Mitigating procurement risks requires a comprehensive approach that combines proactive planning, strategic partnerships, and the use of technology.

Diversification

Diversification involves spreading procurement across multiple suppliers and geographic regions to reduce dependency on any single source and mitigate risks associated with supplier failure or regional disruptions.

Key Approaches:

Multi-Sourcing: Engage multiple suppliers for critical components or services. This ensures a backup in case one supplier faces issues.

Geographic Spread: Source from suppliers in different countries or regions to protect against local disruptions such as natural disasters, political instability, or regulatory changes.

Supplier Tiers: Develop a tiered supplier structure with primary and secondary (backup) suppliers, ensuring continuity in case of primary supplier failure.

During the COVID-19 pandemic, companies with diversified supply chains were better able to manage disruptions.

For instance, Procter & Gamble’s strategy of using multiple suppliers and production facilities worldwide helped them maintain product availability despite regional lockdowns.

Contracts and Service Level Agreements (SLAs)

Contracts and SLAs are formal agreements defining the terms, conditions, and performance standards suppliers expect.

They provide legal recourse and clarity in case of disputes or non-compliance.

Key Approaches:

Detailed Contracts and Contract Management: Draft comprehensive contracts that cover all aspects of procurement, including quality standards, delivery schedules, compliance requirements, and penalties for non-performance.

SLAs: Include specific SLAs that outline performance metrics such as delivery times, defect rates, and response times. These help ensure accountability and performance consistency.

Risk Clauses: Incorporate clauses that address potential risks, such as escalation provisions for price increases, force majeure clauses for unexpected events, and exit strategies in case of prolonged non-compliance.

Tech companies like Dell often include stringent SLAs in their contracts with component suppliers to ensure timely delivery and high-quality standards, reducing the risk of production delays.

Technology Integration

Advanced technologies can enhance procurement processes’ visibility, control, and efficiency, mitigating risks.

Key Approaches:

Supply Chain Management Software: Implement software solutions that provide real-time visibility into the supply chain, enabling better tracking and management of procurement activities.

Automation: Use automation tools to streamline routine procurement tasks throughout the procure-to-pay cycle, like purchase orders and approval workflows, reduce human error and data entry, and improve process efficiency.

Data Analytics: Employ data analytics to gain insights into supplier performance, market trends, and potential risks, allowing for informed decision-making.

Blockchain: Consider blockchain technology to enhance transparency and traceability in the supply chain, reducing risks related to fraud and compliance.

Walmart uses blockchain technology to track the provenance of fresh produce from farm to store, enhancing food safety and reducing risks associated with contamination and recalls.

Continuous Improvement

Continuous improvement involves regularly reviewing and refining procurement processes to address emerging risks and enhance overall efficiency and effectiveness.

Key Approaches:

Kaizen: Adopt the Kaizen philosophy of continuous incremental improvements by involving all employees in identifying and solving procurement-related issues.

Regular Audits: Conduct regular internal and external audits of procurement processes to identify weaknesses and areas for improvement.

Feedback Loops: Establish feedback mechanisms with suppliers and internal stakeholders to continuously gather input and make necessary adjustments.

Benchmarking: Compare procurement practices against industry best practices to identify gaps and implement improvements.

Toyota’s implementation of the Kaizen philosophy in its supply chain management has led to continuous improvements in efficiency, quality, and risk mitigation, contributing to its reputation for operational excellence.

Supplier Development

Supplier development involves working closely with suppliers to improve their capabilities, reliability, and overall performance.

Key Approaches:

Training Programs: To enhance suppliers’ performance, offer training programs on quality management, compliance, and best practices.

Joint Improvement Initiatives: Collaborate with suppliers on joint improvement projects, such as process optimization or technology upgrades.

Incentives: Provide incentives for suppliers to meet or exceed performance standards, such as long-term contracts or financial bonuses.

Capacity Building: Assist suppliers in building capacity to handle larger volumes or more complex orders, reducing the risk of bottlenecks.

General Motors invests in supplier development programs to improve the capabilities of its suppliers, ensuring consistent quality and reliability in the supply chain.

Insurance

Insurance provides financial protection against specific risks, helping mitigate unforeseen events’ impact on the procurement process.

Key Approaches:

Political Risk Insurance: Obtain insurance to cover losses arising from political events such as expropriation, currency inconvertibility, or civil unrest.

Business Interruption Insurance: Secure insurance that compensates for lost income and additional expenses if a disruption halts operations.

Product Liability Insurance: Cover risks associated with defects or failures in supplied products that could lead to legal claims or financial losses.

Natural Disaster Insurance: Protect against losses from natural disasters like earthquakes, floods, or hurricanes that could disrupt supply chains.

Airbus uses political risk insurance to protect its investments and supply chain operations in regions prone to political instability, ensuring minimal financial impact in case of disruptions.

