy data from the previous systems into the new P2P automation platform can be time-consuming and difficult.

It’s important to work with the vendor ahead of time to ensure you know how the data migration process works and coordinate with your team to get your historical data ready to be migrated.

The faster this goes, the easier the overall roll-out process will be.

Procure-to-Pay Automation Best Practices to Consider

Implementing a few best practices helps set you up for P2P automation success and overcome common challenges. The following strategies will help you successfully implement automation and keep it running smoothly.

Standardize Your Processes

Standardization helps P2P automation function well, as it reduces the risk of inconsistency.

To standardize your P2P processes, it’s important to define clear duties and responsibilities, provide standardized training for everyone, establish clear policies (and enforce them automatically through the software), and keep processes simple.

Encourage Collaboration

Procurement software can promote collaboration between different departments, such as purchasing and finance. Getting everyone to use the system fosters that collaboration.

To make this happen, it’s essential to have C-suite partners on board. Once everyone is informed from the top down that this is ‘the system’, collaboration can happen much more easily.

Set Measurable Goals

Identify procurement goals for accountability, efficiency, cost savings, or faster delivery speeds.

Use procurement key performance indicators (KPIs) to make sure these goals are measurable and attainable. You can use your P2P software platform to track these KPIs and help you attain your goals.

Prioritize Control and Visibility

Automation is more compelling when you add control and visibility to the mix. The added control helps ensure policies and procedures are met, and the total visibility shows off the results that automation creates.

Make sure that you prioritize using the P2P software tools for control and visibility, as they will not only create compelling results but show them off and get more buy-in.

P2P Automation Generates More Value from Every Transaction

P2P automation helps you greatly reduce the overall cost of spending money for your business.

With it, you can create more value from every aspect of the procure-to-pay process from streamlined processes to vendor relations and sourcing.

All tasks are easier, and more value is found at every corner when compared to manual tasks that rely heavily on Excel, email, and paper forms.

Automating P2P frees your procurement department and finance team to fully support improving your company’s bottom line—instead of getting bogged down with busy work and problems that hurt cash flow.