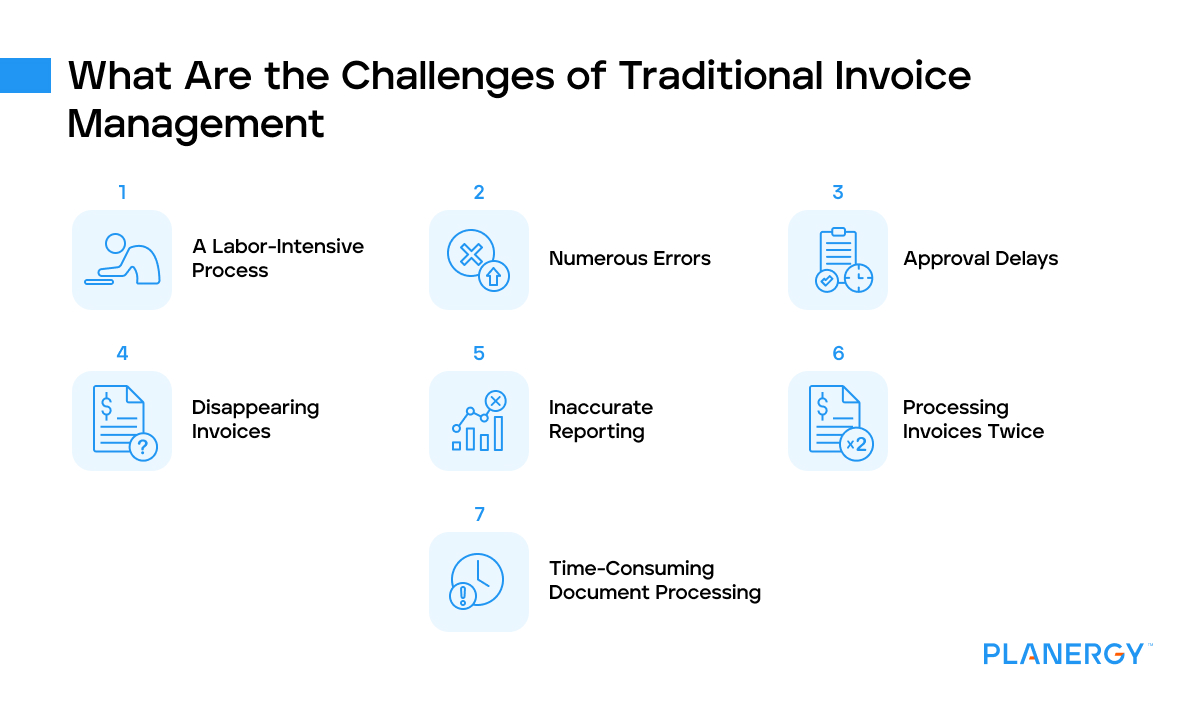

Traditionally managing invoices is a time-consuming process that often leads to errors.

Matching invoices, purchase orders, and shipping receipts, routing invoices to multiple approvers, and entering invoice data into an accounting software application eats up a lot of valuable employee time.

Even the simple process of routing paper invoices to the correct approvers can cause significant delays in payment processing, resulting in late fees and a lot of unhappy vendors and suppliers.

This usually occurs when an invoice is forwarded to the wrong department, where it remains on someone’s desk for days or even weeks before they’re discovered- if they ever are.

Is it any wonder that the latest survey from Ardent Partners State of ePayables 2023 shows that 49% of respondents indicated that invoice processing time and payment approval still takes too long?

But that’s not the only problem with manual AP processing, with 47% of survey respondents stating that they’re required to process too many AP exceptions.

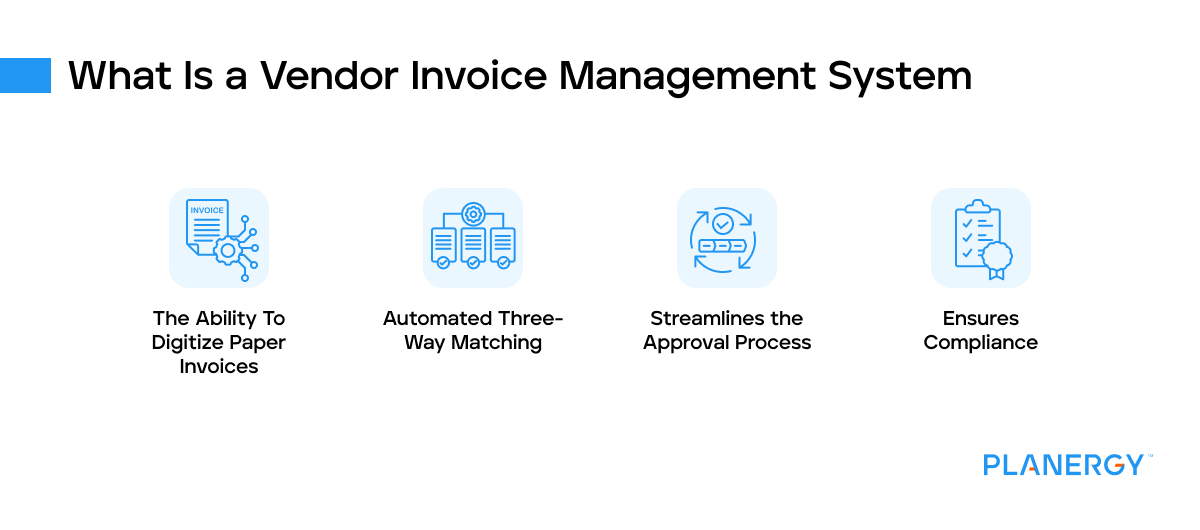

That’s why vendor invoice management systems can play such an important role in business today, regardless of the size of the business.