Comprehensive Procurement Risk Management Plan

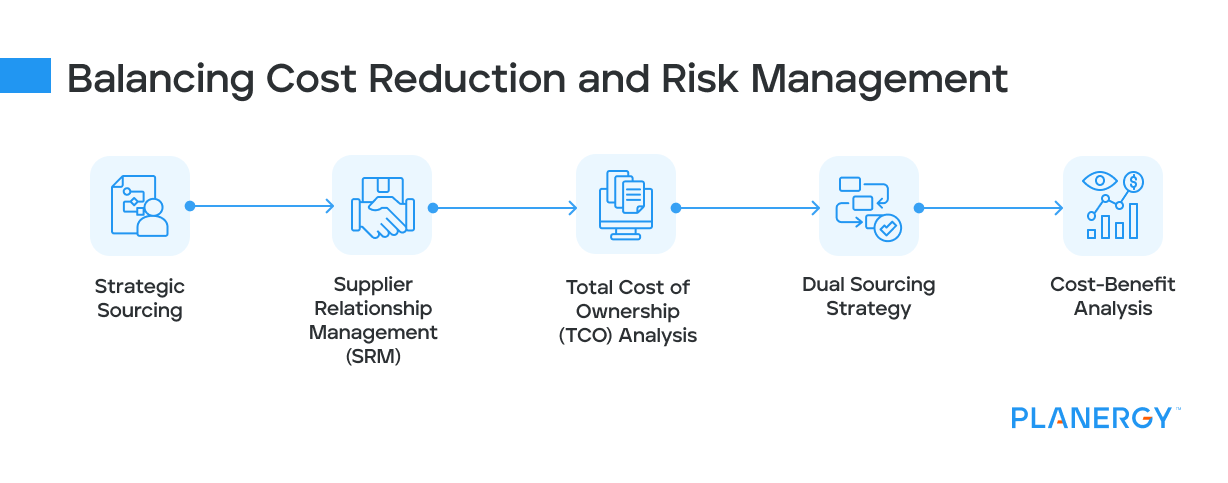

A comprehensive procurement risk management plan incorporates all the above strategies into a cohesive approach, ensuring that risks are identified, assessed, mitigated, and monitored effectively.

Key Components:

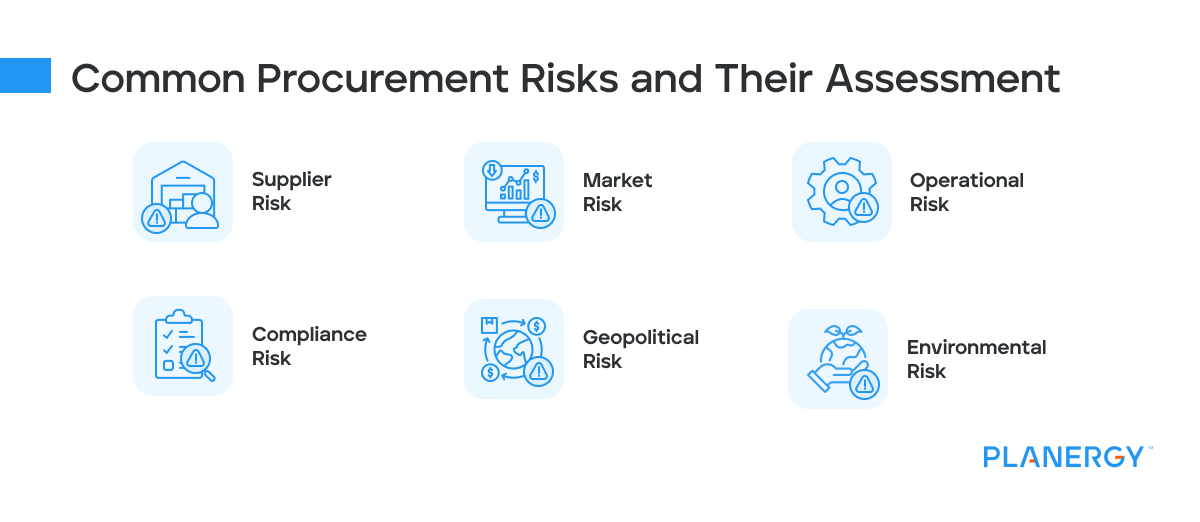

Risk Identification: Catalog potential risks through supplier assessments, market analysis, and historical data review.

Risk Assessment: Evaluate the likelihood and impact of each risk using quantitative and qualitative methods.

Risk Mitigation Strategies: Develop and implement strategies tailored to address specific risks, such as diversification, contracts, and technology integration.

Monitoring and Review: Continuously monitor risks and review the effectiveness of mitigation strategies, making necessary adjustments based on changing conditions.

Boeing’s comprehensive risk management plan includes supplier diversification, rigorous quality controls, technology integration, and continuous improvement initiatives.

During the 737 MAX crisis, Boeing’s ability to quickly adapt and manage its supply chain risks minimized disruptions and facilitated a faster path to recovery.