While a small business owner can certainly benefit from better invoice management, an enterprise-level organization would likely be completely dysfunctional without some level of invoice management in place.

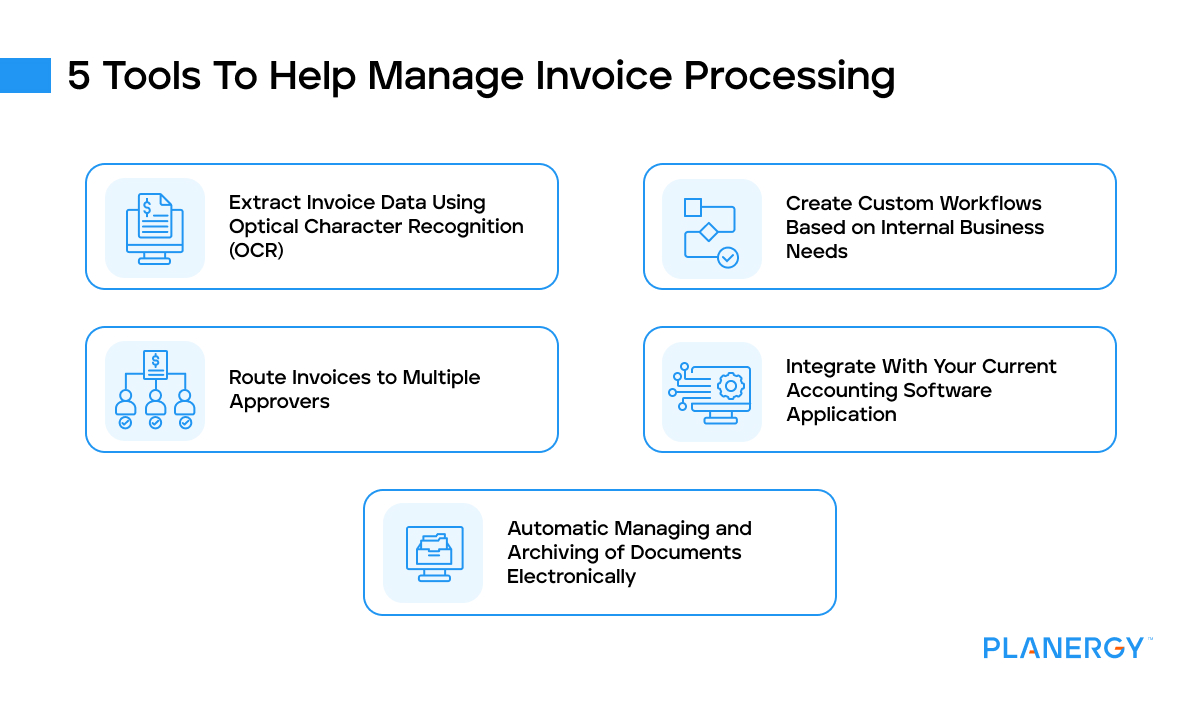

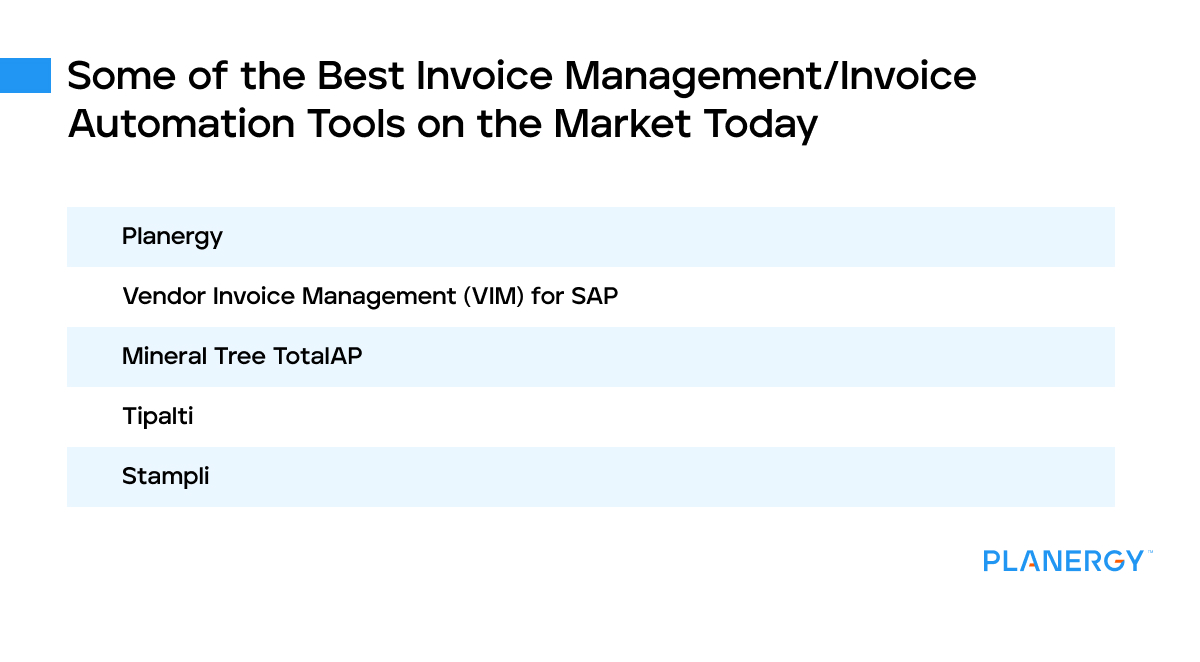

We’ll cover what vendor invoice management is, the latest tools to help your AP department eliminate manual processes, and why vendor invoice management and an automated AP solution are so important for your business going forward.